17 December 2025

Alex Grassino, Global Chief Economist, Multi-Asset Solutions

Dominique Lapointe, CFA, Senior Global Macro Strategist

Erica Camilleri, CFA, Senior Global Macro Analyst, Multi-Asset Solutions Team

Yuting Shao, Senior Global Macro Strategist, Multi-Asset Solutions Team

Hugo Bélanger, Senior Global Macro Analyst, Multi-Asset Solutions Team

Our 2026 macro outlook highlights key themes across global economies and commodities, what we'll be watching closely in the new year, and portfolio takeaways for investors to consider.

This past year has been eventful—and turbulent—from a global economic and capital markets perspective. President Trump’s second administration, ongoing geopolitical tensions, fiscal policy developments worldwide, uncertainty around central banks’ monetary policy paths, and the artificial intelligence (AI) boom have all featured prominently.

Several of these factors will probably continue shaping the global macro backdrop in 2026 and beyond. While some economies are likely to benefit from a heady combination of easier monetary policy and fiscal support, others will have to contend with structural forces that could hamper their growth prospects; others still face unsettled policy environments that could drastically alter their trajectories.

As we approach 2026, we provide a high-level overview of selected countries/regions and commodities, focusing in on key macroeconomic themes and potential capital markets implications.

After a period of heightened uncertainty in the first half of 2026, we expect U.S. economic activity to steadily improve as the year progresses. In addition to the simple passage of time as businesses and consumers become more acclimated to the operating environment under the second Trump presidency, our forecast derives from two main sources: stimulative fiscal policy and the lagged effects of monetary policy easing.

On fiscal policy, the full impact of the One Big Beautiful Bill Act is likely to support U.S. growth in two ways next year. First, the ability to fully amortize capital expenditures (capex), along with the general reduction in the corporate income tax rate, should promote increased spending in the corporate sector, potentially including a broadening out of business investment beyond AI infrastructure-related capex. Second, various household tax rebates should bolster consumer spending beginning in the second quarter of 2026.

U.S. monetary policy remains a subject of debate. The Federal Reserve (Fed) must weigh the relative importance of still-too-high inflation, which we think will moderate but remain above trend next year, and concerns around a cooling labour market. While we believe the Fed will ultimately ease policy further toward a 3% benchmark rate, the more salient point is that the aggregate effects of policy easing over the past 18 months should already provide a means of support for the overall economy.

AI capex looks poised to skyrocket over the next two years

Source: Bloomberg, Manulife Investment Management, as of 10/11/25. Based on four-quarter moving totals for the six largest U.S. cloud computing hyperscalers. Past performance does not guarantee future results.

Two themes are worth monitoring closely:

Despite elevated uncertainty around reciprocal tariffs, China’s economy proved resilient in 2025, thanks to government policy support and solid contributions from the country’s net exports. Looking ahead, we think the sequential slowdown that occurred in late 2025 calls for both monetary and fiscal policy to remain accommodative—especially amid a struggling property sector, falling investment levels, and soft domestic demand. Additionally, we believe a supportive global growth and trade backdrop will be key to China’s economic outlook, particularly as tariff-related tensions with the U.S. potentially ease somewhat next year.

2026 will mark the first year of China’s Fifteenth Five-Year Plan. We expect the nation’s growth target to once again be set at around 5% and, accordingly, anticipate the People’s Bank of China (PBoC) lowering its benchmark interest rate by roughly 10-20 basis points. Indeed, we could see a front-loading of both PBoC monetary policy support and fiscal stimulus measures by the government to help ensure that China’s economy gets off to a strong start in 2026. That said, overcapacity issues and an imbalance between supply and demand will likely persist, as might a lingering deflationary impulse. If downside risks to growth materialise, authorities may be inclined to step up the fiscal stimuli in response.

Chinese domestic demand remains sluggish

Bloomberg, Macrobond, Manulife Investment Management, as of 25/11/25..

Will recent equity outperformance produce enough of a “wealth effect” to sustainably boost consumer sentiment and spending?

