22 December 2025

Murray Collis, Head of Asia Fixed Income

Chris Lam, Portfolio Manager, Asia Fixed Income

Eric Lo, Portfolio Manager, Asia Fixed Income

Asian fixed income posted strong gains in 2025 amid myriad challenges. Entering the new year, the asset class is poised for continued momentum on the back of numerous beneficial tailwinds. In this 2026 Outlook, the Asian Fixed Income team analyses the key factors likely to propel performance and identifies opportunities for investors based on key themes and developments in three regional bond markets: China, Japan, and India.

1) A lower US interest rate environment could drive investor preference for money market and cash-plus solutions, and Asian credit.

2) An evolving and more balanced Asian high-yield (HY) universe reinforces our preference for HY over investment-grade bonds.

3) Asian local markets are riding on the momentum of increased investor interest to continue delivering strong performance amid de-dollarisation and US dollar volatility.

Asia has faced numerous headwinds this year, including global trade tensions, uncertain US economic policies, US dollar (USD) volatility, and persistent deflation in China.

Despite these concerns, Asian fixed-income markets have forged ahead, delivering strong absolute and relative returns on the back of solid economic fundamentals, attractive valuations, and gains in Asian local markets and currencies.

As we look ahead to 2026, we expect the positive momentum to roll on, helping underpin returns and diversification benefits for investors.

Key market themes worth highlighting for 2026 include: 1) lower interest rates; 2) the evolving Asian HY market; 3) de-dollarisation; 4) promising developments in Asia’s three largest bond markets.

Chart 1: Asian and Emerging Market bonds have delivered robust returns year-to-date in 2025, with related funds on track for their first year of net inflows since 20211

Despite numerous headwinds, Asian fixed income continues to demonstrate resilience, underpinned by the region’s solid growth prospects, benign inflation, healthy corporate fundamentals, and proactive government stimulus measures.

Notably, in 2025, heightened US market volatility and the developing de-dollarisation theme have prompted investors to increasingly recognise the structural shifts underway in global markets, further enhancing the appeal of local markets, including Asia.

We believe the shift in investor interest and positive flow momentum will extend into the new year, positioning Asian bonds as a compelling choice for stable income and diversification amid a changing global landscape.

In 2026, we see numerous opportunities across Asian fixed income on the back of both cyclical and structural developments, according to several market themes.

With over USD 7 trillion of assets currently invested in cash-equivalent products, money market and cash-plus (MMCP) solutions will return to the spotlight for investors in 2026. These offer relatively higher yields compared to ordinary savings accounts and deposits due to their ability to invest in a broader investment universe and the flexibility to adjust portfolio maturity.

Investors who have been sceptical of tight credit spreads or high equity valuations and want to reduce the impact of falling rates on their cash returns will likely find MMCP solutions attractive, given the added stability and liquidity they offer for their investment portfolios.

