25 June 2025

Alex Grassino, Global Chief Economist

Dominique Lapointe, CFA, Global Macro Strategist, Multi-Asset Solutions Team

Erica Camilleri, CFA, Senior Global Macro Analyst, Multi-Asset Solutions Team

Hugo Bélanger, Senior Global Macro Analyst, Multi-Asset Solutions Team

At the beginning of 2025, we identified five key macroeconomic themes that we believed would likely persist throughout the year:

1 A mixed bag for global growth

2 A circuitous route to neutral rates

3 A mountain of government debt

4 A likely shift in global trade

5 Challenged emerging markets

What a difference six months can make. More forceful-than-expected government policy decisions, particularly by the United States, have swiftly overtaken some of our early 2025 views.

For example, while still stronger than in other regions, US economic growth appears to be catching down to global counterparts; conversely, the eurozone economy now has some structural tailwinds behind it. And although the idea of world central banks moving toward neutral policy rates is somewhat intact, the clean convergence we’d anticipated hasn’t occurred.

On the flip side, however, other 2025 themes of ours have been validated and reinforced. Global trade issues and deglobalisation have indeed come to the fore, with knock-on effects for many trade-sensitive emerging markets. Elsewhere, capital markets the world over are contending with a big wave of government debt supply, which is driving global bond yields higher.

With the year now half over, we take a geographic rather than a thematic approach this time around, outlining region by region how we envision the rest of 2025 unfolding.

We believe that given volatile government policies, US economic growth will probably slow during the second half of 2025. In fact, heightened uncertainty around trade policy has already had noticeable effects on the economy this year, including massive swings in net trade and inventory building, along with a now-unwinding pull-forward in business activity. At this stage, we see signs of a moderating labor market, weakening industrial production, and flagging household consumption. Upward inflationary pressures from the reciprocal tariffs haven’t yet hit the US economy, but it may only be a matter of time before they do.

However, from the US Federal Reserve (Fed)’s perspective, we believe a focus on softening growth and job market dynamics will ultimately win out over inflationary concerns, leading to further interest rate cuts in the coming months that bring the Fed funds rate to 3.5% by mid-2026. Across global markets, the question of whether American “exceptionalism” is at an end is being asked more frequently amid mounting worries about US fiscal policy and the country’s relationships with key allies.

Investment takeaways: Through the first half of 2025, said question and related worries have been manifested in the markets as lagging US equities, a weaker US dollar (USD), and rising long-term US Treasury rates. While we would expect these performance trends to continue going forward, any removal of (or even reduction in) macro and policy uncertainty could cause quick, sharp trend reversals.

