15 May 2025

Since the beginning of this year, a series of US tariff policies have drastically reshaped global trade dynamics. The impact on economic growth, inflation, and central bank monetary policy is uncertain. Coupled with geopolitical tensions, all these factors have heightened uncertainty in financial markets. In response, employees may seek safer havens by switching their Mandatory Provident Fund (MPF) contributions to lower-risk funds to reduce the impact of this unprecedented market volatility.

However, it is important to note that these lower-risk funds may exhibit significantly different characteristics and returns compared to the investor’s current funds. Moreover, it is crucial to adopt a strategic approach. After a brief “risk off” period, investors should consider a timely reallocation of their assets to other fund options that align with their risk tolerance levels.

Given current market conditions, there are three possible reasons why an employee would allocate a more significant portion of their MPF contributions to the Money Market Fund - MPF Conservative Fund1 - that carries lower risk:

1. The current market volatility has surpassed the risk tolerance level of the investor. Therefore, the investor may allocate a portion of their accrued benefits and/or new contributions to low-risk funds as a “short-term refuge” to reduce overall portfolio volatility.

2. The investment outlook and long-term trends for the assets held by the investor suddenly change or deviate from the original investment objectives and their risk tolerance. In that case, the investor may sell the relevant investments and switch to lower-risk funds until other suitable investment options become available for portfolio rebalancing. However, it is essential to remember that short-term market volatility does not reflect the investment outlook and long-term trends. It should not undermine the individual's long-term investment goals.

3. The investor plans to switch funds. Unlike regular monthly contributions, fund switching represents a lump-sum investment and does not benefit from the advantages of dollar-cost averaging. The returns will depend on the buying and selling prices at the time of the switching. The investor will also face higher risks during volatile markets, or when the amount involved in the fund switch is significant/ represents a higher proportion of the portfolio value.

While conservative funds do not guarantee capital preservation, they typically invest in low-risk assets denominated in Hong Kong dollars, such as Hong Kong dollar bank deposits and Hong Kong dollar bonds. Consequently, these funds exhibit lower potential volatility (and returns).

