31 July 2023

The Mandatory Provident Fund (MPF) offers a range of investment tools, and employees with ambitious goals or the younger generation who are far from retirement tend to choose equity funds with higher potential returns and volatility1. Long-term investors are guided to eschew any short-term speculative impulses. Given that global equity markets have experienced multiple waves of volatility since 2008, it may be essential to consider adopting an "active yet defensive" approach that focuses on strengthening a portfolio’s risk controls, while pursuing of potential capital appreciation. This also applies to investors managing an asset-allocation strategy with a long investment horizon (up to 40 years) that centres around equity funds.

So far this year, factors such as elevated global inflation, especially in developed markets, and ongoing central-bank rate hikes have led to market volatility. In addition, there have been investor concerns about a potential global recession that could impact corporate profits and trigger another wave of equity market turbulence.

Investors seeking to manage portfolio risk could consider constructing an investment portfolio with a lower volatility profile that aims to achieve relatively stable performance. This would reduce psychological pressure and limit the chances of making irrational trades. However, it is important to note that financial turbulence is a relative concept, and instead of avoiding equity funds, investors could consider those with a lower volatility profile.

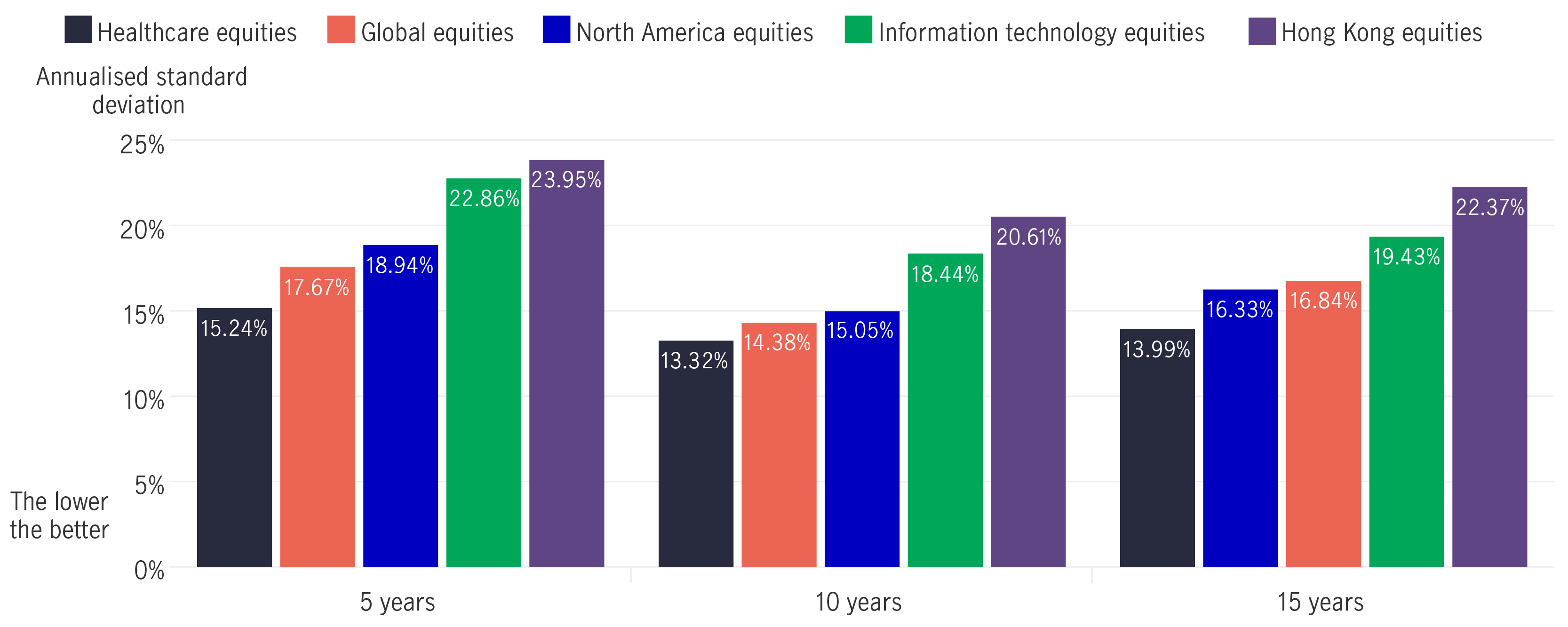

Investors can utilise standard deviation data to gauge equity-market volatility. Standard deviation is a measure of an asset's risk profile. A lower value is generally considered better, as it indicates that the asset exhibits less volatility and relatively stable movements, which translates into lower investment risk and vice versa.

