27 January 2026

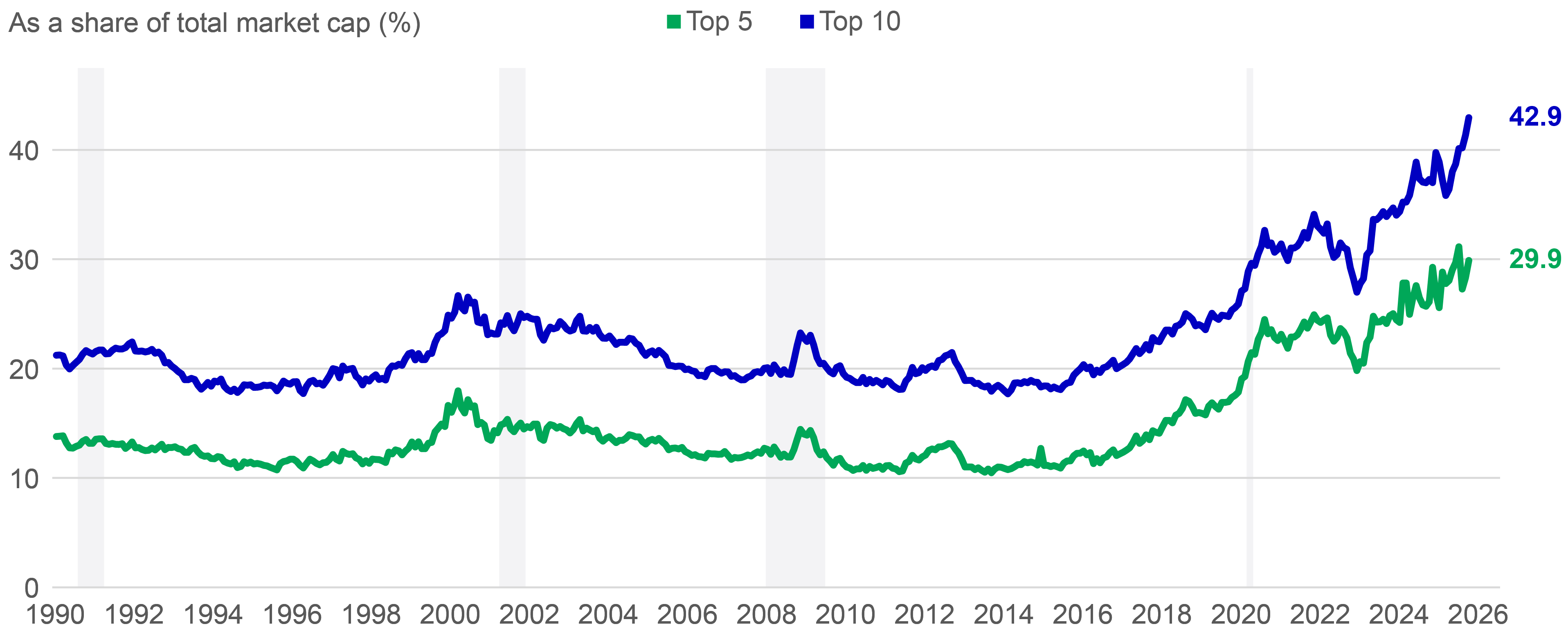

After an extended period of dominance by a narrow group of large cap growth technology companies – such as FANG, the Magnificent 7, Artificial Intelligence (AI)- related names – equity market opportunities are likely to broaden out in 2026. We observed some diversification in 2025, as markets from Canada to Korea delivered strong returns. This continued ‘sharing of the wealth’ could expand performance participation across sectors and geographies, particularly as many leading tech performers are United States (US)-based. Growth style’s leadership may persist, but value and income-focused securities could also benefit as investors seek diversification and rebalance portfolios. Finally, the quality factor, historically aligned with outsized excess returns, could return to prominence in 2026 as investors refocus on and allocate to companies with strong fundamentals and predictable earnings.

Global equity markets posted strong returns in 2025, supported by positive global growth, declining inflation, and robust corporate earnings. Stocks were further boosted by aggressive interest rate cuts from major central banks, including the European Central Bank (ECB), Bank of England (BOE), Bank of Canada (BOC) and the US Federal Reserve (Fed). AI enthusiasm added another tailwind, fuelling rallies in US mega-cap technology stocks that make up a sizable percentage of the world indexes and adjacent beneficiaries. These factors offset concerns about the US protectionist trade stance.

