16 January 2026

Global equity markets delivered strong returns in 2025, supported by steady economic growth, declining inflation, and robust corporate earnings. Aggressive interest rate cuts by central banks, especially the US Federal Reserve, added fuel to the rally. The excitement surrounding artificial intelligence was an additional tailwind for the markets, driving meaningful rally in the US mega-cap technology stocks that dominate global indexes. These positives helped offset concerns about the protectionist shift in US trade policy.

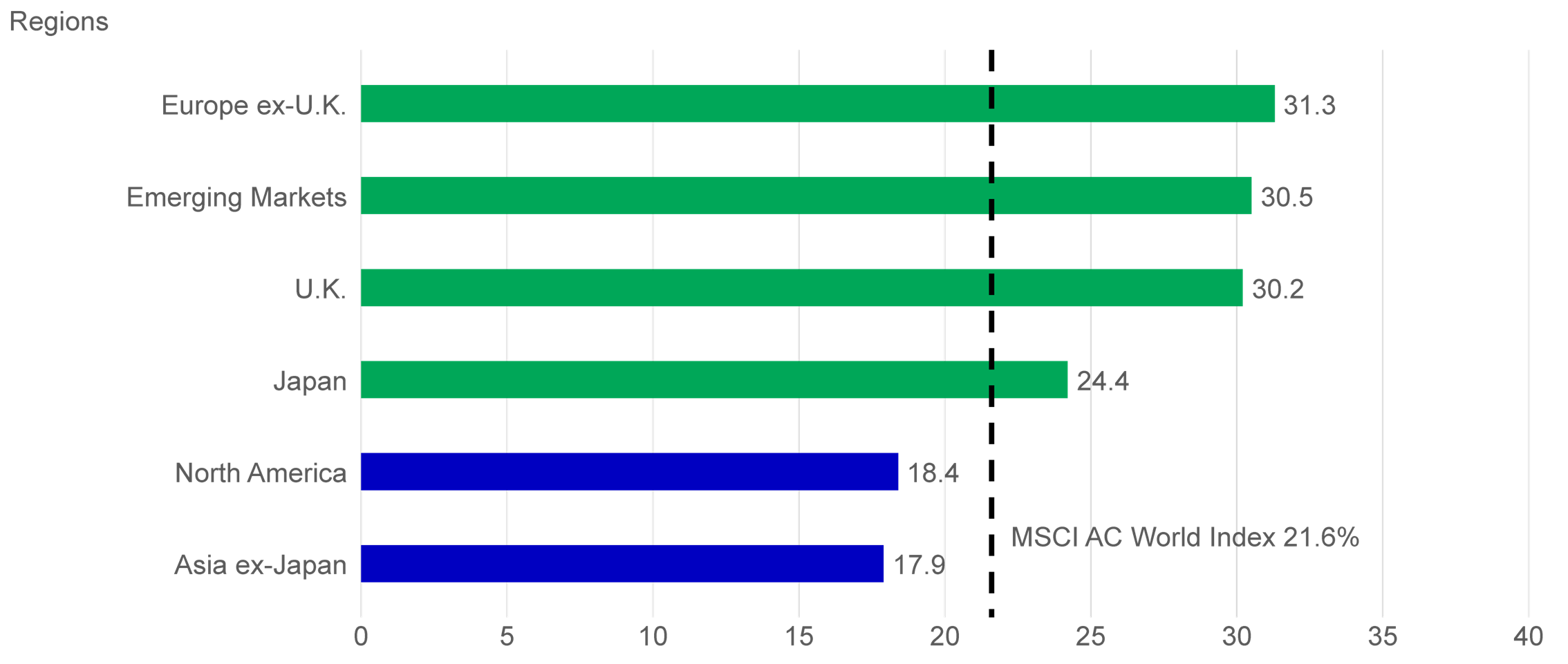

Europe led performance at the regional level, helped by optimism around the potential economic impact of lower interest rates and increased government spending. Emerging markets also outperformed developed markets, showing broad-based strength across regions. The US and developed Asia, posted gains but lagged global peers.

