6 May 2025

The intersection between the macro backdrop and the market setting investors must navigate has perhaps never been more apparent than it is today. The five themes discussed below highlight this critical intersection.

Tariffs and trade. Recession risks. Geopolitics. In today’s environment, it’s becoming increasingly difficult to not view investment strategies and allocations at least partly through a macroeconomic lens. With that in mind, here are five of our latest high-conviction global macro themes and some potential implications for multi-asset investor portfolios.

In recent years, we’ve observed extreme levels of uncertainty around global monetary policy, as reflected in sharp and frequent swings in the futures market pricing of central bank interest rate cuts. Barring unforeseen circumstances, we anticipate that this trend will likely persist in the months and years to come.

Why the uncertainty? Heightened short-term volatility of two key economic variables—growth and inflation—has been prompting global central bankers to be more data dependent rather than forward looking, driving a more reactive policy function and leading to lower market confidence in the monetary policy path that lies ahead. In addition, severe supply-side constraints since the COVID-19 pandemic have been exacerbating the near-term volatility of growth and inflation readings and the push-and-pull dynamic between the two.

As of this writing, we believe that global growth risks are tilted to the downside, while global inflation risks are clearly skewed to the upside in the wake of the recent U.S. tariff announcements. The U.S. Federal Reserve (Fed) and other world central banks may have to make tough policy decisions regarding whether to prioritize economic growth or inflation, especially as today’s supply-driven inflation backdrop might require very different policy responses than the more demand-driven inflation of previous years.