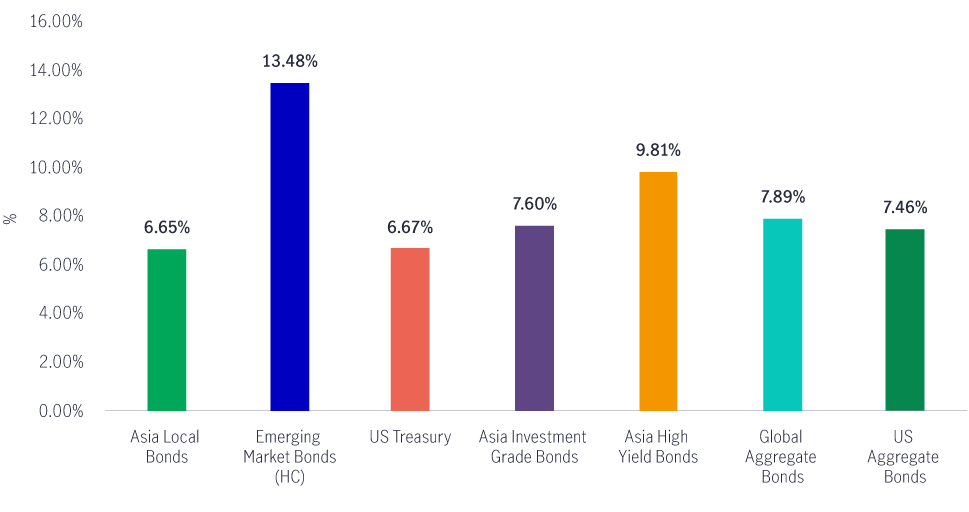

Lower US interest rates will also reset the relative attractiveness of different USD fixed income asset classes.

As the yield curve normalises, investors will likely need to take on more risk – whether duration, credit, or currency – to achieve higher expected returns. Risk-reward considerations will play a bigger role in investment decisions, and we believe investors will find assets with higher all-in yields and relatively shorter duration profiles, such as Asian dollar bonds, even more appealing.

Chart 2: Asian credit all-in yields remain compelling2

We also expect this environment to be supportive of primary issuance in the Asian dollar bond space, which has been muted for a few years. With issuers potentially returning to the market to refinance at lower funding costs, this would be a positive catalyst for credit profiles and fundamentals and could also reignite growth in the Asian dollar bond space.

Demand for Asian local credit markets has also strengthened significantly since April, accompanied by a notable increase in local credit issuance – for instance, in the offshore Chinese renminbi (CNH) and Singapore dollar (SGD) markets – creating compelling opportunities in the primary market. The selective SGD-denominated credit segment particularly offers a broader investment universe with attractive concessions and favourable valuations.

Further, Singapore, with its AAA credit rating, has stood out as a safe-haven destination for investors seeking quality and has garnered more inflows. We believe actively allocating between Asian dollar bonds and local credits offers enhanced yield pick-up opportunities in today’s rapidly evolving interest rate environment.

