13 April 2023

Murray Collis, Chief Investment Officer, Fixed Income (Asia ex-Japan)

Jimond Wong, Senior Portfolio Manager, Asia Fixed Income

Chris Lam, Portfolio Manager, Asia Fixed Income

Asian high-yield bonds have experienced a volatile two years of underperformance amid the prolonged slump in China’s property sector and the country’s strict zero-Covid policy. But as Murray Collis, Chief Investment Officer, Fixed Income (Asia ex-Japan), Jimond Wong, Senior Portfolio Manager, Asia Fixed Income, and Chris Lam, Portfolio Manager, Asia Fixed Income, point out in this investment note – although emerging from a difficult period, Asian high yield has rebounded since last November and maintained positive momentum into 2023. Moreover, the asset class currently offers compelling risk-reward opportunities for investors and is poised to weather market volatility due to regional economic resiliency and unique asset-class characteristics.

Asian high yield has experienced a "perfect storm" of headwinds over the past two years.

The uncertainty began with China property in August 2021. The Chinese government released its unofficial "Three Red Lines" policy that fundamentally recalibrated the real estate sector’s role in the economy by reducing the leverage levels of developers. The abruptly shifting commercial environment, coupled with strict COVID-19 lockdowns, strained developers’ cash flows and dented consumer sentiment. Without significant government support, this resulted in a cascade of sector defaults, credit downgrades, bond exchanges and withdrawn credit ratings.

In 2022, global macro risks were piled onto existing regional idiosyncratic ones as the US Federal Reserve (Fed) undertook aggressive monetary tightening to curb surging inflation. The fed funds rate increased from a range of 0-0.25% in early March to a range of 4.25%-4.50% by December 2022. As most developed and emerging market central banks followed the Fed’s lead, global fixed income posted its worst annual performance on record back to 1900.

