29 December 2021

Ronald Chan, Chief Investment Officer, Equities, Asia ex-Japan

In the first few months of 2021, asset prices benefited from expectations for a global recovery, rising vaccination rates, and the reopening of developed markets. However, growth in Asia was impeded by the resurgence of COVID-19 and the emergence of the Omicron variant, as well as slower-than-expected inoculations, especially among the emerging territories. Sentiment was further impaired by events in China, where we saw an extensive regulatory tightening cycle, funding issues among weaker property developers, and power outages. In this 2022 outlook, Ronald Chan, Chief Investment Officer, Equities (Asia ex-Japan), considers these developments and assesses their potential impact on the regional economic landscape over the year ahead.

Throughout the COVID-19 pandemic, both last year and into 2021, we foresaw a divergence in the performance of Asian equity markets. In 2020, those Northeast Asian markets with superior virus containment measures and relatively higher vaccination rates led the region, while ASEAN countries lagged due to concentrated urban populations, limited access to vaccines, and less developed healthcare infrastructure.

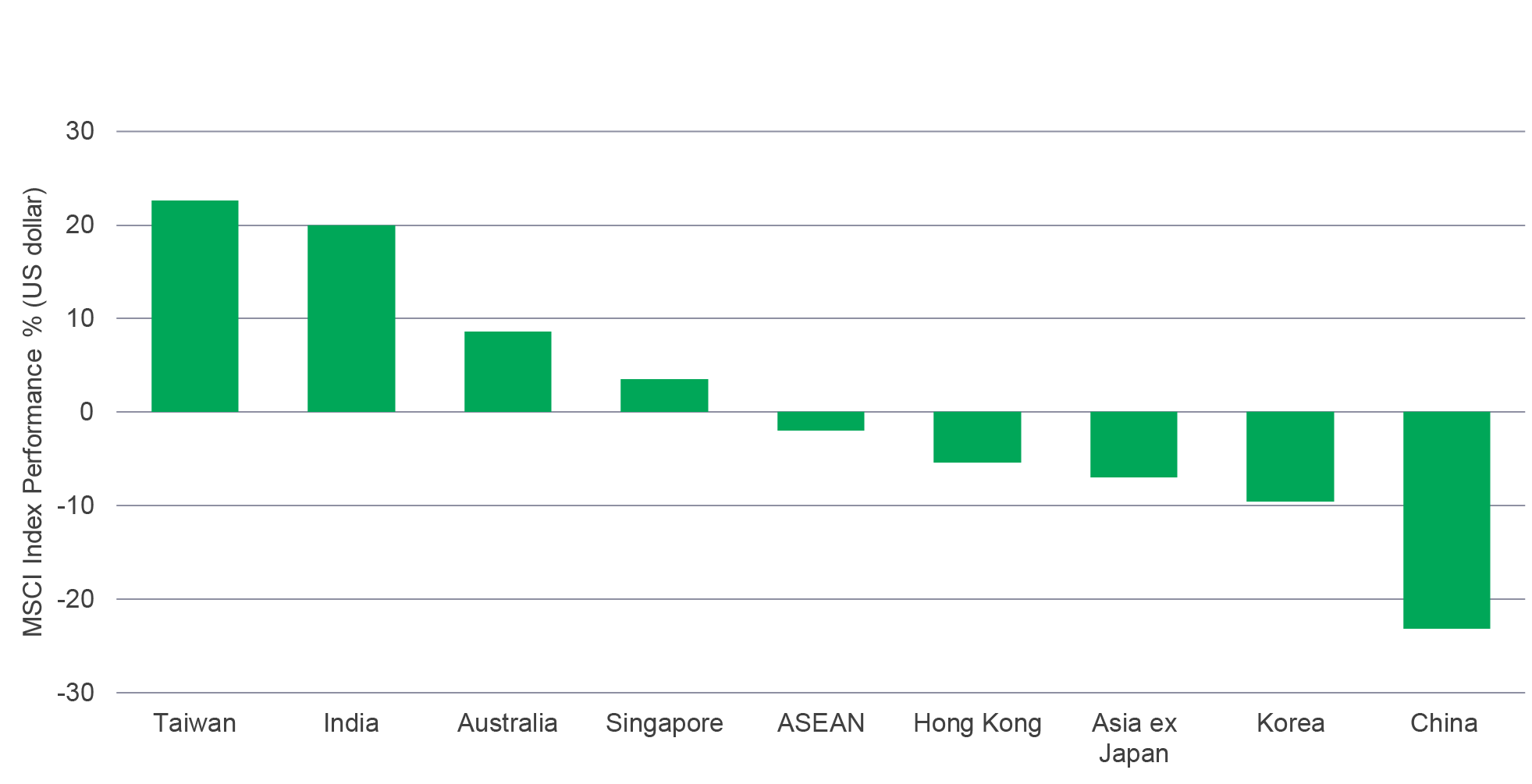

Looking at regional performance year-to-date (21 December 2021), this dynamic has experienced some changes (see Chart 1). Some North Asian markets, such as Taiwan, continued their outperformance on the back of strong technology-related exports; however, Korea and China faced greater challenges, the latter for idiosyncratic reasons related to a raft of high-profile regulatory challenges. India also posted impressive results in 2021 on the back of strong economic performance after a severe COVID-19 wave in the first quarter.

Chart 1: Asian equity market performance, 2021 (YTD)1

Finally, most ASEAN markets (except for Singapore) lagged the region in 2021 as mobility restrictions and recurring bouts of COVID-19 stymied a robust rebound.

Amid the spread of the Delta variant, an increasing number of Asian economies, most notably in Southeast Asia, have reached critical mass with their vaccination programmes. And as Southeast Asia adopts “living with COVID” strategies, the sub-region may also introduce reopening strategies. Should governments exploit the opportunity and manage the pandemic without lockdowns, this could boost service-sector and consumption growth. There will be exceptions, namely China and Hong Kong SAR, which will maintain a “zero-COVID” strategy.

