5/2/2026

Alvin Ong, Head of Singapore Fixed Income

Esther Koon, Portfolio Manager

Joshua Phoon, Portfolio Manager

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

The Singapore bond market enters 2026 on a solid footing, having delivered robust returns in 2025 amid a complex global environment of elevated uncertainty.

The iBoxx Singapore index, which tracks the asset class, posted a strong gain of +7.65% (in Singapore Dollars) last year, reflecting resilient investor demand and the safe-haven status of Singapore bonds.

This positive momentum is expected to continue over the upcoming year, supported by structural inflows, sound sovereign fundamentals, and a dynamic credit landscape.

A key driver of recent performance has been the broad de-dollarisation trend, which has channelled significant inflows into Singapore Government Securities (SGS) and Singapore dollar credit throughout 2025.

The visibility and accessibility of the Singapore dollar bond market have increased as global investors seek diversification away from US dollar assets. This trend is likely to persist into 2026, sustaining demand for both SGS and local corporate bonds.

Singapore’s sovereign strength remains a cornerstone of market stability. The country is the only one in Asia to hold AAA ratings from all three major credit rating agencies—a distinction shared by only nine countries globally.

This gold-standard credit quality is underpinned by Singapore’s constitutional requirement for balanced budgets, which reinforces fiscal discipline and investor confidence. In addition, many high-quality Singapore corporates maintain close links to the sovereign and major local banks, underpinning the Singapore bond market’s resilience.

The Monetary Authority of Singapore (MAS) eased policy twice in 2025, responding to a global environment marked by shifting trade dynamics and increasing protectionist measures.

While Singapore’s growth exceeded expectations last year, growing 4.8% (year on year), export momentum is likely to moderate in 2026 as global trade faces new tariff threats. Nevertheless, Singapore’s resilient services segment and ongoing public sector projects should help cushion any negative impact. Capital expenditure on artificial intelligence is poised to support export growth and investment activity further.

Inflation in Singapore appears to be bottoming out. MAS has recently revised its headline and core inflation forecasts to 1.0-2.0%, from the previous range of 0.5-1.5%. However, core inflation is still projected to remain slightly below trend in 2026.

MAS is likely to retain its appreciating policy stance for now, though additional tightening remains possible if growth or inflation surprises to the upside.

Front-end rates such as SORA (Singapore Overnight Rate Average) declined sharply in 2025, driven by US Federal Reserve (Fed) rate cuts and abundant liquidity.

This spillover effect benefited the broader SGS curve, with SGS outperforming US Treasuries over the past year. Accommodative liquidity conditions are expected to persist over the forthcoming year, acting as a natural hedge against sharp rises in SGS yields and supporting Singapore’s safe-haven appeal. Continued capital inflows should help keep domestic interest rates low.

Nevertheless, we see less scope for SGS to outperform US Treasuries further in 2026. Current valuations make US Treasuries relatively attractive, though Singapore investors should consider the high cost of currency hedging when expressing this view.

While the rate differential between SGS and US Treasuries has narrowed, it remains wide by historical standards, suggesting only modest potential for further SGS gains. The cost of currency hedging is likely to decline gradually as US front-end rates fall in response to ongoing Fed easing.

As developed fixed-income markets experience potential steepening pressures amid deteriorating fiscal and budget dynamics, we believe investors are likely to rotate toward sovereign markets with stronger macro fundamentals, including SGS.

In contrast with other markets, steepening pressure on the long end of the SGS curve is likely to be contained in 2026. The regular issuance calendar does not include a 50-year bond, and only one 30-year bond is scheduled for issuance in the first quarter of the new year.

Overall, the duration or average maturity of SGS new issues will be reduced relative to 2025, which should support the longer end of the curve. Notably, a new 20-year green SGS is planned for issuance in the second half of 2026 via syndication, further supporting Singapore’s leadership in sustainable finance.

As cash rates decline, investors will likely need to move away from cash and short-dated instruments into longer-duration credit to achieve higher-yielding portfolios.

The Singapore dollar credit market is expected to remain well-supported in 2026, underpinned by strong market technicals—robust investor demand and limited new supply.

