24 September 2024

Joseph Bozoyan, Portfolio Manager

The wait is over. The US rate-cut cycle has started. Against a backdrop of stable or falling US Treasury yields, US investment-grade (IG) fixed-income assets will generally find support – our analysis shows that US IG credits and preferred securities have historically performed well following US Federal Reserve (Fed) rate cuts. We maintain our favourable view of asset classes that offer unique investment opportunities for fixed-income investors looking for potentially attractive returns.

Market rates and bond prices generally move in opposite direction, however, fixed income performance in a rate-cutting environment is intricately tied to the state of the economy. When a modest slowdown in employment or a soft landing occurs, fixed income can deliver strong returns. However, if employment continues to deteriorate significantly, the market may face additional headwinds, potentially impacting fixed-income performance. We believe that September’s rate cut was a positive sign of the US economy's current state: inflation is back on track to the Fed’s 2% target, ensuring the job market stays strong.

Although the Fed has removed some uncertainty surrounding its first interest-rate cut, future moves will depend on economic data. In recent months, economic results have been mixed, with softness in some segments, such as the labour market, and strength elsewhere. Once economies slow faster than inflation normalises, we believe the pressure to ease current monetary policy stances will intensify. If the final stage of inflation’s return to traditional targets proves difficult to achieve, a growing chorus of voices could potentially call for lowering the bar to cuts by raising the inflation target.

The global credit team adopts a fundamental, bottom-up approach. We are macro-aware, analysing our position in the business cycle, influencing sectors and capital structure investments. We focus on rate directionality rather than predicting when and how much the Fed will cut rates.

We maintain a balanced view of performance for global credit asset classes. We see opportunities to invest lower in the capital structures of high-quality businesses to achieve competitive income generation. The ability to select securities from a broad credit universe and the flexibility to allocate across fixed-income sectors and up and down the credit spectrum should also help navigate a potentially softer economic landscape.

More broadly, we believe that attractive opportunities remain within credit and spread sectors to generate income with the added potential for upside spread compression and the limited risk of permanent capital impairment.

Historically, companies with positive fundamentals, such as those with high return-on-equity ratios, low leverage, and consistent posted earnings growth, have performed well going into slower growth cycles.

