Important Notes:

28 October 2025

Christopher Walsh, CFA Senior Portfolio Manager, Multi-Asset Solutions

Paul Kalogirou, Head of Client Portfolio Management, Asia & Global Multi-Asset Solutions

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2%1 - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Across major economies, especially outside the US, monetary policy is easing even as fiscal expansion accelerates. In the US, the Federal Reserve is expected to pivot toward monetary stimulus despite the absence of a clear economic shock. This double-barreled stimulus – monetary and fiscal – arrives at a time when inflation has already bottomed at levels above the Fed’s 2% target2. As of this writing, core Consumer Price Index (CPI) stands at 3.1%3, and the risk is that inflation could reaccelerate once stimulus fully takes hold.

This risk is compounded by the fact that the US output gap is closed. The economy is operating above potential, meaning there is little slack to absorb additional demand. In such an environment, any incremental stimulus – especially fiscal – has a higher probability of translating into price pressures rather than real growth. This dynamic increases the likelihood of an inflation shock, increasing the attractiveness of inflation-sensitive assets.

Structural forces are also shifting. Deglobalisation is reversing decades of supply chain optimisation. Rising trade barriers, reshoring initiatives, and geopolitical fragmentation are reducing efficiency, increasing redundancy, and raising unit labor costs. These changes are inherently inflationary and diminish the deflationary impulse once provided by globalisation.

China, long a source of global disinflation, is undergoing a strategic pivot. Its anti-involution campaign aims to reduce excess production capacity, consolidate industries, and restore pricing power. This shift will likely reduce China's role as a supplier of ultra-low-cost goods. Meanwhile, other countries are pushing back on Chinese exports in recent days: the US is considering new tariffs, Mexico has followed suit, and the European Union is investigating dumping practices and considering trade restrictions4. These developments suggest a global tightening of supply, supporting higher prices.

Thematic trends are also inflationary. The AI buildout is driving massive capital investment in data centers, straining electricity grids and increasing demand for semiconductors, metals, and energy. Simultaneously, defense spending is rising as geopolitical tensions mount. These trends are not cyclical – they represent long-term shifts in fiscal priorities and industrial demand, both of which are inflationary.

Despite these pressures, markets have only partially priced in a higher inflation regime. The yield curve has steepened, but not dramatically. This suggests that while investors are adjusting to the reality of structurally higher inflation, we believe valuations for inflation-sensitive assets remain compelling. This creates a compelling entry point for strategies that benefit from inflation surprises.

We see specific real asset classes benefiting from structural shifts in inflation and demand:

Infrastructure is evolving beyond roads and bridges. The asset class stands to benefit from rising demand for AI and digital infrastructure, supported by the continued electrification and energy transition efforts globally. Electric and Gas utilities have been strong this year, driven by record-high electric consumption from data processing growth, factory reshoring, and decarbonisation initiatives.

Energy: OPEC’s effort to stabilise oil prices may support demand growth and benefit the refining sector. We expect natural gas to remain a bright spot over the next year, with Canadian and US Liquefied Natural Gas (LNG) projects ramping up supply needs. Near term prices could remain elevated as it appears that production will lag demand for natural gas. Furthermore, countries in Europe and Asia are looking to diversify away from Russian gas and reduce coal use, likely locking in long term LNG contracts with North American suppliers. AI-driven power demand remains a wild card, potentially further increasing North American gas consumption.

Metals & Mining are supported by multiple tailwinds. Gold remains resilient, backed by global central bank purchases and strong Chinese demand. Geopolitical risks and uncertainty enhance its diversification appeal, whilst metal miners operating leverage boosts profitability. Copper faces tighter supply due to mine disruptions in the Democratic Republic of Congo (DRC) and Panama and falling inventories point to global deficits. A strong secular demand from electrification and higher capex expectations from grid upgrades adds to a positive outlook.

Uranium continues to benefit from the clean energy push, especially China’s nuclear expansion. Meanwhile, silver and platinum are showing signs of catching up to gold, supported by supply deficits and improving fundamentals.

