28 August, 2019

Fiona Cheung, Head of Credit, Asia

On 5 August, the Chinese renminbi (RMB) notably depreciated against the US dollar (USD), breaching the psychologically important level of “7 per dollar” in response to a reescalation of Sino-US trade tensions1 . Three days later (8 August), the People’s Bank of China (PBoC) fixed the RMB’s midpoint2 weaker than “7” for the first time since 2008. In this investment note, our Asian credit team shares its views on how the RMB’s acute weakness, if sustained, may impact China’s economy and credit markets.

To understand the RMB’s sudden weakness, we need to look at the macroeconomic backdrop of a sharp deterioration in Sino-US trade relations and accommodative rhetoric by major global central banks. On 1 August, the US administration announced a fresh round of tariffs on US$300 billion of Chinese imports to be implemented on 1 September3. The unexpected announcement came after the two countries had agreed at the June G-20 summit to resume trade talks. On 5 August, the US Department of the Treasury announced that China was a currency manipulator, escalating bilateral tensions further. At the same time, major global banks have followed the US Federal Reserve’s (Fed) dovish tone, trimming growth forecasts and pledging lower interest rates.

That said, we see the RMB’s depreciation as a one-off strategic measure by the Chinese government that is designed to blunt the impact of these rising global economic risks. This is different from the last significant devaluation back in August 2015, when comprehensive RMB pricing-and-flow reforms were also introduced in order for the currency to be included in International Monetary Fund’s Special Drawing Right (SDR) basket.

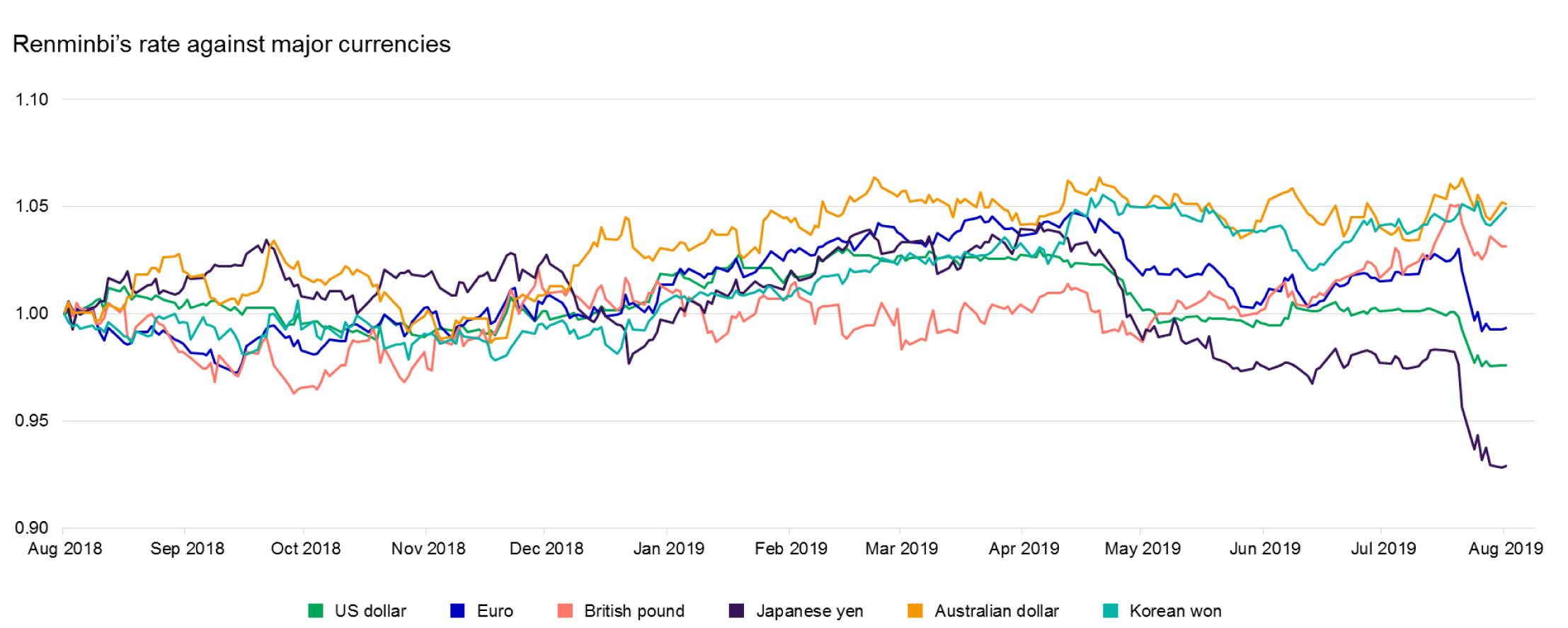

Overall, the weakening of the RMB against the USD should not be viewed as an outlier, as other major global and regional currencies have also recently weakened against the greenback due to dovish central bank policies and rising geopolitical risks (see Chart 1).

