8 September 2022

Market volatility is unavoidable. Despite this, data shows that the number of years with positive returns is still higher than those with negative returns, as indicated by the historical performance of Asian equities1. So, how should investors stay calm and ride through market ups and downs?

Volatility is a normal feature of investing, especially when it comes to equities. However, some investors might not be aware that historically, the number of positive years outweighs those that resulted in negative returns. Understanding market psychology – the overall sentiment or behaviour that the market experiences at any given time – provides some revealing insights into the world of investing.

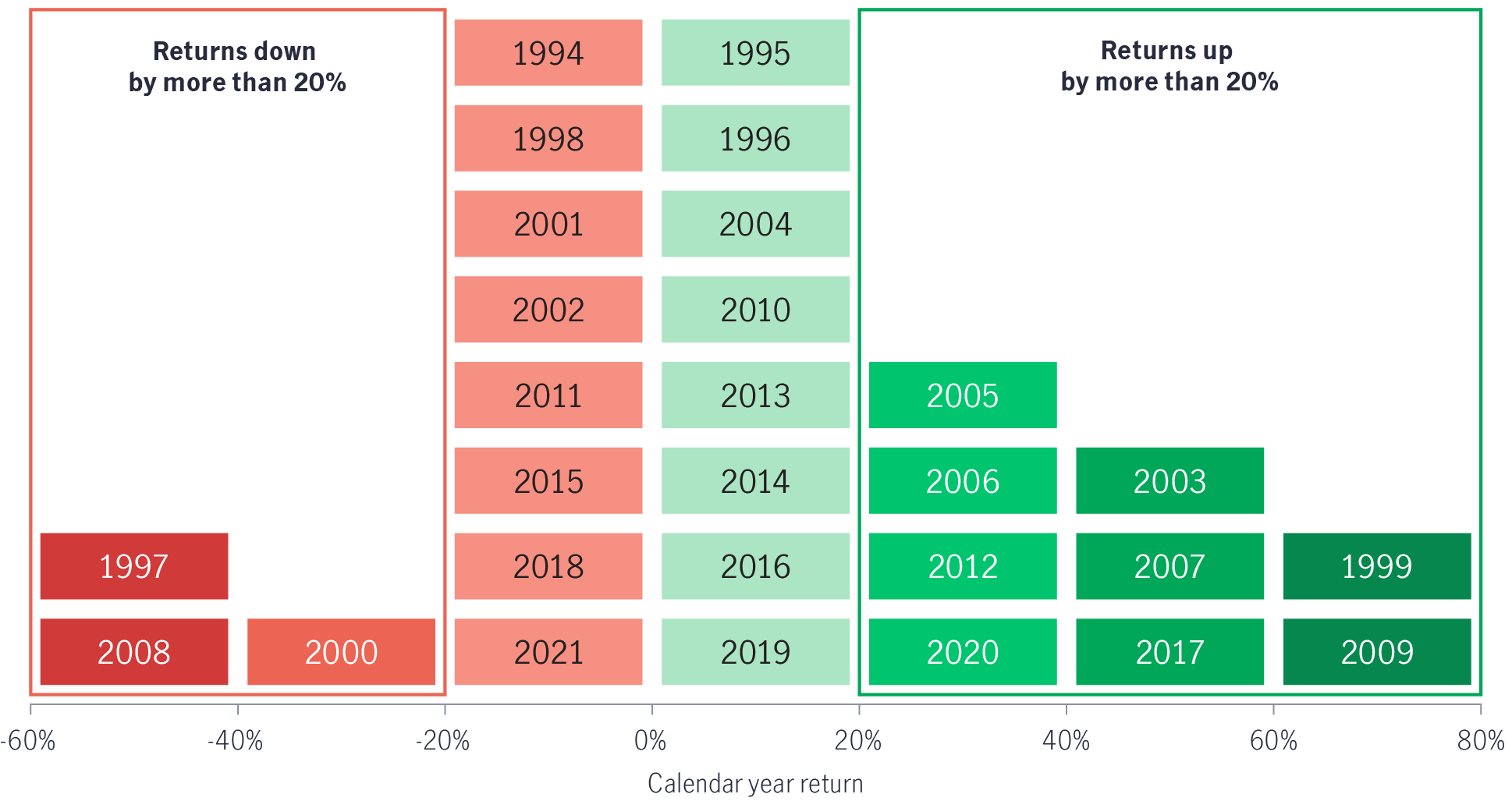

The chart below shows the calendar-year performance of Asian equity markets, represented by the MSCI AC Asia ex Japan Index, from 1994 to 2021 (28 calendar years). The data reveals that the number of years with positive returns (17 years) was higher than those with negative returns (11 years).

