8 February 2022

Sue Trinh, Head of Macro Strategy, Asia

Asia isn’t immune to emerging global macro headwinds. The region’s overall growth picture this year is likely to be mixed; however, there are good reasons to believe that inflation isn’t likely to dent the continent’s prospects.

It would be disingenuous to paint a rosy picture of the region’s growth prospects— important challenges remain. It’s undeniable that economies in the region have a long way to go to recoup output that’s been lost due to disruptions brought about by the pandemic. In our view, the biggest concern remains weak consumer demand, which will be exposed by the looming downturn in export growth.

The upshot, however, is that policymakers in the region can afford to be patient when it comes to monetary policy normalization. While prices are expected to tick up further, large output gaps—the difference between an economy’s actual output and its potential output—should help keep underlying price pressures in check. As such, we believe Asia will escape the worst of the global inflationary shock, particular versus other emerging-market (EM) economies, even if inflationary pressures heighten as a result of ongoing global supply bottlenecks.

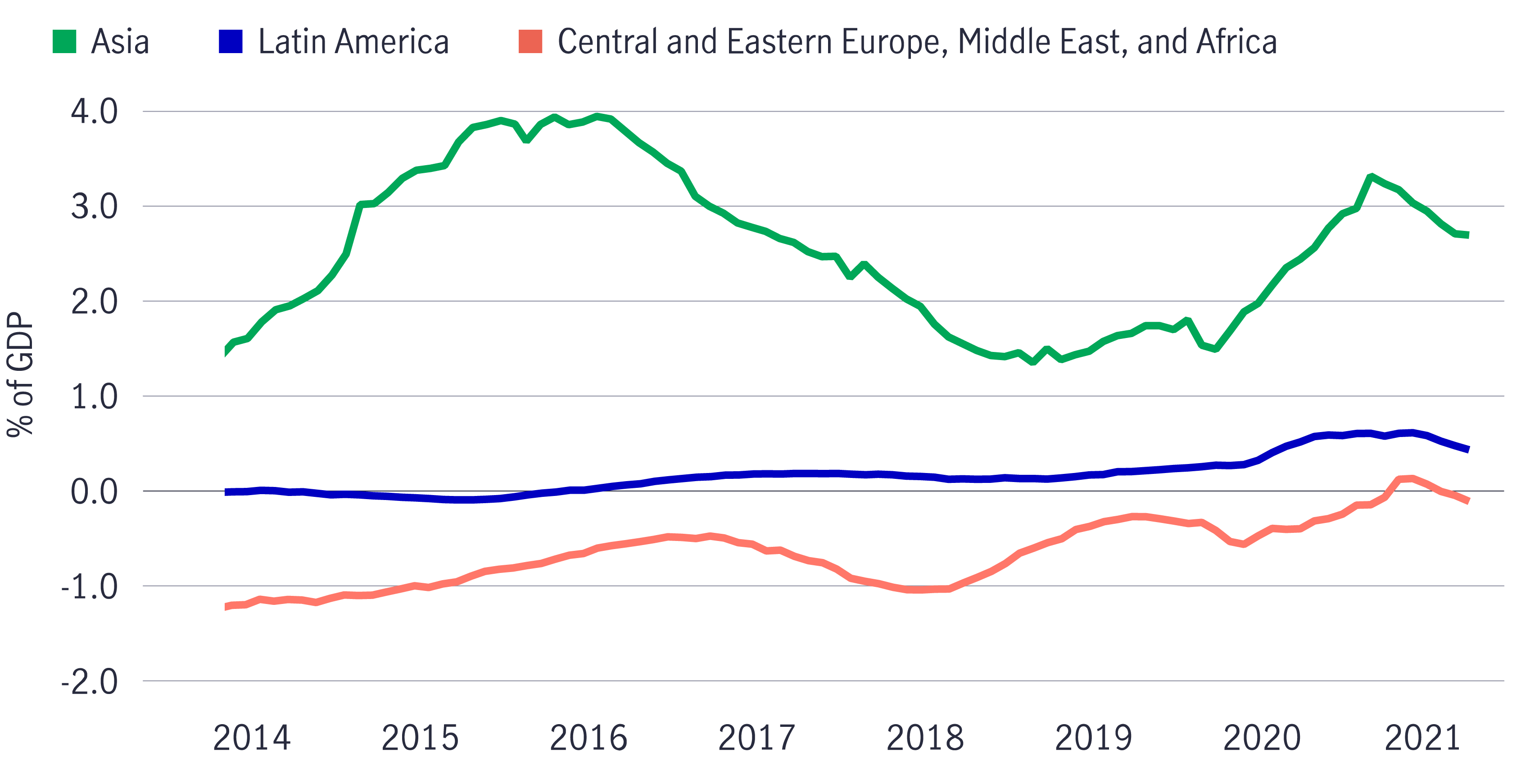

Broadly speaking, Asia’s milder inflation outlook comes down to one simple factor— trade surpluses. Economies in the region were able to maximize export production through much of the past two years. At the same time, the surge in pent-up demand in Asia after the reopening wasn’t as strong relative to other regions, particularly when compared with other EM economies.

Chart 1: EM economies: aggregate trade balances

(2013–2021)