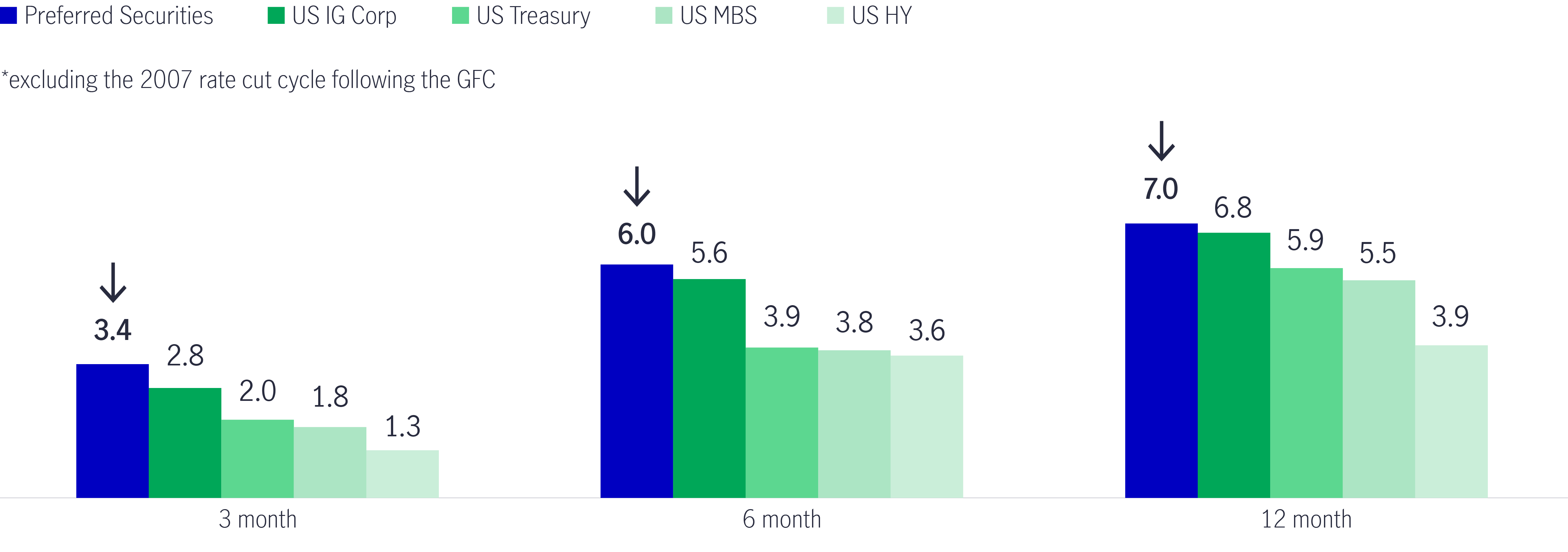

Chart 1: Average market returns (%) following the start of past four rate cut cycles1

Conversely, companies in weaker financial positions have faced challenges from elevated refinancing costs when financial conditions have tightened.

Against this backdrop, the importance of security selection and differentiation among spread sector allocations and capital structures is at a premium, as is preserving capital and limiting permanent capital losses due to defaults.

With their combination of relatively higher quality, higher yields and lower sensitivity to rate changes, US IG credits and preferred securities have historically delivered positive returns in the wake of Fed rate cuts. Chart 11 shows that following the start of the past four rate-cut cycles, both asset classes outstripped US Treasuries, US mortgage-backed securities (MBS) and US high-yield bonds over three-, six- and 12-month periods.

The only exception was the 2007 rate-cut cycle following the global financial crisis (GFC). The GFC recession led to a financial industry consolidation that significantly impacted financial assets, e.g., bonds, stocks and preferred securities. Preferred securities were under massive pressure, given the outsized financial allocations to this asset class. Following the GFC and increased regulation, global bank balance sheets are now at their strongest levels, and preferred securities have rebounded to a new high2.

