23/12/2025

亞洲區股票投資部主管 蔡尚琴

亞洲(日本除外)股票於2025年表現強勁。展望2026年,亞洲區股票投資部主管蔡尚琴仍看好該資產類別,並指出多項正面刺激因素提供支持,包括:美元走弱、美國聯儲局的減息步伐、企業盈利和估值水平利好,以及不同地區擁有獨特的增長動力。

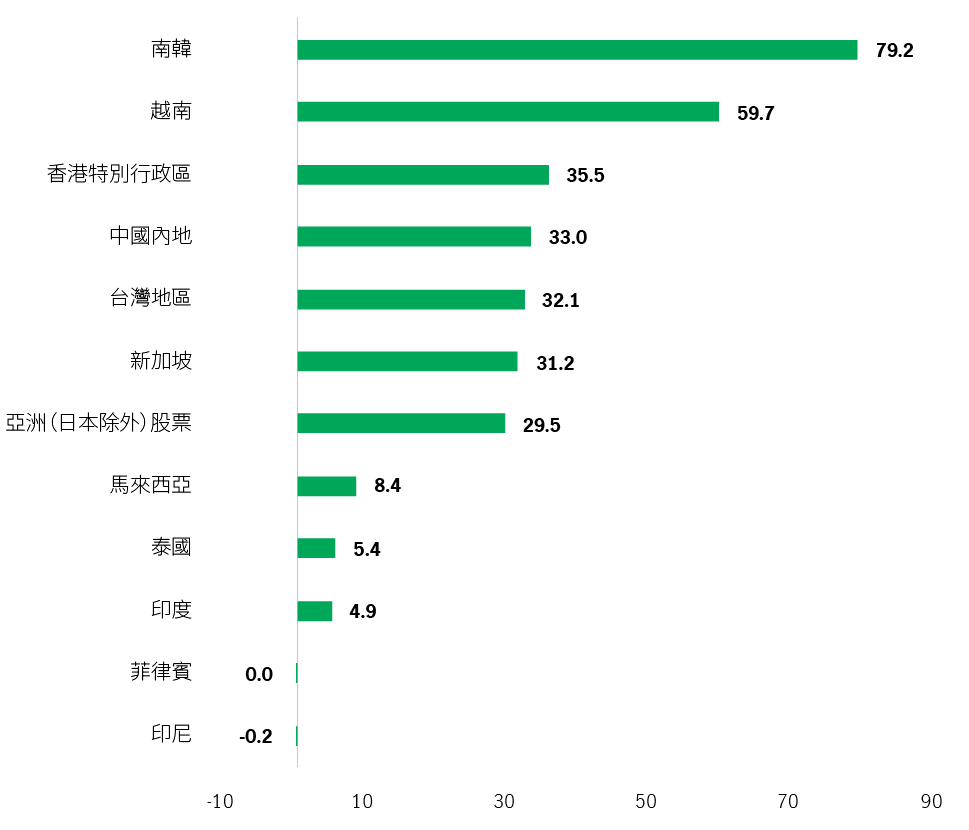

儘管亞洲股票在2025年上半年受貿易相關因素影響而波動,但年初至今表現強勁,上升29.5%(圖1)1。市場表現由多項因素帶動,包括美元走弱、貿易緊張局勢緩和、市場對人工智能與科技的樂觀情緒,以及聯儲局的減息步伐。