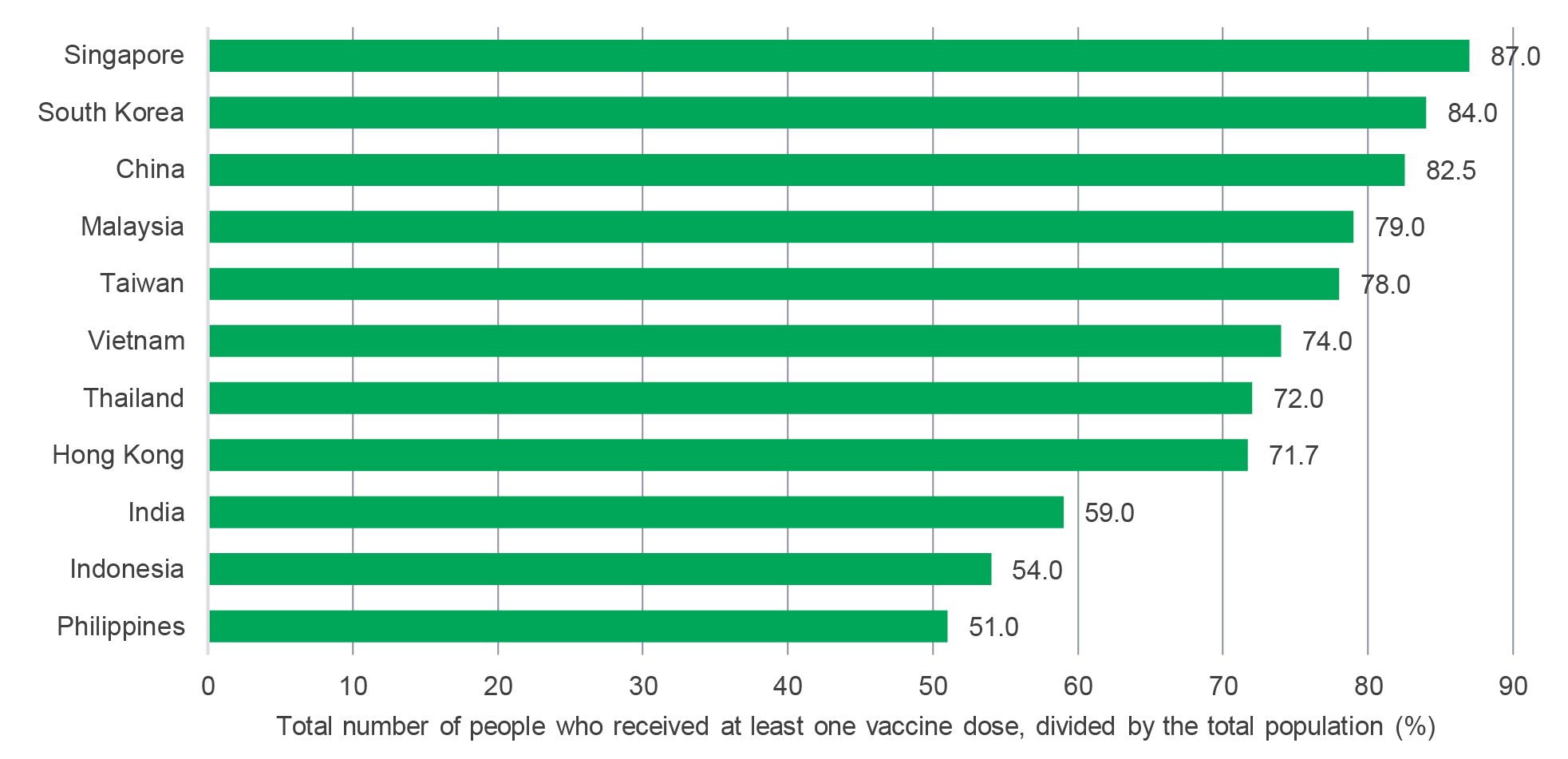

Chart 2: Asia’s vaccination rates2

That said, the threat from further waves of the pandemic should dissipate, as most countries and territories are projected to reach vaccination rates of around 80% by the end of 2021. (Chart 2). After two years of tackling and controlling the spread of the virus, governments in the region have acquired a better understanding of how and when to deploy border restrictions, community controls, and lockdowns. Various governments are rolling out booster shots to enhance overall levels of immunity while the development of Omicron is believed to be contagious but with less serious impact. We are hopeful that the impact of COVID-19 will be reduced in 2022 with the possibility of COVID transforming from pandemic to epidemic in the coming years.

US Federal Reserve (the Fed) tightening is also imminent. The tapering process started in late 2021 and is due to conclude in summer 2022. A rate hike may follow in late 2022 or 2023. The normalisation of monetary and fiscal policies warrants careful monitoring but are not a cause for concern at this stage. Macroeconomic stability indicators, such as real rates, real-rate differentials, inflation, current-account balances, and foreign reserves, in most Asian economies are at levels that would not pose an immediate risk should there be sharp, near-term policy tightening. In short, most Asian countries are in better shape than in 2013 when the Fed announced a tapering of its quantitative easing programme. Unless we see an expedited tapering process, Asia looks well-prepared for this normalisation.

Chart 3: Asia’s macro indicators are in better than in 20133

It’s worth noting that as China slows, those economies more exposed to changes in its growth patterns, such as Taiwan and South Korea, are expected to feel a more significant impact, as the demand from developed markets will concurrently shift from goods to services. That said, in the wake of 2021’s reopening, consumer spending in developed-market economies has started to rebalance from goods back to services, a process that marks the start of normalisation in global-trade growth. We will be mindful of this development when China begins to loosen its policy to mitigate the slowdown.

China’s decarbonisation policies and weather disruptions have pushed energy prices higher, presenting risks to the upside for inflation. Supply-chain issues have also lasted for longer than expected, creating pressure on both supply and the cost of goods. In response, some central banks are turning more hawkish, but we are not in the stagflation camp. Besides, Southeast Asia still has the capacity to absorb demand-led inflation, as the threat of runaway inflation is relatively low.

