23 January 2025

Murray Collis, Chief Investment Officer, Fixed Income (Asia ex-Japan)

Following the decline in Asian dollar-bond issuance in recent years due to the higher funding cost environment -- in addition to net redemptions -- investors have started to consider the broader Asia-Pacific dollar-bond market, which includes markets such as Japan and Australia.

Historically, Asia-Pacific dollar bonds (Asia-Pacific bonds) have been an excellent diversifier and can greatly reduce overall portfolio volatility. Given their emphasis on providing stable income and the generally higher quality of companies issuing bonds, Asia-Pacific bonds have produced attractive returns (4.5% p.a. since Oct. 2005) with relatively low volatility (5.0% p.a. standard deviation) compared with Asia-Pacific equities, which returned 5.4% p.a. but with a much higher volatility of 16.4% p.a. over the same period.

Similarly, if we look at the maximum drawdown (i.e. the maximum loss from a peak to a trough) for both asset classes over this period, the worst drawdown for Asia-Pacific bonds was -17.3%, which occurred in October 2022 due to the combined effects of a spike in US interest rates while credit spreads widened due to defaults in the China property space. Asia-Pacific equities experienced its worst drawdown of -54.5% in February 2009 as global risk assets sold off dramatically due to the global financial crisis.

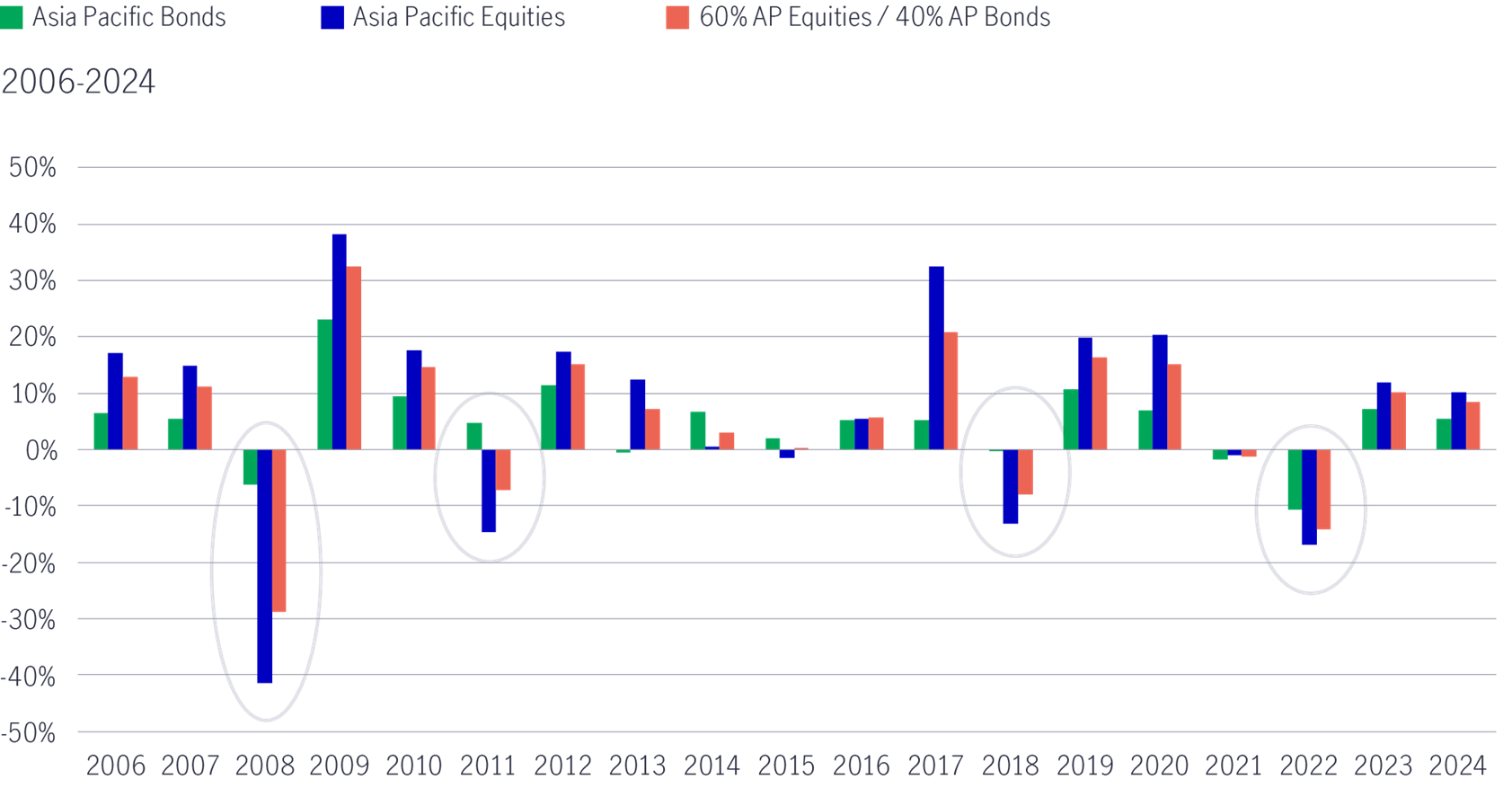

Looking at calendar year returns since 2006, Asia-Pacific bonds only experienced one year where returns were below -10% compared with Asian equities, which experienced returns below -10% four times. Again, to emphasise the crucial role bonds play in providing stable income and acting as a diversifier to reduce overall portfolio volatility, a diversified portfolio comprising 60% Asia-Pacific equities and 40% Asia-Pacific bonds would have produced annual returns of 5.3% p.a. and a much lower standard deviation of 11.2% p.a. (compared with Asia-Pacific equities which had a total return of 5.4% p.a. and a standard deviation of 16.4% p.a.) over the period from October 2005 to December 2024. The 60/40 portfolio experienced a much lower maximum drawdown of -38.2% and experienced two calendar years of returns below -10% compared with the maximum drawdown of -54.5% and four calendar year returns below -10% for Asia-Pacific equities.

As the global economy enters a period of increased uncertainty due to potential changes in trade policy and US equity markets see much richer valuations, Asia-Pacific bonds have a clear role to play in adding stability and reducing overall risk in investment portfolios.

Chart 1: Returns comparison among Asia Pacific Bonds, Asia Pacific Equities and a 60/40 portfolio

Source: Manulife Investment Management, Bloomberg as of 31 December 2024.

Chart 2: Adding Asia Pacific Bonds could significantly reduce portfolio risk

Source: Manulife Investment Management, Bloomberg as of 31 December 2024.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.