圖1:MSCI明晟亞洲指數在2025年初至今的表現(美元,%)2

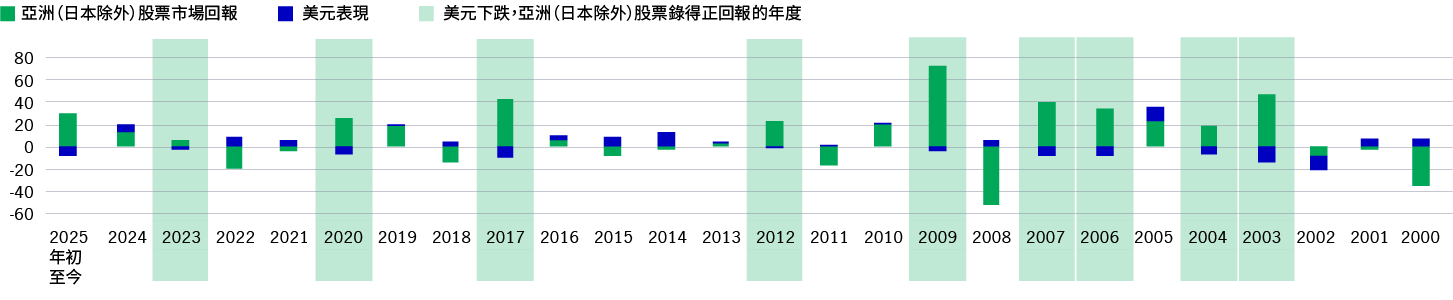

在2000年至2024年期間,美元曾有10個年度錄得跌幅(圖2),而亞洲(日本除外)股票於其中9個年度錄得正回報。在美國減息或導致美元走弱的環球宏觀環境下,歷史上這通常有利於亞洲股票。

