27 July, 2021

Fiona Cheung, Head of Global Emerging Markets Fixed Income Research

With better economic news being offset by headlines about defaults and missed payments, investors would be forgiven for thinking that the credit backdrop in China is somewhat gloomy. Yet, when viewed over a longer time frame, we believe these developments will ultimately be a force for good. The Chinese authorities see these events as an opportunity to tackle lingering issues and develop a sustainable corporate-bond market positioned for long-term growth.

Key takeaways:

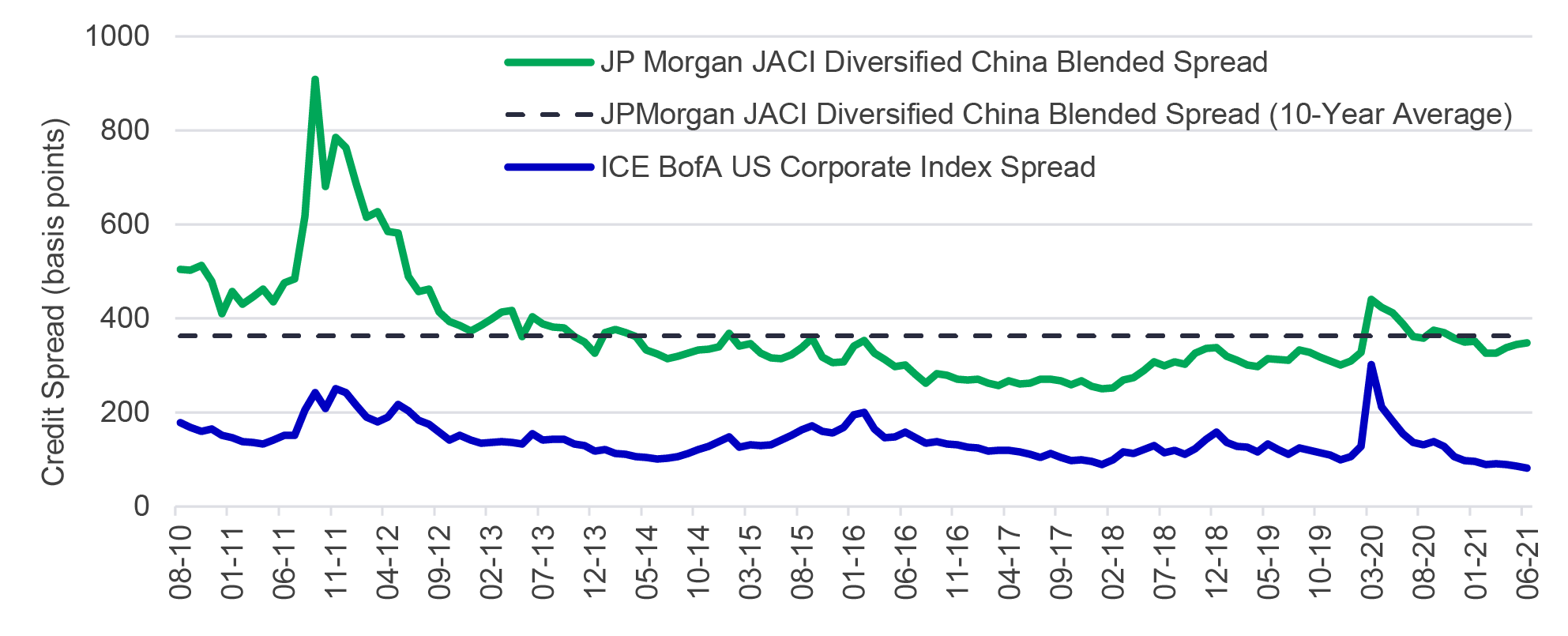

Despite the recent increase in credit events, we believe the case for investing in Chinese corporate bonds remain strong, with the search-for-yield theme very much in play. Along the way, we acknowledge the issue of Chinese corporate-debt defaults and explain that, with careful credit selection, the country’s credit market can remain a good opportunity for investors. China’s economic and market resilience with a spread premium over developed-bond markets places it in a unique global position (Chart 11).

Chart 1: China US dollar credit can offer a spread pick-up versus US corporate bonds

During the first half of 2021, we saw an increasing number of onshore and offshore credit events, with YTD onshore bond default numbers already exceeding 50% of the full-year total for 20202. Instead of “kicking the can” down the road, we believe the Chinese government is allowing more debt defaults in a controlled manner, as a continuation of the credit clean-up that has been taking place over the past few years. We think this move is positive for the financial health of the corporate sector, especially property and state-owned enterprises (SOEs). Policymakers now have a higher tolerance of defaults amid the sustained recovery in China’s economy that has materialised since the second quarter of 2020. Also, we see an increasing willingness to let creditors bear losses, a shift from the prior belief that the government would bail out bondholders of failed financial institutions. More market-driven and orderly defaults should lead to credit-risks pricing that is more reflective of credit fundamentals.

While these defaults may lead to market jitters and a widening of credit spreads, our base case is that the SOE defaults will likely come from those with low strategical importance or weak fundamentals and may not cause systemic risk3. In our view, the recent trend of large and high-profile SOE defaults highlights the importance of fundamental credit analysis and credit selection – especially in the China onshore bond market where there is limited credit differentiation, and government support is taken for granted. Our Asian fixed income team practices what it preaches – with a robust credit process and onshore and offshore presence, it has avoided all these Chinese credit defaults4.