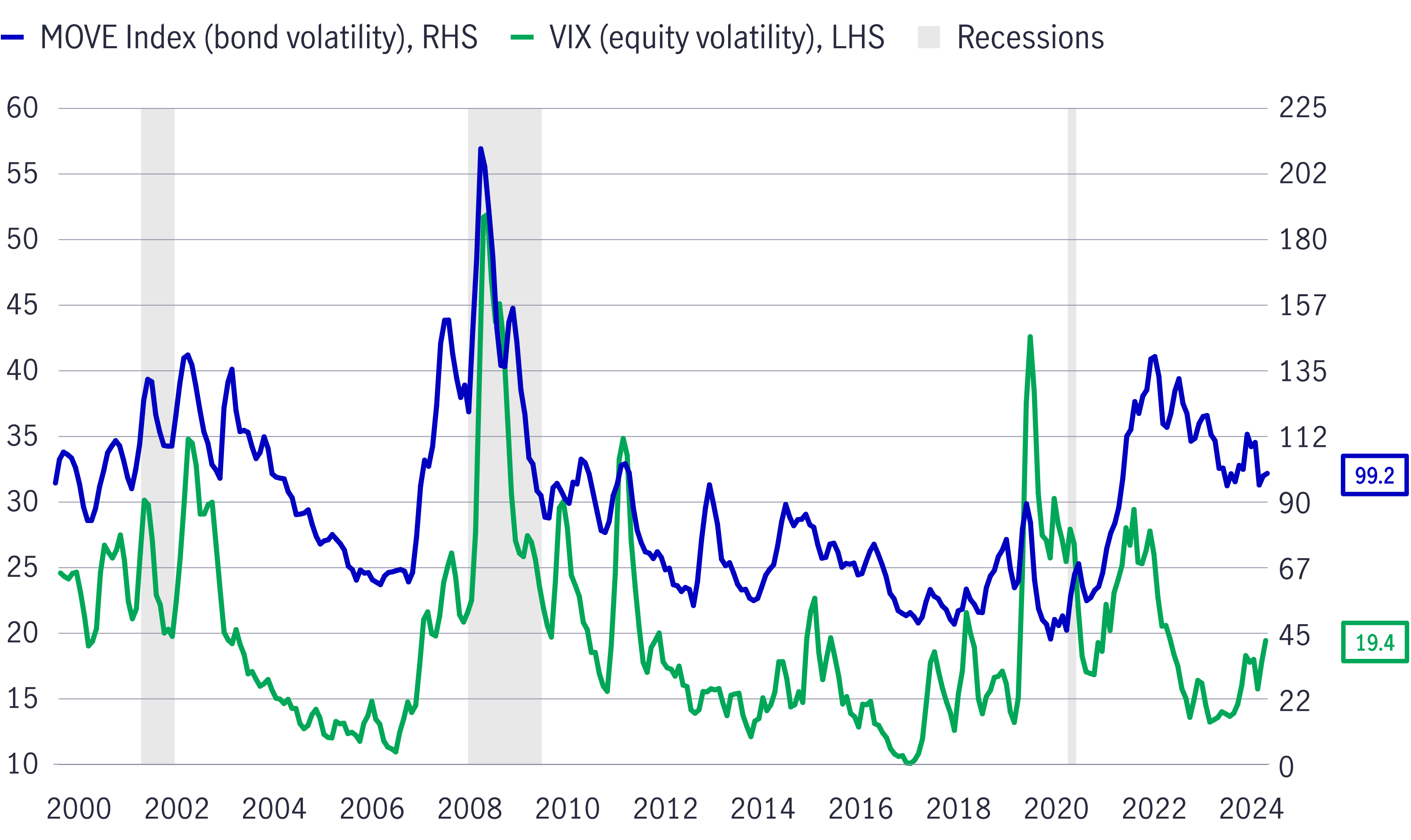

Multi-asset portfolio implications: Over the past five years, while equity market volatility has fluctuated quite a bit, bond market volatility has remained consistently pronounced. Looking ahead, we expect ongoing monetary policy uncertainty to sustain relatively high bond market volatility, which could act as a headwind to the traditional diversification benefits of government bonds within a multi-asset investor portfolio, particularly on the front end of the yield curve.

Bond market volatility has been higher than equity market volatility in recent years

Source: Bloomberg, Macrobond, Manulife Investment Management, as of 4/14/25. Data has been smoothed using moving averages of data points over 3-month periods, a technique designed to minimize short-term data fluctuations and reveal underlying longer-term patterns. The Intercontinental Exchange (ICE) Bank of America (BofA) U.S. Bond Market Option Volatility Estimate (MOVE) Index is a yield curve-weighted index of the normalized implied volatility on one-month U.S. Treasury options. The Cboe Volatility Index (VIX) tracks the U.S. equity market’s expectation of 30-day volatility and is constructed using the implied volatilities of a range of S&P 500 Index options. It is not possible to invest directly in an index. Past performance does not guarantee future results.

That’s largely due to global inflation and the price-level shocks to which it has subjected Main Street consumers: Over the past five years, prices for many core goods and services have surged by more than 30%. Given inflation’s stickiness and potential to accelerate in the period ahead, the Fed and other world central banks may be reluctant to ease monetary policy too aggressively. While some countries’ economies may experience bigger spikes in inflation than others, structural upward inflationary pressures appear to be growing worldwide in today’s macro landscape.

For example, the upcoming U.S. tariff rollout and related factors caused us to ratchet up our U.S. CPI estimates for 2025, 2026, and 2027. On interest rates, over a year ago, we raised our projections for neutral-rate targets (and, recently, further upped our terminal-rate forecasts) in bellwether developed economies such as the United States, Canada, the eurozone, the United Kingdom, and Japan. Along with rising inflation expectations, long-term secular themes such as deglobalization, demographics, and artificial intelligence support our outlook for higher global rates.

That being said, some central banks may have the flexibility to provide further (perhaps even ultra-accommodative) monetary policy easing if necessary; for instance, rate cuts and other measures in the event of a liquidity crisis like we had in 2008, but their bar to do so may be higher than in recent history.

Multi-asset portfolio implications: Global bond yields may continue to be a source of healthy income for many investors, but don’t count on the same amount of price appreciation seen in other monetary policy easing cycles. Moreover, we don’t envision most global central banks (including the Bank of Japan) adopting or returning to zero/negative interest rate policy stances anytime soon.

Price-level inflation shocks: increases in CPI categories since 2020

Source: U.S. Bureau of Labor Statistics, Macrobond, Manulife Investment Management, as of 4/21/25.