圖2:亞洲股市相對美元表現3

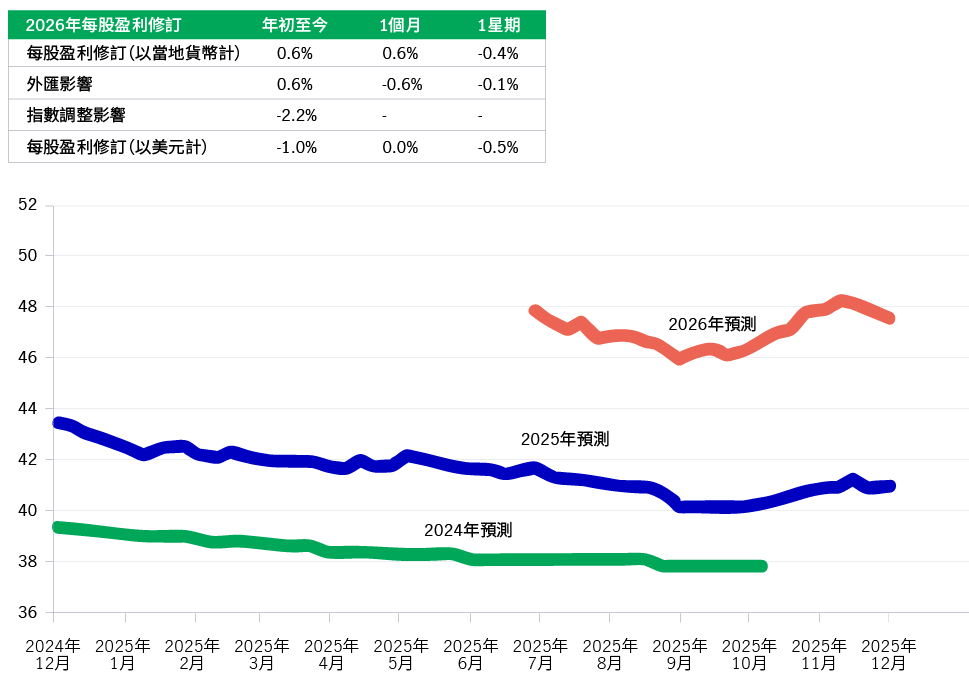

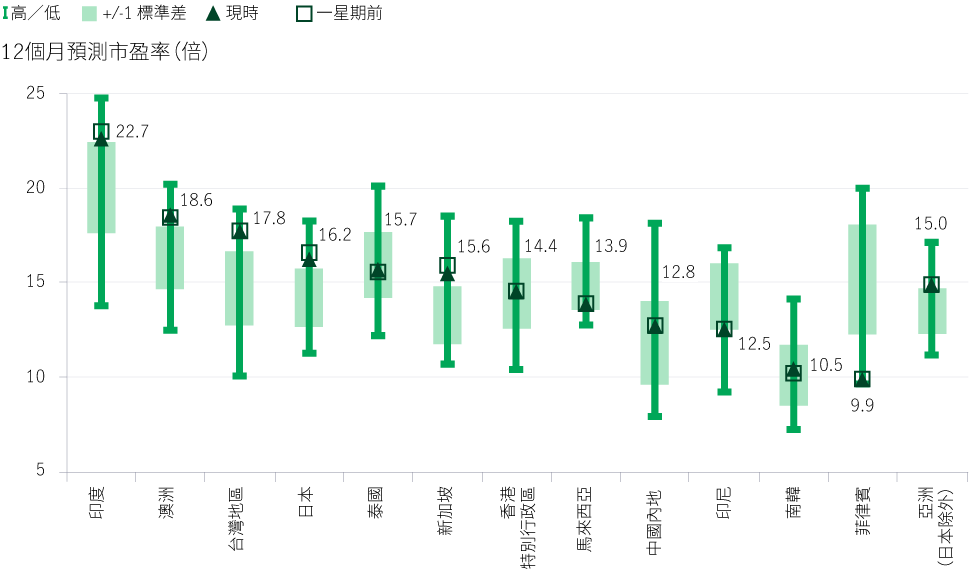

除了美元整體疲弱外,亞洲市場的企業盈利及估值水平仍為市場帶來支持,區內整體前景正面(圖3及圖4)。

圖3:MSCI明晟亞太(日本除外)指數每股盈利預測(美元)4

圖4:亞洲股票預測市盈率(現時對比10年平均值)5

2026年亞洲股票盈利預測在2025年大部份時間向下修訂,但於第四季出現轉捩點,在科技股強勢帶動下,南韓、台灣及香港市場成為主要推動力。

下文將會探討亞洲各個市場於2026年呈現的不同增長動力。

從宏觀經濟角度而言,在「十五五」規劃(2026年-2030年)的支持下,我們相信大中華區經濟將受惠於多股增長動力。展望2026年,受惠於估值吸引及資金流向穩健,我們重申看好大中華股票市場的觀點。

隨著關稅的雜音減退,我們相信大中華區將出現更多不同的投資機會,特別是:(1) 科技、(2) 工業、(3) 可再生能源、(4) 康健護理及 (5) 嶄新/獨特/體驗式消費。

台灣地區方面,(1) 晶圓代工、(2) 外判半導體封裝和測試(OSAT)供應鏈、(3) 散熱解決方案及 (4) 供電方案領域繼續出現穩健的新興結構性增長機會。

如需更深入的分析,請參閱我們的《2026年大中華股票前景展望》。

印度市場在過去一年錄得正絕對回報,但表現遜於亞洲其他地區,主要由於近期與美國的貿易緊張局勢升溫,引發投資者關注印度經濟前景,以及對當地財政、經常帳和貨幣(印度盧比)的潛在影響。

單獨來看,若現行關稅稅率不變,並假設受影響出口籃子遭受50%至80%衝擊,印度國內生產總值增長將面臨60至100點子的下行風險。

經常帳赤字原先預計佔國內生產總值的0.5%,但現在可能擴大至介乎1.1%至1.5%,取決於出口損失的嚴重程度。儘管印度的外匯儲備強勁,宏觀政策框架具公信力,應可遏制印度盧比的波幅6,但仍可能面對貨幣貶值的壓力。

然而,印度政策官員亦同時在財政及貨幣政策方面作出回應,相關措施可望顯著抵銷加徵關稅帶來的負面影響,當中包括改革商品及服務稅制、聯邦預算案的直接稅務寬減措施,以及印度儲備銀行於2025年累計減息125點子。

整體而言,鑑於印度在財政結餘、通脹及外貿結餘方面嚴守紀律,因此應能把推行刺激政策的潛在成本維持在可負擔水平。若50%關稅在持續談判期間下調至25%,甚或進一步降至介乎15%至20%區間(與其他亞洲經濟體一致),將顯著利好印度經濟和盈利增長。