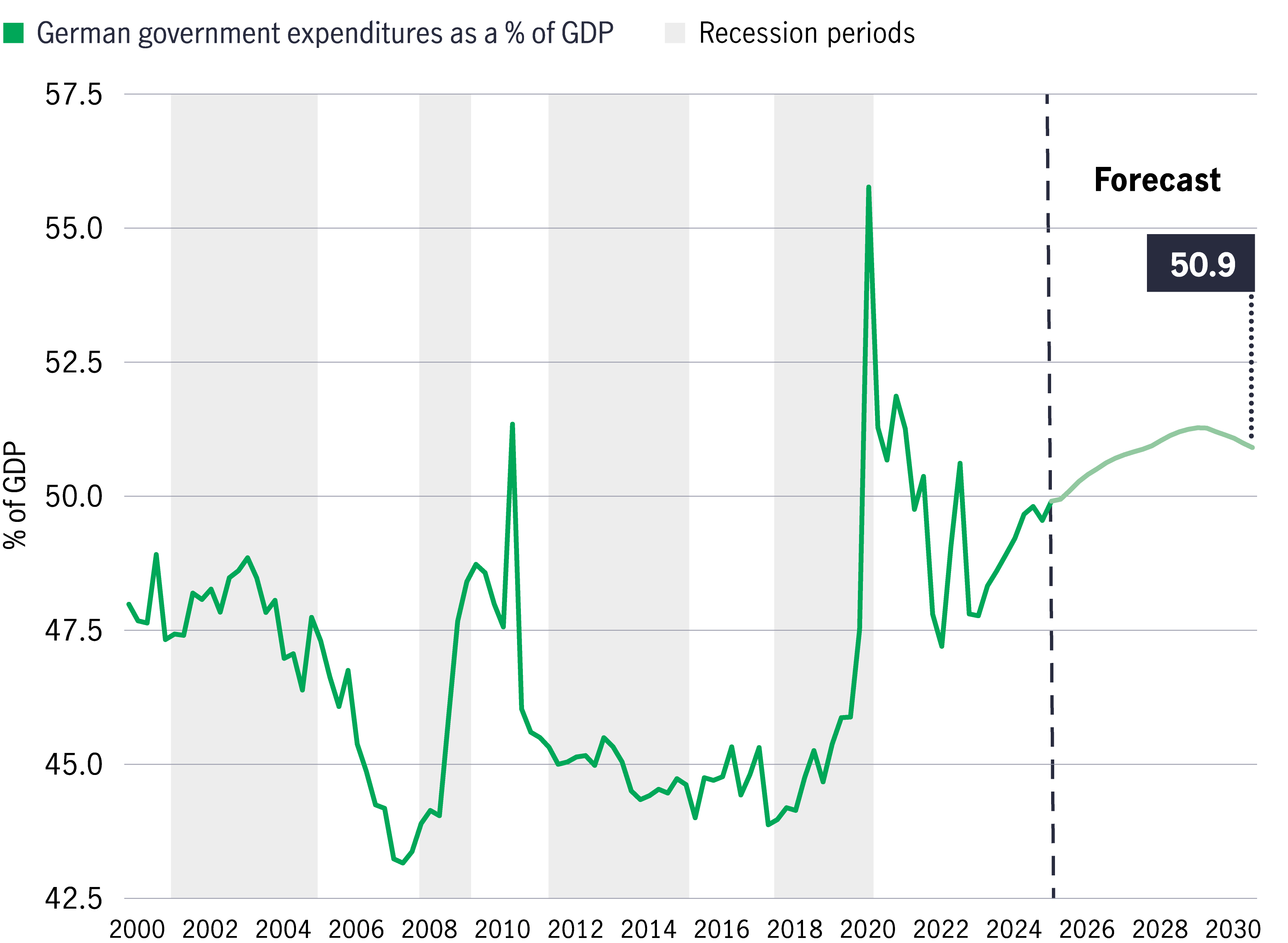

We expect the cyclical economic rebound that the euro area experienced in 2025 to continue into 2026, with further contributions from the European periphery (e.g., Spain and Italy). While regional growth may recover to only below-trend levels next year, we see potential for some upside surprises: Pro-business and pro-growth structural reforms and German-led fiscal stimulus could be tailwinds for the eurozone economy into 2026, perhaps leading to above-trend growth in 2027. A possible fly in the ointment for the region’s economic outlook is France, where political volatility and fiscal consolidation could weigh on growth in the coming quarters. In addition, slowing overseas exports remain a key risk for the euro area, particularly in the first half of 2026.