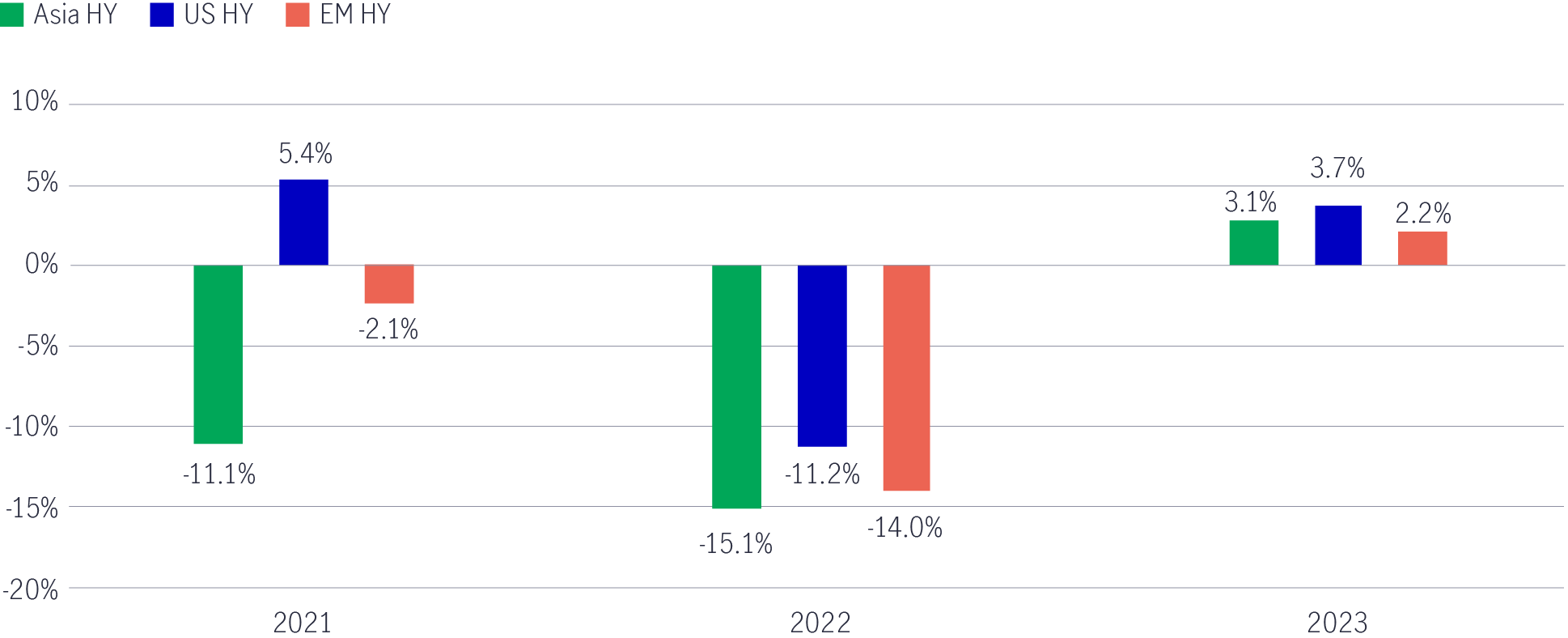

As a result, Asian high yield underperformed global high-yield peers in 2021 and 2022 (see Chart 1). However, the asset class sharply rebounded in November 2022 along with announcement of China’s economic reopening and the release of supportive policies for the property sector.

Chart 1: Global high-yield bond performance 2021-2023 (YTD)1

Despite recent market volatility, the outlook for Asian high yield in 2023 remains broadly constructive in an admittedly challenging environment. This is due to the region’s economic resiliency and unique characteristics of the asset class.

In our 2023 Asian Fixed Income Outlook, we posited that although we didn’t see a significant improvement in global macro conditions, most of the unprecedented headwinds facing fixed income had likely passed. Indeed, much of the monetary tightening needed to contain inflation had already been priced in, and less relative uncertainty existed regarding the trajectory of future Fed policy, i.e., higher rates over a longer period.

At the same time, we believe Asia is better positioned than other regions to navigate the current complex macro landscape for two reasons.

Most importantly, China’s decision to abolish its zero-Covid policy and reopen its economy has progressed at a faster-than-expected pace. The IMF recently upgraded China’s 2023 GDP forecast to 5.2% in late January, which should pay dividends for its neighbours with notably positive spillover effects. For example, Thailand recorded a nearly sixteen fold increase in year-on-year tourist arrivals in January 2023, with the number of Chinese tourists rising by roughly 80% from the previous month during the country’s peak season.

Second, this reopening dynamic dovetails with existing regional economic strength and a more favourable inflation outlook. The IMF forecasts that Asia-Pacific will grow by 4.7% in 2023 – a notable acceleration from 2022- and the fastest regional rate in a decelerating global economy.

Inflationary pressures are also arguably lower overall and uneven across the region, leading monetary policies to diverge from developed markets (except Japan). Due to its delayed economic reopening, China has adopted a countercyclical rates policy, evidenced by its recent banks’ reserve requirement ratio cut. Other markets such as Indonesia, Malaysia, and South Korea have paused monetary tightening, with India contemplating the same, as inflation has moderated due to differing price dynamics with developed economies.

In addition to potential economic tailwinds, the asset class possesses several key advantages over its global peers.

