The principles of investing are a constant no matter your financial need and risk appetite. Will you empower your future self with the financial resilience they deserve to ensure they thrive, free from financial worry?

Beyond diversification, you may also wish to build a stream of passive income in preparation for retirement. Our Enhanced Distribution Retirement Investment Series does just that.

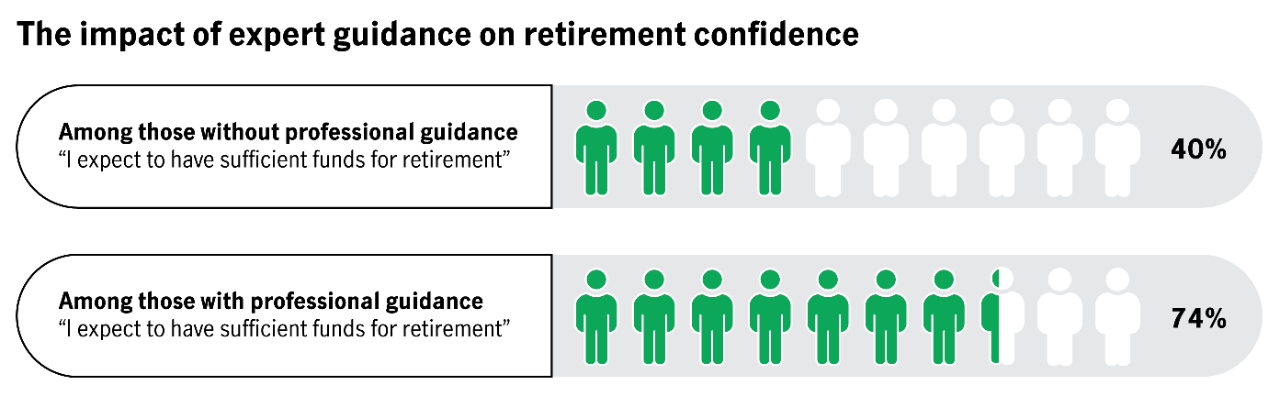

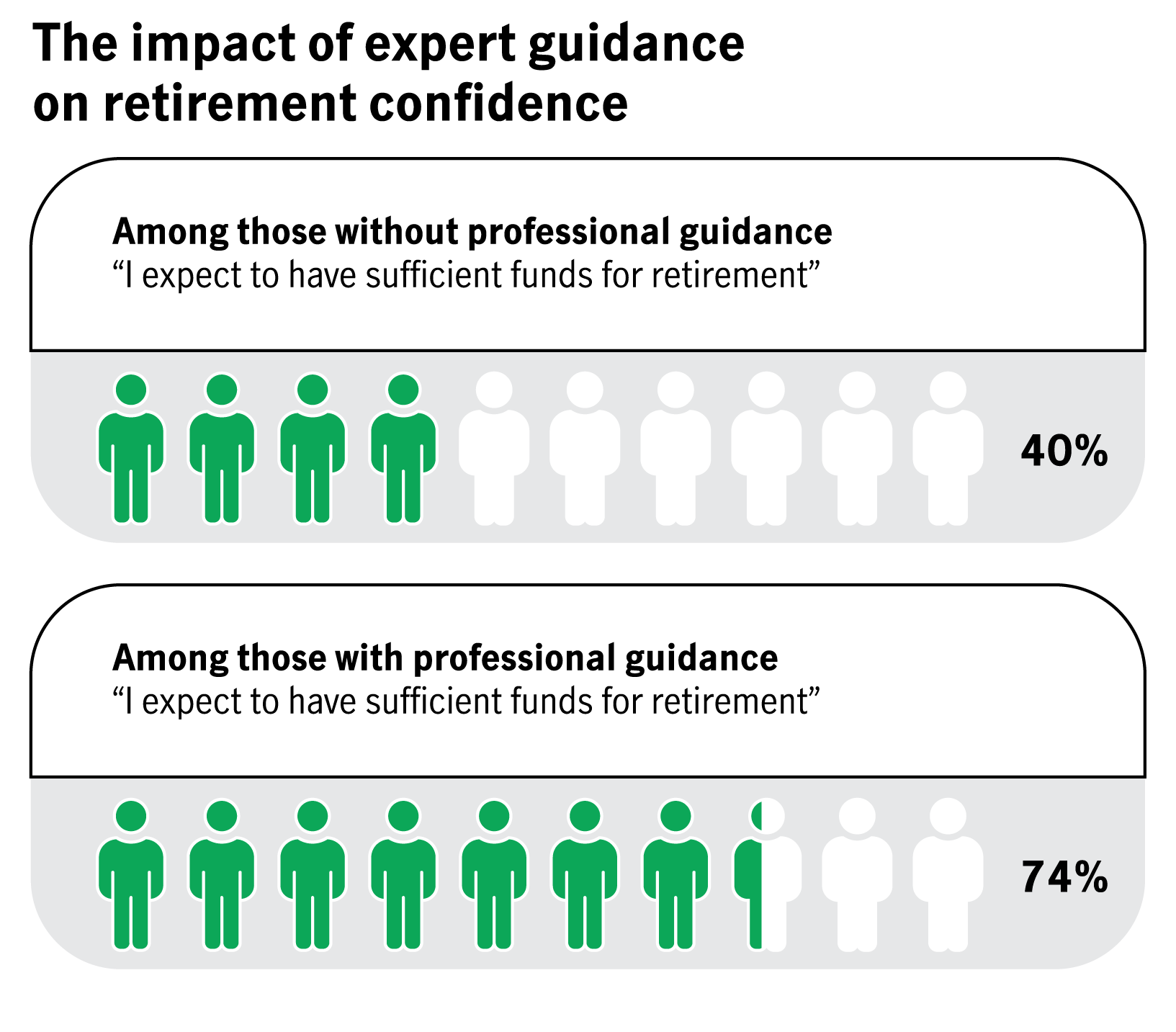

Do speak to our financial advisors if you require investment recommendations tailored to your needs. Our team of experts is always happy to help.

A lifelong commitment to your financial longevity & resilience

The principles of investing are a constant no matter your financial need and risk appetite. Will you empower your future self with the financial resilience they deserve to ensure they thrive, free from financial worry?

Beyond diversification, you may also wish to build a stream of passive income in preparation for retirement. Our Enhanced Distribution Retirement Investment Series does just that.

Do speak to our financial advisors if you require investment recommendations tailored to your needs. Our team of experts is always happy to help.