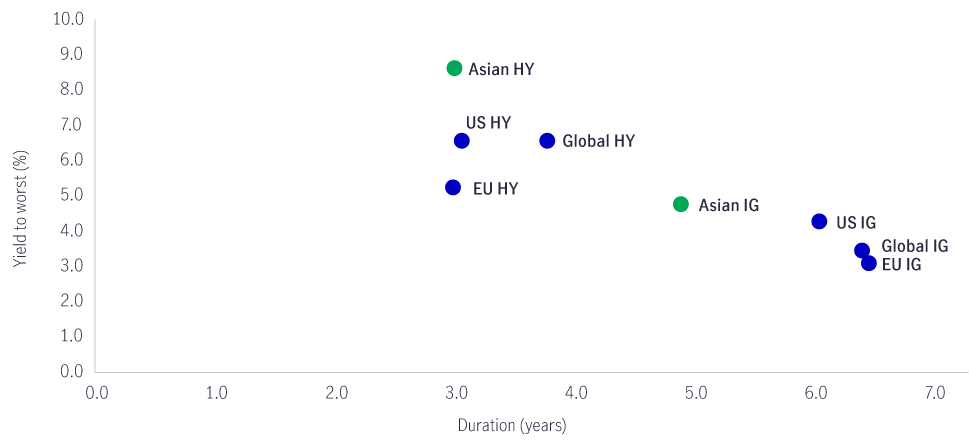

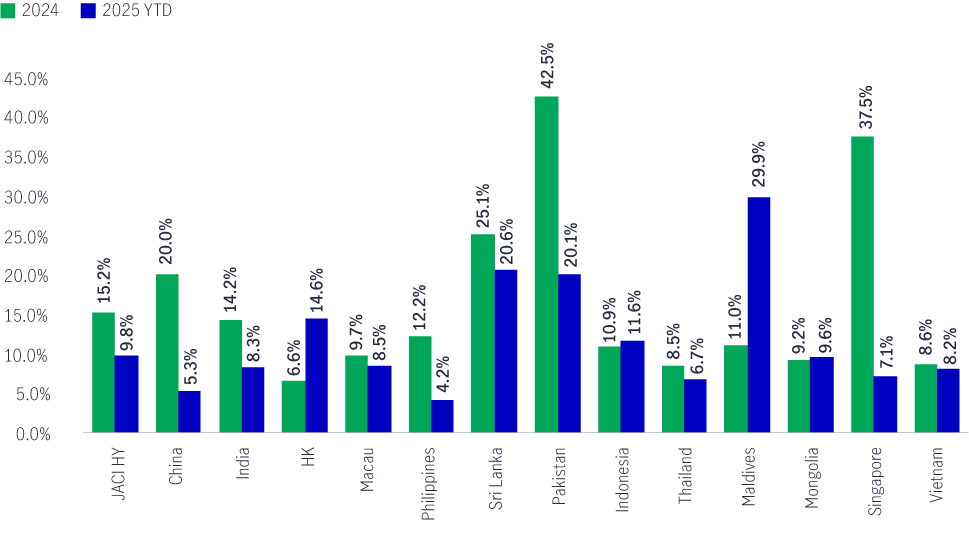

Asian HY remains under the radar for many investors, and few have noticed that all major Asian HY markets have delivered positive returns in 2024 and year-to-date 2025, driven by a more diversified, balanced, and higher-quality investment universe.

We expect this strong market breadth to continue to drive outperformance for the asset class in 2026, as broader market strength will likely offset potential idiosyncratic weaknesses, with additional tailwinds from normalising defaults and a supportive macro backdrop across the region from monetary and policy support.

Chart 3: Positive returns across Asian HY over 2024 and 20253

Furthermore, the compelling all-in yield offered by Asian HY (8.6%) outpaces that of US HY (6.6%) and Euro HY (5.2%), which carry similar credit ratings.

With dispersion still present in the market, ample investment opportunities remain for skilled managers to generate alpha through prudent security selection and active risk management. Asian HY is expected to remain an attractive source of income and diversification in 2026.

Since the Liberation Day tariffs announced by the US on 2 April and Moody’s downgrade of the US sovereign rating from Aaa to Aa1 on 16 May, there has been evidence of diversification out of the USD by some public sector investors.

The Moody’s downgrade came amid concerns about the rising federal budget deficit. This is projected to exceed USD 1.4 trillion in 2025 and more than 5% of GDP, and the US’ total federal debt surpassing USD 36 trillion. For example, China has reduced its US Treasury holdings while increasing its gold purchases.

At the same time, some global investors have allocated to high-carry currencies in Latin America (LATAM) and Europe, the Middle East, and Africa (EMEA).

Chart 4: Most Asia/G10 currencies have outperformed the USD (YTD)4

Chart 5: United States’ rising federal debt to GDP5

US Treasuries remain a cornerstone for global investors, especially as a safe-haven asset during times of market stress, while the USD continues to dominate as the world’s reserve currency.

Nevertheless, recent policy shifts have prompted a deterioration in the USD’s long-term status, with concerns persisting about the US fiscal position, its international alliances, and the independence of the US Federal Reserve (Fed).

As a result, the trend towards de-dollarisation is expected to persist in the longer term, driving investors to seek greater diversification through alternative markets.

Although the USD has rebounded from its September lows as the market reassessed the Fed’s easing path amid stronger economic data and persistent inflation, we anticipate ongoing volatility and depreciation of the USD over the medium term, particularly as policy-related pressures weigh on US economic growth. This evolving landscape underscores the importance of broadening investment horizons beyond traditional US assets.

Despite numerous challenges faced by the Chinese economy this year, export growth has remained intact while China’s GDP growth is broadly in line with the annual 5% target.

China approved its 15th Five-Year Plan (2026-2030) on 28 October. This timeframe is a critical stage of China’s 2035 goal of “basically achieving socialist modernisation”.

