17 September, 2020

Frances Donald, Chief Economist

Framed as a subtle shift in policy, U.S. Federal Reserve (Fed) Chair Jerome Powell recently announced an important, if widely expected, shift in the way it thinks about employment, inflation, and interest rates—with far-reaching implications for investors.

When the Fed announced its decision to move toward “a flexible form of average inflation targeting,” effectively confirming the central bank’s desire to overshoot its official 2% inflation target,¹ the markets barely budged. However, it wouldn’t be wise to mistake Wall Street’s subdued response for disinterest—it’s an announcement that’s very relevant to investors, particularly those interested in inflation dynamics, specifically, upside surprises to inflation over the next three to six months. In our view, a structurally dovish Fed combined with stronger inflation data ahead effectively moves inflation expectations higher and moves real rates lower.

The inflation versus deflation discussion isn’t necessarily binary in nature; it’s filled with nuance, counterforces, and a number of unknowns. In truth, inflationary and deflationary pressures are at play simultaneously and as these opposing forces fluctuate, investors will likely go through periods during which they worry about deflation and other periods during which they’ll fret about inflation. These are important investment considerations with different implications that could lead to different investment outcomes. In our view, there are four key ideas that are central to any debate about inflation.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

We may be in the midst of a structural regime shift in terms of the drivers of inflation. We expect future inflation to be driven more by active fiscal policy and deglobalization, and less by monetary policy. Classic inflation models are therefore far less relevant and shouldn’t be used to predict future inflationary pressures. This suggests old-school correlations, such as the Phillips curve, might not be as useful as they once were. And remember, economists generally don’t have a good track record at predicting (or understanding) inflation.

It’s also important to note that classic CPI measures weren’t able to accurately measure the cost of living in the United States for some time now—it isn’t a new issue and we believe it’s likely to be even less accurate now. Policymakers are increasingly looking to address this problem, and it’s likely that both formal and informal measurements of inflation will need to be adjusted in the coming years, particularly with respect to housing costs and asset prices, which would likely push measured inflation higher.

Given that the United States is in the middle of a pronounced recession, the idea of rising inflationary pressure within the next three to six months might seem counterintuitive. Shouldn’t a recession lead to demand deflation typically associated with large output gaps? In theory, yes, but the current economic shock is fundamentally different from a regular recession, and we see 10 key near-term inflationary pressures that are likely to contribute to inflation moving quickly back to 2% or above before year end. Given the economy’s weak growth profile, we think it’s more accurate to characterize this tactical period as stagflation.