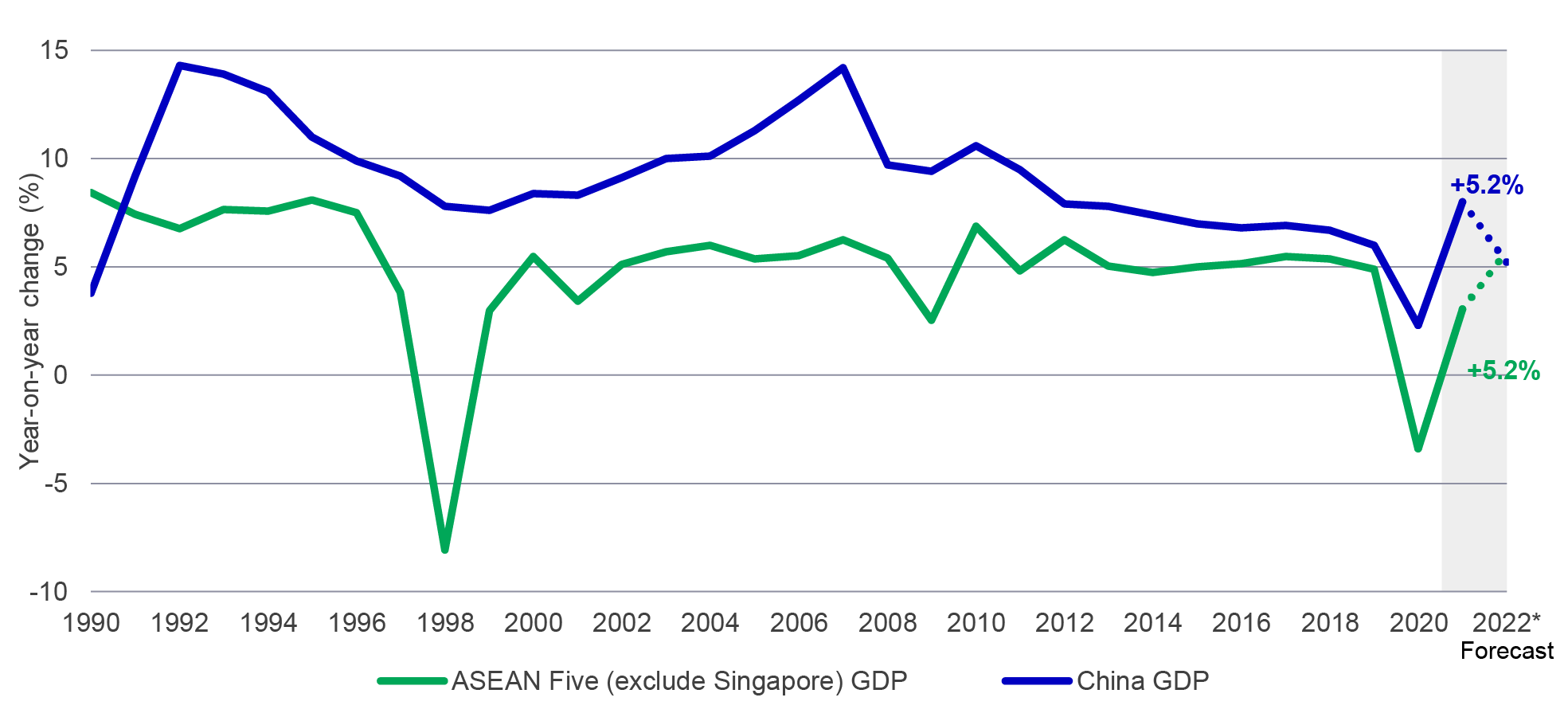

It’s important to set things in perspective. The three macro factors aforementioned undoubtedly represent growth headwinds for Asia. However, their impact is expected to be felt differently in North Asia compared to Southeast Asia. As such, we expect GDP growth in China growth to slow from 8% in 2021 to around 5% in 2022, lower than the growth projection in Southeast Asia (Chart 4). Our positive outlook for Southeast Asia is further propelled by 6–7% expected growth momentum in India.

