6 November 2023

Hong Kong has one of the longest life expectancies in the world – 81 years for men and 87 years for women.1 Also, the city is home to over 11,000 centenarians.2 Preparing for retirement expenses spanning at least twenty years from the age of 65 presents numerous challenges, particularly for individuals retiring during periods of market volatility, such as 2022 and 2023. To achieve a generous income and hassle-free post-retirement life, it is crucial to develop a comprehensive strategy that includes maintaining moderate investments and receiving a potentially regular and stable income.

Firstly, retirees should consolidate their current and non-current assets, including cash, investments property, and savings policies. After deducting emergency reserves and immediate cash needs, they may consider the following two income strategies:

Retirement marks the start of a long vacation, enabling retirees to free themselves from the daily toils of work and enjoy a relaxing lifestyle that nurtures their bodies and minds. However, it would be prudent to continue investing during retirement. By maintaining a moderate level of investments, individuals could enhance the potential for capital appreciation throughout their retirement years while lengthening the availability of assets for future withdrawals.

In volatile market conditions, retirees may worry about potential losses and become cautious about making new investments or even decide to cash out all their assets. However, it is not always necessary to select new funds to continue investing, nor should retirees rush to cash out all their assets. Instead, they can consider retaining their Mandatory Provident Fund (MPF) accounts after the age of 65 and continue investing in the scheme. Some MPF providers offer income funds that regularly distribute dividends, allowing investors to receive an income every month while remaining invested in dividend-paying funds. By staying invested, retirees can potentially sidestep the adverse consequences that may arise from "exiting the market" during headwinds, which could significantly erode their returns accumulated over the years or realise the losses. Additionally, they may miss out on subsequent market rebounds.

In addition to MPF schemes, there are also retail funds offering monthly distributions. Investors can gradually invest in suitable income funds before retirement based on their individual needs and risk tolerance. By applying the dollar cost averaging3 strategy, they might mitigate the impact of volatility in markets.

Retirement marks the onset of a phase where employment income ceases, and expenses become the primary focus. Therefore, it is essential to devise feasible plans to secure a steady cash flow and a certain amount of monthly income.