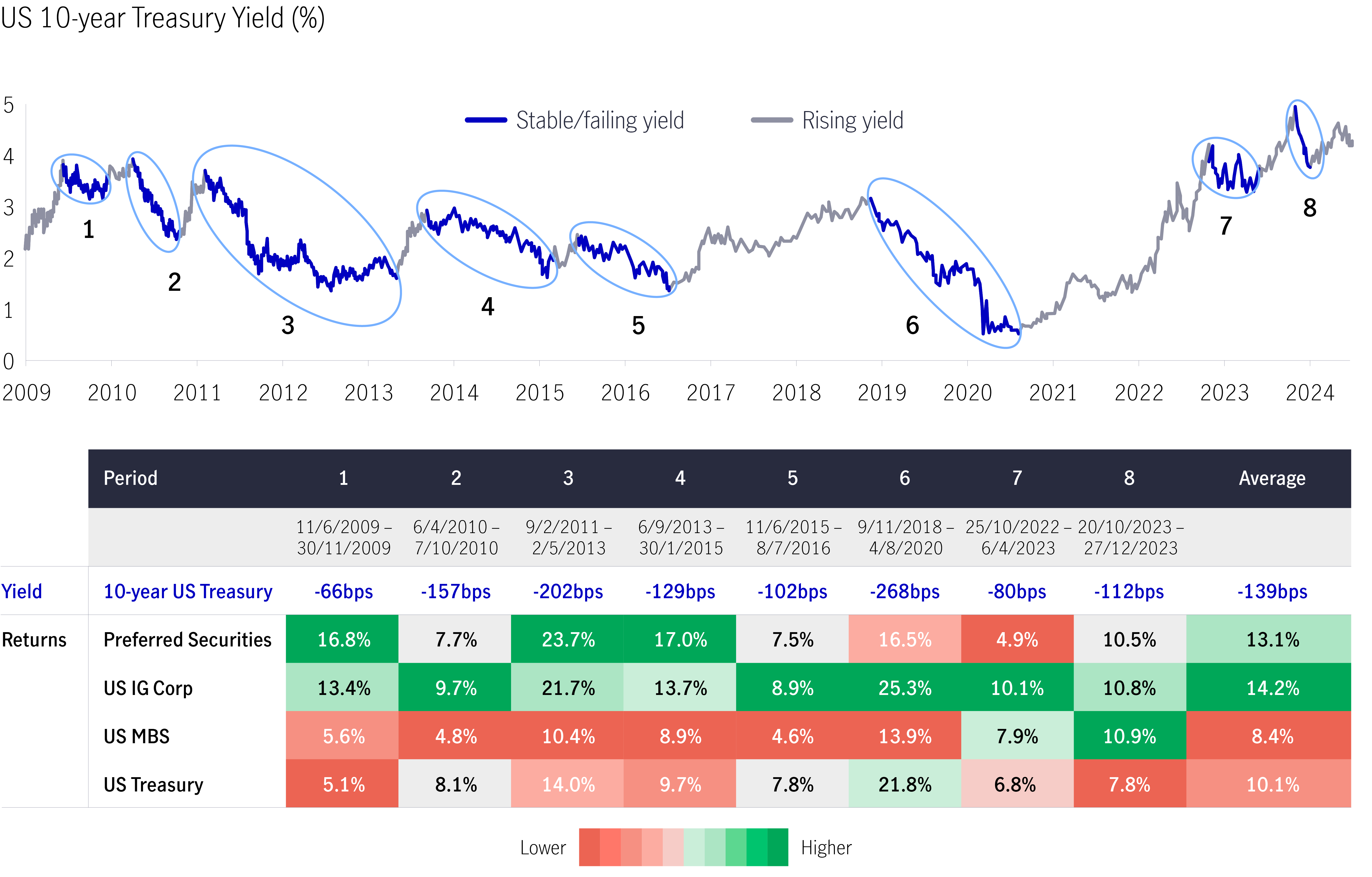

Historically, yields have declined when the Fed pivots to a rate-cutting cycle. As Chart 2 demonstrates the returns of high-quality US IG credits and preferred securities have generally outpaced US Treasuries and US MBS when Fed funds rate (borrowing costs) fall, and 10-year US treasury yields move lower3.

Chart 2: US IG and preferred securities excel in falling yield environment3

Apart from the Fed’s rate pathway, the US labour market, inflation and economic growth trends are also on investors’ radars. In such an uncertain and volatile environment, we believe that active management, a defensive approach, and a greater choice of credit tools are vital to generating potential excess returns in the new interest-rate regime.

We believe a softer economic downturn and interest rate reductions could potentially create favourable conditions for investing in preferred securities, particularly in electric utilities and regional banks. We are more optimistic in both sectors, as there has been a high level of new issuance in the electric utilities market combined with a tailwind of falling rates. Regional banks are showing strong relative valuations as they trade at deeper discounts to par, following the US regional bank issues in early 2023, which have been looming over the asset class.

1 Bloomberg, as of 30 June 2024. Past four rate cut cycles refer to July 1995 - January 1996, September 1998 – November 1998, March 2001 – June 2003 and July 2019 – March 2020. Monthly data are used for average return calculation. Total return. Preferred securities are represented ICE BofA Fixed Interest Preferred Securities Index (P0P1) for the rate cut cycle of 1995 – 1996 and represented by 50% ICE BofA Fixed Interest Preferred Securities Index (P0P1) and 50% ICE BofA US Capital Securities Index (C0CS) for the rate cut cycle of 1998 – 1999, 2001 – 2003 and 2019 – 2020. US IG Corp are represented by ICE BofA US Corporate index; US Treasuries are represented by ICE BofA US Treasury & Agency index ; US MBS are represented by ICE BofA US Mortgage Backed Securities Index; US HY Corp are represented by ICE BofA US High Yield index;. For illustrative purposes only. Past performance is not an indication of future results.

2 Bloomberg, data as of 20 September 2024, Preferred securities are represented by 50% ICE BofA Fixed Interest Preferred Securities Index (P0P1) and 50% ICE BofA US Capital Securities Index (C0CS) before 31 March 2012 and represented by ICE BofA US All Capital Securities Index (I0CS) starting from 31 March 2012.

3 Bloomberg, as of 30 June 2024.Total return. Preferred securities are represented by 50% ICE BofA Fixed Interest Preferred Securities Index (P0P1) and 50% ICE BofA US Capital Securities Index (C0CS) before 31 March 2012 and represented by ICE BofA US All Capital Securities Index (I0CS) starting from 31 March 2012. US IG Corp are represented by ICE BofA US Corporate index; US HY Corp are represented by ICE BofA US High Yield index; US Treasuries are represented by ICE BofA US Treasury & Agency index; US Equities are represented by S&P 500 Index. For illustrative purposes only. Past performance is not an indication of future results.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.