18 September 2025

Alex Grassino, Global Chief Economist

Yuting Shao, Senior Global Macro Strategist

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.

The FOMC’s decision to cut the Fed funds rate by 25 basis points was hardly a surprise. In fact, the markets had pretty much been pricing in this move since Fed Chair Powell’s Jackson Hole speech in late August. As a result, the main focus was on what the Fed might do next and when.

Bottom line: Against a backdrop where the Fed's forecasts call for slightly better growth, slightly firmer inflation, and a slightly lower unemployment rate, Fed watchers should expect the central bank to deliver more rate cuts in the coming months. At this point, the “dot plot” is signalling that a reasonable base case would be for the Fed funds rate to be 50 bps lower by year-end 2025, with one additional cut likely in 2026. This rate path would be in line with our own expectations between now and the end of Fed Chair Powell’s term next May. Where we differ from the Fed’s latest projections is that we expect new Fed leadership to continue easing interest rates toward neutral, which we currently have at 3%.

The much-anticipated Fed rate cut in September should bring positive momentum for emerging markets (EM) as the resumption of the Fed easing cycle loosens financial conditions, boosts investor sentiment, and generally bodes well for risk assets. Asian economies, and assets in particular, should also stand to benefit via the following channels:

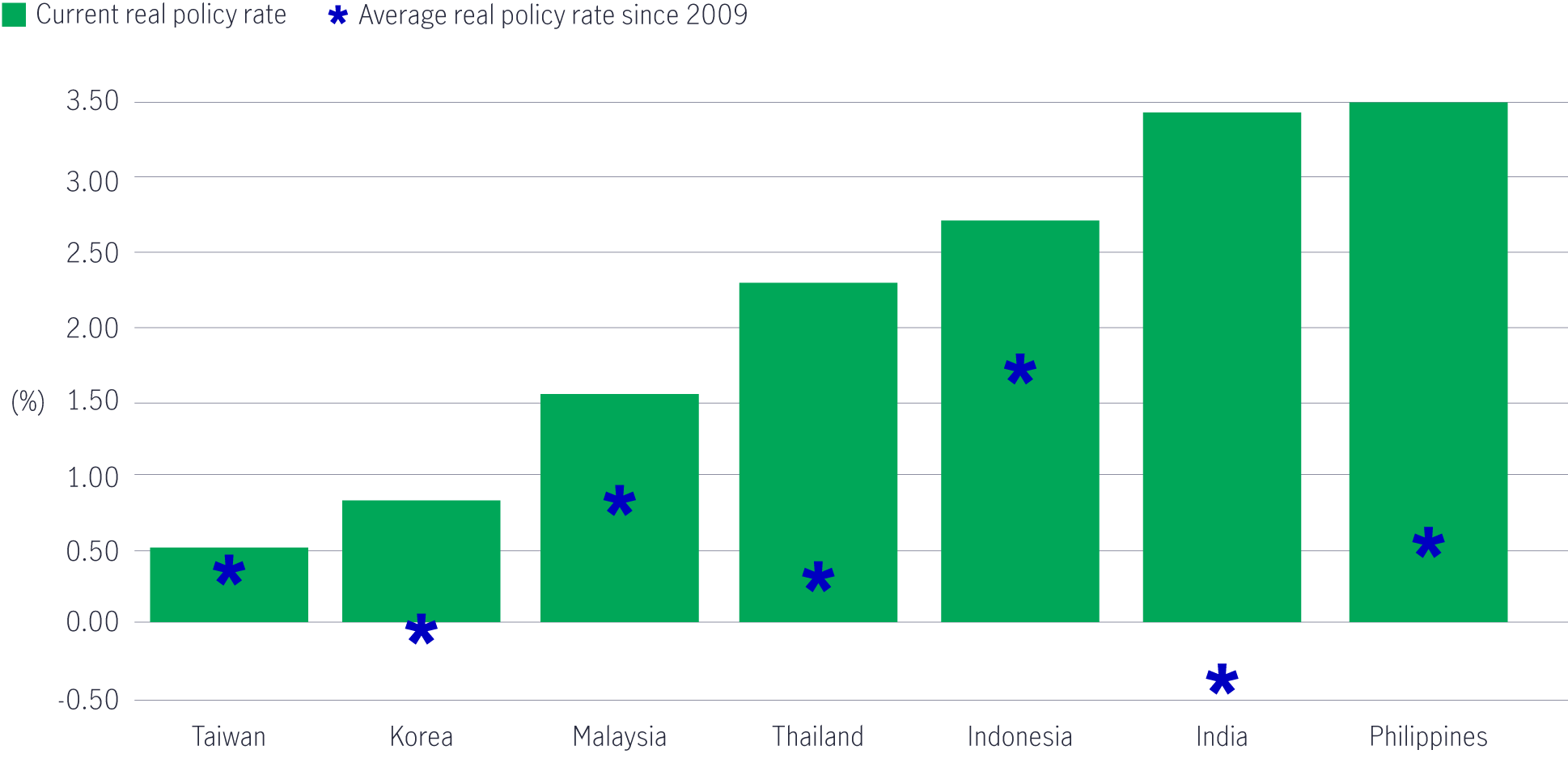

Despite continued disinflationary trends across most economies in the region and lower oil prices, policymakers have been mindful of interest-rate differentials with the US, given that narrowing differentials could trigger capital outflows and currency depreciation (we will elaborate on these two points later). For the first half of 2025, most Asian central banks maintained a cautious approach toward monetary easing despite high real policy rates (the nominal policy rate minus inflation). The Fed’s September rate cut and the expectation of further easing in the coming months should give Asian central banks the space to introduce policy rate reductions to boost their economies. Another surprise rate cut by Bank Indonesia earlier this week is a case in point.

Although growth stayed resilient amid the front-loading of trade and bilateral trade agreements between the US and many Asian economies that helped alleviate tariff uncertainty, the fact that most economies in the region run a current account surplus means the risk of “payback” and slowing exports will weigh on growth. To that end, having more room for central banks to ease will improve the regional macroeconomic outlook.

Chart 1: Key Asian central bank policy rates (real)

Source: Macrobond and Manulife Investment Management, as of 17 September 2025.

