25 April 2022

Kai Kong Chay, Senior Portfolio Manager, Greater China Equities

On 15 April, the People’s Bank of China (PBOC), China’s central bank, announced a reduction in its reserve requirement ratio (RRR). Last week, the government also published 23 measures to support individual and small businesses, and stepped up its efforts to keep supply and industrial chains stable. In this investment note, Kai Kong Chay, Senior Portfolio Manager, Greater China Equities, presents an updated view of the China and Hong Kong markets. He believes that the latest measures reiterate China’s stance on economic stability and sees opportunities in China and Hong Kong equities that could benefit from these supportive policy actions.

China announced several measures to release long-term liquidity into the financial system to bolster the economy. These include:1

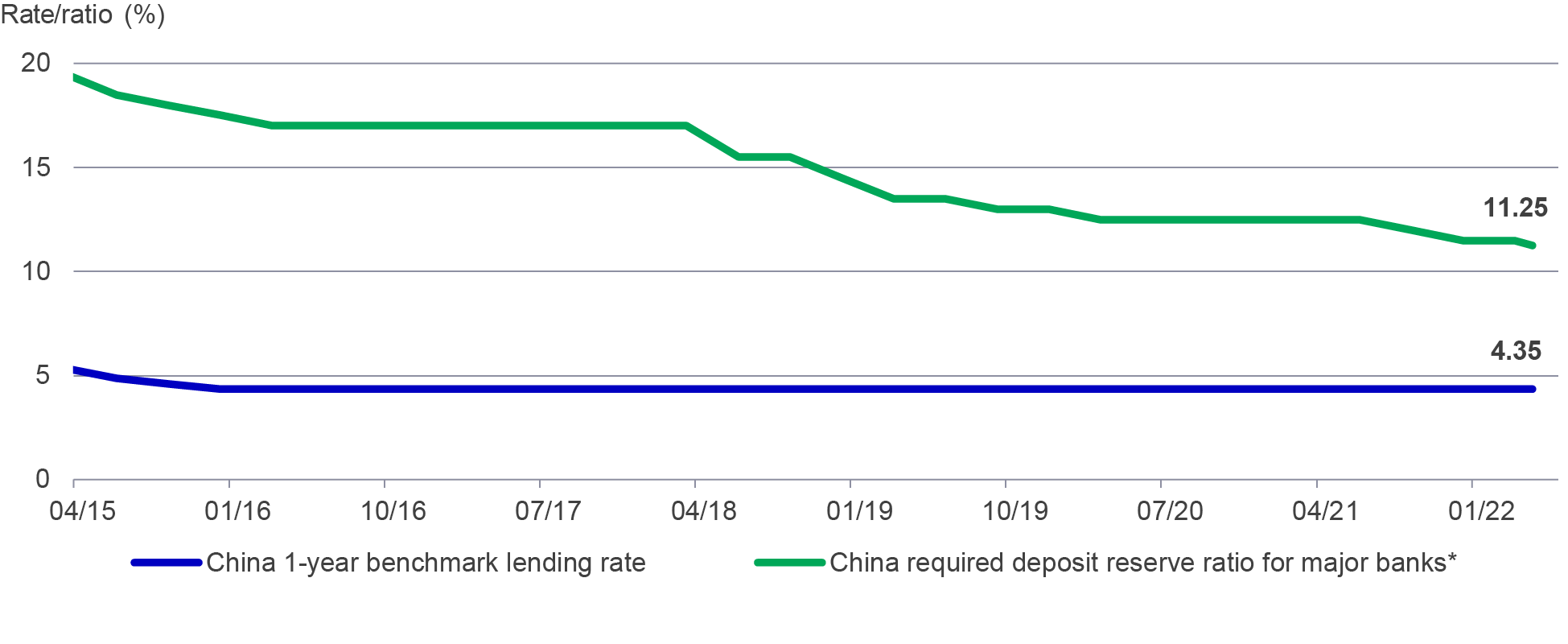

Chart 1: China’s reserve requirement ratio and lending interest rate (as of 19 April 2022)

Source: Bloomberg, 19 April 2022. *Note: The reserve requirement ratio (RRR) will be reduced to 11.25% is effective from 25 April 2022.

In addition, China’s corporates or small and medium enterprises (SMEs) may benefit after the central bank announced 23 additional measures to support the economy. Some key highlights include:3

Separately, the China Banking and Insurance Regulatory Commission vowed to increase financial resources for logistics, transportation, and courier industries and use the relending funds to lower financing costs. It will provide funding support to smaller businesses suffering from temporary difficulties due to COVID-19.

While some market participants expected a bold reduction in interest rates, we believe China has adequate policy tools other than a rate cut to support growth if needed.

Despite a near-term dampening of investor sentiment, we believe the recent measures prove that China is determined to support the local economy:

While we remain selective, we see opportunities in the sectors and key themes of China and Hong Kong equities that should benefit from China’s structural growth story. These opportunities include:

Overall, we believe China is ready to act and likely to step up policy easing should a sharper economic slowdown occur. In addition, China has the levers for fiscal support, such as further spending on investments and infrastructure, as well as tax refunds and cuts. While near-term market sentiment has been mixed, we view the latest measures as signs that China is on track to maintain its economic course.

1 Bloomberg, 19 April 2022.

2 Reuters, 18 April 2022.

3 Bloomberg, 19 April 2022.

4 Reuters, 18 February 2022.

5 South China Morning Post, 4 April 2022.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.