Rare Earths, Critical Metals & Minerals (Cobalt, Antimony, Tantalum, Scandium) continue to be of strategic importance for their use in defense technologies, electronics, aerospace components and permanent magnets.

Real Estate Investment Trusts (REITs): Despite some signs of stabilisation, we see persistent macroeconomic and sector-specific headwinds. While falling interest rates may offer some relief, the lagged impact of prior rate hikes, elevated financing costs, and uncertainty around tariffs and trade policy continue to cloud the outlook—particularly in the US office and retail segments. Additionally, US office REITs remain under pressure from structural shifts in workplace demand, with utilisation improving but not yet translating into new leasing activity.

However, we do see attractive valuations in Hong Kong and Singapore as well as seeing M&A activity picking up in UK industrial REITs. Healthcare related REITs offer selective opportunities within senior housing as ageing populations drive demand. Lastly data center/ AI infrastructure build-out continues to support occupancy.

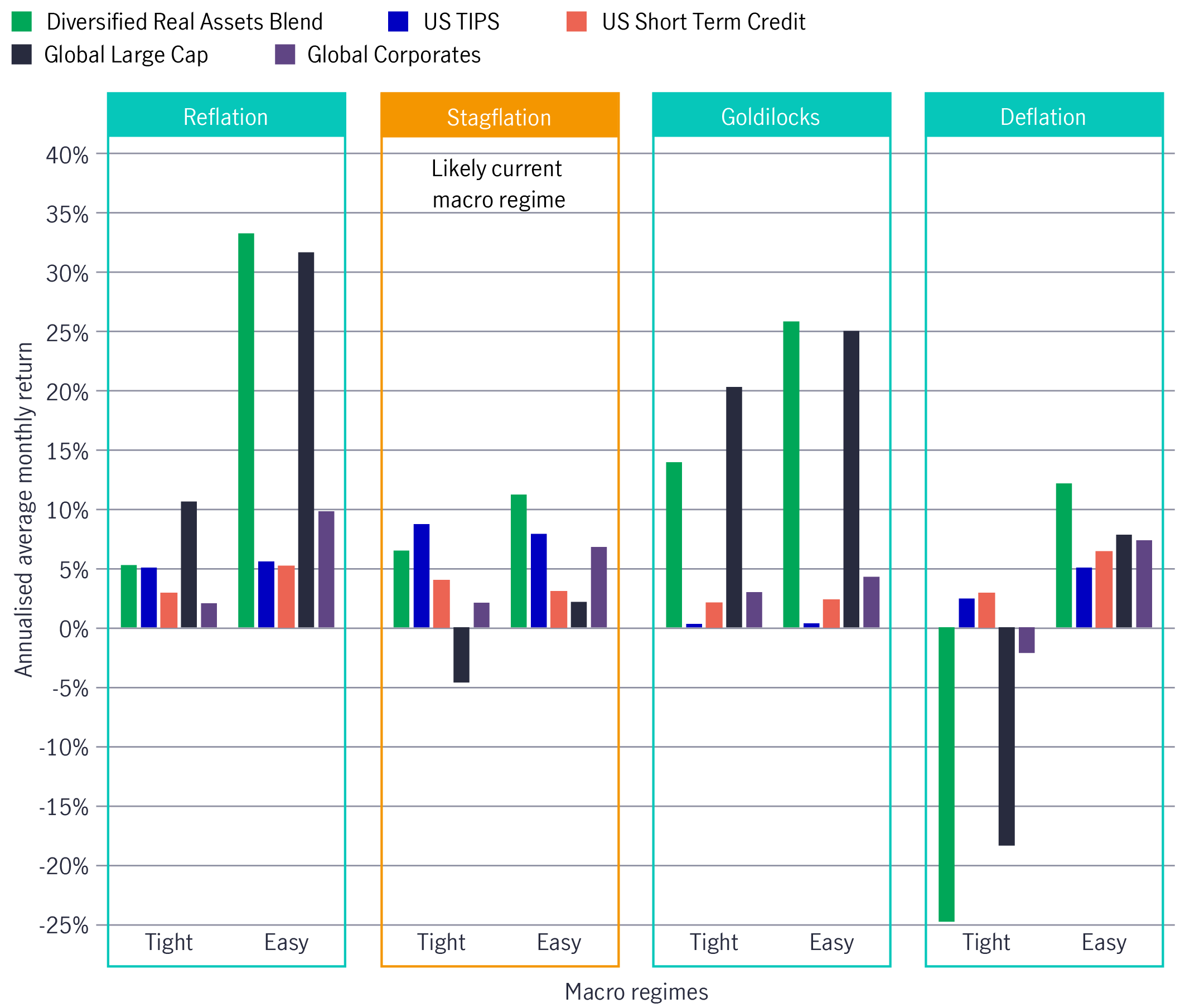

Inflation expectations are likely to remain elevated as tariffs percolate through higher consumer prices. We believe increased political pressure on the Fed could modestly dampen inflation expectations over a 2-year horizon. The shift back to low growth aligns with our view of below-trend economic performance in the near term. With the Fed now expected to cut rates several times in 2025 and 2026, financial