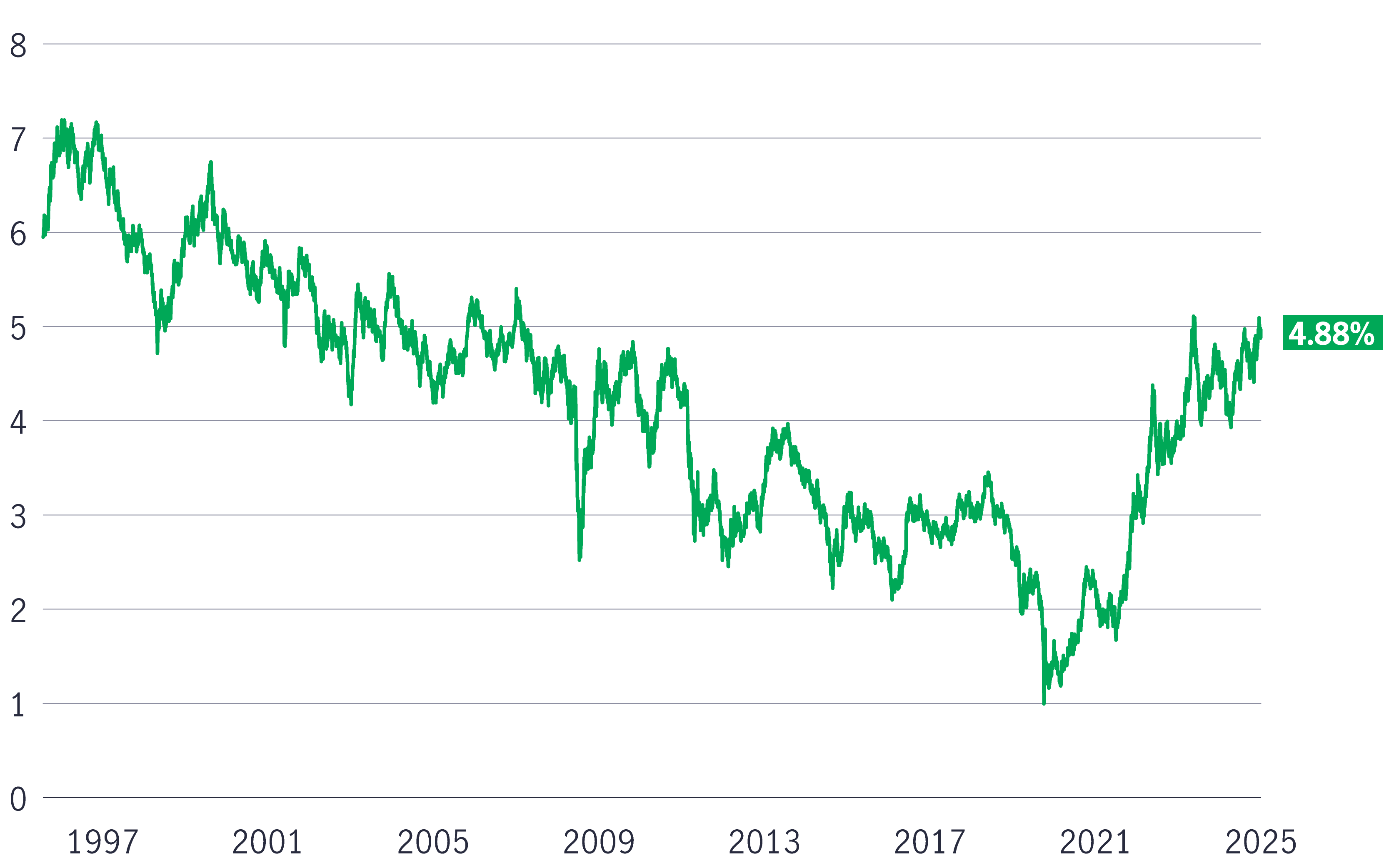

The 30-year US Treasury yield has reached levels not seen since the 2008 global financial crisis

Source: U.S. Treasury, Macrobond, Manulife Investment Management, as of 6/6/25.

Canada’s economy ended 2024 on a relatively strong footing, supported by an improved global trade picture and a positive shift in domestic conditions. By mid-2025, however, US tariffs imposed on key Canadian exports (including steel, aluminium, and autos) had disrupted the nation’s trade activity and weighed heavily on business sentiment. As the effects of the tariffs filter through the Canadian economy, we expect a protracted slowdown in the second half of 2025, followed by a gradual rebound in 2026 and 2027.

This forecast notably hinges on the Bank of Canada providing some additional monetary easing in the next 12 months, which is currently in question due to rising inflation in Canada.

Investment takeaways: These challenges notwithstanding, the Canadian dollar has appreciated year to date and may keep doing so amid global concerns about US policies. We’re less optimistic about Canada’s equity market despite sizeable first-half gains by gold mining stocks. We don’t expect oil prices to stay high and lift Canadian energy stocks, while the country’s financial institutions may feel the brunt of the domestic economic slowdown.