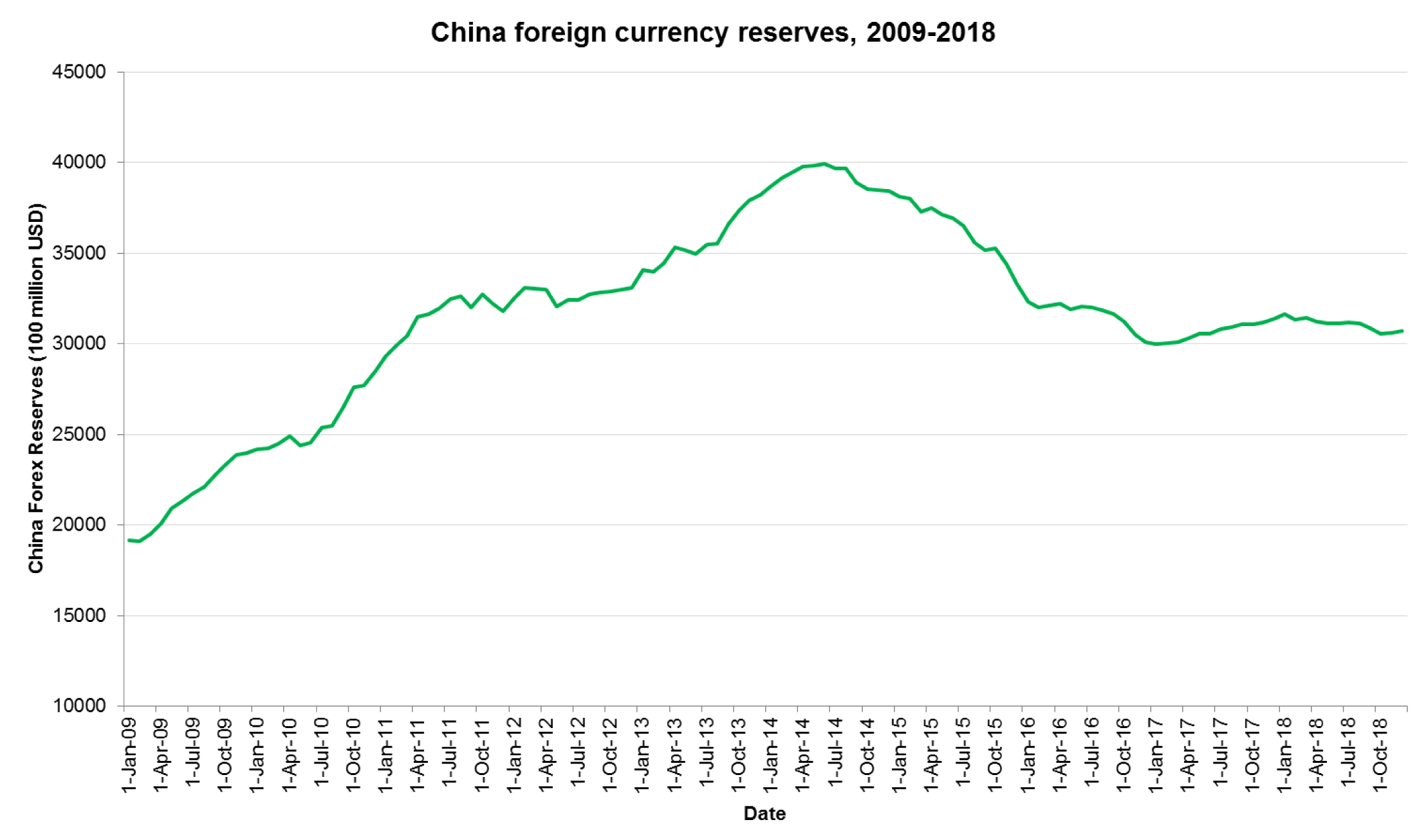

Historically, the central bank has supported the RMB, fixing the currency at a stronger level after acute market selloffs and spending roughly US$1 trillion of its massive foreign exchange reserves4 over the past five years (see Chart 2).

After the RMB’s recent dip, we do not expect further aggressive currency depreciation for two reasons: 1) Expectations of a more acute decline could spark capital outflow worries; 2) The RMB/USD interest-rate gap is now widening, as the Fed is expected to cut rates further while the PBoC remains neutral.

From an economic perspective, we do not think that a weaker RMB will lead to a material increase in growth. China’s current account has turned to a surplus of roughly 0.4% of GDP5, meaning trade is not a major driver of growth at present. The impact of an increase in exports should also be marginal.

However, the currency’s depreciation may have significant distributional impacts. A weaker RMB helps to boost margins in the struggling export sector, right at the time when it may face escalating costs. Simultaneously, it hurts the burgeoning import and consumption sector, which has driven recent economic growth. Thus, the currency move could boost social stability while distributing pain to a more robust segment of the Chinese economy.

We believe that the impact of RMB weakness on sovereign-debt markets will be quite limited: foreign debt as a total of Chinese government debt remains quite small6. The effect on corporate-debt markets, however, may be more significant, especially for those sectors or companies with large currency mismatches and unhedged foreign-exchange risk and weak margins, particularly if the currency remains at a lower level for a prolonged period. In particular:

Amid the escalation of the Sino-US trade war and potential for a further RMB weakening, we also expect issuers to be more cautious with their foreign-debt exposure that could lead to lower appetite to issue in the offshore bond market.

While we believe there’s still a high level of uncertainty on the eventual outcome of the US and China trade tension and its potential drag to the global economy we remain constructive of the credit fundamentals of China’s corporates we cover, which are largely intact on the back of ample market liquidity. We also believe that stronger companies are well positioned to withstand any further fall in the RMB, given their good access to domestic funding and manageable USD debt maturity profile.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

1 Bloomberg, 5 August 2019.

2 The RMB is allowed to trade in a narrow daily band which is defined by a midpoint fixing rate set by the PBoC each morning.

3 Tariffs on a portion of the US$300 billion tranche have been delayed until at least mid-December.

4 Source: Manulife Investment Management. Assumption based on the drop in foreign exchange reserves from 2014-2018

5 Source: State Administration of Foreign Exchange, as of 31 December 2018.

6 Foreign debt accounts for only 0.4% of China’s total sovereign debt, inclusive of debt issued by provincial governments, as of 2018. Source: Moody’s, August 2019.

7 Company financials as of 2018

8 Bloomberg, as of 13 August 2019.

9 People’s Bank of China as of Dec 2018.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.