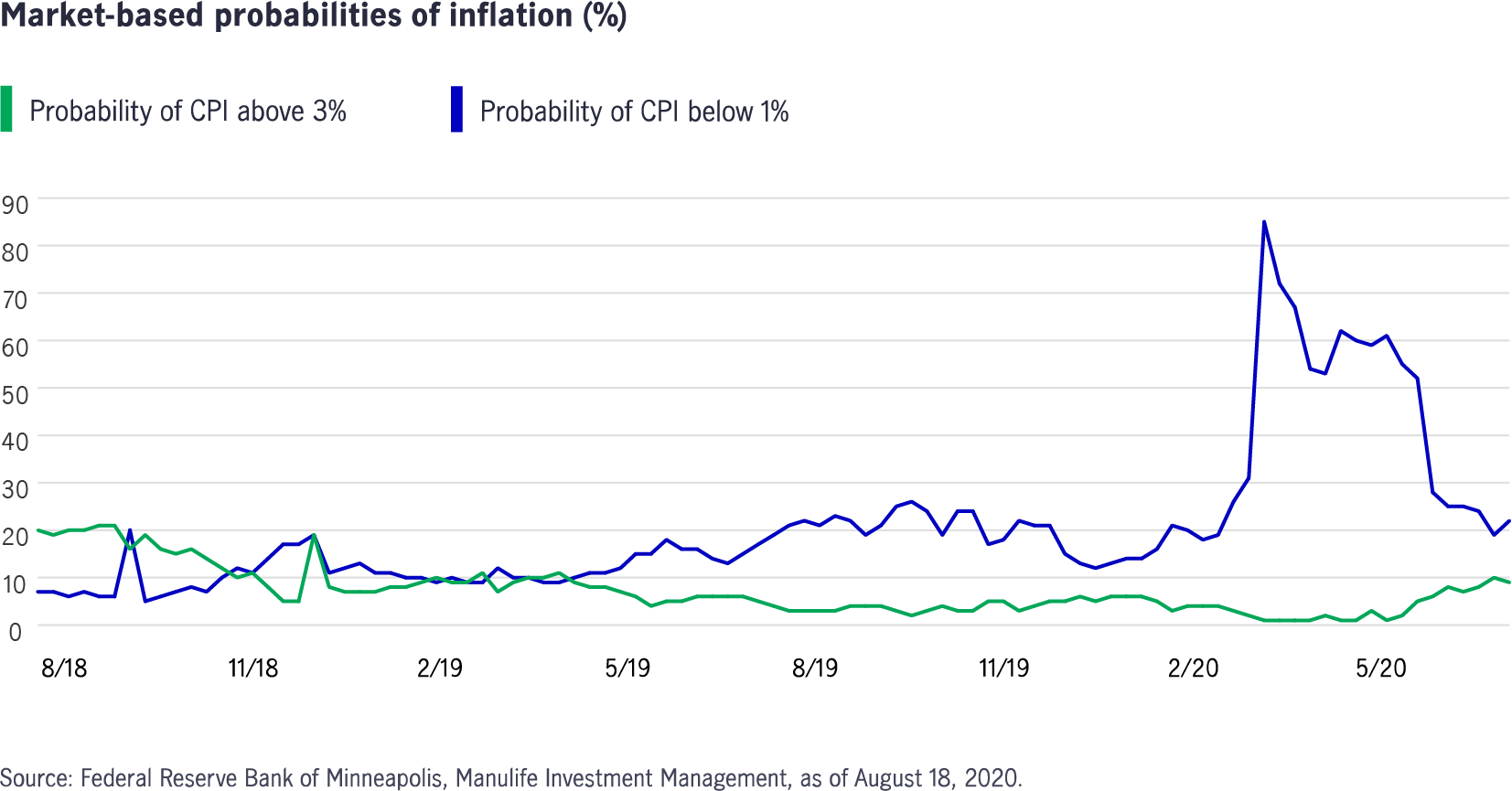

While markets may already be awakening to the inflation upside narrative, we see evidence that inflation may still be underpriced. U.S. bond markets may have nudged inflation expectations higher, but we believe the rise has more to do with improved liquidity conditions and the term premium than a surge in expectations of higher prices. In addition, both the Minneapolis Fed’s measure of market expectations for inflation (which remains extremely asymmetric, suggesting a 22% probability of inflation falling below 1% and only a 9% probability of inflation rising above 3%) and the Citi Inflation Surprise Index (which remains below 0) suggests there’s considerable scope for an upside surprise.

Given the Fed’s formal shift to average inflation targeting, the bond markets aren’t likely to associate higher inflation with higher nominal rates—at least not for now. As a result, as inflation rises, nominal yields are likely to remain around current levels even as real rates fall deeper into negative territory.

We also expect the yield curve to continue to steepen, particularly between the belly of the curve and the long end—the Fed’s constant references to yield curve control, which it isn’t likely to implement just yet, has the effect of keeping the front end of the yield low. Finally, mild inflation is historically correlated with a positive rerating of equities (well, until about 3%). In our view, investors shouldn’t view higher inflation by itself as a cause for an equity market sell-off. For the time being, it might be useful for investors to start embracing a new reality and get used to slightly higher levels of nominal inflation, even if it makes us all slightly uncomfortable.