To achieve a doubling of its GDP by 2035, compared with 2020, this implies an average GDP growth rate of 4.4% p.a. from 2026-2030. Core priorities of the Five-Year Plan will involve developing “new productive forces”, including shifting from speed to higher-quality, sustainable growth. China will focus on developing a modern industrial system whilst achieving technological self-reliance by investing in semiconductors, artificial intelligence (AI), quantum technology, 6G, etc., as well as making progress on green and low-carbon energy.

More fiscal and financial policies will also be needed to support household consumption and end deflation.

Driven by de-dollarisation and renminbi internationalisation policies, the CNH bond market has expanded rapidly in terms of liquidity and market depth as issuers have shifted from the USD market to the CNH market for issuance. New-issue premiums, as well as flows from the Southbound Bond Connect programme, are expected to continue providing tactical investment opportunities in this market.

Heading into 2026, we expect the People’s Bank of China (PBOC) to coordinate monetary and fiscal policies to prevent deflation from spiralling further and to support higher consumption as policymakers seek to guide the economy into a more self-reliant and more sustainable mode.

We expect the 10-year Chinese Government Bond (CGB) to range between 1.6% and 1.9% in the first half of 2026, while the curve may see bull steepening following the expected PBOC rate cut and CGB buying.

Accordingly, we will maintain an overweight duration position with equal exposure to both onshore rates and high-quality CNH-denominated corporate bonds. The renminbi remains anchored by the PBOC. Its fundamental valuation remains cheap, and with inflows picking up in the second half of this year, we could see gradual appreciation in the currency, with the renminbi expected to range between 7.0 and 7.3 against the USD.

The trade truce between China and the US is also expected to provide relief and support a stable, positive performance in Chinese fixed income and the renminbi over the next twelve months. Further, the recent rapid expansion of the offshore CNH market from both issuance and investor demand perspectives has shown that Chinese fixed income can provide diversification for global investors amid de-dollarisation and possible further USD weakness over the next 12-18 months.

As the world’s third-largest bond market and the region's second largest, the Japanese fixed-income market can offer ample liquidity and, coupled with its single-A sovereign rating, reinforces its longstanding reputation as a safe-haven destination for global investors.

In 2025, the combination of a de-dollarisation trend and a shift in the Bank of Japan’s (BOJ) policy stance has brought renewed focus to Japanese bonds as a compelling source of opportunities.

After hiking policy rates from 0.25% to 0.50% in January, it seems that Japan is finally on the path to gradual interest rate normalisation after negative and near-zero interest rates over the past two decades. For now, consensus forecasts expect the BOJ to gradually lift policy rates to around 1.0% in 2026 and 1.2% by 2027.

The election of Sanae Takaichi as Japan’s first female prime minister in October 2025 has also introduced a new variable for investors.

Prime Minister Takaichi’s administration is preparing an economic stimulus package that may include expanding local government grants to small and medium-sized companies, investing in growth industries such as artificial intelligence and semiconductors, and strengthening national security by accelerating defense spending.

These policies support broader corporate fundamentals and, given that the government may need to issue new bonds to fund the initiatives, may also lead to higher government bond yields.