In the meantime, inflationary impulses continue to ease across the region. We expect eurozone inflation to hover around the European Central Bank’s (ECB's) 2% target in 2026 amid countervailing forces that may create a measure of stability: On the plus side, U.S. tariffs are likely to put upward pressure on inflation, whereas energy deflation and a stronger euro should temper it somewhat. The pairing of a benign inflation outlook with a solid labor market underpins our view that monetary policy easing by the ECB is probably over for now. As such, we expect the central bank to maintain its benchmark interest rate at 2%—a comfortably neutral policy stance—throughout 2026.

German fiscal policy is set to expand materially

Source: OE, Macrobond, Manulife Investment Management, as of 19/11/25.

Implementation progress on fiscal stimulus packages and structural reforms.

We see the United Kingdom’s stagflationary macro conditions persisting into 2026, marked by below-trend growth and sticky inflation. Structural growth headwinds such as weak productivity and lackluster investment are likely to limit the economic recovery, while easier monetary policy should help support headline growth. In contrast to the euro area, the U.K.’s fiscal impulse is expected to contract in 2026 as policymakers prioritize deficit reduction. Tax and wealth redistribution policies continue to dampen consumer and business confidence, which is also weighing on the real economy, particularly the labour market.

We anticipate a rise in the U.K.’s unemployment rate next year, as both the private and public sectors look to reduce headcounts. This largely drives our relatively dovish outlook for the Bank of England (BoE), which we expect to lower its key policy rate to neutral (3%) by the first quarter of 2027. The main risk to our BoE forecast is inflation, which we see remaining above the BoE’s 2026 target due to a constrained supply side, placing the central bank in an unenviable position.

The BoE’s dilemma: weakening employment, sticky inflation

Source: Bloomberg, Manulife Investment Management, as of 19/11/25.

Deficit reduction progress and the health of the labour market.

Japan’s goal of fostering a structurally stronger growth outlook, led by domestic consumption and investment, remains unchanged. Economic activity has improved in recent years, prices have gradually picked up, and the output gap is now close to zero. Despite a slowdown in the second half of 2025, we see the economy resuming a moderate recovery path next year. Broad inflation should trend lower, toward 2%, even as wage growth is likely to persist into 2026.

Expansionary fiscal policy will be a hallmark of Prime Minister Takaichi’s administration, aiding the economic recovery. In November 2025, the government unveiled the nation’s biggest fiscal stimulus package since the COVID era. Next year’s budget is also expected to reflect the administration’s determination to use fiscal policy to boost growth. Meanwhile, with real interest rates still negative, we expect the Bank of Japan (BoJ) to continue normalizing monetary policy in 2026. However, debt-servicing cost concerns stemming from high levels of national debt could keep the BoJ on the sidelines for longer, as could the government’s strong fiscal impulse.

Japan’s debt sustainability in focus

Source: Bloomberg, IMF, Macrobond, Manulife Investment Management, as of 25/11/25.

The impact of increased government spending on growth, versus the risk of a worsening fiscal outlook triggering debt sustainability and market stability concerns.

Emerging market (EM) economies enter 2026 with improving fundamentals, but many must contend with a still-fragile global trade backdrop. Next year, we expect world economic growth to gradually strengthen and the macro narrative to continue shifting away from U.S. “exceptionalism” toward a more balanced global profile. At the same time, less uncertainty around U.S.-imposed tariffs should help reduce headwinds to global trade and manufacturing activity.

While manufacturing and trade cycles appear to have withstood last year’s U.S. tariffs shock, we expect their initial rebound to be modest, with momentum building as supply chains continue to adapt and negotiated trade agreements take effect. EM equities have started pricing in brighter global growth prospects, with market sectors such as information technology, materials, and consumer discretionary having outpaced their developed market (DM) peers recently.

On the monetary policy front, most EM central banks are near the end of their easing cycles. Although headline inflation has more or less returned to target levels in many EM economies, improving growth and sticky core inflation will likely make central banks more hesitant to cut rates in 2026. Nonetheless, the lagged effects of already-lower rates should continue to support growth for much of 2026. Ongoing U.S. dollar (USD) weakness could provide an additional tailwind to EM economies and global trade next year.

Strong trade and manufacturing should support EM earnings growth

Source: S&P Global, MSCI, Macrobond, Manulife Investment Management, as of 25/11/25.

To what extent might reaccelerating global manufacturing and trade boost EM economies and assets?

After a year of outperformance, with EM equity valuations back to around their historical averages, sustained market upside in 2026 will depend on stronger corporate earnings, continued trade recovery, and further weakening of the USD.

