5 February 2026

Alvin Ong, Head of Singapore Fixed Income

Esther Koon, Portfolio Manager

Joshua Phoon, Portfolio Manager

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

The Singapore bond market enters 2026 on a solid footing, having delivered robust returns in 2025 amid a complex global environment of elevated uncertainty.

The iBoxx Singapore index, which tracks the asset class, posted a strong gain of +7.65% (in Singapore Dollars) last year, reflecting resilient investor demand and the safe-haven status of Singapore bonds.

This positive momentum is expected to continue over the upcoming year, supported by structural inflows, sound sovereign fundamentals, and a dynamic credit landscape.

A key driver of recent performance has been the broad de-dollarisation trend, which has channelled significant inflows into Singapore Government Securities (SGS) and Singapore dollar credit throughout 2025.

The visibility and accessibility of the Singapore dollar bond market have increased as global investors seek diversification away from US dollar assets. This trend is likely to persist into 2026, sustaining demand for both SGS and local corporate bonds.

Singapore’s sovereign strength remains a cornerstone of market stability. The country is the only one in Asia to hold AAA ratings from all three major credit rating agencies—a distinction shared by only nine countries globally.

This gold-standard credit quality is underpinned by Singapore’s constitutional requirement for balanced budgets, which reinforces fiscal discipline and investor confidence. In addition, many high-quality Singapore corporates maintain close links to the sovereign and major local banks, underpinning the Singapore bond market’s resilience.

The Monetary Authority of Singapore (MAS) eased policy twice in 2025, responding to a global environment marked by shifting trade dynamics and increasing protectionist measures.

While Singapore’s growth exceeded expectations last year, growing 4.8% (year on year), export momentum is likely to moderate in 2026 as global trade faces new tariff threats. Nevertheless, Singapore’s resilient services segment and ongoing public sector projects should help cushion any negative impact. Capital expenditure on artificial intelligence is poised to support export growth and investment activity further.

Inflation in Singapore appears to be bottoming out. MAS has recently revised its headline and core inflation forecasts to 1.0-2.0%, from the previous range of 0.5-1.5%. However, core inflation is still projected to remain slightly below trend in 2026.

MAS is likely to retain its appreciating policy stance for now, though additional tightening remains possible if growth or inflation surprises to the upside.

Front-end rates such as SORA (Singapore Overnight Rate Average) declined sharply in 2025, driven by US Federal Reserve (Fed) rate cuts and abundant liquidity.

This spillover effect benefited the broader SGS curve, with SGS outperforming US Treasuries over the past year. Accommodative liquidity conditions are expected to persist over the forthcoming year, acting as a natural hedge against sharp rises in SGS yields and supporting Singapore’s safe-haven appeal. Continued capital inflows should help keep domestic interest rates low.

Nevertheless, we see less scope for SGS to outperform US Treasuries further in 2026. Current valuations make US Treasuries relatively attractive, though Singapore investors should consider the high cost of currency hedging when expressing this view.

While the rate differential between SGS and US Treasuries has narrowed, it remains wide by historical standards, suggesting only modest potential for further SGS gains. The cost of currency hedging is likely to decline gradually as US front-end rates fall in response to ongoing Fed easing.

As developed fixed-income markets experience potential steepening pressures amid deteriorating fiscal and budget dynamics, we believe investors are likely to rotate toward sovereign markets with stronger macro fundamentals, including SGS.

In contrast with other markets, steepening pressure on the long end of the SGS curve is likely to be contained in 2026. The regular issuance calendar does not include a 50-year bond, and only one 30-year bond is scheduled for issuance in the first quarter of the new year.

Overall, the duration or average maturity of SGS new issues will be reduced relative to 2025, which should support the longer end of the curve. Notably, a new 20-year green SGS is planned for issuance in the second half of 2026 via syndication, further supporting Singapore’s leadership in sustainable finance.

As cash rates decline, investors will likely need to move away from cash and short-dated instruments into longer-duration credit to achieve higher-yielding portfolios.

The Singapore dollar credit market is expected to remain well-supported in 2026, underpinned by strong market technicals—robust investor demand and limited new supply.

Recently, MAS provided clarity regarding the treatment of Singapore AT1 (Additional Tier 1) and Tier 2 bank and insurance papers and has decided against a more punitive approach that would restrict retail investors’ exposure to such instruments.

These clarifications have removed uncertainty, which should benefit the financial sector. High-quality, sovereign-linked issuers of SGD credit are expected to provide stable carry, while foreign issuers may offer pockets of alpha-generation opportunities through new issue concessions and yield enhancements.