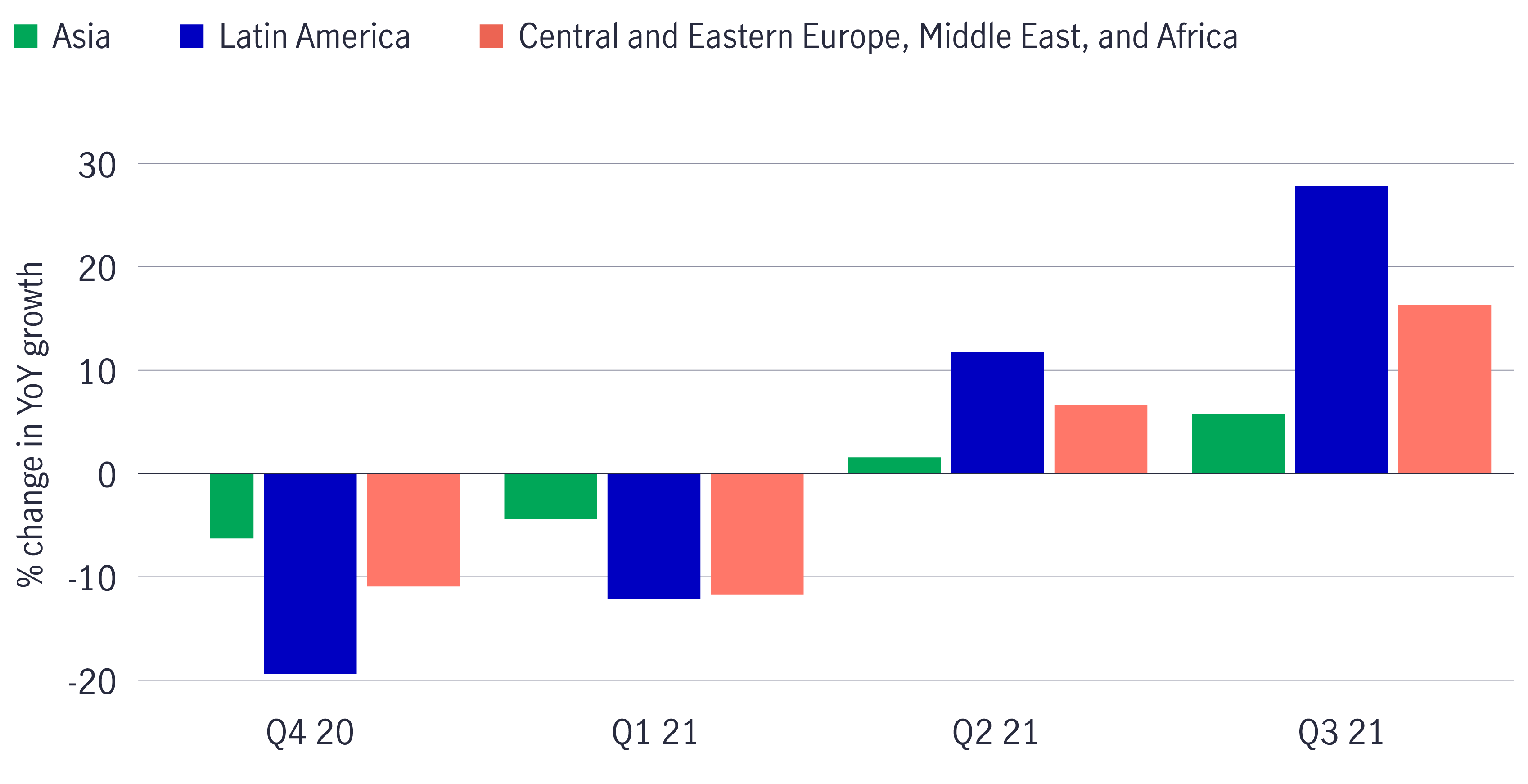

Chart 2: Household consumption growth

Much smaller-ramp up in Asia vs. other EM in past year

Source: Macrobond, Manulife Investment Management, as of January 7, 2022. EM refers to emerging markets. YoY refers to year over year.