Chart 4: ASEAN economic growth is expected to outpace China in 2022

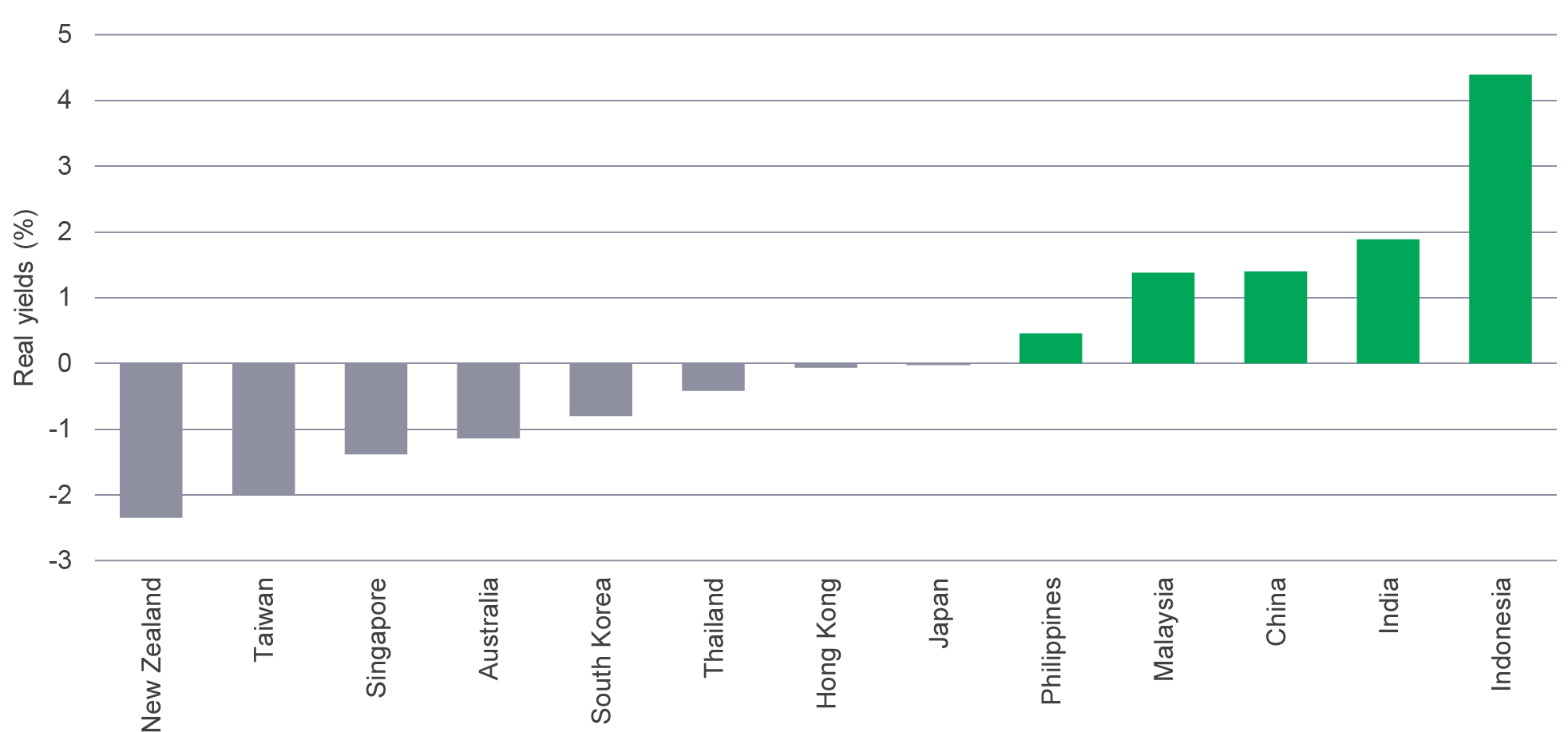

Our positive view towards Southeast Asia is further reinforced by the higher real yields in the region’s major economies, namely Indonesia and India (Chart 5), which are attracting capital flows.