Further, sustainability-related issuance of SGD corporate bonds is projected to rise, reflecting growing demand for sustainable finance and strong domestic policy support. The increasing ease with which global issuers can tap the SGD market for funding also broadens the investment universe and enhances market liquidity.

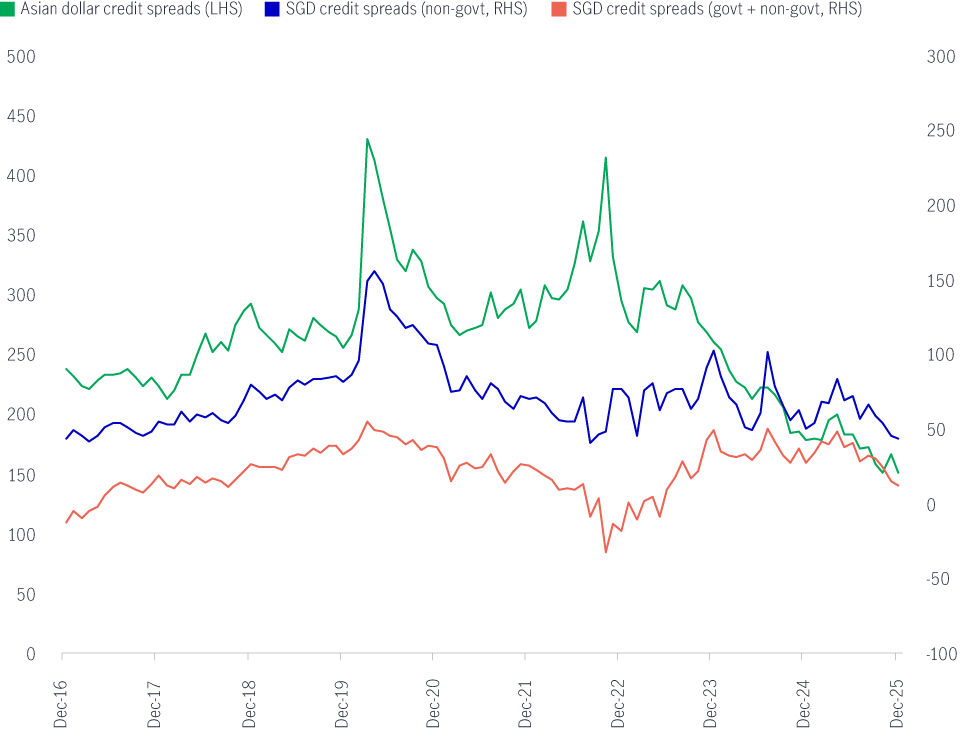

Chart 1: Credit spread of SGD bonds versus Asian dollar bonds1

Chart 2: Historical SGD bond issuance (SGD bn)2

While the outlook for the Singapore bond market remains constructive, investors should remain vigilant for signs of liquidity withdrawal, particularly if economic growth and inflation exceed expectations.

Such developments could put selling pressure on SGS and Singapore dollar credit. Additionally, global policy uncertainty—especially around US fiscal and trade policies—may continue to influence investor sentiment and contribute to market volatility.

That said, a combination of sovereign strength, robust technicals, and increasing sustainability-related issuance positions the Singapore bond market as a compelling choice for investors seeking stability, diversification, and sustainable income in 2026 amid heightened uncertainty in global markets.

1 Source: Bloomberg, as of December 31, 2025.

2 Source: Bloomberg, as of December 31, 2025.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Outlook Series: Manulife Global Multi-Asset Diversified Income Fund

In 2026, a clearer macroeconomic outlook is expected as momentum improves following strong 2025 drivers such as AI growth, energy transition, anticipated Fed rate cuts, and wider fiscal support. While the US Federal Reserve is likely to continue easing policy, diverse income opportunities remain across global markets, extending beyond traditional government bonds to high yield assets and option writing. Within this environment, the Manulife Global Fund – Global Multi‑Asset Diversified Income Fund (GMADI) remains with a clear and heightened focus towards income generation. The Fund seeks to deliver a high and consistent distribution income while maintaining exposure to long term capital growth opportunities.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Outlook Series: Manulife Global Multi-Asset Diversified Income Fund

In 2026, a clearer macroeconomic outlook is expected as momentum improves following strong 2025 drivers such as AI growth, energy transition, anticipated Fed rate cuts, and wider fiscal support. While the US Federal Reserve is likely to continue easing policy, diverse income opportunities remain across global markets, extending beyond traditional government bonds to high yield assets and option writing. Within this environment, the Manulife Global Fund – Global Multi‑Asset Diversified Income Fund (GMADI) remains with a clear and heightened focus towards income generation. The Fund seeks to deliver a high and consistent distribution income while maintaining exposure to long term capital growth opportunities.