31 December 2025

Joseph Bozoyan, Portfolio Manager

Heading into 2026, preferred securities remain an attractive asset class supported by strong fundamentals and favourable macro trends. In particular, utilities preferreds stand out as a core allocation, benefiting from structural growth drivers, such as artificial intelligence (AI)-driven energy demand, easing monetary policy, and their defensive characteristics amid potential market uncertainties.

Despite three US Federal Reserve (Fed) rate cuts in 2024, the 10-year US Treasury yield rose significantly at the beginning of 2025 amid inflationary fears. This led to the underperformance of preferreds in January. In April, after US President Donald Trump announced his “Liberation Day” tariffs, most financial assets began to perform poorly, including preferred securities. Preferreds quickly recovered, however, and performed well through October.

The solid economic growth in US provides support to the overall preferred securities market, because a strong economy generally benefits credit spreads.

Several factors lead us to believe that US economic growth will be strong in 2026. The “One Big Beautiful Bill Act” is expected to contribute to economic growth in 2026, as it allows accelerated depreciation of capital goods, incentivising companies to spend more to gain this one-time benefit. In addition, US consumers are expected to get around USD 100 billion (0.3% of GDP) in fiscal stimulus. Of the USD 100 billion, USD 65 billion will be a tax refund windfall due to the favourable treatment of gratuity and overtime income. The combined effect of more capital goods investments and tax refunds is expected to boost GDP growth by 0.3 to 0.4 percentage point. The other two factors are 1) the lagged effect of Fed rate cuts and 2) AI investment.

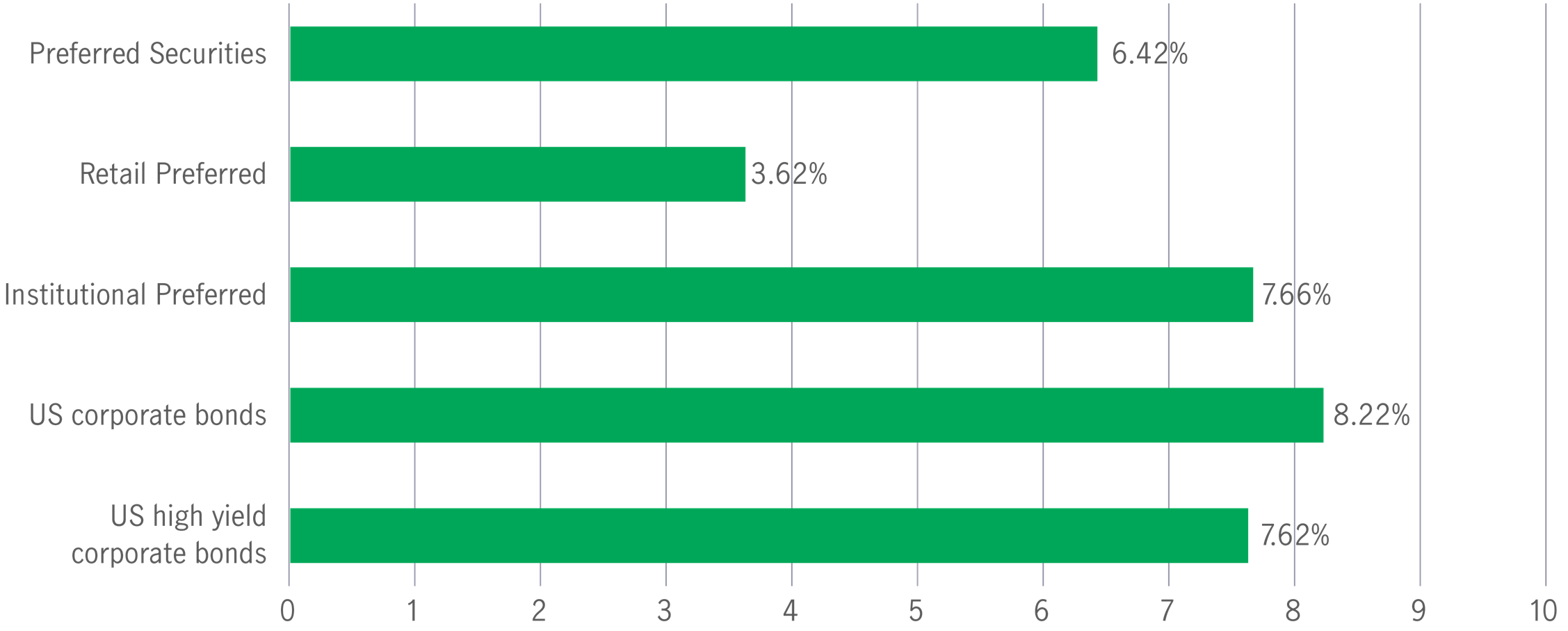

Chart 1: 2025 year-to-date US fixed income performance (as of 30 November 2025)2

We have been overweighting utilities preferreds for years, given the sector’s excellent fundamentals, low valuations relative to the market benchmark, investment-grade-rated balance sheets, and attractive yields. In 2026, utilities should remain our core play, supported by rapid AI development, as the reindustrialisation should no longer serve solely as downside protection.