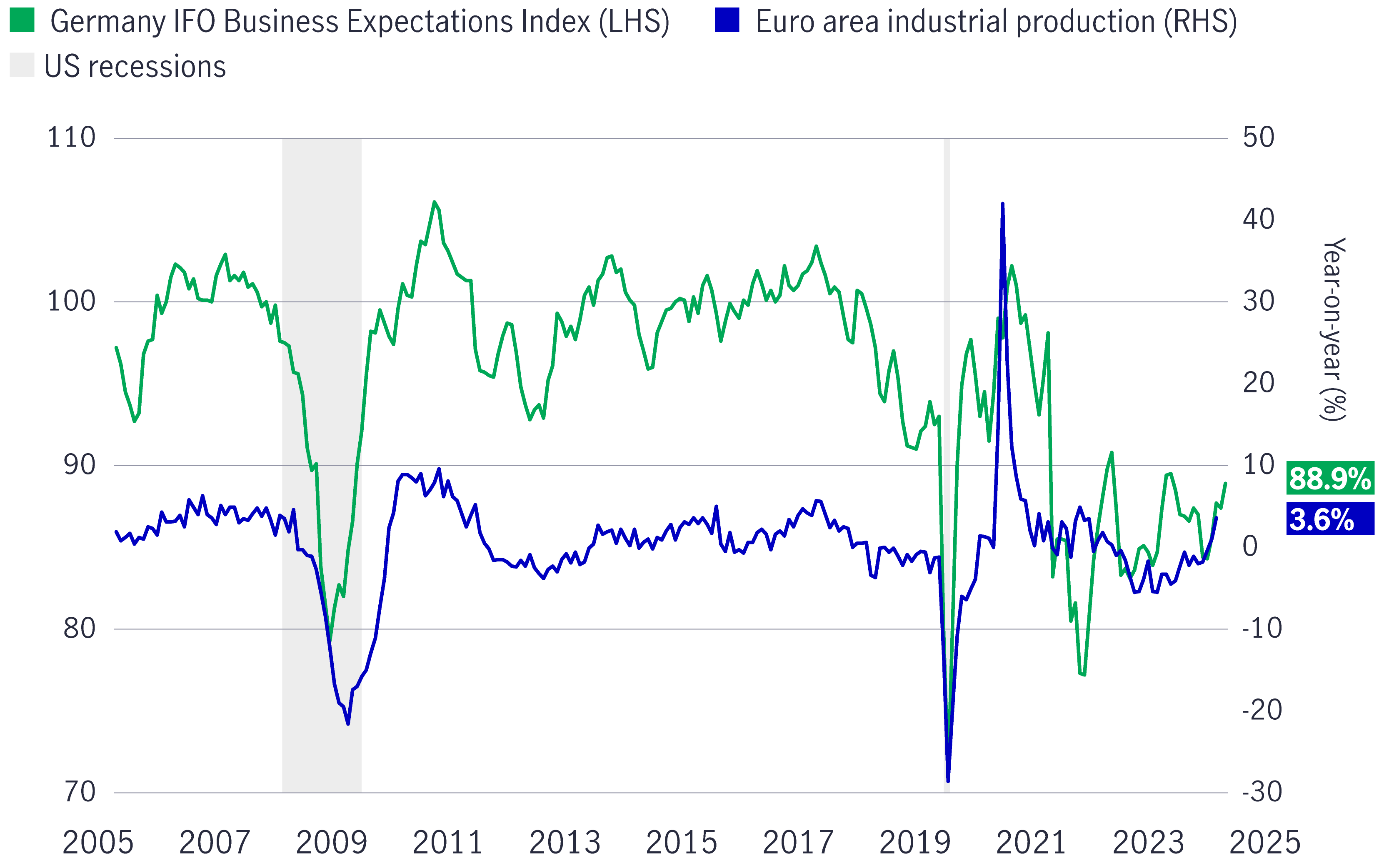

We believe the euro area as a whole is likely to continue experiencing below-trend economic growth in the second half of 2025 despite recent improvements in a variety of cyclical indicators. For instance, while the manufacturing sector has shown signs of life following years of recession-like conditions, persistent uncertainty around US trade policy is likely to limit a full recovery. We’re optimistic that structural reforms and fiscal stimulus across much of Europe should provide tailwinds for the regional economy, but we don’t expect the positive impacts to take hold until 2026 and beyond.

Meanwhile, eurozone inflation has continued to move toward the European Central Bank’s (ECB’s) target, with moderating wage growth, cheaper energy prices, and a stronger currency (the euro) all contributing to slower inflation. We expect the ECB to finish its monetary easing cycle at 2%, which we currently view as its neutral policy rate. However, should a more draconian implementation of US trade policy further weaken Europe’s growth impulse, the ECB may need to ease policy more aggressively.