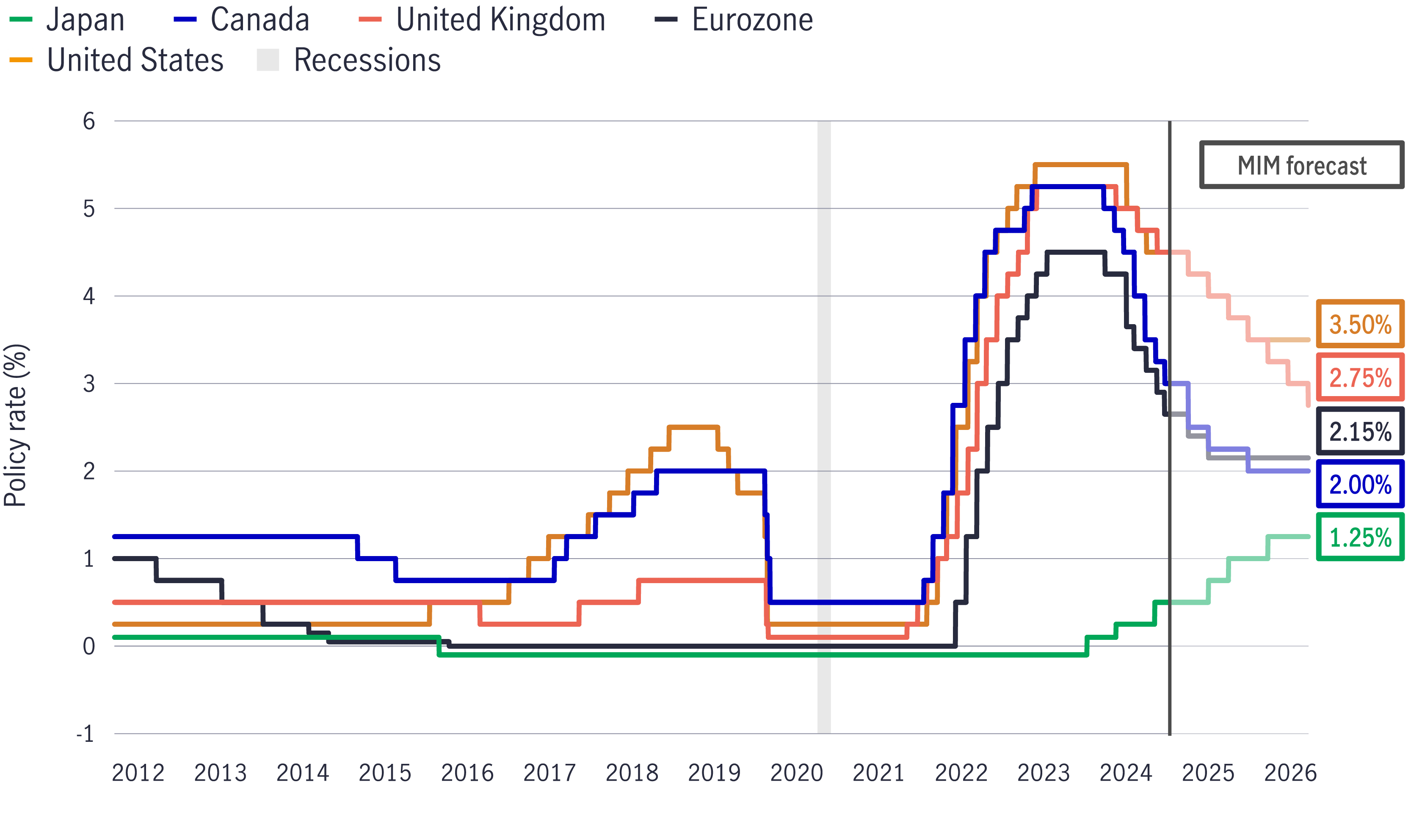

Given the tug-of-war tension between economic growth and inflation, and the complications it often creates for monetary policy, we anticipate global central bankers diverging in their policy approaches as they navigate varying domestic conditions in their respective economies. This would mark a sea change from the past several years, when the world’s major central banks tended to move more or less in tandem: Most were slashing rates in 2020, hiking in 2022, and then cutting again in 2024.