Recently, MAS provided clarity regarding the treatment of Singapore AT1 (Additional Tier 1) and Tier 2 bank and insurance papers and has decided against a more punitive approach that would restrict retail investors’ exposure to such instruments.

These clarifications have removed uncertainty, which should benefit the financial sector. High-quality, sovereign-linked issuers of SGD credit are expected to provide stable carry, while foreign issuers may offer pockets of alpha-generation opportunities through new issue concessions and yield enhancements.

Further, sustainability-related issuance of SGD corporate bonds is projected to rise, reflecting growing demand for sustainable finance and strong domestic policy support. The increasing ease with which global issuers can tap the SGD market for funding also broadens the investment universe and enhances market liquidity.

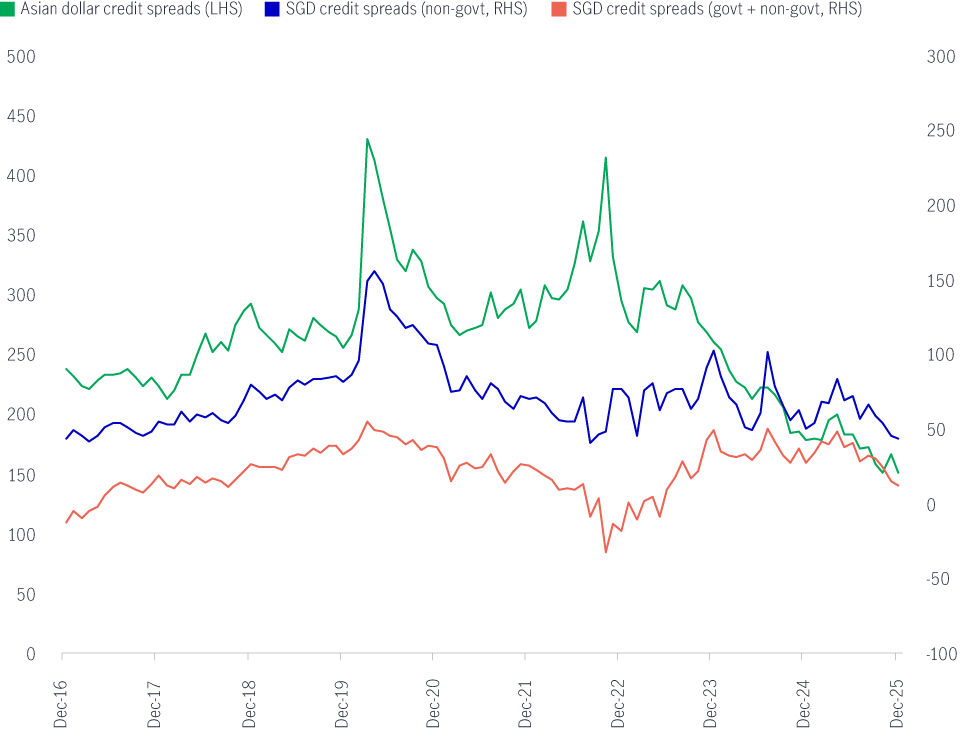

Chart 1: Credit spread of SGD bonds versus Asian dollar bonds1

Chart 2: Historical SGD bond issuance (SGD bn)2

While the outlook for the Singapore bond market remains constructive, investors should remain vigilant for signs of liquidity withdrawal, particularly if economic growth and inflation exceed expectations.

Such developments could put selling pressure on SGS and Singapore dollar credit. Additionally, global policy uncertainty—especially around US fiscal and trade policies—may continue to influence investor sentiment and contribute to market volatility.

That said, a combination of sovereign strength, robust technicals, and increasing sustainability-related issuance positions the Singapore bond market as a compelling choice for investors seeking stability, diversification, and sustainable income in 2026 amid heightened uncertainty in global markets.