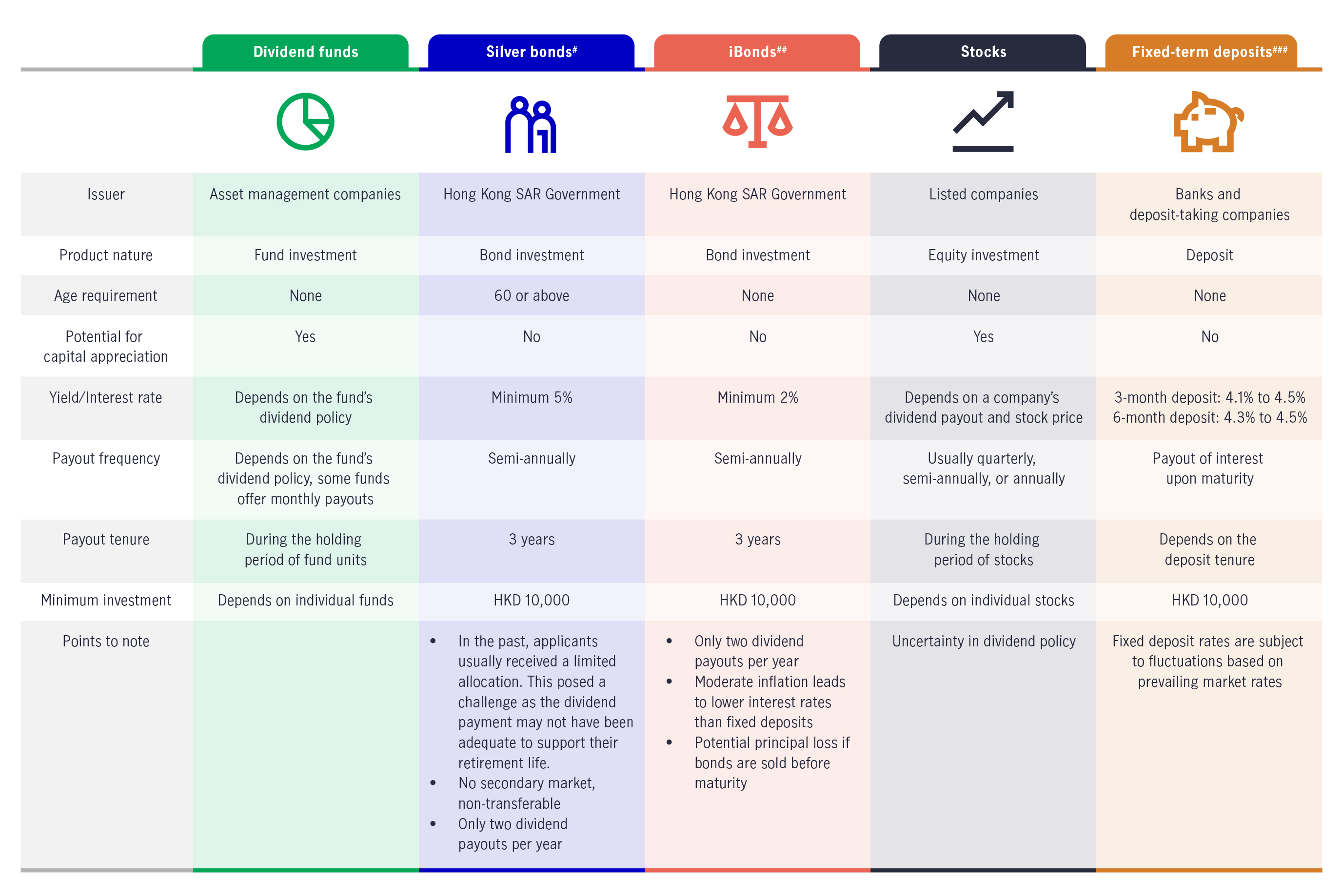

In addition to the aforementioned dividend funds, the past few years have seen retirees presented with other options, such as fixed-income investment instruments. For instance, the HKSAR government issues the Silver Bond and iBond series, both of which offer a guaranteed minimum interest rate. However, it's important to note that these bonds only provide semi-annual dividend payouts, irregular issuance schedules, and limited allotments. While the dividend amounts are foreseeable, they may not fully meet the monthly financial needs of retirees.

As for stocks, certain listed companies in Hong Kong distribute dividends on a quarterly or interim basis. However, in times of market volatility, it becomes less certain whether these companies can maintain their earnings and dividend policies. Moreover, investing in individual stocks entails higher risk.

Given the unstable market conditions, fixed deposits with lower risks have become popular. Investors can choose the deposit period (e.g., one month, three months, or six months etc.) to align with their individual financial needs. Currently, fixed deposits offer competitive interest rates compared to other income investments (see table 1). However, deposit rates are influenced by factors such as bank funding costs and local interest rates, making it difficult for retirees to predict the amount of interest they will receive or whether the rates can be sustained at a fixed level over the long term.

