26 May 2021

US bank portfolio management team

With each passing quarter since the pandemic began to disrupt the economy in early 2020 and the outlook for U.S. banks was upended, the industry has managed to successfully retrench and position itself to help lead the economy’s broader recovery. Nearly all publicly traded U.S. banks have released first-quarter results as of this writing, and the industry as a whole continues to exceed our expectations. Based on our analysis, here are nine salient points about the current state of banks and the implications for equity investors.

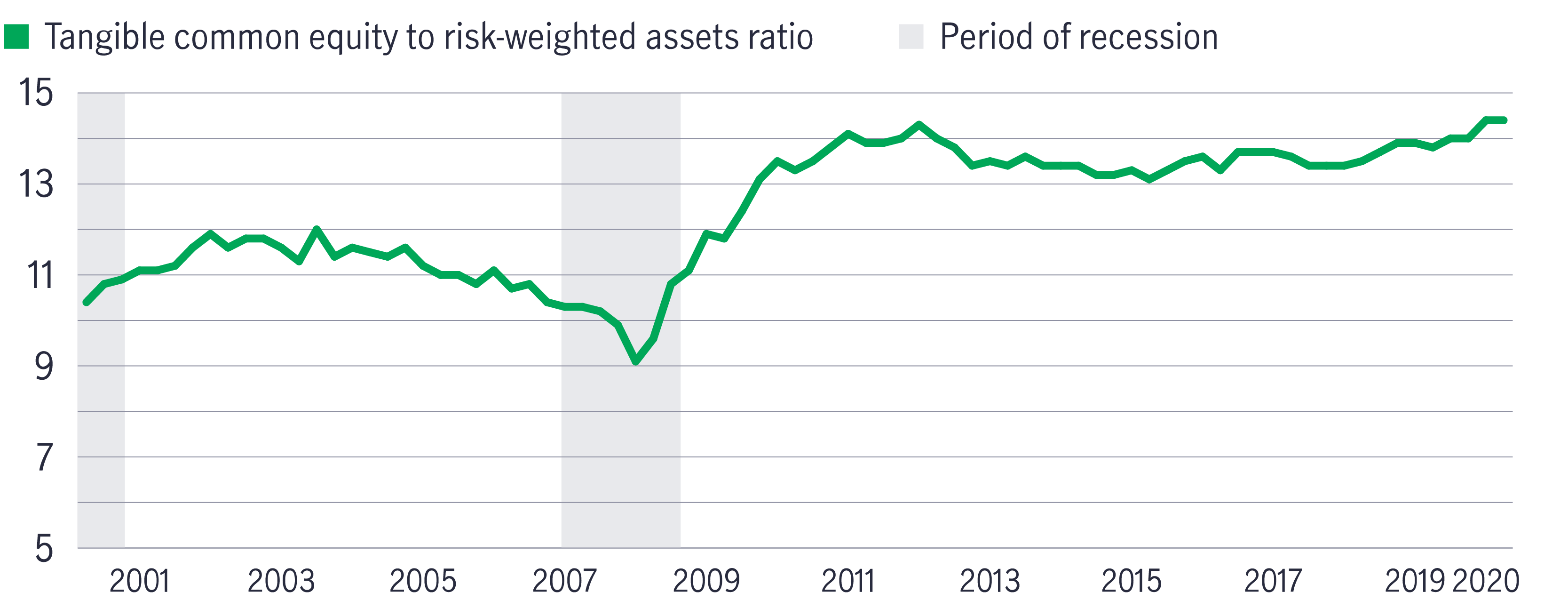

U.S. banks' capital levels have surged since a 2009 low

U.S. banks' ratio (%) of tangible common equity to risk-weighted assets, 2001–2020

Source: Federal Deposit Insurance Corp., January 2021. A tangible common equity to risk-weighted assets ratio is used to assess the potential for future bank financial stress based on commonly measured capital ratios.

U.S. banks appear to us to be fundamentally strong, with historically high levels of capital and liquidity. As the economy has reopened, credit fundamentals have been materially better than had been expected a year earlier. Strong results from regulators’ latest round of stress tests to assess major banks’ abilities to weather further economic shocks triggered a further loosening of restrictions related to share buybacks. We view these developments as a testament to the industry’s capital strength and improved underwriting. In addition, we believe that the most recent stimulus package that Congress approved in March should further support the economy and reduce credit costs. As these trends persist, we expect U.S. bank earnings to accelerate throughout 2021.

1 “KBW Bank Earnings Wrap-Up 1Q21, v. 2: Banks Continue to Deliver EPS Beats on Mostly Favorable Credit Trends,” Keefe, Bruyette & Woods, April 23, 2021.

2 Earnings per share (EPS) is a measure of how much profit a company has generated calculated by dividing the company's net income by its total number of outstanding shares.

3 U.S. Federal Reserve press release, March 25, 2021.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.