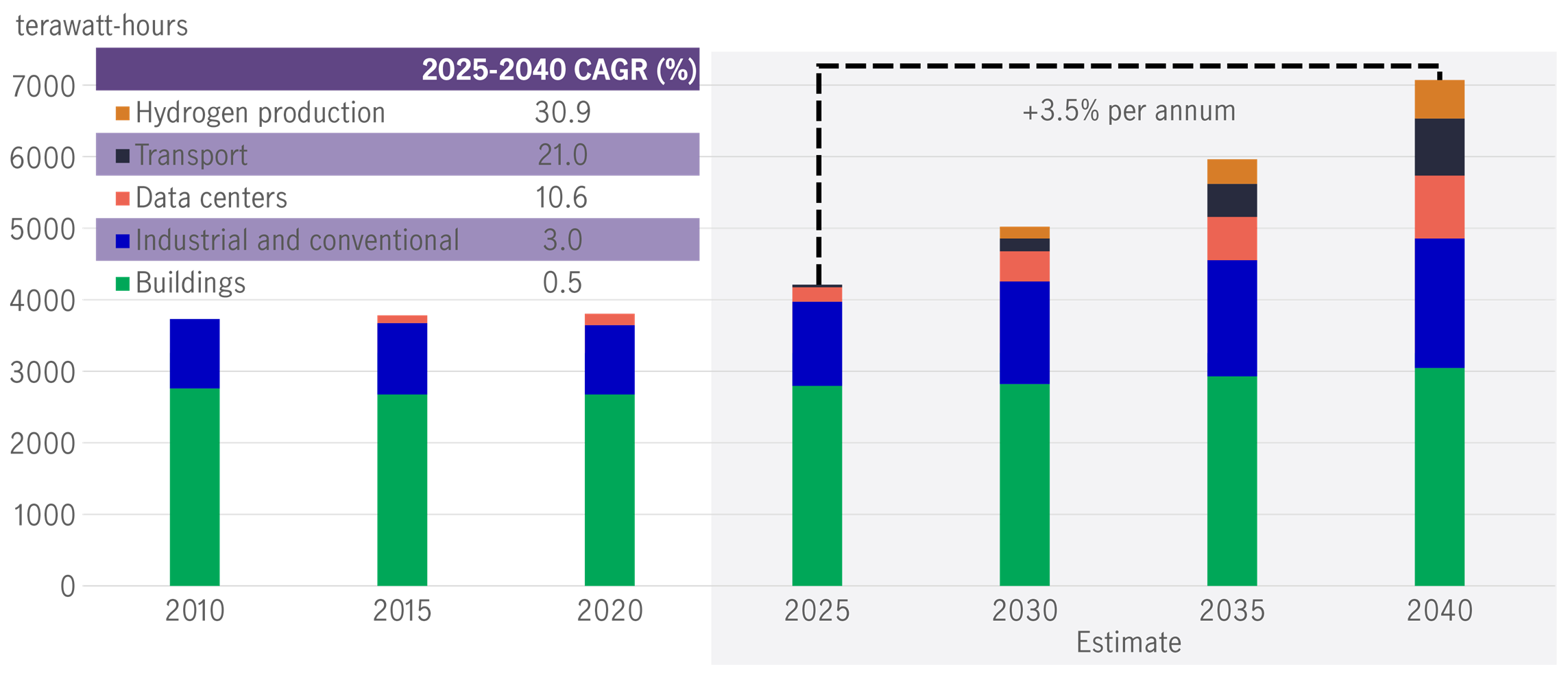

The rapid growth of AI is driving a surge in data centre usage and electricity consumption because training and running large AI models require massive computational power, typically provided by high-performance graphics processing units (GPUs) and specialised chips housed in data centres. As AI workloads scale, data centres consume significantly more electricity than traditional IT operations, and the market has been gradually raising the US power consumption forecast, with the latest estimate of 68% growth over the next 15 years.

Increasing power demand could result in two outcomes:

1. Driving renewable investment and earnings prospects

Accelerating investment in US renewables and storage solutions for now, given renewables like solar and wind can be deployed faster at a lower marginal cost, and provide clean energy. Gas and nuclear are expected to further supplement in the next decade. The trend could result in significant investments in the sector. We believe this could potentially translate to consistent earnings and cash flow growth of between 6%-8% for at least the next five years.

2. The need for investment financing and preferred issuance

US utilities tapped the preferred market to power the AI boom. In 2024, the sector raised USD 18.8 billion from new issuance, a nine-fold jump from 2023, and surpassed the US banking sector. The trend continued in 2025, and we expect issuance to increase in 2026.

Chart 2: US power demand is expected to increase up to 3.5% annually through 2040

US power demand by sector

Source: McKinsey, 29 April 2025. For illustrative purposes only. CAGR stands for compound annual growth rate.

We expect this trend to continue, and, in particular, energy midstream companies are major beneficiaries, presenting more investment opportunities for investors seeking income via quality investment tools.