Investment takeaways: We continue to see upside potential for the euro going forward, supported by a narrowing growth differential between Europe and the United States, as well as many investors’ search for USD alternatives as US policy volatility mounts. We arecautiously bullish on euro area equities amid an improving structural market outlook and attractive relative valuations.

After years of recession-like conditions, Europe’s industrial production may be bottoming

Source: Bloomberg, Macrobond, Manulife Investment Management, as of 2/6/25.

We believe economic growth in the United Kingdom likely troughed last year, so we expect a modest recovery to below-trend levels in the second half of 2025. The country’s more service-driven economy should provide some measure of insulation from any damage caused by global trade headwinds. Meanwhile, we continue to monitor the UK labour market, with recent increases in employer-paid taxes likely to dampen the outlook.

Despite the economy’s still-sluggish growth trajectory, stubbornly high inflation has so far constrained the Bank of England (BoE) from significantly easing its key policy rate, which is currently perched at 4.25%. Accordingly, we expect the BoE to deliver only two additional rate cuts in the back half of 2025.

Investment takeaways: We’re cautious on UK government bonds (gilts) at the long end of the yield curve, given their potential sensitivity to US macro and market spillovers. Within UK equities, we prefer large caps over small caps because they may be more defensive in volatile markets and less susceptible to the UK’s stagflationary economic environment.