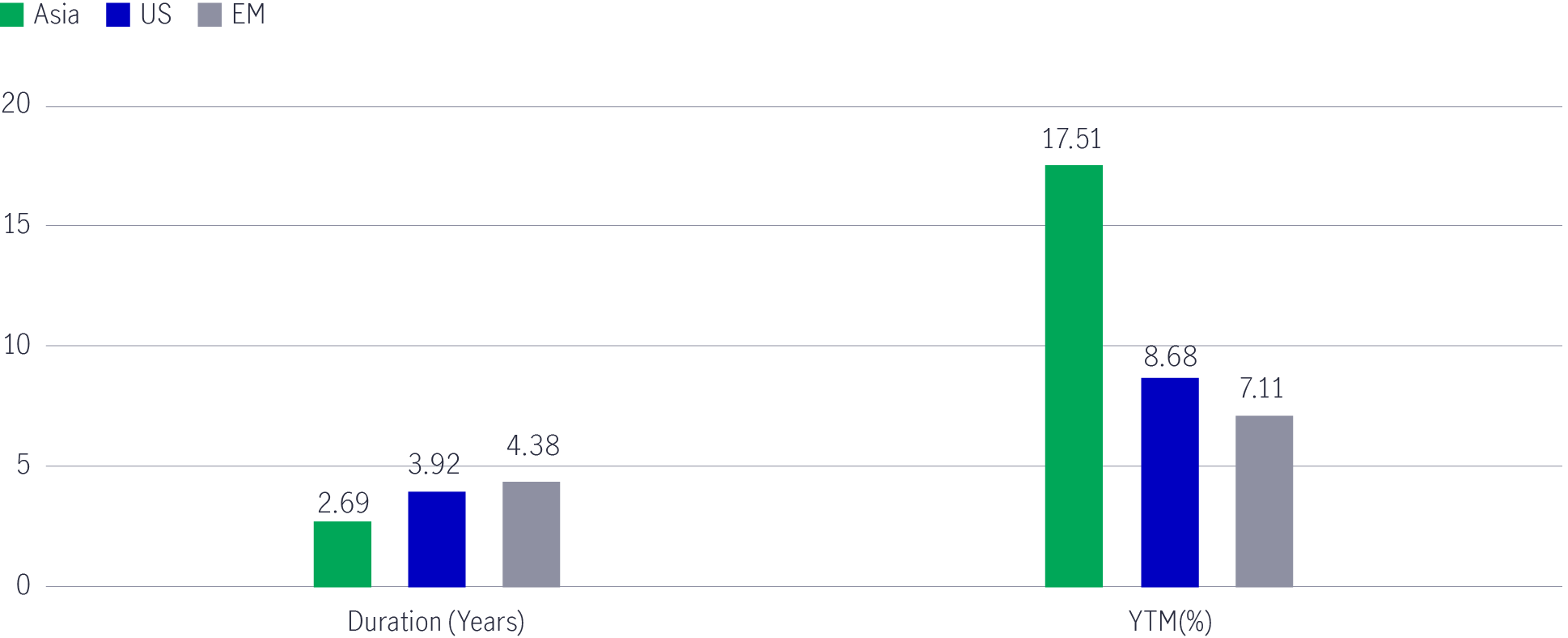

The Asian high-yield universe traditionally boasts a shorter duration profile, or bond price sensitivity to movements in interest rates, compared to global peers.

Asian high yield currently boasts shorter duration (2.69 years) compared to high yield in the US (3.92 years) and emerging markets (4.38 years). It also potentially offers yield pick-up for investors (see chart 2), as the region has, on average, the highest bond yield levels since 20112.

Chart 2: Duration and yield-to-maturity among global high-yield indices3

These characteristics add to the overall attractiveness of Asian high yield, which has outperformed regional investment grade bonds 10 out of the last 17 calendar years (2006 to 2022)4. With current volatility in US rates, the asset class is well positioned as it trades more on changes in credit spreads than interest rates- that is, the correlation of Asian high yield to the 10-year US Treasury is relatively low5.