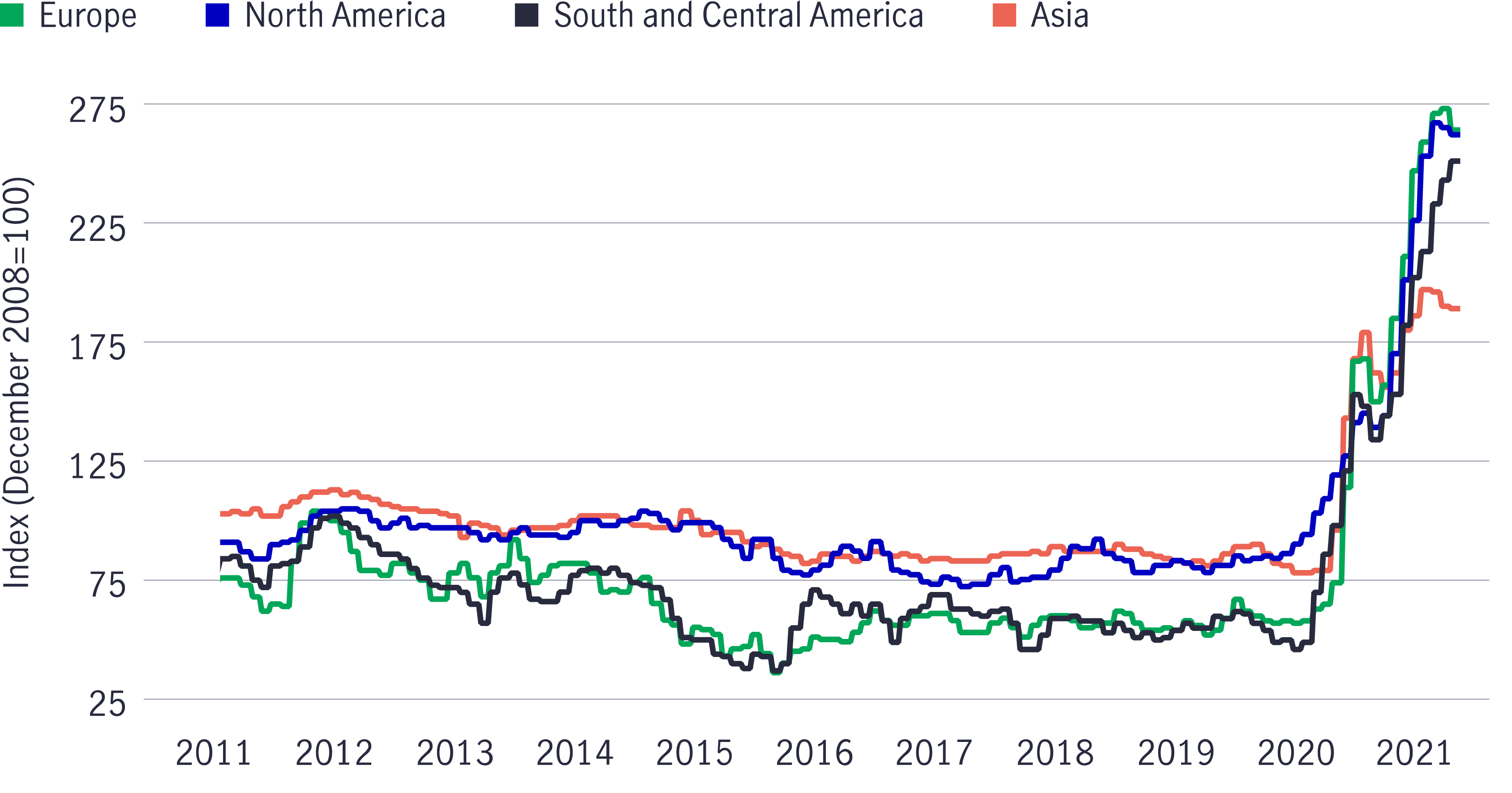

One other set of data also supports our view that inflationary pressure in Asia is likely to be more tamed: long-distance freight rates. The rise in intra-Asia shipping costs has been much more muted in comparison with other regions, thanks to excess manufacturing supply and relatively weaker consumer spending. An important takeaway here is what this means in regard to monetary policy: For the region as a whole, we expect to see policy normalization take place at a much slower pace and at a lower magnitude relative to previous cycles and other EM economies.

Chart 3: Shipping costs from Asia have risen dramatically since the pandemic

Source: Bloomberg, Macrobond, Manulife Investment Management, as of January 13, 2022.

Taiwan and Vietnam

These two economies are already growing above their long-term trend GDP levels, and consensus forecasts point toward a Goldilocks regime of accelerating growth and decelerating inflation this year.

In Taiwan’s case, GDP is likely to be boosted by a consumption recovery and steady support from investment. Continued global demand for semiconductors amid tight supply should help support Taiwan exports even as global consumption patterns normalize.

Meanwhile, economic activity in Vietnam has resumed much faster than anticipated following extensive factory disruptions in Q3. Fiscal support also continues unabated. Vietnam’s parliament has approved a stimulus package worth ~5.5% of the country’s GDP, with a focus on assisting virus-hit businesses and workers. Notably, around half the package is focused on increased infrastructure spending for 2022/2023. In our view, foreign direct investment into Vietnam should underpin GDP for some time.

Singapore and Malaysia

These two economies may be starting the year at below-trend GDP, but we think they have strong potential to recoup lost output. In Singapore, the pace at which vaccination/booster shots are administered has enabled a calibrated reopening; a broad-based recovery therefore seems feasible with an improving labor market. In Malaysia, an accelerated vaccination rate and higher government spending ahead of the upcoming election—widely expected to take place in the second half of the year— should support domestic demand.

Japan

Personal consumption, particularly of in-person services, has been picking up since the state of emergency was lifted last September. Nonetheless, prices should stay benign, and we believe any effort from the Bank of Japan to withdraw liquidity will lag its developed-market peers.

Overall, the macro picture in Asia is likely to be mixed; however, the operating environment is likely to be more favorable for select economies in the region. Crucially, the relatively muted rise in consumer demand and existing excess capacity mean that inflationary pressure on the continent isn’t likely to be as acute as in other parts of the world—implying that the likelihood of a mad dash to normalize monetary policy is much lower.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.