Important Notes:

An unconstrained income driven approach across global asset classes can become an attractive strategy in order to capture a sustainable high-income payout within a challenged growth outlook.

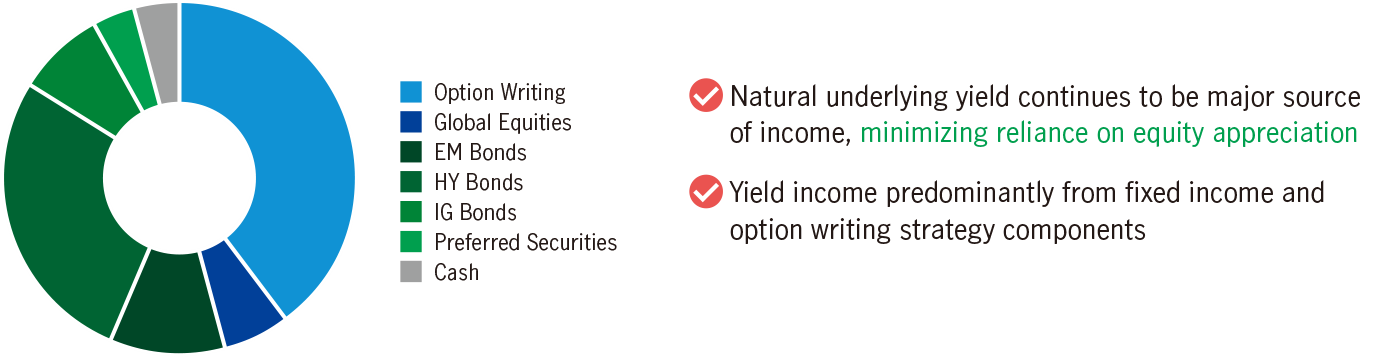

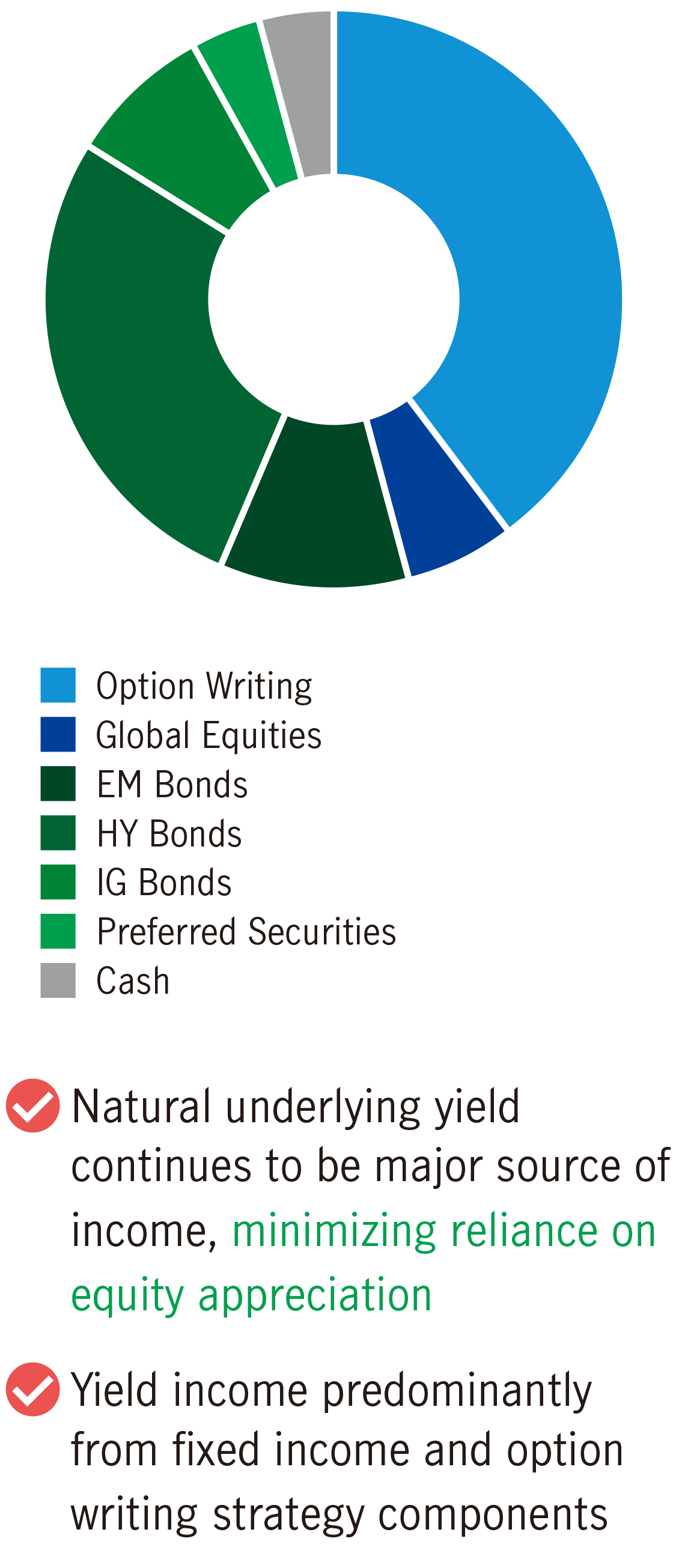

To strive for a sustainable long-term income distribution, our strategy adopts a differentiated approach of achieving yield, minimizing reliance on equity appreciation by focusing on maximizing yield from income generating assets.