我們繼續堅守「5D」結構性投資主題 — 數碼化、人口結構、去全球化、減碳及減赤,以捕捉印度經濟轉型的多元特性。

南韓市場在2025年表現強勁,帶動亞洲(日本除外)股票造好。

這主要受惠於人工智能相關主題。人工智能數據中心觸發資訊科技及工業領域新一輪成長,我們認為這次結構性轉變的規模將會相當龐大。

由於人工智能數據中心的需求急增,令記憶體與電力兩大領域出現瓶頸狀況,因此我們持正面的觀點。生成式人工智能架構需要大量同步記憶體以進行運算。

然而,擴大記憶體產能缺乏靈活性,當中涉及巨額資本開支(硬資產)及漫長生產期:建造及配備設施需時超過兩年,晶片製造需時九個月,伺服器整合則另需三個月的時間。

電力方面也面臨相若情況。數據中心耗電量目前佔系統總耗能的1%,預計將於五年內增至10%。不過,發電及輸電產能擴張均面對時間與物理方面的絕對限制。

除了科技發展外,南韓社會正就必須建立「股東資本主義」新時代逐漸形成共識。

上屆政府聚焦於銀行及國有企業等,較易受政府政策影響的領域,以推動管治改革及增加股息。現屆政府則開始直接挑戰家族/大型企業。

相關措施包括改革《商法》以重組董事會職權,以及懲罰尚未註銷庫存股的公司。這些行動最終有助加強南韓的股東資本主義,為長期處於折讓水平的市帳率帶來顯著的重估潛力。

我們對南韓整體工業板塊維持樂觀看法。雖然我們在電力設備的配置一直集中於變壓器領域,但預期發電領域將出現重大機遇,並相應擴大投資布局。

值得注意的是,南韓可能是全球唯一擁有氫燃料電池量產能力的國家,而且依然是主要的核能技術出口國。

我們的工業投資主題亦涵蓋造船及國防領域,南韓企業在這些範疇穩佔全球寡頭壟斷地位。隨著地緣政治緊張局勢及衝突帶動需求上升,我們正對這些重工業垂直領域進行廣泛而深入的研究。

消費品行業亦帶來吸引的投資機會。

首先,全球對南韓文化內容(例如電視劇及流行音樂)的需求激增,為南韓食品及化妝品行業帶來直接的正面溢出效應。此外,隨着汽車行業的消費者偏好由引擎性能,轉向乘客便利性及電子技術整合,南韓汽車製造商正好發揮在相關領域的競爭優勢。

我們預期,美國市場將繼續成為南韓汽車製造商的重要盈利來源,因為在中國內地同業未有參與競爭下,其市場佔有率將持續擴大。

2025年初至今,大部份東盟股票市場的表現遜於北亞市場。

投資氣氛受多項因素拖累,包括:盈利增長前景轉弱;印尼、泰國和菲律賓的政治不確定性;以及全球貿易政策風險揮之不去。

此外,中國內地企業進軍多個東盟行業,導致競爭加劇,使部份當地企業的盈利受壓。由於美國總統特朗普加徵關稅的潛在影響未明,令出口導向型公司暫緩擴充產能。

雖然面對充滿挑戰的環境,但我們相信各地政府、央行及企業正積極採取協調措施,以應對這些不利因素。

各個東盟市場具備不同的驅動因素:新加坡的「股票市場發展計劃」正為研究覆蓋不足的公司釋放價值;印尼的政治雜音或已消失,消費可望回升;馬來西亞繼續受惠於數據中心建設;泰國則繼續受內需及旅遊業復甦所支持。最後,菲律賓的情況與印尼相若,政治雜音料已消退,消費增長將再次回升。

利好的宏觀經濟環境、結構性增長主題及具吸引力的估值,構成2026年亞洲(日本除外)股票的投資基礎。雖然地區差異仍然存在,例如印度的貿易相關不利因素及東盟的政治不確定性,但市場仍不乏投資機會,特別是在科技、工業及消費領域。

我們的投資團隊在選股流程中保持高度紀律,專注於財務穩健,並具備可持續長期增長前景的企業。隨著全球宏觀經濟狀況改善及當地企業盈利回升,我們相信亞洲(日本除外)股票仍是長期投資組合的重要組成部份。

1 彭博資訊,截至2025年11月30日。

2 資料來源:彭博資訊,截至2025年11月30日。個別市場表現以各自的MSCI明晟指數為代表。

3 資料來源:彭博資訊,截至2025年11月30日。亞洲(日本除外)股市回報以MSCI明晟綜合亞洲(日本除外)指數為代表。美元表現以美匯指數為代表。

4 資料來源:FactSet、機構券商預測系統(IBES)、MSCI明晟、高盛全球投資研究部,截至2025年12月6日。

5 資料來源:FactSet、機構券商預測系統(IBES)、MSCI明晟、高盛全球投資研究部,截至2025年12月6日。

6 資料來源:宏利投資管理預測,2025年11月30日。

2026年亞太房託展望:由減息紓緩邁向增長復甦

亞太區(日本除外)房地產投資信託基金(亞太房託)於2025年表現理想,展望2026年有望迎來關鍵轉捩點 — 由減息帶動的紓緩期過渡至增長復甦階段。在本期《2026年前景展望》中,投資組合經理黃惠敏及Derrick Heng將深入剖析利率下調如何為亞太房託開啟兩大增長動力 — 一方面透過節省利息成本推動內部增長,另一方面透過資本循環帶動併購增長。同時,團隊亦會分析歷史相對估值優勢及區內交易所政策利好等催化因素,如何進一步提升亞太房託的投資吸引力,並分享團隊於新一年看好的行業板塊。