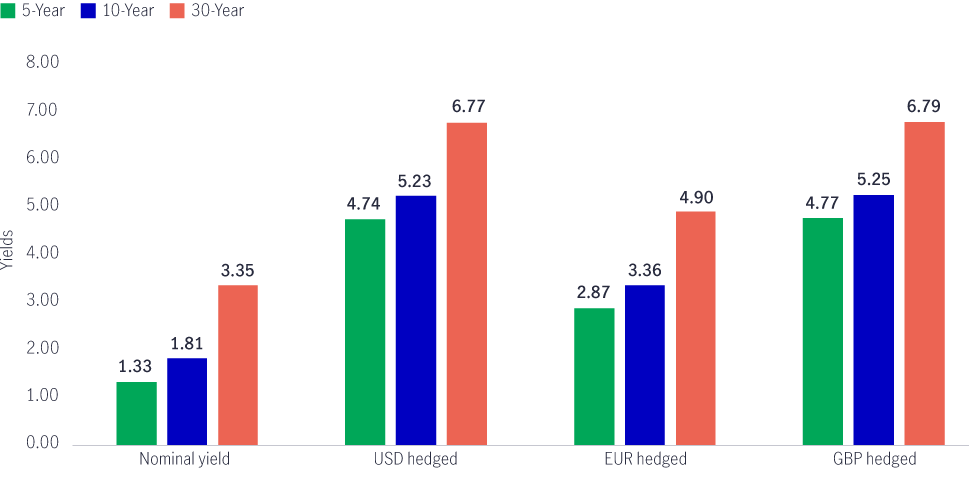

Looking at the local rates, Japanese government bonds (JGB) could potentially provide an attractive all-in yield from the yield pick-up from currency hedging, such as a 3.4% annualised currency gain when hedged to USD and 1.5% when hedged to the euro (EUR), based on current three-month forward rates. Additionally, the Japanese yen stands out as a valuable tool for currency diversification, given its historically low correlation with other developed- market currencies.

Chart 6: JGB nominal yields before and after currency hedging6

Yen-denominated hybrid bonds, a subset of the Japanese credit market, have been gaining popularity in Japan, as the country transitions out of an ultra-low interest-rate environment. These instruments can offer enhanced yields above JGBs and IG corporate bonds whilst retaining a shorter duration profile and similarly high AA credit ratings.

India sustained its strong growth trajectory in 2025, with better-than-expected quarterly GDP, a supportive monetary easing policy, together with S&P upgrading India’s long-term sovereign credit rating to BBB from BBB- on strong growth and sovereign stability.

Although market volatility emerged in August following the US administration’s imposition of a 50% tariff on Indian goods, the Indian market has demonstrated resilience, absorbing the shock quickly due to its limited direct exposure to US trade, expectations of further tariff negotiations would improve their overall position, and a commitment by the Reserve Bank of India (RBI) to mitigate the tariffs’ impact through targeted support.

Recent headlines on India and the US finalising the first phase of a bilateral trade agreement further support the country’s outlook.

We believe the most significant tariff-related challenges have passed, and we remain constructive on India’s medium-term prospects, underpinned by robust economic growth, strengthening corporate fundamentals, and positive technical factors, including further inclusions of India bonds in other global market indices.

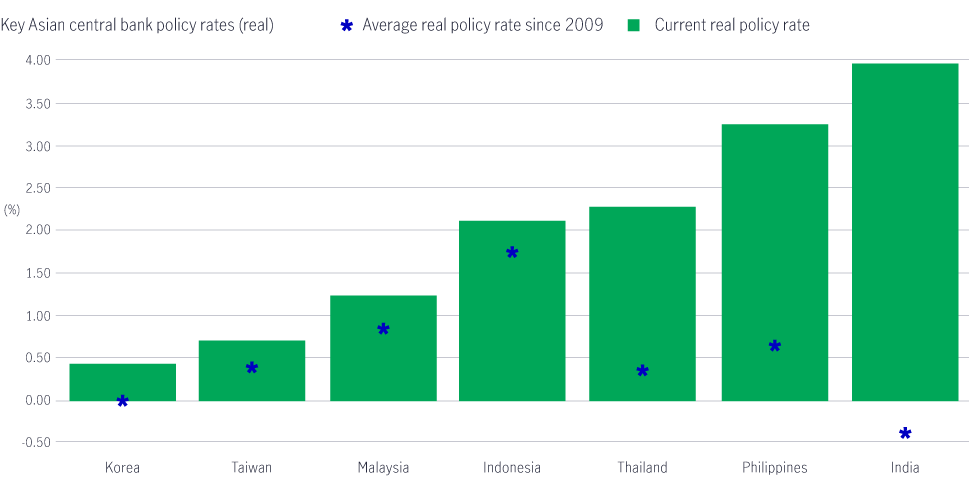

On the local rates front, Indian local government bonds remain among the highest yielding in the region and relative to global peers.