What about market ups and downs? For Asian equities, annual market returns rose or declined by over 20% in 12 years. Drilling deeper and despite this volatility, the number of years when returns were up by more than 20% (9 years) outnumbered those when returns fell by greater than 20% (3 years).

As we can see from the chart below, market swings are inevitable, but there was still a greater chance of generating positive returns. The question is: How should investors remain calm and stay invested even when market conditions are stormy?

Source: Bloomberg, as of 31 December 2021. Total returns in US Dollar. It is not possible to invest directly in an index. Past performance is not indicative of future performance.

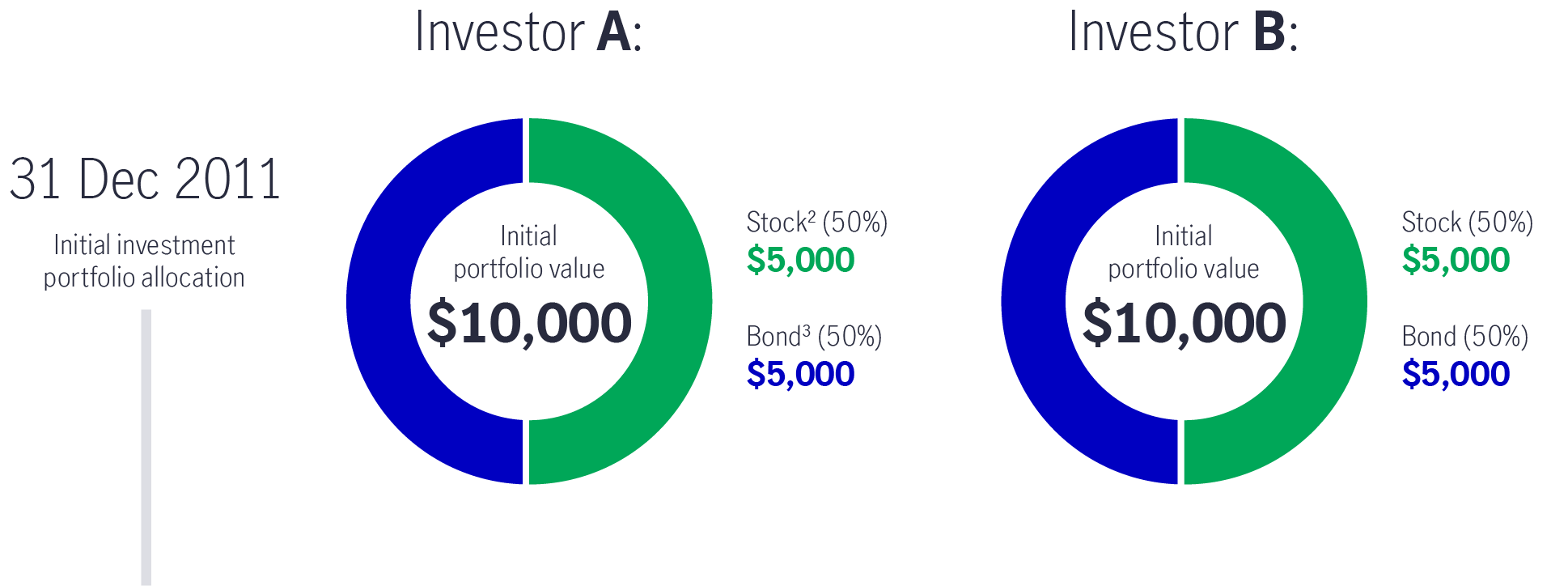

Let's look at a hypothetical example of two investors: Investor A and Investor B. Both invested US$ 10,000 on 31 December 2011, with 50% in stocks and 50% in bonds.