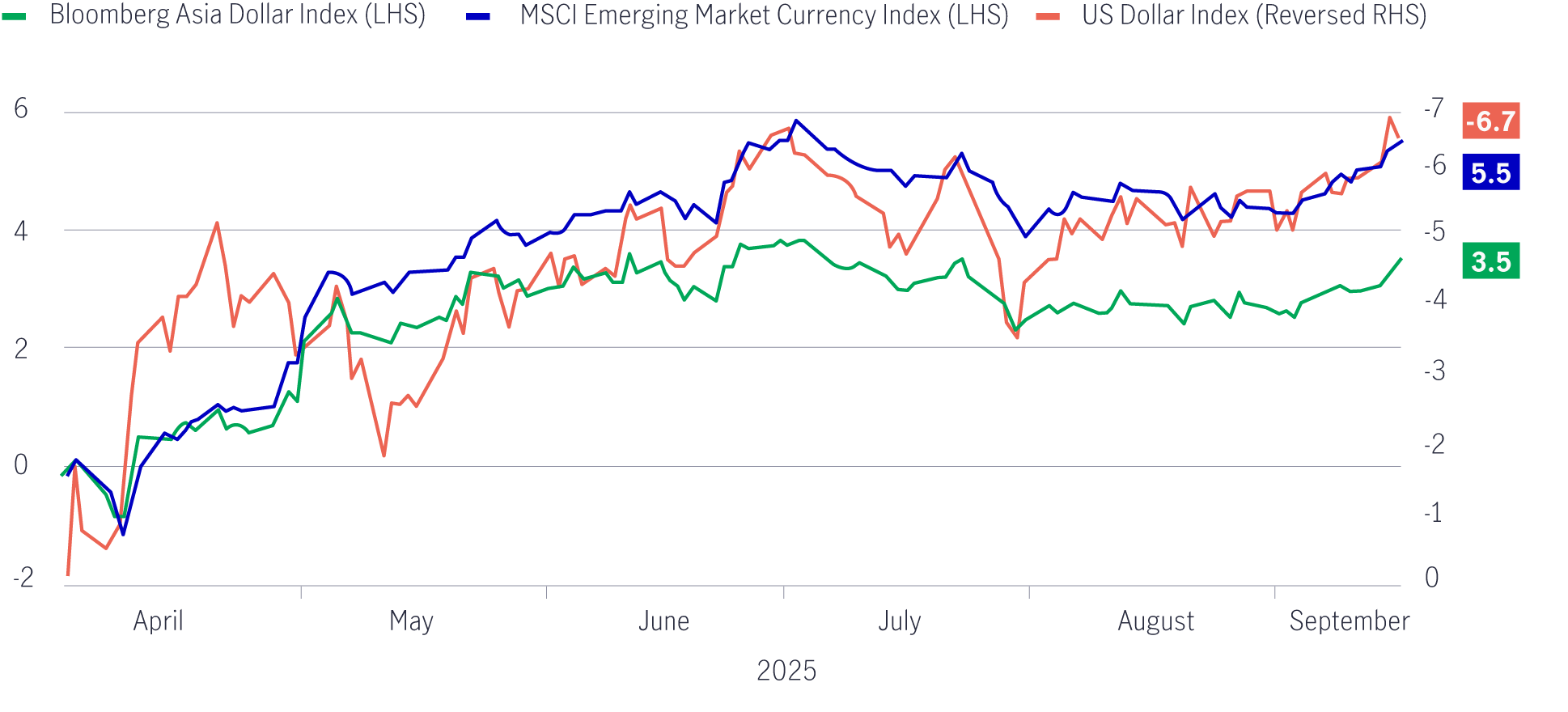

In our opinion, although the Fed is likely to stay data dependent, the rate cut in September and further easing expectations put pressure on the US dollar. What’s more, recent developments surrounding the Fed’s independence confirm our belief that there is a structural trend of greenback weakness. Asian currencies have largely underperformed their EM peers since “Liberation Day” on 2 April, given the higher tariff risk they face. However, with lower inflationary pressures and a weaker US dollar, EM Asia currencies have the scope to catch up in an environment where volatility remains low, especially for high yielders in the region. That said, we note the caveat that recent domestic political developments, especially in ASEAN economies, could impact macro policy and investor sentiment.

Chart 2: Asian currencies underperformed EM peers since Liberation day (Cumulative returns, %)

Source: Bloomberg and Manulife Investment Management, as of 17 September 2025. Past performance is not an indicative of future performance.

Asia has been on the receiving end of global inflows over the past few months, riding on the boom of the artificial intelligence (AI) and information technology themes, as well as recovering investor interest in China equities. Although the valuation edge has waned given the recent outperformance, Asian equities remain undervalued compared to many of their developed-market counterparts. On top of Asia’s relatively resilient growth, benign risk, and accommodative monetary policy backdrop, corporate reforms in major markets (including mainland China, South Korea, Japan, and Singapore) aimed at enhancing corporate governance, improving profitability and returns, will likely attract more foreign investment.

Middle East developments - Implications for Asian equities and fixed income

The Asian Equities and Asian Fixed Income team assess the recent Middle East developments and implications for Asia asset classes.

Quick comments on geopolitical tensions in the Middle East

Alex Grassino, Global Chief Economist, shares his latest views on the recent increase in military activity and geopolitical tensions in the Middle East.

Economic and market implications for oil prices

Recent geopolitical tensions involving Iran have renewed focus on oil prices and their potential economic and market effects. Paul Kalogirou, Head of Client Portfolio Management, Asia & Global Multi-Asset Solutions, shares latest views on it.

Middle East developments - Implications for Asian equities and fixed income

The Asian Equities and Asian Fixed Income team assess the recent Middle East developments and implications for Asia asset classes.

Quick comments on geopolitical tensions in the Middle East

Alex Grassino, Global Chief Economist, shares his latest views on the recent increase in military activity and geopolitical tensions in the Middle East.

Economic and market implications for oil prices

Recent geopolitical tensions involving Iran have renewed focus on oil prices and their potential economic and market effects. Paul Kalogirou, Head of Client Portfolio Management, Asia & Global Multi-Asset Solutions, shares latest views on it.