In fact, the monetary policy divergence theme has already been in motion for a few months: The Bank of Canada (BoC) and the European Central Bank (ECB) have continued to reduce their benchmark interest rates toward neutral, while the Fed has stayed on hold through the first four months of this year. We expect the Fed to reach neutral by early 2026 and the ECB by mid-2025, whereas the BoC may well go below neutral later this year. The Bank of Japan’s current rate-hiking cycle makes it an outlier among developed-market central banks.

The uneven and nonlinear global impacts of U.S. tariffs further contribute to regional monetary policy discrepancies, as many countries now begin to decouple along trade lines as well. From our perspective, 2025 is shaping up as a year of below-trend yet still positive global growth, but should more worrisome economic deterioration occur, central banks might once again be apt to ease policy synchronously.

Multi-asset portfolio implications: Regional divergences in global central banks’ monetary policy approaches may translate to corresponding adjustments in interest rate differentials among countries. Multi-asset investors should be on the lookout for relative-value opportunities in the global rates and currency spaces while being aware of currency hedging strategies (such as forward contracts) that can help mitigate the risk of changing currency values.

Developed-market central bank policy rates may diverge going forward

Source: U.S. Federal Reserve, Bank of England, European Central Bank, Bank of Canada, Bank of Japan, Macrobond, Manulife Investment Management, as of 4/14/25.

In our 2025 macroeconomic outlook, we outlined our argument for why global bond yields may rise in 2025. More than three months later, we expect yields to stay higher for longer due to a combination of tight bond market supply, insufficient buyer demand to match, and (as described above) global central banks’ potential reticence to engage in deep monetary policy easing cycles going forward. As a result, the interest expenses paid by governments to service their debt burdens are likely to remain elevated as well.

In the United States, it’s hard to envision a scenario in which government deficits and debt levels shrink substantially, especially in the midst of slowing domestic growth and potential federal tax cuts (both of which could weigh on tax revenues collected). But what’s particularly noteworthy is that fiscal expansion is no longer just a U.S. story, but rather a global one. Indeed, many of the world’s other largest economies are now undertaking or seriously considering such fiscal policies of their own.

For example, after years of fiscal austerity, Germany’s government recently passed a massive fiscal spending package1, and throughout the broader eurozone region, we expect defense spending to climb given the global geopolitical climate. Meanwhile, China seems prepared to deliver additional fiscal stimulus to bolster its economy in the face of a weaker global trade impulse. Japan’s fiscal policy has been expansionary for years.

Multi-asset portfolio implications: We believe debt-supply issuance will increasingly be a catalyst for bond yields in the global fixed-income space, particularly at the long end of the yield curve. Multi-asset investors might revisit both equity and credit allocations to economies that are planning to boost their fiscal spending, which has historically been a tailwind to domestic demand and growth for many countries.

Mounting fiscal deficits: debt-to-GDP ratios for selected developed markets

Source: Bloomberg, Manulife Investment Management, as of 12/31/24.