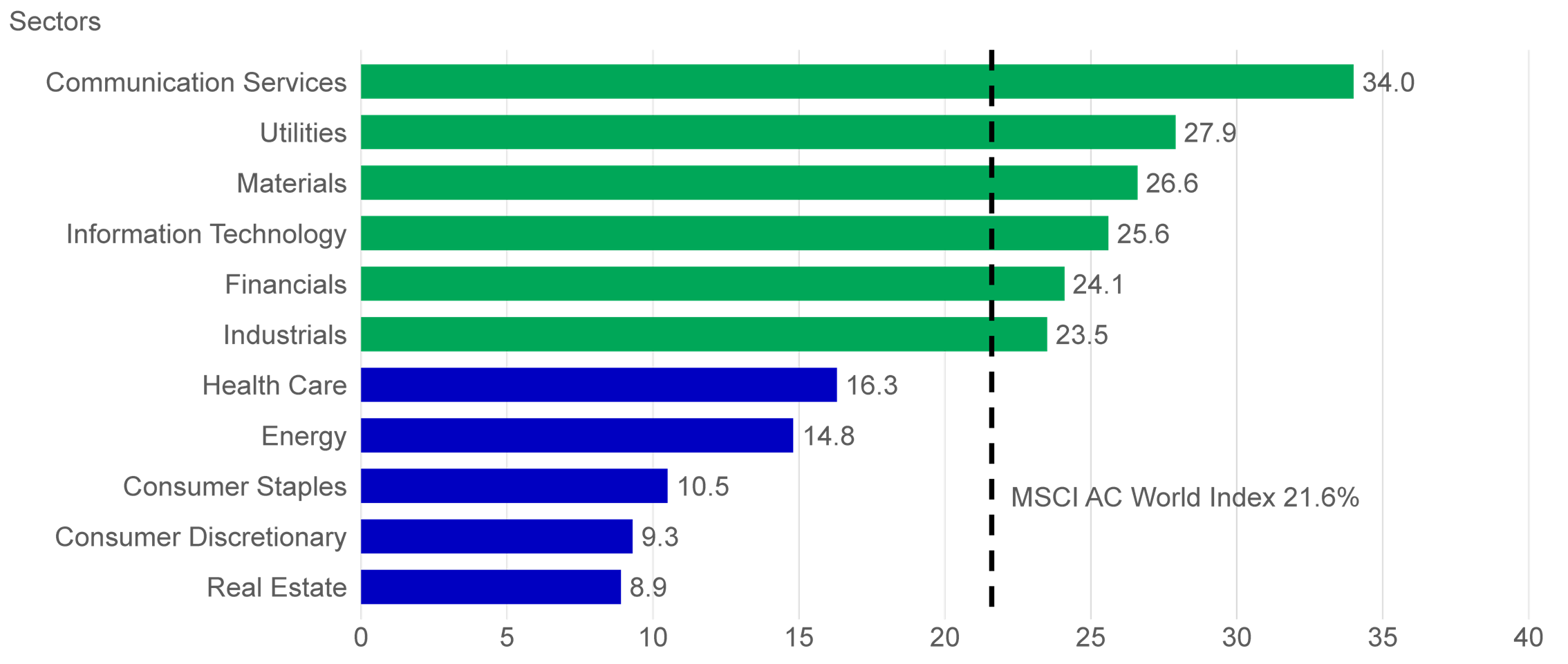

2025 January – November returns of MSCI ACWI regions and sectors

Source: Manulife Investment Management, FactSet Research Systems, data as of 30 November, 2025, in USD. Past performance is not an indicative of future performance. It is not possible to invest directly in an index.

Dynamic leaders are high-quality, industry-leading businesses with attractive growth profiles that have the potential to outpace the market and deliver strong profitability, revenue, earnings, and cash flow. We look for opportunities globally across sectors and markets. While sector weights can shift with valuations and opportunities, several themes guide our approach.

Sectors

Geographies

Company fundamentals and a supportive macro environment should continue to underpin global equities. Resilient economic data and good earnings growth have pushed valuations higher, lifting indexes to record highs. While tariff-related challenges could create short-term headwinds, we believe fiscal and monetary policies remain favourable.

As we enter 2026, we remain positive on equities. We expect opportunities beyond US markets should persist, and industry leaders are likely to strengthen their positions, offering higher return potential.

A continued broadening of market leadership should benefit active strategies like ours. Over the medium to long-term, we believe high-quality industry leaders with strong brands, sound balance sheets, and compounding earnings profiles should continue to deliver consistently solid financial results and share-price returns.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.