conditions could ease more decisively, potentially triggering a trend reversal. This reinforces the odds of easy-stagflation or easy-reflation regimes ahead. In such environments, real assets have historically outperformed broader markets, making them a compelling allocation for investors (see Chart 1).

Chart 1: Real assets can add value under current macro regimes and environment

Source: For illustrative purposes only. Data since 1999 and as of 30 September 2025 based on historical analysis and Manulife's MAST’s proprietary macro regime model. Average is computed as the sample mean of all total monthly returns associated to a given regime. Average is annualised by multiplying by 12. *Diversified Real Assets Blend includes 40% MSCI World Energy Sector Index, 26% of FTSE NAREIT All Equity REIT Index, 17% of MSCI World Metal & Mining Index, 8.5% of FTSE EPRA/NAREIT Developed ex US Index, and 8.5% of Brookfield Global Infrastructure Index. Past performance does not guarantee future results.

A diversified allocation to liquid real asset – spanning energy, materials including precious/base metals and mining, real estate, infrastructure equities, and short-maturity Treasury Inflation-Protection Securities (TIPS) – may help investors manage inflation risk. These assets tend to benefit from rising input costs, pricing power, and real asset exposure. Many real assets have the potential to generate steady income, such as rent from property, tolls from infrastructure, or utility cashflows, that may provide competitive yields linked to inflation.