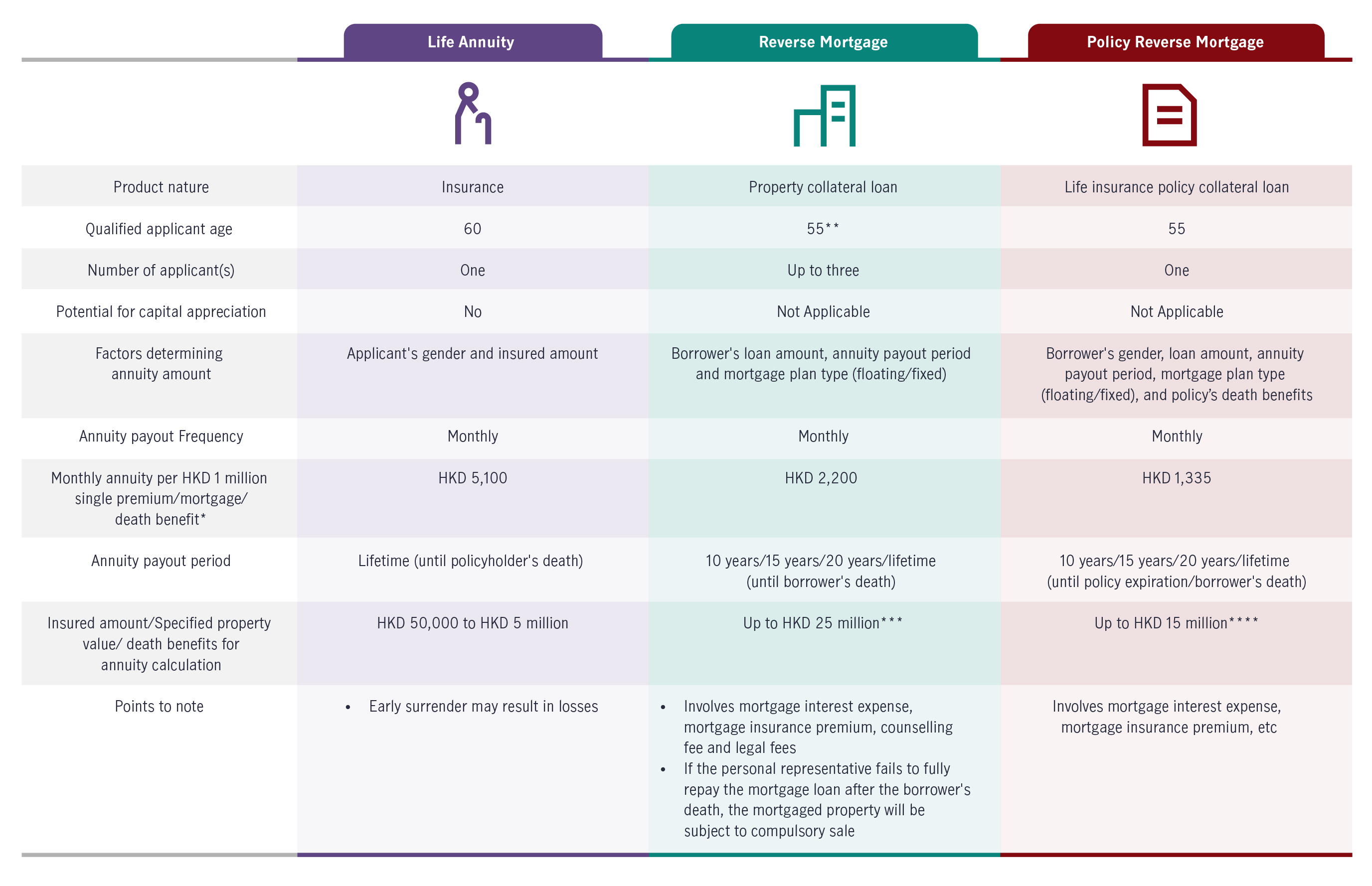

To enhance income stability, retirees may consider selecting annuity products that provide monthly payouts, such as those offered by insurance companies or HKSAR government organisations. However, these products are not investment tools and require a thorough understanding of their terms and conditions.

For example, life annuities fall under the category of lifelong insurance products. If the policyholder decides to surrender the policy within the guaranteed period, the accumulated annuity income and surrender value may be considerably lower than the total premiums paid. On the other hand, reverse mortgages and policy reverse mortgages are collateral loans that can have implications on asset inheritance.

The products discussed above have distinct characteristics and varying natures, interest rates, payout frequencies and risks. No universally applicable tool or income plan suits everyone. Retirees may consider flexibly allocating their assets and choose instruments that align with their age, financial situation, and cash flow needs to construct a portfolio that strikes a balance between capital appreciation and income.