Chart 1: US equities continue to be led by largest names in index

Largest S&P 500 weights

Source: Bloomberg, Macrobond, Manulife Investment Management, as of Wednesday, 5 November, 2025. The grey areas represent recession. Past performance is not an indicative of future performance.

Europe led regional performance, reflecting optimism about the potential economic impact of falling interest rates and increased government spending. Emerging markets outpaced developed markets, with broad-based strength across all regions. The US and developed Asia delivered positive but relatively modest gains.

We anticipate moderating global economic growth in early 2026 due to tighter policy conditions, but momentum should improve as fiscal support strengthens monetary policy eases in key markets, and businesses adapt better to the current environment.

We believe fiscal policy will increasingly support growth, particularly as spending plans in major developed economies take effect and boost demand meaningfully. Monetary policy remains complex and regionally varied. The US and Canada have entered the second phase of easing cycles, while the ECB may hold steady, and the Bank of Japan signals a gradual move toward policy normalization.

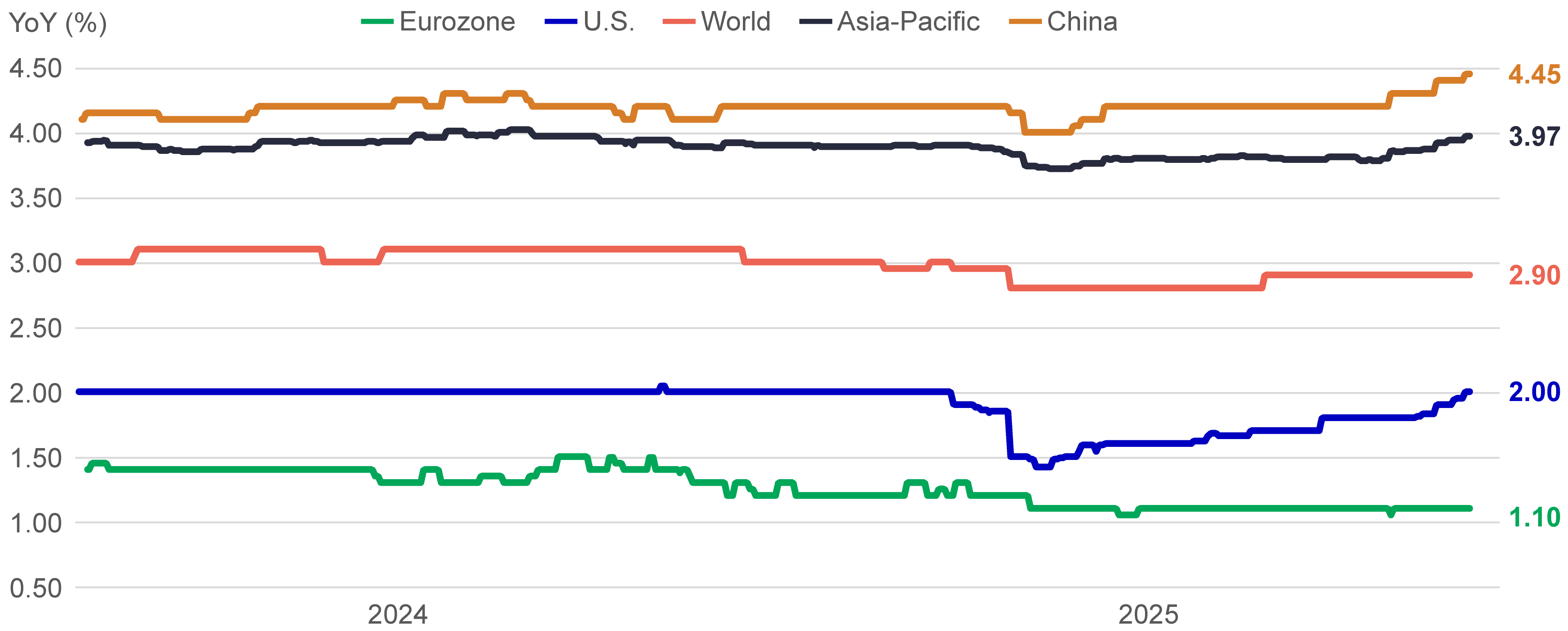

Chart 2: Consensus GDP forecasts

Source: Macrobond, Manulife Investment Management, as of Monday, 8 December, 2025. YoY refers to year over year.