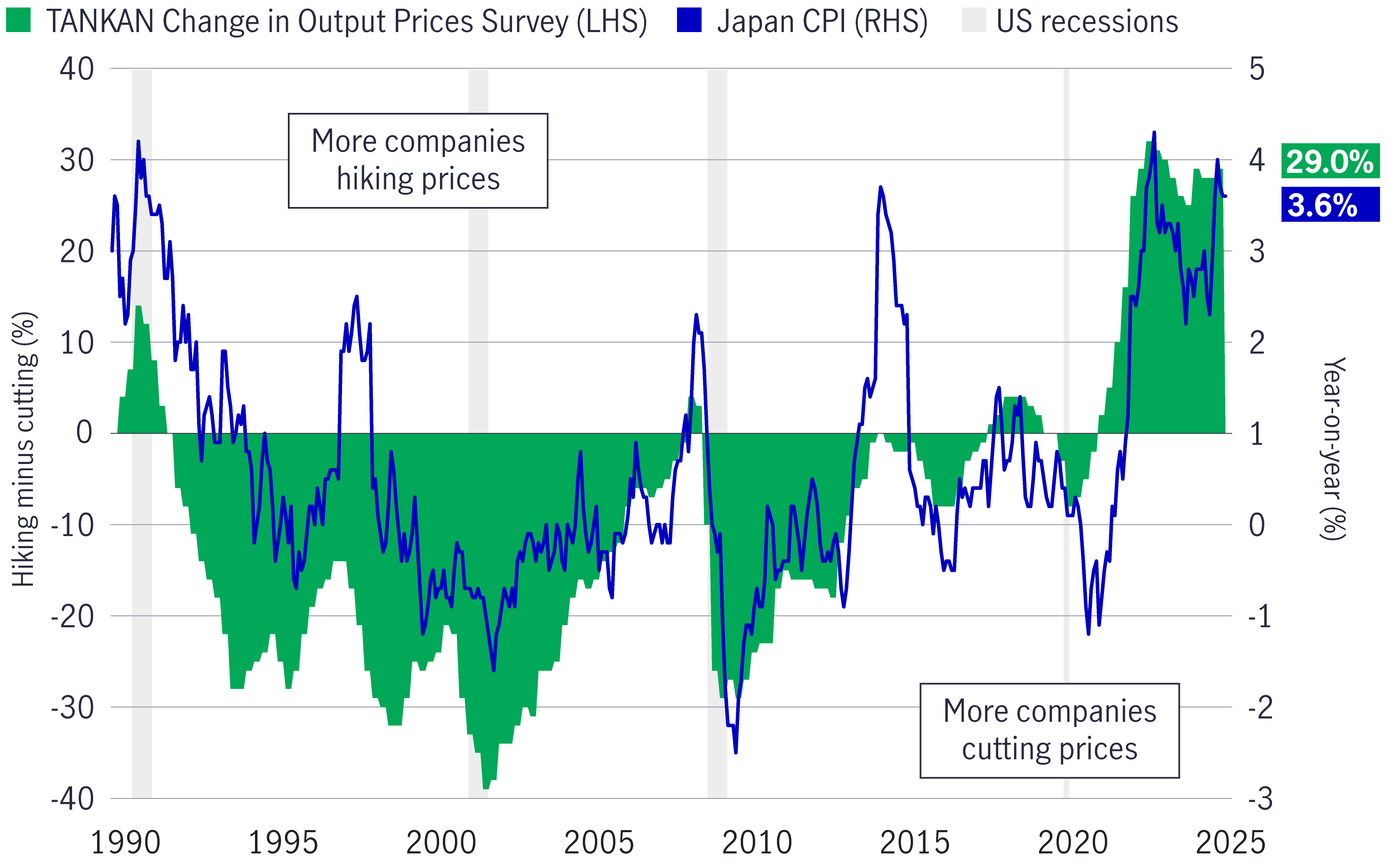

The output gap in the Japanese economy—the difference between its actual output and its potential output—has narrowed recently as the structural growth outlook has improved somewhat. However, cyclical indicators suggest a likely slowdown in the second half of 2025 as global demand softens. Upward price pressures in Japan are likely to persist as wage growth pushes to multidecade highs, unlocking a virtuous wage-price cycle, while lofty food inflation should help keep headline inflation firm.

We continue to expect the Bank of Japan to hike its policy rate in the latter half of this year, supported by above-target inflation and negative real interest rates. The nation’s elevated government debt levels should continue to be a headwind to Japanese long-bond yields, as fiscal policy is becoming an increasingly relevant driver of global markets.

Investment takeaways: We expect the Japanese yen to continue appreciating in the months ahead, which could weigh on domestic equities in the short term. Corporate profits and capital expenditures continue to rise on the back of steady corporate reforms, which should provide a tailwind for Japan’s equity market over the medium to longer term.

Japan’s Tankan survey suggests continued upward pressure on domestic inflation

Source: Bank of Japan, Macrobond, Manulife Investment Management, as of 2/6/25.

China’s economy improved modestly through the first half of 2025, due in part to a front-loading of government policy support and a pull-forward in economic activity caused by looming US tariffs; however, we expect a slight slowdown ahead. Chinese exports largely drove growth in late 2024 and early 2025, but rising global trade uncertainty means China can’t rely solely on this channel anymore.

In order to see a sustainable economic and market rebound, the nation’s domestic activity must accelerate, which, to us, would require more fiscal stimulus directed at the property and consumer sectors. Ultimately, the extent of China’s economic slowdown will likely be determined by the degree to which such stimulus measures can mitigate or offset the adverse impact of a weaker trade impulse.

We believe Chinese government policy will remain reactive and, therefore, expect the economy to decelerate before stabilising. Structural challenges such as industrial overcapacity, a lack of social safety nets, and a sluggish property sector should continue to pose downside risks to potential growth.