1 Source: Bloomberg, as of December 31, 2025.

2 Source: Bloomberg, as of December 31, 2025.

2026年亞太房託展望:由減息紓緩邁向增長復甦

亞太區(日本除外)房地產投資信託基金(亞太房託)於2025年表現理想,展望2026年有望迎來關鍵轉捩點 — 由減息帶動的紓緩期過渡至增長復甦階段。在本期《2026年前景展望》中,投資組合經理黃惠敏及Derrick Heng將深入剖析利率下調如何為亞太房託開啟兩大增長動力 — 一方面透過節省利息成本推動內部增長,另一方面透過資本循環帶動併購增長。同時,團隊亦會分析歷史相對估值優勢及區內交易所政策利好等催化因素,如何進一步提升亞太房託的投資吸引力,並分享團隊於新一年看好的行業板塊。

2026 年前景展望系列:環球股票多元入息

展望2026年,主導股市上升的動力可能擴展至超大型科技股以外領域,為不同行業及地區創造投資機遇。受惠於主要市場的財政開支及寬鬆貨幣政策,預期環球經濟增長將趨於穩定。歐洲及個別亞洲經濟體的估值具吸引力,而且基本因素持續改善,與美國市場的韌性相輔相成。在良好基本因素支持下,除了增長型投資風格外,以價值和收益為本的策略或再度成為焦點。環球股票多元入息策略致力把握機遇,分散投資於不同地區、行業和風格,旨在爭取收益及資本增值。

2026年前景展望系列:宏利環球多元資產入息基金

在人工智能大趨勢、能源轉型、聯儲局減息預期、聯儲局潛在人事變動,以及財政支持擴大的推動下,2025年市場表現強勁。我們預計,隨著2026年時間逐步推移,宏觀經濟環境將更趨明朗,增長動力將會改善。儘管美國聯儲局預期將於今年內繼續放寬貨幣政策,但市場仍蘊藏豐富的收益投資機會,其來自多元化全球市場及不同來源,並由傳統政府債券延伸至高收益債券及期權沽售交易。在此環境下,宏利環球基金—環球多元資產入息基金(「本基金」)的主要目標,依然是以更清晰且高度專注的方式聚焦於締造收益。無論短期股市表現如何,或是貨幣政策周期如何波動,本基金都致力維持投資於長期資本增長機會,同時提供穩定而較高的收益分派。

2026年亞太房託展望:由減息紓緩邁向增長復甦

亞太區(日本除外)房地產投資信託基金(亞太房託)於2025年表現理想,展望2026年有望迎來關鍵轉捩點 — 由減息帶動的紓緩期過渡至增長復甦階段。在本期《2026年前景展望》中,投資組合經理黃惠敏及Derrick Heng將深入剖析利率下調如何為亞太房託開啟兩大增長動力 — 一方面透過節省利息成本推動內部增長,另一方面透過資本循環帶動併購增長。同時,團隊亦會分析歷史相對估值優勢及區內交易所政策利好等催化因素,如何進一步提升亞太房託的投資吸引力,並分享團隊於新一年看好的行業板塊。

2026 年前景展望系列:環球股票多元入息

展望2026年,主導股市上升的動力可能擴展至超大型科技股以外領域,為不同行業及地區創造投資機遇。受惠於主要市場的財政開支及寬鬆貨幣政策,預期環球經濟增長將趨於穩定。歐洲及個別亞洲經濟體的估值具吸引力,而且基本因素持續改善,與美國市場的韌性相輔相成。在良好基本因素支持下,除了增長型投資風格外,以價值和收益為本的策略或再度成為焦點。環球股票多元入息策略致力把握機遇,分散投資於不同地區、行業和風格,旨在爭取收益及資本增值。

2026年前景展望系列:宏利環球多元資產入息基金

在人工智能大趨勢、能源轉型、聯儲局減息預期、聯儲局潛在人事變動,以及財政支持擴大的推動下,2025年市場表現強勁。我們預計,隨著2026年時間逐步推移,宏觀經濟環境將更趨明朗,增長動力將會改善。儘管美國聯儲局預期將於今年內繼續放寬貨幣政策,但市場仍蘊藏豐富的收益投資機會,其來自多元化全球市場及不同來源,並由傳統政府債券延伸至高收益債券及期權沽售交易。在此環境下,宏利環球基金—環球多元資產入息基金(「本基金」)的主要目標,依然是以更清晰且高度專注的方式聚焦於締造收益。無論短期股市表現如何,或是貨幣政策周期如何波動,本基金都致力維持投資於長期資本增長機會,同時提供穩定而較高的收益分派。