As electricity demand is strong, new generation is required to meet that demand. Natural gas-fired generation can meet this demand, so more natural gas is needed as well. This is positive for energy midstream companies, as a large share of their earnings comes from transporting natural gas through their pipelines. More volumes in their pipes result in higher earnings and cash flow for these companies.

Secondly, we have a constructive view on utility preferreds amid the easing monetary policy trend. The US Fed cut interest rates by 25 basis points (bps) at its mid-September meeting, marking the first rate cut in 2025. Fed Chairman Jerome Powell’s term ends in May 2026, with his replacement expected to be more dovish, potentially leading to two more rate cuts in 2026, bringing the Fed funds rate to 3%.

A lower Fed funds rate provides a tailwind for fixed income, particularly preferred securities. That said, despite the 2025 rate cuts, long rates remained range-bound and didn’t fall by all that much. We expect the same in 2026, with short rates continuing to move lower. However, long rates will be range-bound. This is because of inflationary concerns that still permeate the economy, which could mean that 2026 will be a year of carry that favours asset classes like preferreds, offering attractive yields of 6.64%.

In particular, utilities preferreds are viewed as a bond proxy and typically underperform in rising rates. The sector historically posts strong returns in a falling-rate environment.

Falling interest rates are beneficial to utilities that must issue debt to fund their capital expenditure. Also, falling interest rates help utility common stocks, as they are considered a bond proxy and, like other fixed-income sectors, do well when rates fall. This helps our utility convertible preferreds, which are equity-linked securities.

From a risk management perspective, utilities' positioning is also crucial as a defensive play, given that their businesses are highly regulated. They can provide downside protection in times of elevated volatility.

This was evident in 2023, when concerns arose about US regional banks. Many of the regional bank preferred securities performed very poorly in 2023. However, utility preferreds significantly outperformed, again showing their defensive characteristics.

A risk we will watch in 2026 is higher-than-expected inflation. Geopolitical risk is also something we will be mindful of in 2026.

Although we have a positive economic outlook for 2026, unforeseen events could still negatively affect the economy. That’s why we believe it is important to have a large weighting in the defensive utility sector, which can mitigate the effects of a weaker economy by maintaining more stable credit spreads. Importantly, utility preferreds have been the best performing element of the strategy over the last three years, despite their defensive characteristics.

Apart from utilities, financial institutions, which represent more than half of the preferred universe, showcase strong industry fundamentals3 that we view positively. Bank fundamentals remain strong with solid loan growth and low delinquencies. The earnings of most banks beat expectations in the third quarter of 2025, driving stock prices higher. A steep yield curve, which we’re likely to see in 2026 as the Fed funds rate comes down, is positive for banks, as they can earn a higher spread between what they pay for deposits and what they earn on loans. Insurance companies, which are regulated businesses, also have strong fundamentals, with property and casualty (P&C) insurers enjoying elevated premiums that drive earnings higher. Life insurance companies are reaping the benefits of higher interest rates in their investment portfolios, which supports credit.

The positive fundamentals outlined above should result in tighter credit spreads in the preferred securities market. Chart 3 shows that credit spreads have widened over the last three months. We believe that credit spreads can tighten back to where they were just a few months ago, given our view of a strong economic environment, plus positive industry fundamentals.

Chart 3: Potential tightening of preferred credit spreads (basis points)

Source: Bloomberg, as of 30 November 2025. The above chart shows the credit spread of ICE Bofa US All Capital Securities Index. For illustrative purposes only.

The Fed is expected to be dovish in 2026, which could lead preferreds to appreciate – although the 10-year US Treasury yield might not come down as much. We believe we should at least achieve a coupon return plus the potential for a little more if spreads further tighten. Higher price appreciation could occur if the entire US Treasury curve declines in parallel with the Fed funds rate. Through an overweight utility play, we can not only benefit from lower interest rates, but also from the AI trend and a defensive hedge.

We believe that, within fixed income, preferreds are a great place to be in 2026, with strong credit fundamentals, wider credit spreads than in other areas of the market, and attractive yields of 6.64%.

1 Bloomberg, as of 30 November 2025. Yield refers to the yield to Maturity (YTM) of ICE Bofa US All Capital Securities Index. YTM is the discount rate that equates the present value of a bond's cash flows with its market price (including accrued interest. Yield to maturity is not an accurate reflection the actual return that an investor will receive in all cases.

2 Source: Bloomberg PORT, data as of 30 November 2025. Performance is in USD and total return. Preferred securities are represented by ICE BofA US All Cap Securities index. Retail preferreds are represented by ICE BofA Core Plus Fixed Rate Preferred Securities Index. Institutional preferreds are represented by ICE BofA US Capital Securities Index. US corporate bonds are represented by ICE BofA US Corporate Index, US high yield bonds are represented by ICE BofA US High Yield Index. Past performance is not indicative of future performance. It is not possible to invest directly in an index. For illustrative purposes only.

3 Source: Bloomberg, as of 30 November 2025. Financial institutions represent 61.81% of the issuers in the US All Capital Securities index, with banking comprising 34.38% and insurance accounting for 21.05%.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.