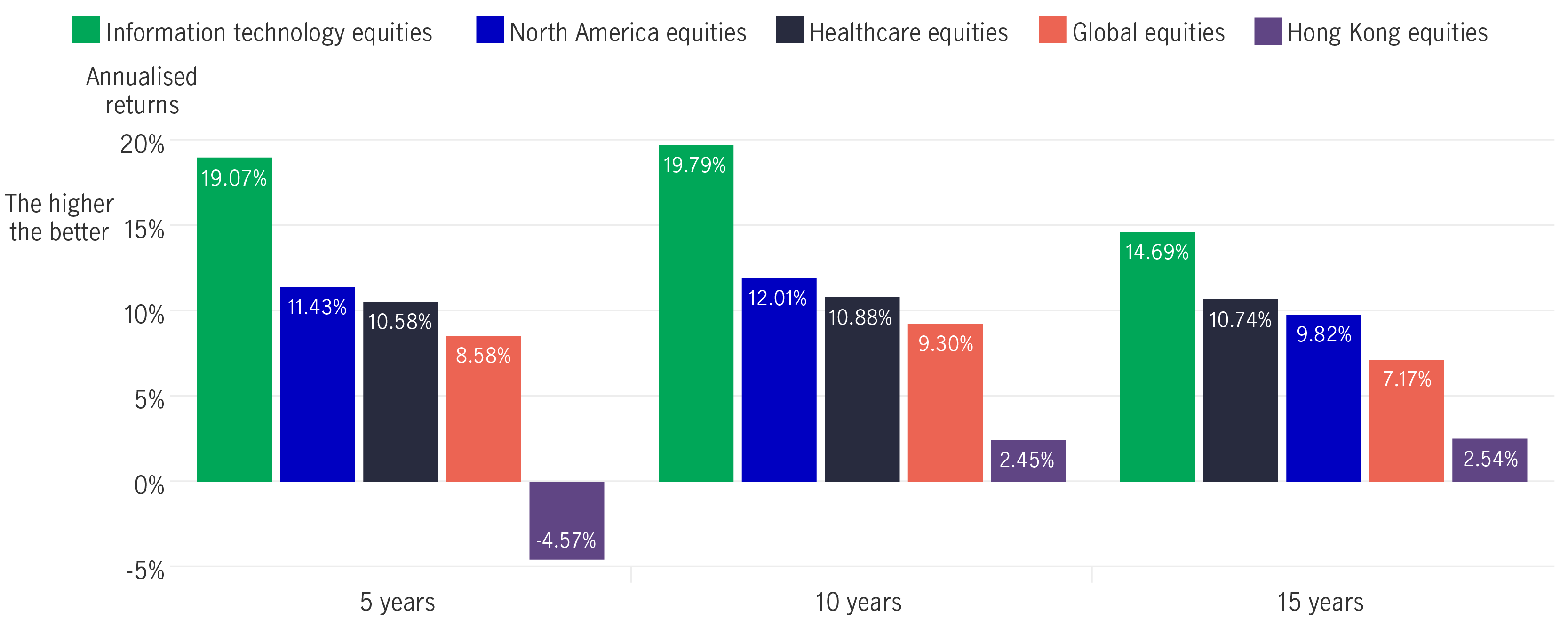

Returns and standard deviation – assessing five sample equity indices

Annualised returns

Volatilty indicator: Annualised standard deviation

Source: Manulife Asset Management, Morningstar, data as of 30 June 2023. Healthcare equities are represented by MSCI World Health Care Total Return Index (USD); global equities are represented by FTSE All-World Total Return Index (USD); Information Technology equities are represented by MSCI World Information Technology Total Return Index (USD); Hong Kong equities are represented by FTSE MPF Hong Kong Total Return Index (HKD); North American equities are represented by FTSE MPF North America Total Return Index (HKD). Returns are calculated based on the total return of the index and the trading currency. Past performance is not indicative of future returns. It is not possible to invest directly in an index.

We have compared five sample equity indices' volatility and return data over the past 5, 10, and 15 years2. Our findings are as follows:

The data highlights that even within stock indices, there can be significant differences in standard deviation and returns. As such, diversification remains crucial to manage volatility. Presently, Hong Kong employees allocate almost 60% of their investments to local assets3, with Hong Kong equities comprising 58% of that portion. While this approach aligns with the investment principle of “not buying what you don't know”, excessive concentration in volatile assets can result in substantial fluctuations in portfolio values, particularly during market volatility.

1 Equity funds can be divided into single-market equity funds (such as Hong Kong Equity Fund), regional equity funds (such as North American Equity Fund), global equity funds (such as Global Equity Fund), index funds (such as Hang Seng Index Fund), and sectoral equity funds.

2 The above-mentioned stock index data is for illustration purposes only and does not represent the data of the relevant equity funds.

3 Hong Kong Mandatory Provident Fund Schemes Authority, "Mandatory Provident Fund Schemes Statistical Digest quarterly report," March 2023.

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Harness lower-risk funds to navigate uncertainty and volatility

Market uncertainties are accelerating recently, this article will discuss how employees navigate the turbulent conditions by making good use of lower-risk fund

Your retirement withdrawal strategy—four tips for managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Harness lower-risk funds to navigate uncertainty and volatility

Market uncertainties are accelerating recently, this article will discuss how employees navigate the turbulent conditions by making good use of lower-risk fund

Your retirement withdrawal strategy—four tips for managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.