Table 1: Comparing common income products (For reference purposes only)

Source: Hong Kong Government Bonds website, local banks websites, Manulife Investment Management. Data as of 16 October 2023. For reference purposes only.

#Based on the eighth batch of Silver Bonds issued by the Government in 2023.

##Based on iBonds issued by the Government in 2021, assuming holding until maturity.

###Based on fixed-term deposit information from major local banks as of 16 October 2023. Individual banks’ terms may vary and be subject to specific requirements such as minimum deposit amount, new funds and designated accounts.

Table 2: Monthly annuity product comparison (For reference purposes only)

Source: HKMC Annuity, Hong Kong Mortgage Corporation Limited. Data as of 16 October 2023. Please note that the information provided above is based on the products offered by the respective organisations and may differ significantly from similar products available in the market. For reference purposes only.

*The annuity amount is calculated based on a 60-year-old male who pays a single premium of HKD 1 million (for life annuity)/applies for a mortgage of HKD 1 million (reverse mortgage)/is entitled to a death benefit of HKD 1 million at the time of application for life insurance (policy reverse mortgage). In case of reverse mortgages and policy reverse mortgages, it is assumed that the applicant chooses a lifetime payout period and a fixed interest mortgage plan. For reference purposes only.

**Owners of subsidised sale flats with unpaid land premium must be 60 years old or above.

***If the valuation of a single property exceeds HKD 8 million, the portion exceeding HKD 8 million is calculated at 50% of its value. Multiple properties can be used as collateral.

****Equivalent to the upper limit of total death benefit for life insurance policy.

1 Census and Statistics Department, average expectancy of life at birth in 2022 (provisional figures)

2 Census and Statistics Department, 2021 Hong Kong Population Census

3 Dollar cost averaging means that a fixed amount is regularly invested in a particular investment, regardless of unit price. When the unit price is high, fewer units can be bought. When the unit price is low, the same amount buys more units. This strategy mitigates the impact of short-term market fluctuations on the investment by averaging out the costs of the units over time.

Disclaimer

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. The information and/or analysis contained in this material have been compiled or arrived at from sources believed to be reliable but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness or completeness and does not accept liability for any loss arising from the use hereof or the information and/or analysis contained herein. Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein.

This material was prepared solely for educational and informational purposes and does not constitute a recommendation, professional advice, an offer, solicitation or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. The economic trend analysis expressed in this material does not indicate any future investment performance result. This material was produced by and the opinions expressed are those of Manulife Investment Management as of the date of this publication, and are subject to change based on market and other conditions. Past performance is not an indication of future results. Investment involves risk, including the loss of principal. In considering any investment, if you are in doubt on the action to be taken, you should consult professional advisers.

Proprietary Information – Please note that this material must not be wholly or partially reproduced, distributed, circulated, disseminated, published or disclosed, in any form and for any purpose, to any third party without prior approval from Manulife Investment Management.

3205233

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

退而不休的豐盛生活

隨著醫療技術的進步,疫苗接種等措施普及,全球人口迎來新一浪的長壽浪潮,年過八十已經是一個新的常態。 因此要對退休生活有良好的規劃,包括維持良好體魄和選擇合適的退休地點,才能讓自己在退休後逾20年間,活得有價值。

不確定性因素增 善用較低風險基金 應對波動市

投資市場不確定性正在加劇,本文將介紹打工仔如何善用較低風險基金應對波動市,以減低受波動市況突襲所帶來的影響。

提取退休收益的策略:應對通脹的四個實用貼士

即使從工作崗位退下來,退休規劃其實仍未能劃上休止符。您必須定期審視提取策略及作出相應的調整,以防不斷變化的經濟情況令您大失預算。即睇四個實用貼士,避免您的退休儲蓄被通脹蠶食而提前耗盡。