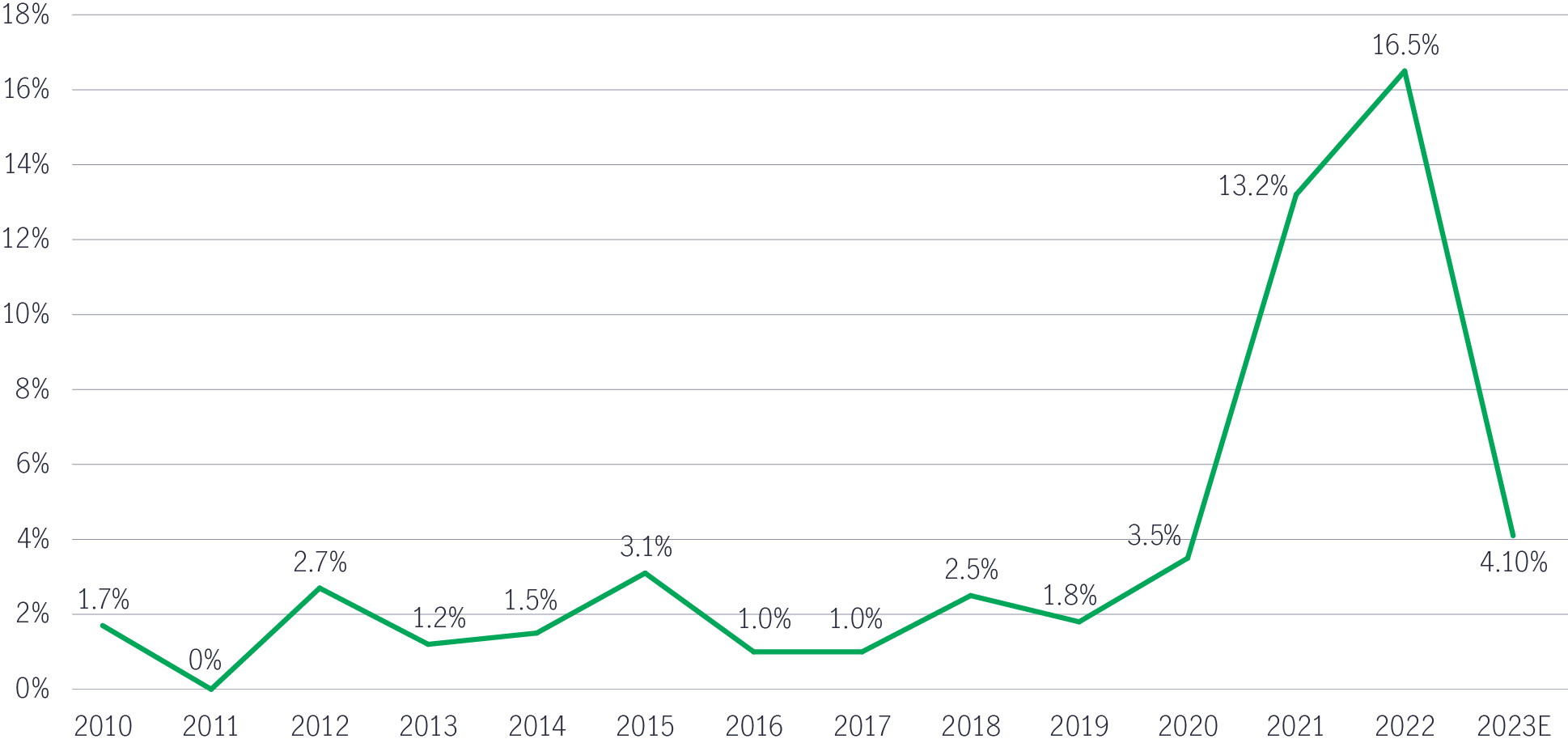

After a tumultuous 2022, which saw the highest default rate among Asian high-yield credits in over a decade (16.5%), defaults are forecast to significantly decelerate in 2023 to 4.1% (see Chart 3)6. This is largely due to the region’s overall economic health, as well as policy support and improvements in China’s property sector (detailed more in the next section).

Chart 3: Declining default risk in Asian high yield6

At the same time, high-yield defaults are expected to increase in the US and Europe, trending toward the historical average, amid slower growth and higher interest rates.

The asset class also offers an increasingly diverse, less concentrated investment universe, which has accelerated with the removal of some Chinese property firms from the major credit indices.

Indeed, while China real estate composed around 39% of the J.P. Morgan Asia Credit Index (JACI) Non-Investment Grade in December 2020, it has significantly contracted to roughly 16% in February 2023 due to defaults and index removals.7 This offers investors new opportunities in less concentrated sectors.

The changing issuance landscape and increased borrower diversity is punctuated by the range of economic models that compose the region, which is unique for emerging market debt. Asia features economies more dependent on manufacturing and exports, particularly in northeast Asia. However, it also features markets rich in natural resources and domestic consumption (Indonesia) and export of services (India), with the latter also quickly building its manufacturing capacity.

