7 September 2021

The COVID-19 pandemic has caused people to pay closer attention to their health. Many have become passionate about weight control and achieving the ideal body shape. Have you considered that your income and expenditure curves also need to have an ideal shape?

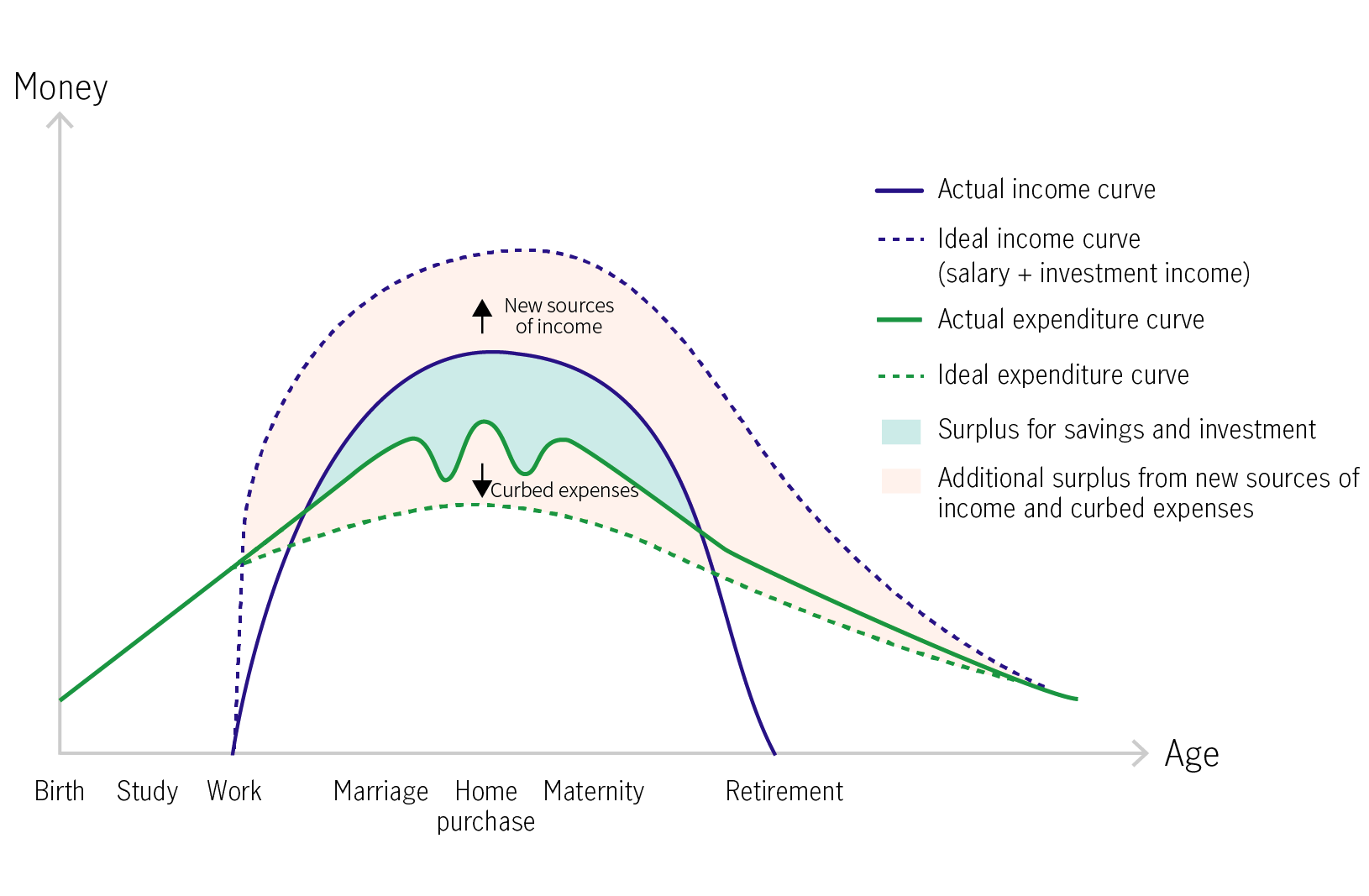

We describe below the actual and ideal versions of the income and expenditure curves. In reality, when a person earns enough to cover any expenses and is financially prudent throughout their working life (around 30 to 40 years), they could have surplus cash for savings and investments (the portion where the income curve lies above the expenditure curve, as highlighted in light blue). However, the crucial question is: Without a regular income, will the surplus be enough to support your living costs during retirement?

Ideally, both the income and expenditure curves should be reshaped. In other words, the income curve should become steeper, with investment income helping extend its end point beyond retirement. And if you spend less, the expenditure curve should be flatter and remain below the income curve, even after retirement.

It is crucial to create a higher surplus by widening the income and expenditure gap (the portion where the ideal income/actual expenditure curve lies above the actual income/ideal expenditure curve, as highlighted in light pink), paving the way for an ideal and relaxed retirement.

For illustrative purposes only. The chart does not represent the income and expenditure of any individual.

What does short-term oil price volatility mean for pension scheme members?

Recent geopolitical tensions involving Iran have renewed focus on oil prices and their potential economic and market effects. How can retirement savers navigate short term oil price volatility?

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Harness lower-risk funds to navigate uncertainty and volatility

Market uncertainties are accelerating recently, this article will discuss how employees navigate the turbulent conditions by making good use of lower-risk fund

What does short-term oil price volatility mean for pension scheme members?

Recent geopolitical tensions involving Iran have renewed focus on oil prices and their potential economic and market effects. How can retirement savers navigate short term oil price volatility?

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Harness lower-risk funds to navigate uncertainty and volatility

Market uncertainties are accelerating recently, this article will discuss how employees navigate the turbulent conditions by making good use of lower-risk fund