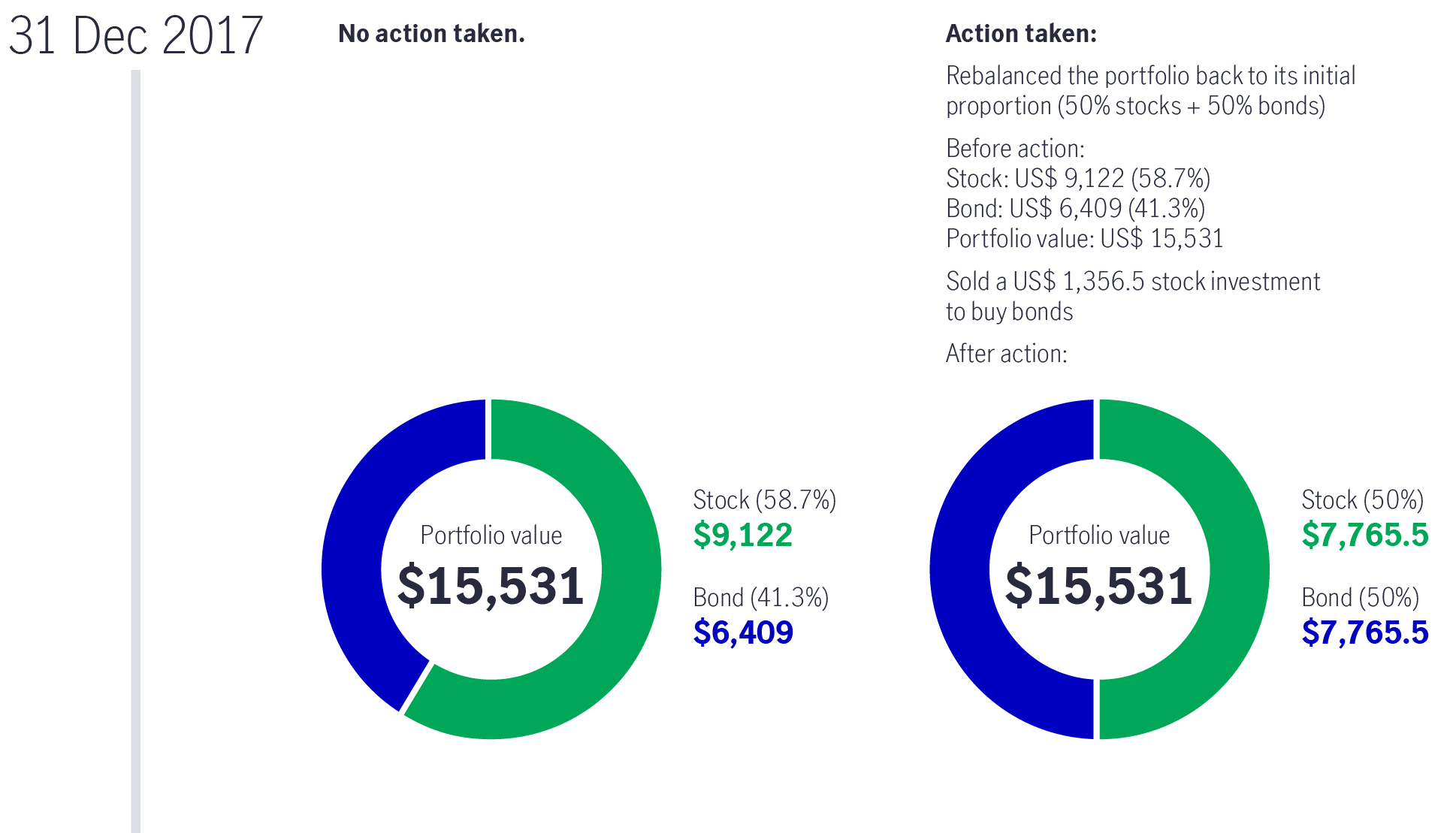

Asian equities ended 2017 on a high due to a strengthening global economy. By the end of that year, Investor A had made no changes to the original allocation. At the same time, investor B performed a review and rebalanced the portfolio back to its initial allocation.