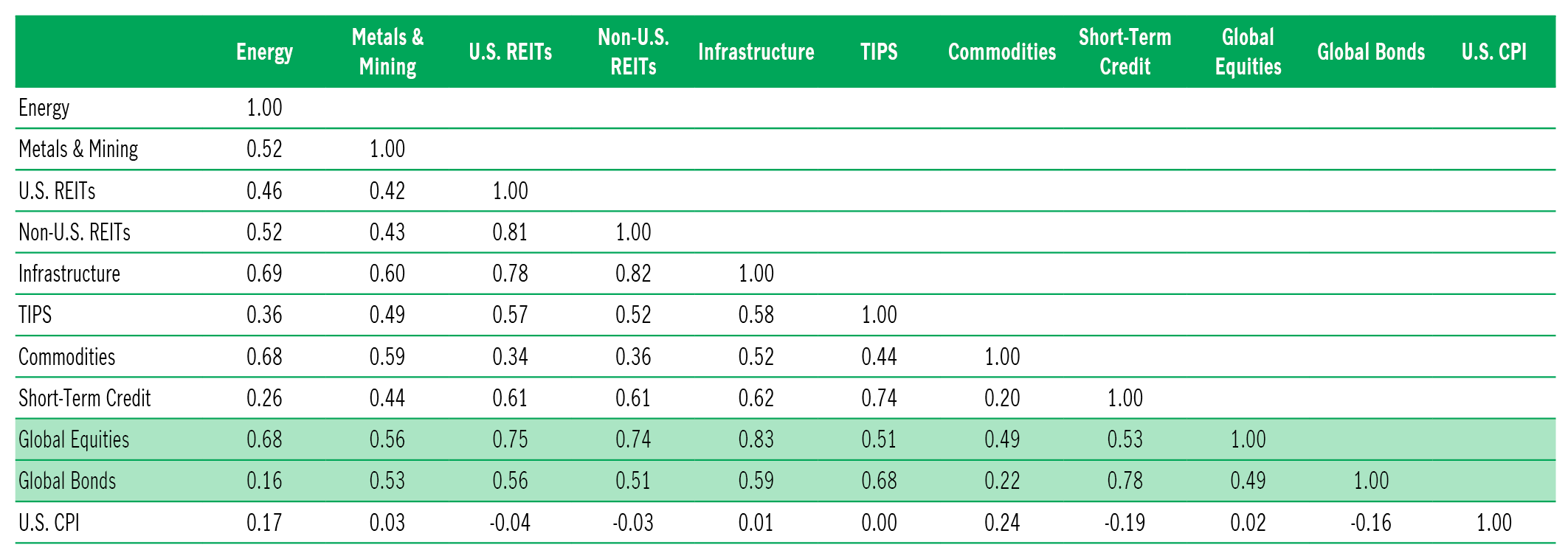

Real assets have at times, shown low return correlation with traditional equities and bonds, offering potential diversification benefits (see Chart 2). The distinct return profile can enhance portfolio resilience, especially during periods of elevated inflation and market volatility.

Chart 2: Correlations of real assets versus traditional global equities and bonds (August 2010 – August 2025)

Source: Bloomberg, monthly returns (indices) / data (US CPI) from August 2010 to August 2025. Total returns in USD for representative indexes: Energy: MSCI World Energy Sector Index; Metals & Mining: S&P/TSX Global Mining Index; US REITs: S&P US Equity All REIT Index; Non--US REIT: S&P Developed ex-US REIT US dollar Index; Infrastructure: S&P Global Infrastructure Index; TIPS: Bloomberg US Treasury TIPS 1-5 Year Index; Commodities: Bloomberg Commodities Index; Short-Term Credit: Markit iBoxx USD Liquid Investment Grade 0-5 Index; Global Equities: MSCI World Index; Global Bonds: Bloomberg Global Aggregate Bond Index; US CPI: US CPI urban consumer less food and energy year-on-year (non-seasonally adjusted).

Correlation shows the strength and direction of a relationship between two variables. It is expressed numerically by the correlation coefficient, which ranges from -1 to 1. A positive correlation (greater than 0 but less than 1) means the two variables move in the same direction, though not necessarily by the same magnitude. A negative correlation (less than 0 but greater than -1) indicates the variables move in opposite directions, also with varying degrees of change. When two assets have a low positive correlation or a negative correlation, they tend to move independently or in opposite directions. Including assets with these correlation characteristics in a portfolio may offer potential diversification benefits.

Past performance does not guarantee future results. Diversification or asset allocation does not guarantee a profit or protect against the risk of loss in any market.

As inflation risks become more entrenched and policy responses more aggressive, investors will need to rethink traditional portfolio construction. Liquid real assets have the potential to offer an inflation hedge alongside income, across a broad diversified global opportunity set – all of which are especially valuable in today’s uncertain environment. Real assets can provide a bridge between inflation protection and capital appreciation, making them a strategic allocation in today’s evolving landscape.

Extended reading: Manulife Global Fund – Diversified Real Asset Fund

1 Source: Manulife Investment Management, Bloomberg, Inflation sensitive equities: A new way forward, January 2025;

2 Source: Manulife Investment Management, Bloomberg, September CPI, as of 14 October 2025.

3 Source: Manulife Investment Management, Bloomberg, September CPI, as of 14 October 2025.

4 Source: Manulife Investment Management, Reuters, Trump ratchets up US-China trade war; China ramps up rare earth restrictions, 14 October 2025.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.