Resilient corporate earnings and improving sentiment should help offset the drag from slowing growth and labour market softness; however, inflation and elevated valuations remain notable headwinds.

Within equities, we favour communication services, technology, financials, utilities, and industrials in the US and European markets. Within Europe, we particularly like the outlook for Spain and Italy, with opportunities in banks, industrials, and value-oriented names. The outlook for emerging-market equities remains neutral, supported by policy consistency, a weaker US dollar and improved trade dynamics.

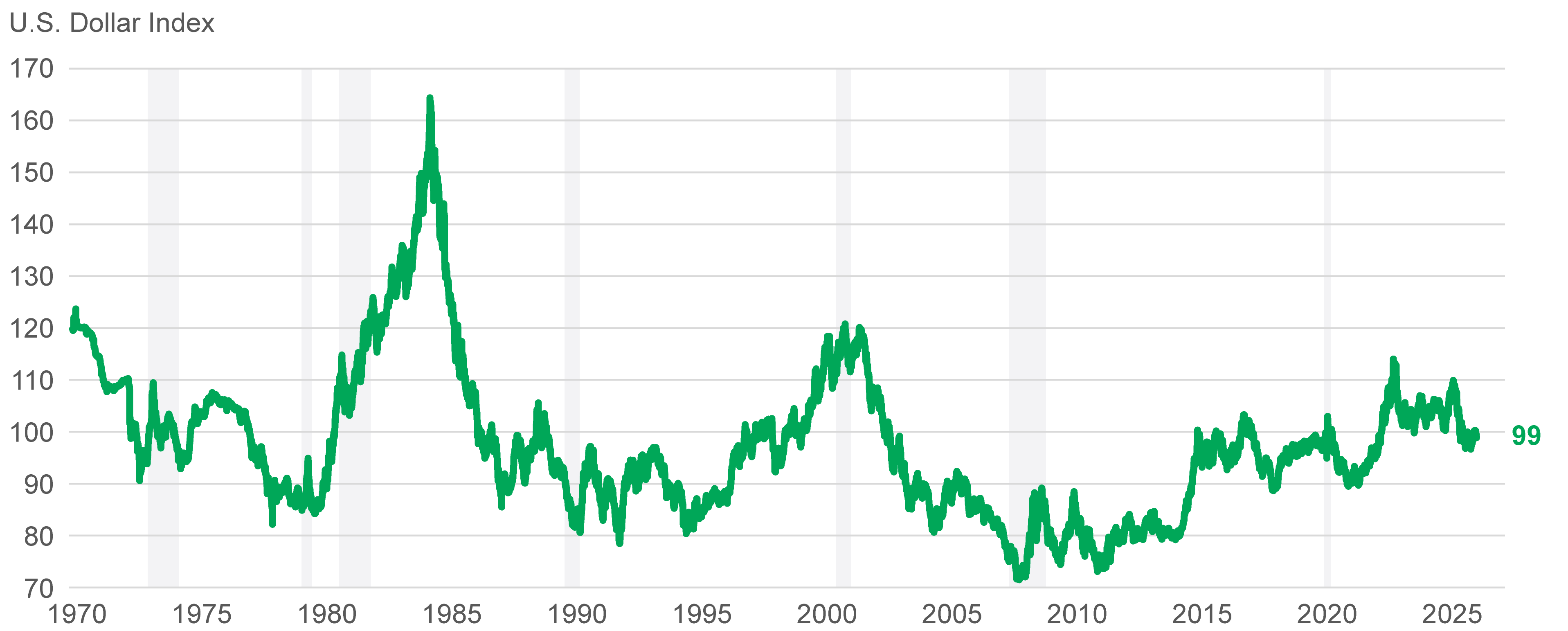

In financials, we see banks are experiencing solid loan growth, low delinquencies and good earnings. Steeper yield curves benefit banks’ net interest margins. Data centre expansion supports the multi-year outlook for utilities, while new AI-driven electricity generation demand should benefit midstream energy companies. A ramp in defence spending and global reshoring of production supports industrials and traditional value industries. A weaker US dollar could act as a catalyst for global manufacturing, potentially supporting a bull market in international industrials and export-driven economies.