2026 年前景展望系列:環球股票多元入息

展望2026年,主導股市上升的動力可能擴展至超大型科技股以外領域,為不同行業及地區創造投資機遇。受惠於主要市場的財政開支及寬鬆貨幣政策,預期環球經濟增長將趨於穩定。歐洲及個別亞洲經濟體的估值具吸引力,而且基本因素持續改善,與美國市場的韌性相輔相成。在良好基本因素支持下,除了增長型投資風格外,以價值和收益為本的策略或再度成為焦點。環球股票多元入息策略致力把握機遇,分散投資於不同地區、行業和風格,旨在爭取收益及資本增值。

2026年前景展望系列:宏利環球多元資產入息基金

在人工智能大趨勢、能源轉型、聯儲局減息預期、聯儲局潛在人事變動,以及財政支持擴大的推動下,2025年市場表現強勁。我們預計,隨著2026年時間逐步推移,宏觀經濟環境將更趨明朗,增長動力將會改善。儘管美國聯儲局預期將於今年內繼續放寬貨幣政策,但市場仍蘊藏豐富的收益投資機會,其來自多元化全球市場及不同來源,並由傳統政府債券延伸至高收益債券及期權沽售交易。在此環境下,宏利環球基金—環球多元資產入息基金(「本基金」)的主要目標,依然是以更清晰且高度專注的方式聚焦於締造收益。無論短期股市表現如何,或是貨幣政策周期如何波動,本基金都致力維持投資於長期資本增長機會,同時提供穩定而較高的收益分派。

2026年亞太房託展望:由減息紓緩邁向增長復甦

亞太區(日本除外)房地產投資信託基金(亞太房託)於2025年表現理想,展望2026年有望迎來關鍵轉捩點 — 由減息帶動的紓緩期過渡至增長復甦階段。在本期《2026年前景展望》中,投資組合經理黃惠敏及Derrick Heng將深入剖析利率下調如何為亞太房託開啟兩大增長動力 — 一方面透過節省利息成本推動內部增長,另一方面透過資本循環帶動併購增長。同時,團隊亦會分析歷史相對估值優勢及區內交易所政策利好等催化因素,如何進一步提升亞太房託的投資吸引力,並分享團隊於新一年看好的行業板塊。

2026 年前景展望系列:環球股票多元入息

展望2026年,主導股市上升的動力可能擴展至超大型科技股以外領域,為不同行業及地區創造投資機遇。受惠於主要市場的財政開支及寬鬆貨幣政策,預期環球經濟增長將趨於穩定。歐洲及個別亞洲經濟體的估值具吸引力,而且基本因素持續改善,與美國市場的韌性相輔相成。在良好基本因素支持下,除了增長型投資風格外,以價值和收益為本的策略或再度成為焦點。環球股票多元入息策略致力把握機遇,分散投資於不同地區、行業和風格,旨在爭取收益及資本增值。

2026年前景展望系列:宏利環球多元資產入息基金

在人工智能大趨勢、能源轉型、聯儲局減息預期、聯儲局潛在人事變動,以及財政支持擴大的推動下,2025年市場表現強勁。我們預計,隨著2026年時間逐步推移,宏觀經濟環境將更趨明朗,增長動力將會改善。儘管美國聯儲局預期將於今年內繼續放寬貨幣政策,但市場仍蘊藏豐富的收益投資機會,其來自多元化全球市場及不同來源,並由傳統政府債券延伸至高收益債券及期權沽售交易。在此環境下,宏利環球基金—環球多元資產入息基金(「本基金」)的主要目標,依然是以更清晰且高度專注的方式聚焦於締造收益。無論短期股市表現如何,或是貨幣政策周期如何波動,本基金都致力維持投資於長期資本增長機會,同時提供穩定而較高的收益分派。