The global oil market faces a challenging start to 2026 due to a large supply surplus, which is keeping prices subdued. However, we expect supply to gradually tighten in the second half of the year as global growth rebounds, non-Organization of Petroleum Exporting Countries (OPEC)+ production slows, and OPEC+ spare capacity narrows.

On the supply side, OPEC+ remains a key player. After bringing back supply of nearly 3 million barrels per day from voluntary cuts (nominally) in 2025, the group intends to pause further increases in early 2026 amid weak market fundamentals. It’s also likely that several producers are already near capacity, reducing their ability to respond to market disruptions and making the rest of the group reluctant to add barrels. Non-OPEC+ supply growth will dominate the first half of the year, yet this momentum is expected to fade as low prices curb investment, particularly for more price-sensitive supply like U.S. shale.

Global geopolitical risks should persist, with sanctions on Russia and instability in Venezuela posing upside risks to oil prices, although our current base case assumes no major export losses.

On the demand side, global economic growth is showing signs of recovery as manufacturing and trade cycles improve. A weaker U.S. dollar could further support demand, especially in emerging markets. Ultimately, however, we believe global inventory levels will shape the path of oil prices in 2026. While most surplus barrels have flowed into Chinese storage this year, a slowdown in stockpiling there will likely push OECD inventories higher in 2026.

Global oil markets are facing a large supply surplus

Source: EIA, Macrobond, Manulife Investment Management, as of 1/12/25.

Gold has been on an exceptional run over the past two years, propelled by numerous factors—geopolitical tensions, U.S. policy uncertainty and fiscal deficits, concerns around U.S. Federal Reserve (Fed) independence, USD weakness, inflation risks, and monetary policy easing. The gold rally has come in waves, each followed by two to four months of consolidation:

We believe a structural shift is underway as world central banks and many investors seek greater portfolio diversification in an increasingly unpredictable global environment. Gold remains under-owned across both private and official sectors, reinforcing its role as a strategic long-term asset.

The most recent rally was powered by the largest ETF inflows since 2020 (after years of outflows), with changing market expectations for Fed rate cuts supplanting policy uncertainty as the key driver. Despite ongoing structural support for gold demand, we believe its next move higher will likely require a catalyst to stimulate additional ETF inflows—for example, markets pricing in deeper Fed rate cuts, or geopolitical and U.S. policy risks flaring up. The former scenario looks plausible in the first half of 2026, which could provide upside to gold next year, until the Fed nears its terminal policy rate.

Gold has rallied in waves over the past two years

Source: LBMA, Macrobond, Manulife Investment Management, as of 2/12/25.

The Fed’s approach to a weakening labour market amid some stickiness in inflation, as more policy easing, a weaker USD, and renewed Fed independence concerns would all help fuel gold’s rise.

We expect gold’s price to remain attractive next year, at least until the Fed approaches its terminal rate, as central banks’ and investors’ appetite for enhanced diversification continues.

2025 was an emotional roller-coaster for Canadian businesses, marked by extreme uncertainty amid border- and fentanyl-related U.S. tariffs, steep sectoral duties, and a federal election. On tariffs, the government imposed (then removed) counter tariffs, and programs to support struggling industries came in sporadically. These challenges have further weakened an economy already burdened by sluggish business investment and low productivity. Although businesses did not resort to widespread layoffs, there remains little appetite for hiring, which has restrained employees’ wage growth.

We think 2026 will be a year of adaptation: U.S.-destined exports have bottomed, while trade activity with select international markets (e.g., England and China) has picked up slightly. Canadian firms are aiming to leverage existing international trade agreements to offset declining exports to the United States, but geography and lack of supply chain integration are limiting factors. Domestically, we think the impact of past monetary policy easing, combined with government industrial policies on housing, infrastructure, and commodities, will start to bear fruit toward the end of 2026. We forecast weak but improving economic growth throughout the year.

Canadian exports to the United States have fallen sharply

Source: StatCan, Macrobond, Manulife Investment Management, as of 28/11/25.

The United States-Mexico-Canada Agreement (USMCA) renewal process:

Despite extreme uncertainty and sectoral tariffs, Canada has avoided recession, partly because about 85% of its exports to the United States remain exempt under USMCA. However, the agreement faces a formal review on 1 July, 2026. While a deal is likely, we expect a volatile renewal process, which might hinder Canada’s economic recovery.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.