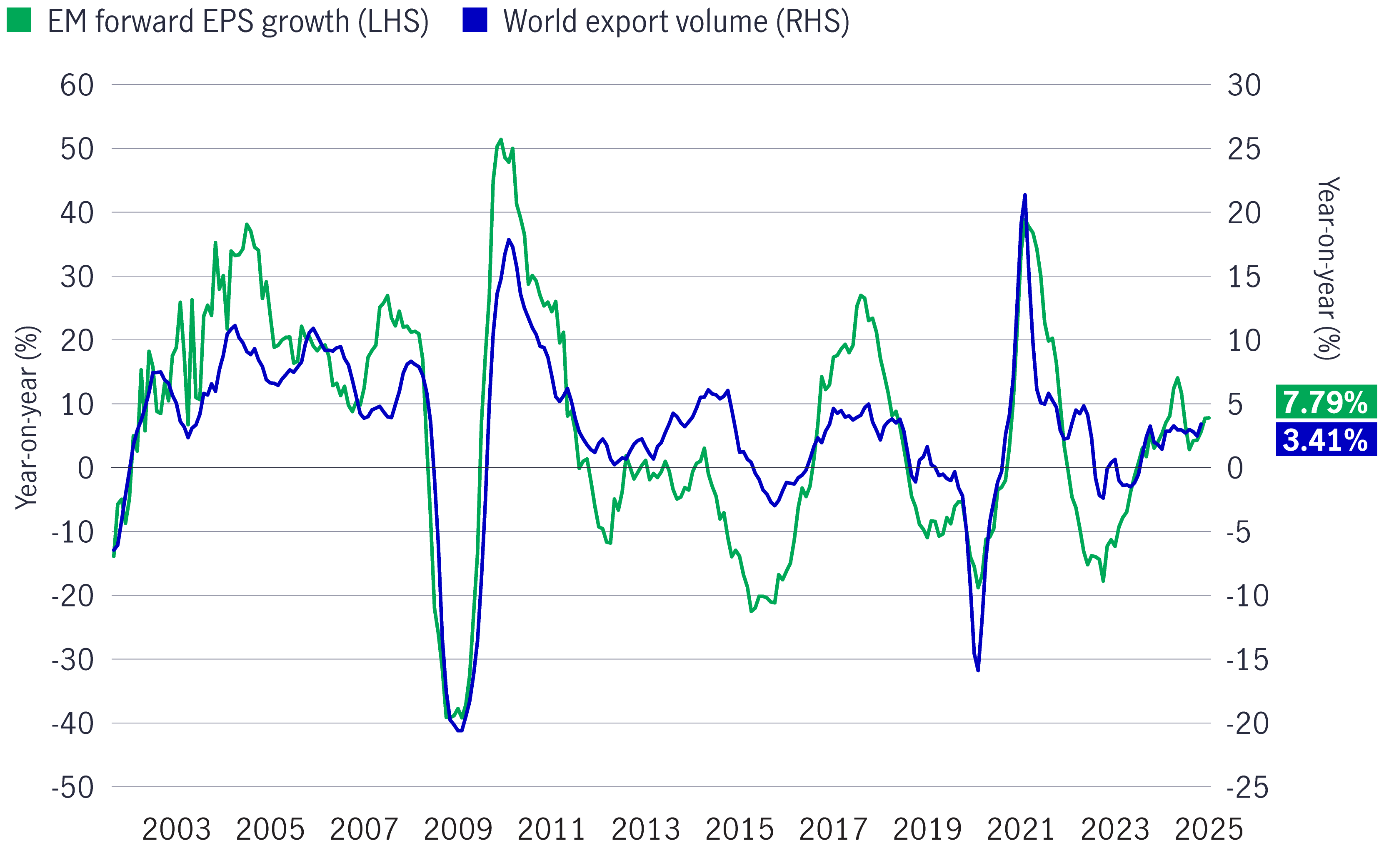

Emerging-market (EM) economies are particularly sensitive to shifts in global trade and manufacturing activity, so a macro environment marked by ongoing trade tensions poses a formidable challenge to many EMs’ economic and earnings growth. We would expect high levels of uncertainty and market volatility around key upcoming dates, such as the end of the 90-day reciprocal tariffs pause in July and the 90-day US-China trade truce in August.

Helping to offset slowing trade activity, many EM central banks are expected to continue cutting interest rates. This dovish policy stance is supported by deflationary trends of moderating growth, a weaker USD, lower commodity prices, and China’s efforts to redirect industrial overcapacity away from the United States. However, because many EMs depend so heavily on global trade, some may not have sufficient policy wherewithal to completely neutralise tariff-related drags on external demand.

In contrast, more domestically oriented EMs with limited US trade ties look better positioned. Structurally, a persistent decline in the USD would likely benefit many EM assets.

Slower global trade would likely have a negative impact on EMs’ earnings growth

Source: MSCI, CPB, Macrobond, Manulife Investment Management, as of 5/6/25. EM forward earnings per share growth is referenced to MSCI Emerging Markets Index.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.