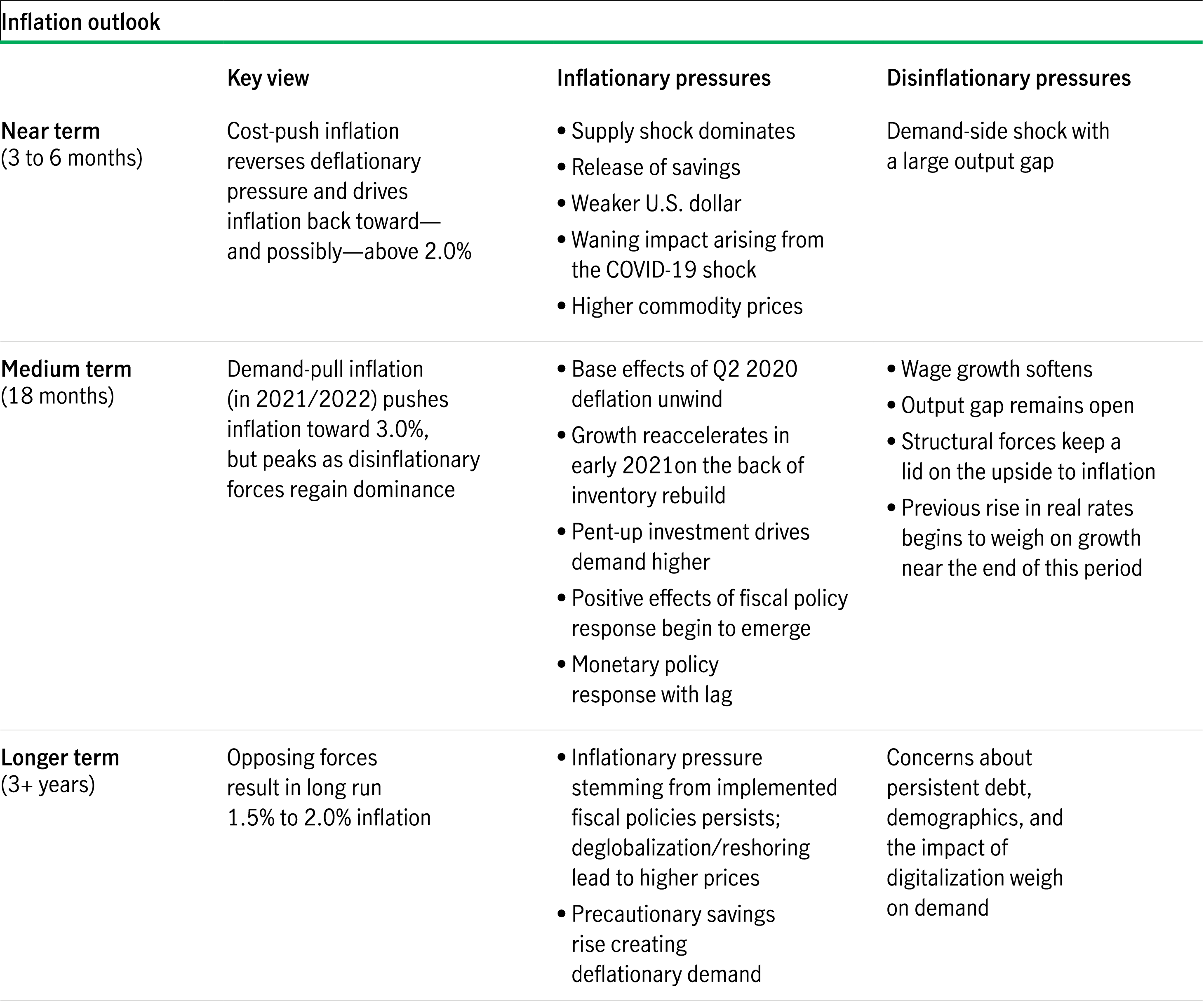

We believe it can be helpful to visualize how inflationary and disinflationary pressures can evolve over three different timelines: within the next 3 to 6 months, within the next 18 months, and beyond the next 3 years. In our view, it’d make sense for investors to draw a clear distinction between long-term deflationary pressures and short-term inflationary pressures given the evolving macro landscape that we find ourselves in.

1 “New Economic Challenges and the Fed's Monetary Policy Review,” federalreserve.gov, August 27, 2020.

2 “Measures of Expected Inflation,” Federal Reserve Bank of Cleveland, accessed August 27, 2020.

3 Bloomberg, as of August 27, 2020.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.