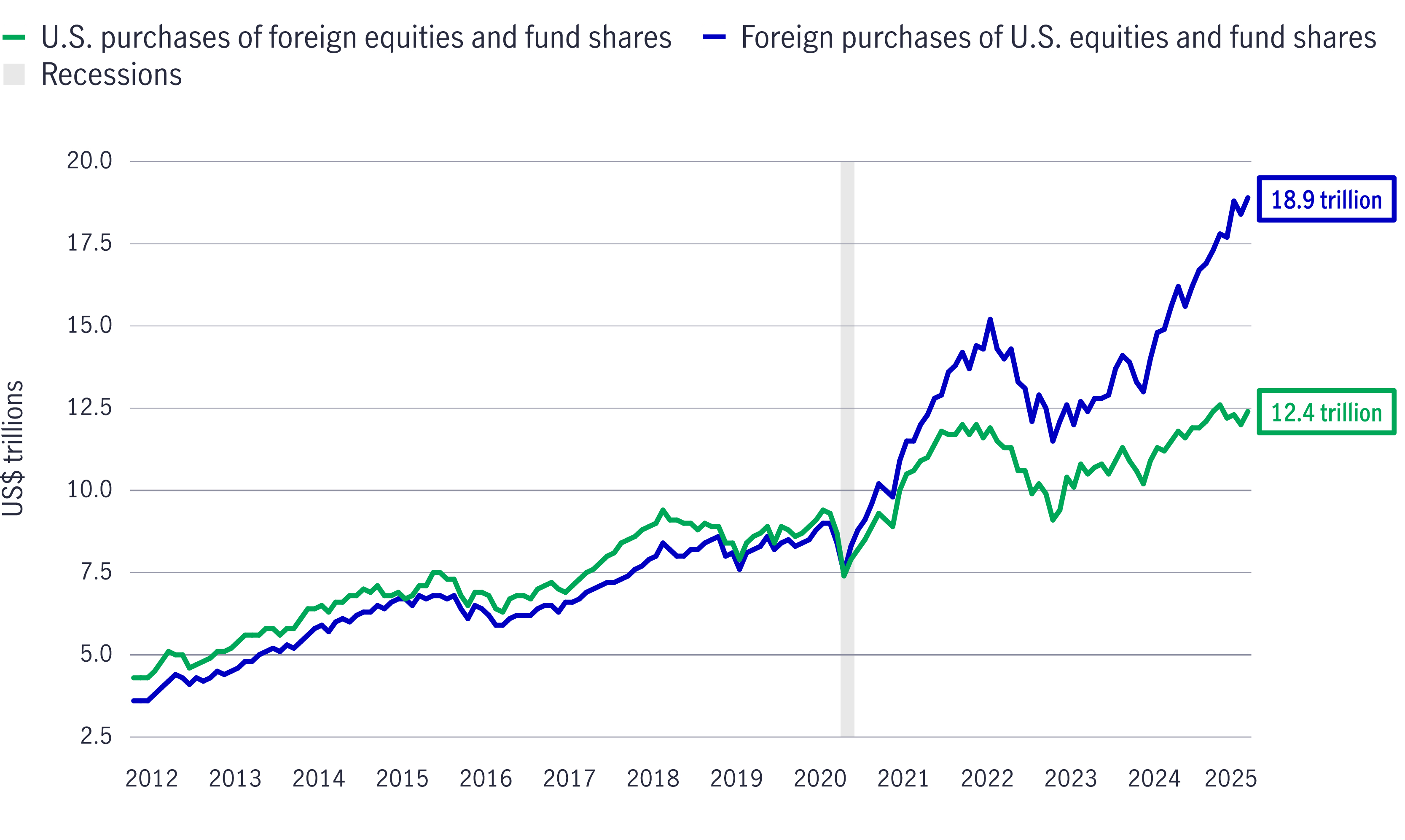

The U.S. political leadership under President Trump reinforces our conviction in the thematic view that the era of hyper-globalization is probably over, potentially unwinding a multidecade global phenomenon that has spurred brisker cross-border trade and capital flows among world economies.

Broadly speaking, globalization fueled deflationary pressures worldwide to the benefit of many U.S. companies that saw robust profit margin expansion on the back of lower costs and a strong dollar. Global allocators built overweight positions in U.S. assets over the past decade, including outsize allocations by foreign investors. But a new world economic order could alter the global profits picture and present attractive opportunities in non-U.S. regions and sectors. On a cyclical basis, government policy visibility is decreasing in the United States more so than in other regions, inducing more investors to look elsewhere in what could signal renewed interest in enhanced portfolio diversification through underowned geographies and asset classes.

However, it’s important to acknowledge that durable macro themes such as artificial intelligence and ever-improving productivity may continue to favor many U.S. companies (and their profits) in relation to the rest of the world.

Multi-asset portfolio implications: The TINA (“There is no alternative” to U.S. stocks) mantra is losing credence as global equity opportunities outside the United States become more appealing to many allocators. Greater investor appetite for non-U.S. investments, including European and Japanese assets, could trigger a vicious feedback loop with the U.S. dollar, potentially threatening the greenback’s long-standing role as the safest haven currency.

Overseas investors have favored U.S. equities in recent years, but that could be poised to change

Source: U.S. Treasury, Macrobond, Manulife Investment Management, as of 4/14/25.

1 “German fiscal bonanza adds to European debt strains and defence challenge” By Yoruk Bahceli, April 1, 2025, The Reuters

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.