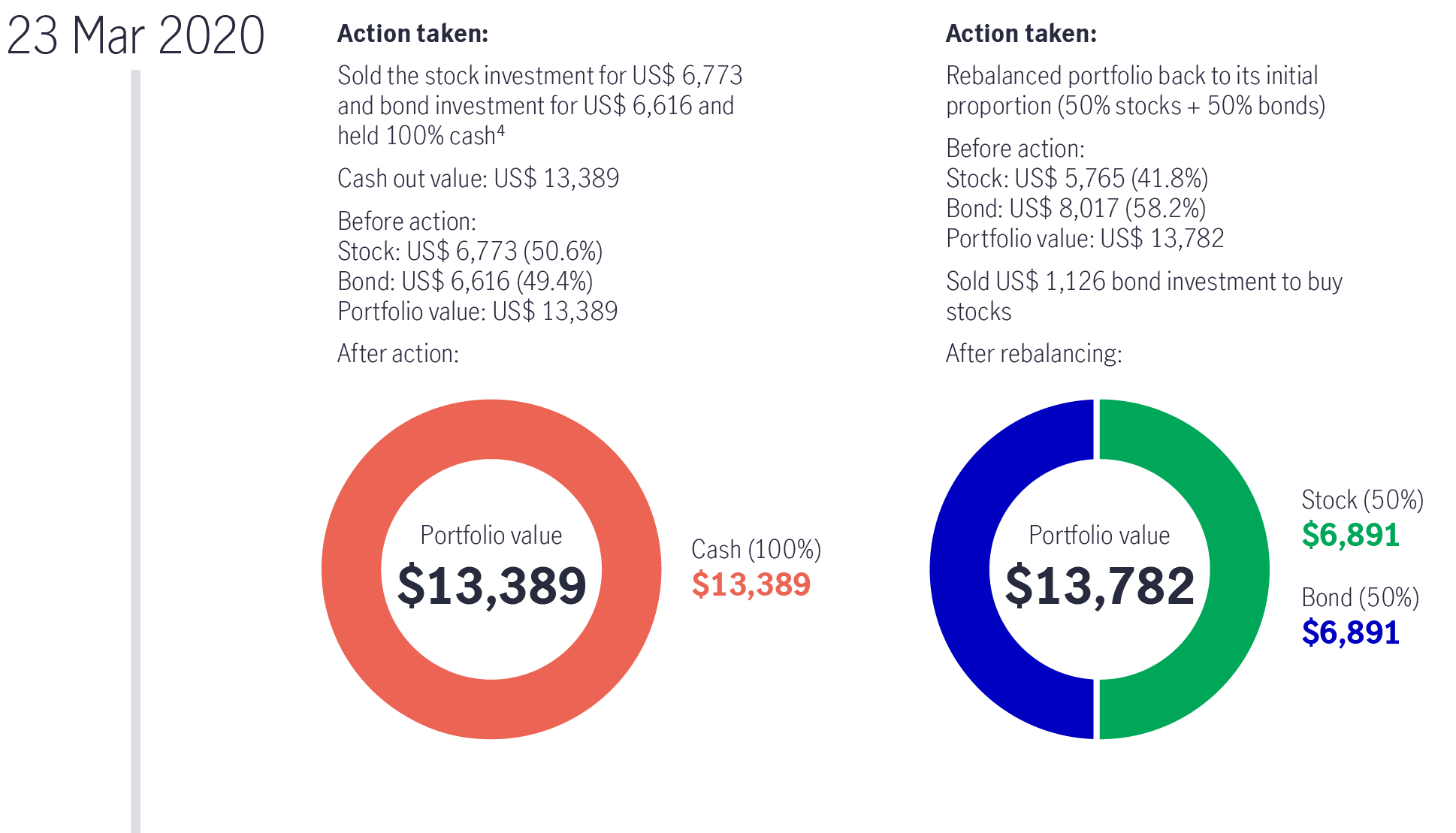

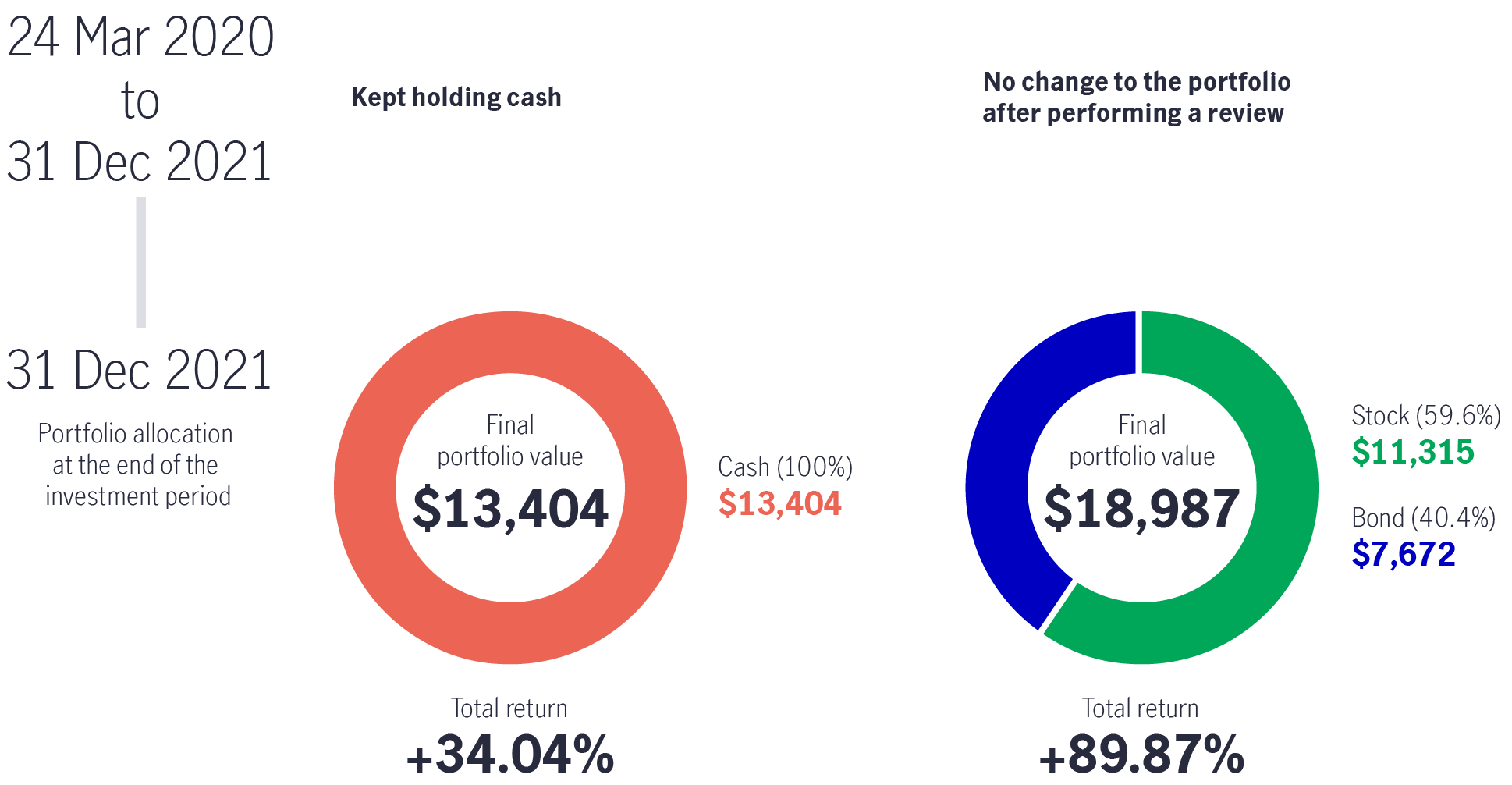

Event: On 23 March 2020, World Health Organization (WHO) declared COVID-19 a global pandemic, which sent the stock market tumbling.

Action: In response, Investor A sold all the stock and bond investments, while Investor B again rebalanced the portfolio by selling bonds and buying stocks.

Outcome: On 31 December 2021, Investor B generated a total return of +89.87%, 1.64 times more than that of Investor A (+34.04%).

The graph below shows how their investment performance varied by adopting different approaches.

Source: Bloomberg, as of 31 December 2021. Total returns in US Dollar. It is not possible to invest directly in an index. Past performance is not indicative of future performance.

Like medical check-ups to detect health issues, it’s important for investors to review and rebalance your portfolio regularly, so your investment remains on track during market rallies and dips. Remaining invested rather than leaving the market immediately could potentially reap better results. In practice, this could mean adjusting a particular segment of your portfolio when markets rise or fall so it doesn’t outweigh or underweight the initial allocation.

1 Asian equities refer to MSCI AC Asia ex Japan Index. This index was launched on 30 September 1993.

2 Stock = MSCI AC Asia ex Japan gross total return US$ index

3 Bond = 50% JPMorgan Asia Credit Index (as of 31 December 2021) + 50% HSBC Asian Local Bond Index (as of 2012)/Markit iBoxx Asian Local Bond Index (1 January 2013 to 31 December 2021).

4 Cash = USD overnight deposit rate

Get started with managing your personal finances

People often view managing their personal finances as a complicated process. In fact, it’s a lot more straightforward – it’s organising your money by establishing a budget that accounts for current expenditure, as well as building a strategy for the years ahead to achieve your financial goals. In this introductory article, we will provide steps for creating a financial plan and underscore the importance of managing your money effectively.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Get started with managing your personal finances

People often view managing their personal finances as a complicated process. In fact, it’s a lot more straightforward – it’s organising your money by establishing a budget that accounts for current expenditure, as well as building a strategy for the years ahead to achieve your financial goals. In this introductory article, we will provide steps for creating a financial plan and underscore the importance of managing your money effectively.

Dollar cost averaging: An easier way to withstand volatile markets

If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the passive strategy of dollar cost averaging may be a feasible choice.

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.