Looking ahead to the rest of 2023, we are positive on selected China credits (including property) and Indian renewable energy.

China property: The sector rebounded strongly at the end of 2022 and the start of 2023, with new government-support measures and optimism about the country’s economic reopening.

With recent notable gains, we remain constructive on certain credits but are far more selective. Further upside should be dependent on improving market sentiment and continuing targeted government policy support.

Early signs indicate a nascent rebound in home sales and prices, which remain a crucial driver of improving consumer sentiment and cash flow among struggling developers.

After 19 consecutive months of decline, the monthly sales of the country’s top 100 real-estate developers rose by 14.9% in February and surged by 29.2% in March (year-on-year). National new home prices in 70 cities ticked higher by 0.3% (month-on-month) in February - the first increase in 18 months.

While it is still too early to call a turnaround definitively, the improving sentiment should be welcomed by investors.

A lack of timely and effective government policy support for the property sector was a key factor denting investor sentiment.

This dynamic changed in November 2022 with the introduction of the comprehensive "16 Measures", which aimed to boost sector liquidity and ensure the completion of unfinished property projects. Ex-Premier Li Keqiang built on this momentum by promoting the sector’s stable development as a key goal for 2023 during the recently held National People’s Congress (NPC).

In addition, the restructuring of property offshore credit defaults had been slow but is gaining momentum. This is an important milestone for investors to watch, as many want to assess how companies treat and compensate creditors as a proxy for further participation in the sector. One of the most significant offshore defaults that occurred in late 2021 announced its long-awaited restructuring plan in late March. Meanwhile, another leading property developer announced that it had reached a tentative agreement with 30% of offshore bond holders to restructure its debt.

China credits: We remain constructive on sectors such as industrials and consumer discretionary (e.g., gaming), which should benefit from accelerated economic growth. We also believe that domestic credits should benefit from recent announcements at the NPC, such as promoting greater economic efficiency by reducing the size of the State Council and creating a new central commission for science and technology.

India renewable energy: Outside of China, we are still positive on India renewable energy. These credits boast a growing investment universe and provide diversification due to India’s lower correlated growth cycle and continued government support for renewables, as seen in the recently released Union Budget.

Finally, even with the potential regional tailwinds and advantages of Asian high yield detailed in this piece, robust credit research and selection remains critical in the current volatile market environment.

Manulife Investment Management boasts unique resources for robust bottom-up credit assessment. These advantages are particularly apparent in Asia due to our unique on-the-ground footprint and insurance heritage which has built a comprehensive in-house coverage of credits: a key competitive advantage over others that rely on third-party ratings.

After two years of underperformance, Asian high yield currently presents compelling risk-reward opportunities for investors. In addition to the region’s economic strength, the asset class’s unique characteristics, such as a shorter duration profile, position it well to perform in a higher-for-longer rates environment compared to its peers. Manulife Investment Management possesses unique resources for robust bottom-up credit assessment to help investors navigate the current volatility and seize opportunities available in Asian high yield.

1 Source: Bloomberg, as of 31 March 2023. Asia HY: JACI NGTR; EM HY: ICE Bank of America All Maturity Emerging Markets Corporates Plus Index (EMJB); US HY: ICE Bank of America US High Yield (H0A0).

2 Asian high-yield: JACI Non-Investment Grade Index (JACINGTR); US high-yield: ICE Bank of America (H0A0); Emerging market High-yield: ICE Bank of America All Maturity Emerging Markets Corporates Plus Index (EMJB).

3 Source: Bloomberg, as of 28 February 2023.

4 Source: Bloomberg.

5 Source: Bloomberg.

6 Source: J.P. Morgan, as of 2 February 2023.

7 Source: J.P. Morgan as of 28 February 2023.

Latest asset allocation views for Asia Q1 2026

Three key global themes for the first quarter: Liquidity and stimulus set the stage for 2026; AI remains a structural growth driver; Accelerating growth may favour diversification

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

Latest asset allocation views for Asia Q1 2026

Three key global themes for the first quarter: Liquidity and stimulus set the stage for 2026; AI remains a structural growth driver; Accelerating growth may favour diversification

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.