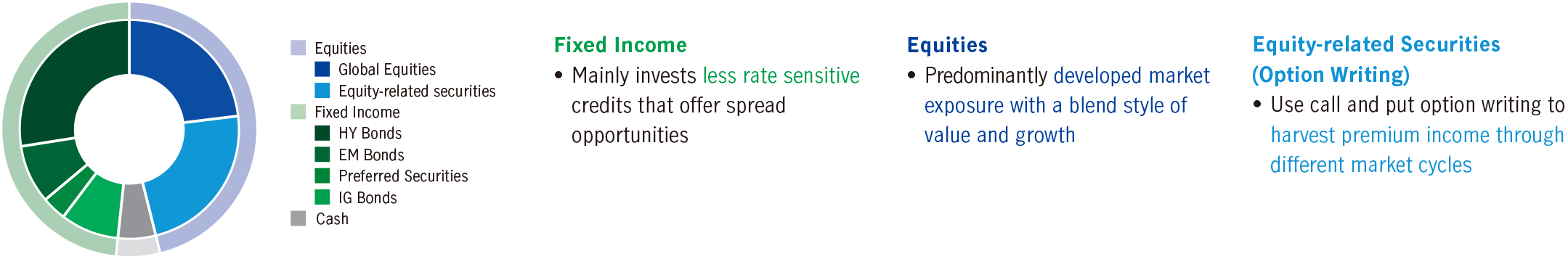

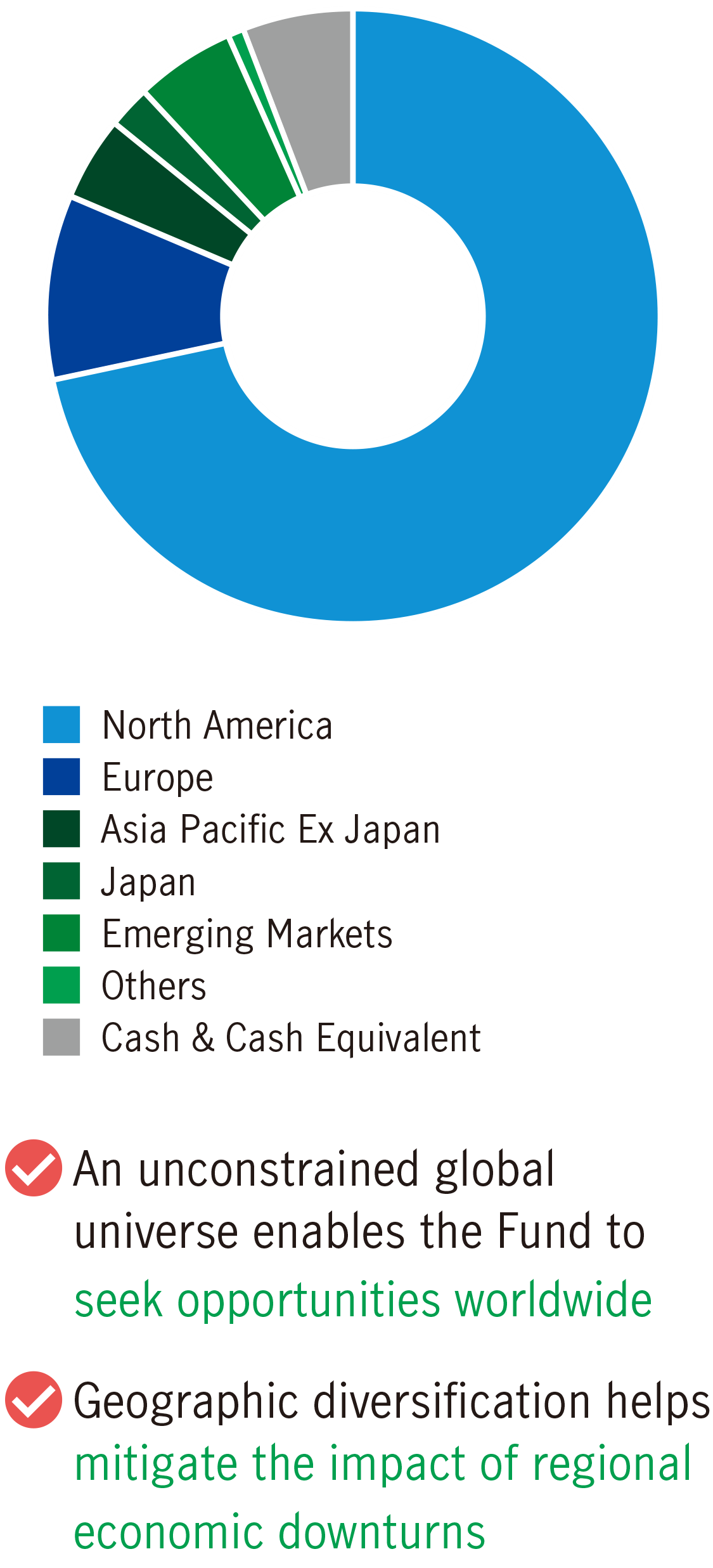

The typical globally diversified asset allocation of the portfolio has a relatively low volatility profile, dominated by fixed income credits, developed market equities and an option writing (income generating) structure.

Typical asset allocation (%)1

Average yield breakdown by asset class (%)1

Typical geographical breakdown

One of the key factors for achieving long-term performance is effectively managing downside risk through a lower volatility construction.

Apart from competitive income distribution, the Fund also aims to achieve an optimal risk-reward profile with a low volatility, minimal style bias portfolio.