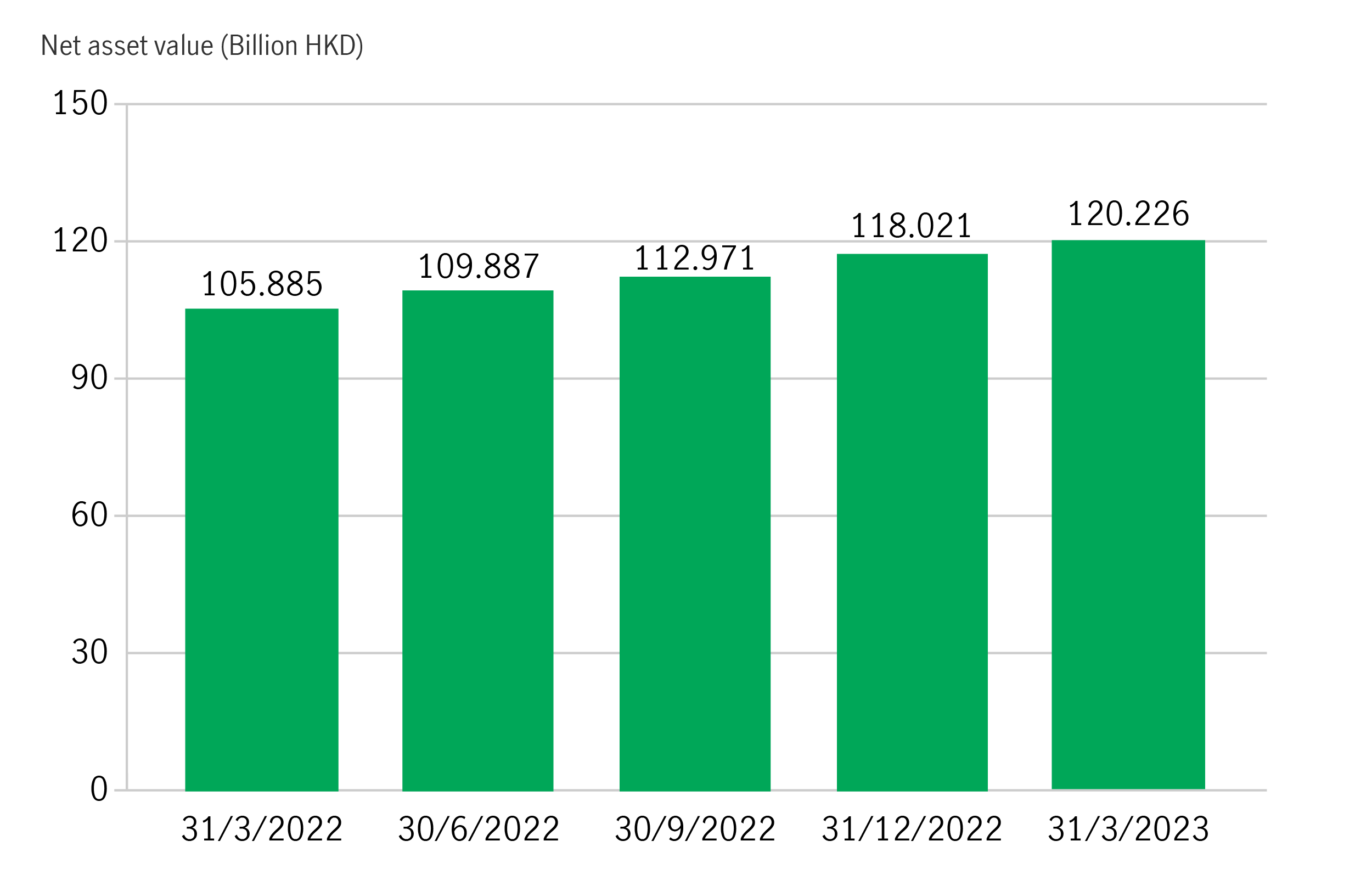

The size of the MPF Conservative Fund has been increasing1

Investor attention may also be drawn to another fund type known as the Guaranteed Fund, which, like the Conservative Fund, is a lower-risk option. However, the Guaranteed Fund typically incorporates mechanisms that ensure the preservation of the principal and/or provide minimum returns, such as interest. Certain funds offer unconditional guarantees that allow investors to receive the guaranteed principal and/or interest. The interest earned (after deducting fees) depends on the investment duration.

It is important to note that some guaranteed funds come with particular conditions. For instance, investors may be required to maintain the investment for an explicit period or until they reach a specific withdrawal age. These funds are suitable for certain groups, such as pre-retirees who aim to lock in their accrued benefits at a set level. If you intend to temporarily park your funds for a few months or even weeks, selecting an unconditional guaranteed fund that aligns with your objectives is crucial. Opting for a guaranteed fund with conditions may mean you cannot access the guaranteed principal or returns and could even involve higher-than-expected risks (as some funds may invest in stocks with greater volatility).

In the face of sudden market volatility, it is understandable for investors to seek refuge in lower-risk assets as a short-term parking place for their assets. However, they should remember that "storms won't last forever." These safe havens are typically intended as temporary shelters, and the initial goal of "short-term parking" should not be transformed into "long-stay parking". Holding too many lower-risk assets for an extended period is not ideal unless the investor approaches retirement age and plans to withdraw funds at age 65, gradually transitioning away from higher-risk assets. This caution is because such assets offer lower capital returns and may not meet the growth requirements of a Mandatory Provident Fund portfolio with a long-term investment horizon spanning 40 years.