Chart 3: US Dollar…are we at the onset of a depreciation cycle?

Source: Macrobond, Manulife Investment Management, as of Monday, 8 December, 2025. The grey areas represent recession.

Despite continued momentum in the AI trend, we think earnings expectations for 2026 are high across several sectors, pointing to a broader opportunity set moving forward. We believe exposure to cyclical and value-oriented areas with improving fundamentals and supportive macro conditions could benefit investors. While the US remains resilient, select regions like Europe show improving macro trends. In Asia, we believe manufacturing and tech-export economies offer compelling opportunities, making regional positioning increasingly important amid global fragmentation and shifting capital flows.

Looking beyond the US, we see opportunity in Europe where the growth gap with the US is narrowing. Attractive valuations, encouraging macroeconomic trends, and supportive policy measures are drawing attention, even as structural challenges and trade tensions linger.

Manufacturing and industrial segments of the regional economy have improved over the past two years, while service activity remains expansionary. Moreover, there are domestic green shoots building in early-cycle parts of the economy, such as construction and new business intentions, which tend to lead the broader growth picture. Tailwinds from stepped-up EU defence spending have also stoked the region’s growth impulse. At the same time, the export side of the global economy has so far held up better than expected in the face of US-imposed tariffs.

We believe the more positive macro setting should exert upward pressure on both company earnings and stock valuations, with the defence, digitalization, and German infrastructure sectors poised to be potential winners. Financial services may get a boost from an uptick in lending fuelled by brighter business prospects, the deregulation trend, and healthier corporate demand for loans.

Emerging Asia is a region with favourable long-term demographics. Manufacturing and tech-export economies like South Korea, Singapore, and Taiwan remain attractive. China continues to advance next-gen industries such as robotics, AI, autonomous and electric vehicles, alternative energy and power under strong policy support, though macro data is uneven. Japan offers appealing valuations despite structural challenges like inflation, debt and politics similar to Europe.

Growth style like technology and the US markets has experienced a meaningful multi-year run as the equity market style leader and may continue, we will continue to have exposure. However, valuation gaps highlight the relative attractiveness of traditional quality value companies. Income-focused securities should also be a part of a diversified equity allocation as opportunities broaden in 2026.

We believe favourable earnings and a broadening market backdrop support dynamic active strategies. The Global Equity Diversified Income strategy is designed to hold diverse global equity exposures across sectors, geographies and styles, with an income focus and potential for capital appreciation while aiming to minimize downside risk. The strategy combines top-down strategic equity allocations with bottom-up research and selection, leveraging our global capabilities.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Manulife Global Multi-Asset Diversified Income Fund

In 2026, a clearer macroeconomic outlook is expected as momentum improves following strong 2025 drivers such as AI growth, energy transition, anticipated Fed rate cuts, and wider fiscal support. While the US Federal Reserve is likely to continue easing policy, diverse income opportunities remain across global markets, extending beyond traditional government bonds to high yield assets and option writing. Within this environment, the Manulife Global Fund – Global Multi‑Asset Diversified Income Fund (GMADI) remains with a clear and heightened focus towards income generation. The Fund seeks to deliver a high and consistent distribution income while maintaining exposure to long term capital growth opportunities.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Manulife Global Multi-Asset Diversified Income Fund

In 2026, a clearer macroeconomic outlook is expected as momentum improves following strong 2025 drivers such as AI growth, energy transition, anticipated Fed rate cuts, and wider fiscal support. While the US Federal Reserve is likely to continue easing policy, diverse income opportunities remain across global markets, extending beyond traditional government bonds to high yield assets and option writing. Within this environment, the Manulife Global Fund – Global Multi‑Asset Diversified Income Fund (GMADI) remains with a clear and heightened focus towards income generation. The Fund seeks to deliver a high and consistent distribution income while maintaining exposure to long term capital growth opportunities.