Chart 5: Real yields (%) in Asia

Given the previous tensions between China and the US, we believe that Southeast Asia will be a strategic beneficiary, at least over the medium term, as there may be foreign direct investment in specific sectors. These include battery suppliers in Indonesia, auto companies in Thailand, and the IT supply chain in Malaysia.

While physical ASEAN integration has been disappointing, digital integration within the bloc is more encouraging. Currently, over 30 big-tech unicorns are due to be listed, and this process is expected to extend to fintech, logistics providers, and e-commerce players.

These companies share some features:

The near-term outlook for ASEAN is expected to improve as economies reopen, with most of the bloc’s countries relaxing movement and travel restrictions, albeit gradually. Strategically, Southeast Asia should play an important post-pandemic role in Asia’s economic trajectory. The “China Plus One” initiative has encouraged multinational companies to diversify their business lines and production bases into regional markets.

In Indonesia, higher commodity prices (coal and palm oil) will be supported by healthier domestic consumption. As the world’s fourth-largest nickel supplier, Indonesia is also well positioned in the EV supply chain. Furthermore, the digital economy is enjoying strong organic growth, with rising demand for fintech providers, logistics warehouses, and associated services.

Malaysia’s economy is also moving towards a gradual reopening, hence the boost for the local tech sector. While higher wages are a headwind for corporate earnings, they simultaneously encourage domestic demand. Meanwhile, in Thailand, infection and hospitalisation rates are declining. The announcement of quarantine-free travel shows that a resumption in tourism activities remains critical for the Thai economy, which is currently supported by the export sector.

India remains a local and bottom-up story with a stable regulatory environment. We expect economic activity to continue improving as vaccination rates increase. The country’s recovery is well supported by a host of structural reforms, including a low corporate tax levy, indirect tax reforms, and the Bankruptcy Act. These developments, coupled with government-led formalisation, digitalisation, and manufacturing-revival policies, are expected to lead to long-term growth. For 2022, import substitution will play a significant part in the “Made in India” policy and, therefore, offers investment opportunities. These companies also stand to benefit from the ongoing economic recovery and production shifts away from China.

The structural growth drivers in Asia will evolve around these several key themes:

As noted, we think there will be softer near-term growth in China as business models realign amid the government aims for common prosperity. In general, we expect the earnings of companies with solid branding and pricing power in the export sector to outperform that of businesses exposed only to domestic demand. Zooming in on consumer upgrade, the winners shall be those that can have fast adoption to local tastes. We have seen local brands gaining market shares from foreign brands in many categories such as sportswear, skincare, and cosmetics. Value is emerging in a few internet bellwethers, and much of the regulatory risk associated with the sector is currently priced in. Also, we continue to like companies that are benefiting from China’s decarbonisation plans. We see solid investment opportunities in the renewable energy sector, which enjoys strategic priority for government funding support. Construction of wind and photovoltaic bases has already been accelerated thanks to the elevated pace in governmental bonds and favourable policy support. However, we will be more selective going forward, as higher raw material prices for alternative energy may impede the pace of investment in this area.

South Korea and Taiwan would continue to provide value in the tech supply chain. With the roll out of 5G and adoption of digitalised cars, chips would need higher processing power, speed, and heat resistance. As such, we expect demand to evolve and migrate from DDR4 to DDR5 memory chips. In Taiwan, we’re seeing developments in how chips can be upgraded in specification and use of new materials, as well as advanced packaging. Besides, the growth of tech companies in South Korea will be helped by a long-term structural demand for higher computing memory and processing power and the structural shift to electric-vehicle (EV) batteries and fintech services.

1 Bloomberg, as of 21 December 2021.

2 Government websites, “Our world in data”, data as of 21 December 2021. Information is for reference only.

3 Bloomberg, as of 18 December 2021. ASEAN Five includes Indonesia, Malaysia, the Philippines, Thailand, and Vietnam. ASEAN, officially the Association of Southeast Asian Nations, is an economic union comprising 10 member states in Southeast Asia, 2021 and 2022 figures are Bloomberg consolidated estimates.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.