Interest rates are expected to be well-anchored by low inflation and the RBI’s accommodative stance. Additional rate cuts are anticipated in 2026, bringing value to front-end local bonds. This favourable environment, combined with potential future index inclusions in, for example, the FTSE Russell and Bloomberg indices, should support further technical support next year.

In credit markets, Indian issuers have benefited from S&P's sovereign rating upgrade this year. Strong performance is expected to continue into 2026, driven by improved fundamentals and ongoing government support. Selective opportunities in non-IG credits, particularly in the renewable energy and infrastructure sectors, can also offer compelling value for investors seeking yields and diversified exposure.

Chart 7: Key Asian central bank rates7

We believe Asian fixed income is well-positioned to benefit from the region’s robust economic growth, resilient corporate fundamentals, and supportive credit technicals. However, we remain mindful that external developments in the global fixed income landscape could influence market sentiment towards Asia.

Policy uncertainty, particularly around the direction of US fiscal and trade policies, may continue to impact investor confidence, raising concerns about global growth prospects and inflation, and potentially triggering further market volatility. Asian currencies, especially in export-oriented economies, could also experience fluctuations in response to evolving trade dynamics.

On the monetary front, there is some uncertainty over the Fed’s rate-cutting cycle, even after the recent resumption of easing.

Mixed signals from Fed officials and economic data recently have tempered expectations for rate cuts in 2026, contributing to a volatile rates market and difficult macro environment for the global fixed-income asset class.

Furthermore, Jerome Powell’s term as Fed Chair ends in May 2026, and the new Fed Chair will be announced in early 2026. Markets will closely study this changing of the guard and its implications for future monetary policy.

With this backdrop, we believe active management is essential to navigating the potentially volatile period ahead.

Our investment team leverages an extensive Asian presence across 10 local markets, including deep knowledge and strong performance track records in the major Asian markets, including China, Japan, and India.

Relative to our peers, we have extensive proprietary research capabilities with over 20 dedicated Asian credit analysts to identify opportunities and manage risks across the region. Moreover, we believe the attractive carry and all-in yields of Asian credit relative to global peers provide a decent buffer against market uncertainties.

At the same time, the asset class continues to offer diversification benefits.

The positive momentum experienced across Asia's fixed-income markets is expected to roll on into 2026. As the Fed is likely to guide interest rates lower and market dynamics for local fixed income markets around the region continue to adjust, we see ample investment opportunities across the spectrum of Asian fixed income to prosper in this environment. Asian credit continues to stand out based on fundamentals and valuations, while Asian local markets can offer investors unique opportunities to benefit from de-dollarisation and diversification.

As one of the leading Asia fixed income houses with a strong investment presence in Asia’s three largest fixed income markets – China, Japan, and India – Manulife Investment Management is positioned to help investors navigate this exciting asset class in the year ahead.

1 Source: Bloomberg, JP Morgan Indices, as of 30 November, 2025.

2 Source: Manulife Investment Management, JP Morgan Asia Credit Non-Investment-Grade Index, Bloomberg US Corporate High Yield Index and Bloomberg Pan European High Yield Index, as of 30 November, 2025. “All-in yield” refers to the asset class’s yield-to-worst.

3 Source: Manulife Investment Management, JP Morgan Indices, Bloomberg, as of 30 November, 2025.

4 Source: Bloomberg, as of 30 November, 2025.

5 Source: Bloomberg, White House Office of Management and Budget, as of December 2025.

6 Source: Bloomberg, as of 30 November, 2025.

7 Source: Macrobond, Manulife Investment Management, as of 2 November, 2025.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.