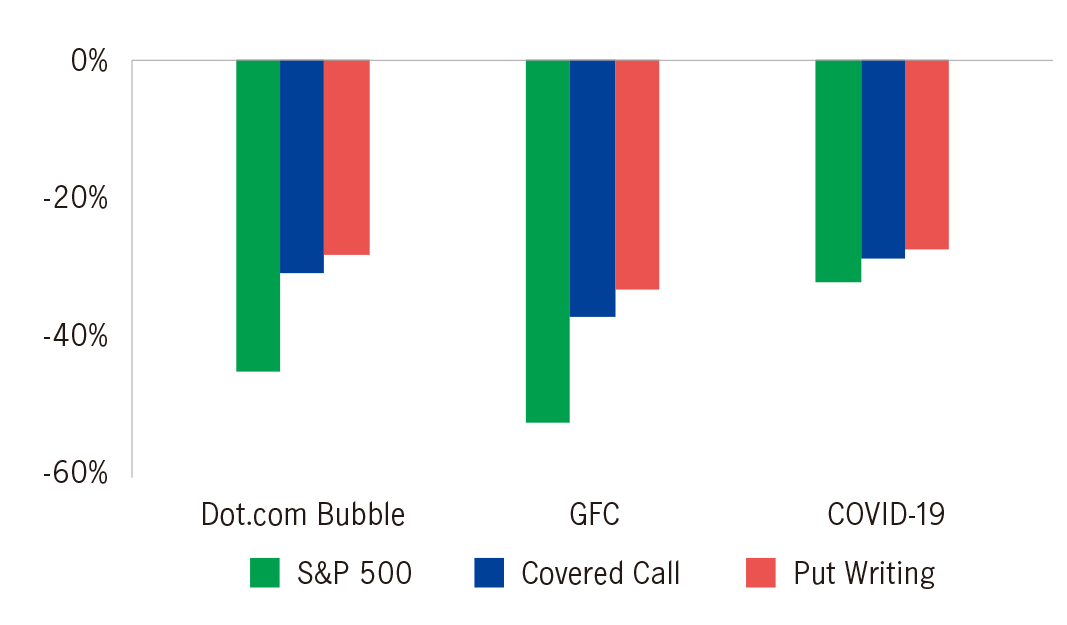

Option writing saw better downside performance2

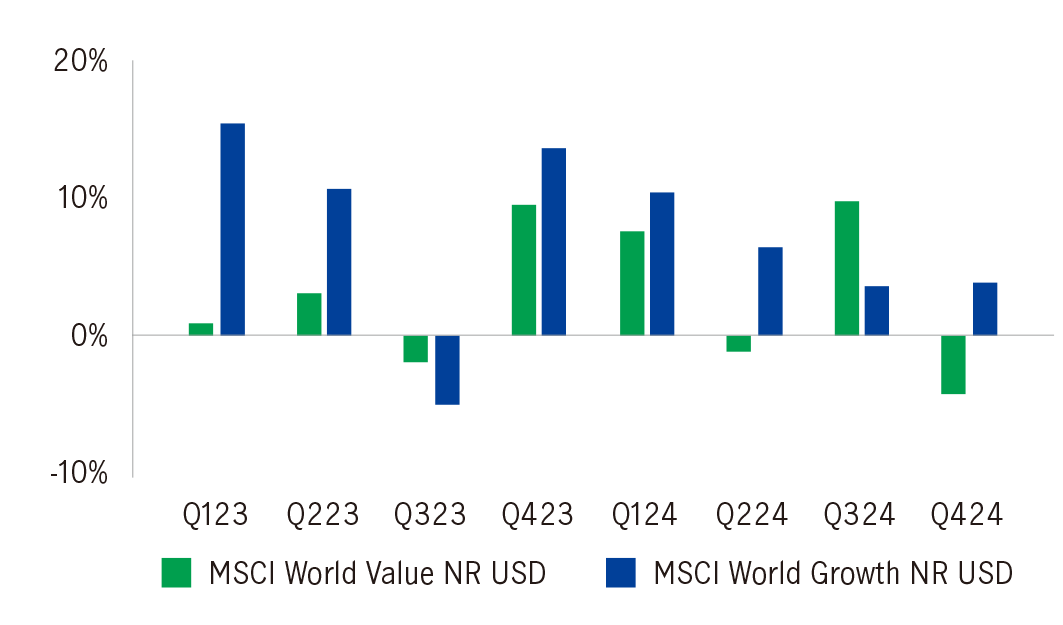

Value vs Growth: Style rotation with volatility3

Aims to generate high, stable income through multiple traditional and non-traditional income sources.

* Applicable to F (USD) MDIST (G) Share class. A positive distribution yield does not imply a positive return. Dividend rate is not guaranteed. Dividends may be paid out of capital. Refer to important note 2. Please note that a positive distribution yield does not imply a positive return. The dividend amount per unit of fixed yield monthly distributing share class “Class F MDIST(G)” is calculated by multiplying the annualized fixed percentage with the NAV per Share at the last dealing day of each month divided by the distribution frequency over a year.

Manulife Investment Management's Global Multi-Asset Diversified Income Fund (GMADI) celebrates its 5th anniversary with outstanding performance. In 2024, it won the Lipper Fund Hong Kong Award for the Best Fund over 3 Years, Mixed Asset USD Flex – Global.

We are the global wealth and asset management segment of Manulife Financial Corporation, we draw on more than 150 years of financial stewardship to partner our clients globally.

25+ years

average investment experience of management team

700+

investment experts across asset classes4

USD 147.8 billion

AUM of multi-asset solutions5

Pursuing a regular and achieving a higher income from investment products is still a top priority for many investors in Asia. Geoffrey Kelley, and John F. Addeo, the portfolio managers, are sharing with us the investment philosophy of our multi-asset income strategy, and how they manage volatility in achieving a relative high- and stable-income payout across market cycles.

4702084