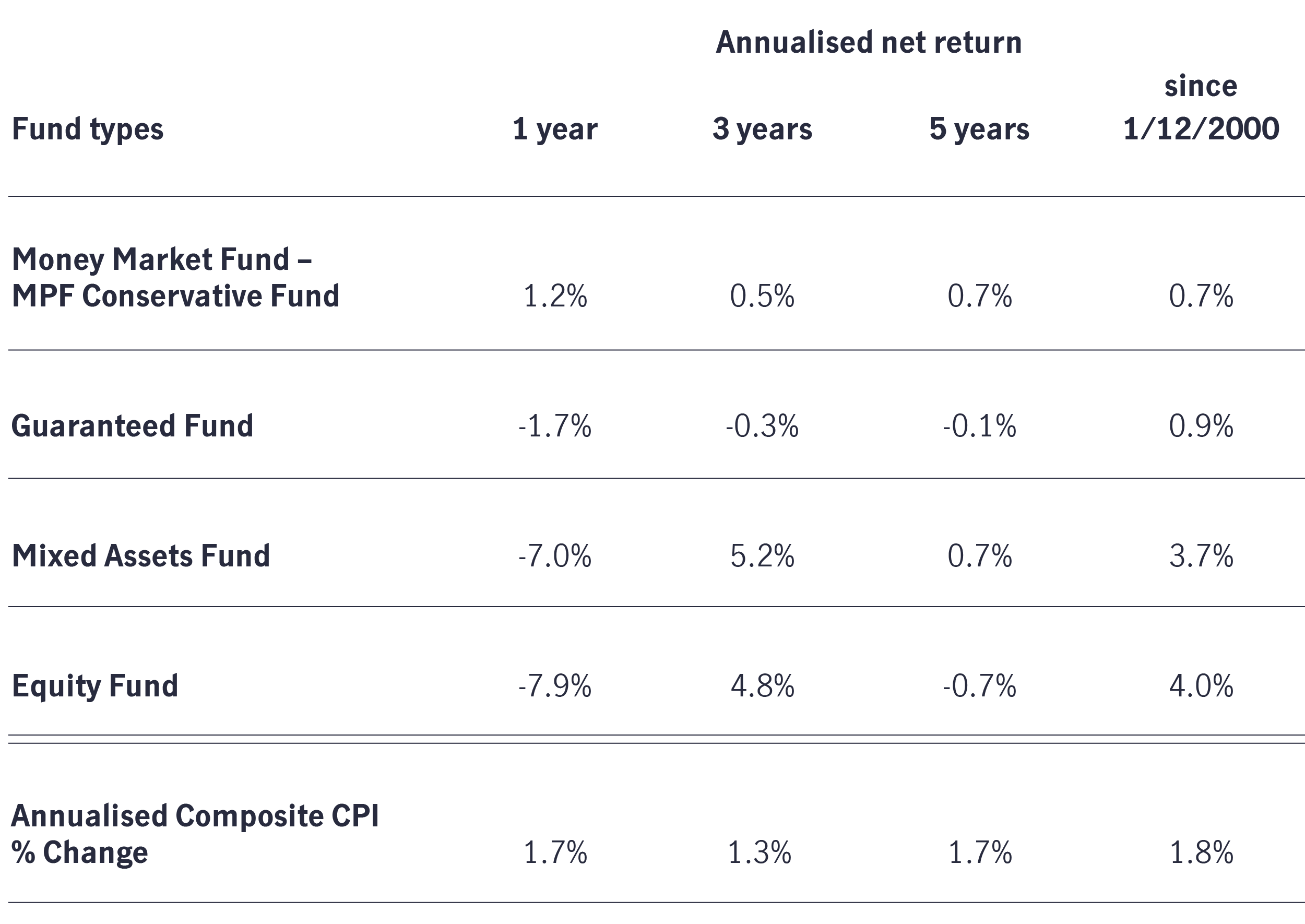

As shown in the table below, since the establishment of the Mandatory Provident Fund in 2000, the annualised net returns of the Money Market Fund - MPF Conservative Fund and the Guaranteed Fund have been only 0.9% and 1.2%, respectively. These returns are lower than the 4.3% return of the Equity Fund and the 4.0% return of the Mixed Assets Fund. They also fell behind the 1.8% inflation rate during the same period.1,2

The Conservative Fund and the Guaranteed Fund underperformed inflation in a long-run1,2

1 Mandatory Provident Fund Schemes Statistical Digest Quarterly Report December 2024 – published by the Mandatory Provident Fund Schemes Authority (MPFA). Data as of 31 December 2024. The net asset value of the Money Market Fund - MPF Conservative Fund was HKD 145.595 billion, higher than the Guaranteed Fund (another lower-risk fund) which had a net asset value of HKD 74.486 billion.

2 Based on data provided by Bloomberg. The annualized Composite CPI based on CPI data published by the Census and Statistics Department. Past performance is not indicative of future performance..

Get started with managing your personal finances

People often view managing their personal finances as a complicated process. In fact, it’s a lot more straightforward – it’s organising your money by establishing a budget that accounts for current expenditure, as well as building a strategy for the years ahead to achieve your financial goals. In this introductory article, we will provide steps for creating a financial plan and underscore the importance of managing your money effectively.

Dollar cost averaging: An easier way to withstand volatile markets

If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the passive strategy of dollar cost averaging may be a feasible choice.

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Your retirement withdrawal strategy—four tips for managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.

Women’s retirement planning: Invest in your future self

With longer average life spans, women are often more at risk of not meeting their retirement income targets. For better retirement, it is important to know the four critical factors which affect the shortfall risk: How long you’re likely to live, Start date for contributions, Contribution rate and Investment choices.