While market dynamics are resulting in a healthier and more sustainable credit environment, government reform also plays an increasingly indispensable role in developing the onshore bond market. In June 2020, President Xi Jinping approved a new three-year reform programme5. This move has kick-started a new round of mergers and asset restructuring among central and local-level SOEs in areas such as steel and the infrastructure space. In summary, the programme is designed to help SOEs become more competitive and market-driven, while solidifying the central government’s influence on SOEs and, in turn, SOEs’ influence in those strategic industries aiming to achieve national goals e.g., carbon neutrality by 20606.

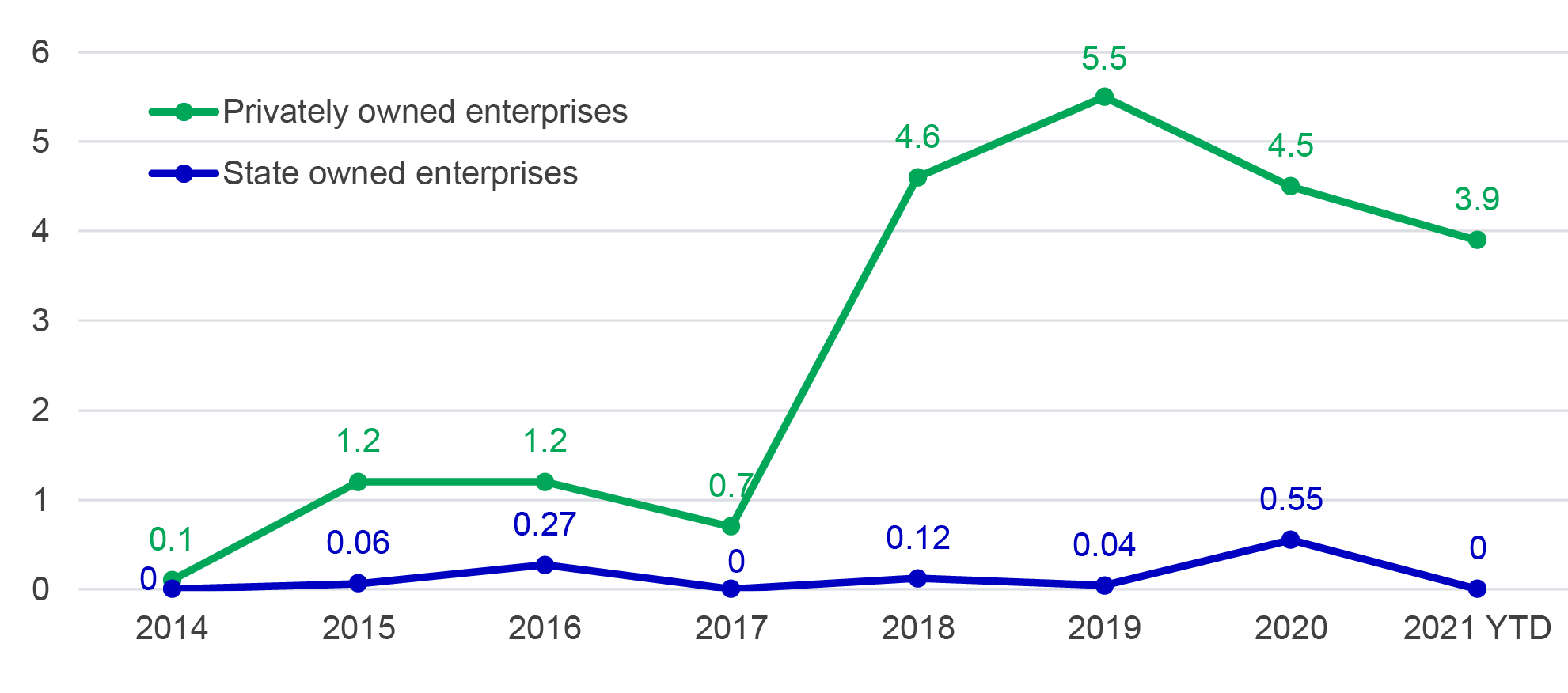

Chart 2: Issuers’ total notional amount of onshore bonds outstanding at the time of default, as a percentage of total corporate bonds outstanding at the start of the year7

As the COVID situation in China has stabilised and the economy is broadly recovering, onshore defaults could pick up moderately. Based on the latest guidance, the central government aims to promote more market-oriented debt resolutions for SOEs, with a greater tolerance for insolvent local government financing vehicles (LGFVs) to default. While we expect the process to be gradual, we believe that the so-called “zombie” SOEs and LGFVs could be default candidates. “Zombie” attributes include very weak fundamental profiles, limited strategic functions, and exposure to highly polluting industries, e.g., coal mining. Having said that, with an overall default rate of less than 1%7, SOE default risk should remain manageable given the efforts by local government to smoothen the process without causing a systemic impact on local funding channels. We believe there are more opportunities in SOE issuers with sound credit profiles, consistent financial policy, and the ability to ride through cycles with manageable fallen-angel risk. Also, we believe issuers with clear strategic importance to warrant government support to offset any fundamental weakness arising from their policy function.

Amid the post-COVID-19 recovery, we expect an improving operating environment, and the broad price recovery in commodities should alleviate some of the pressure on privately owned enterprises (POEs). Since the weaker POEs have already defaulted, we believe that the rate should moderate from the record high in 2019.

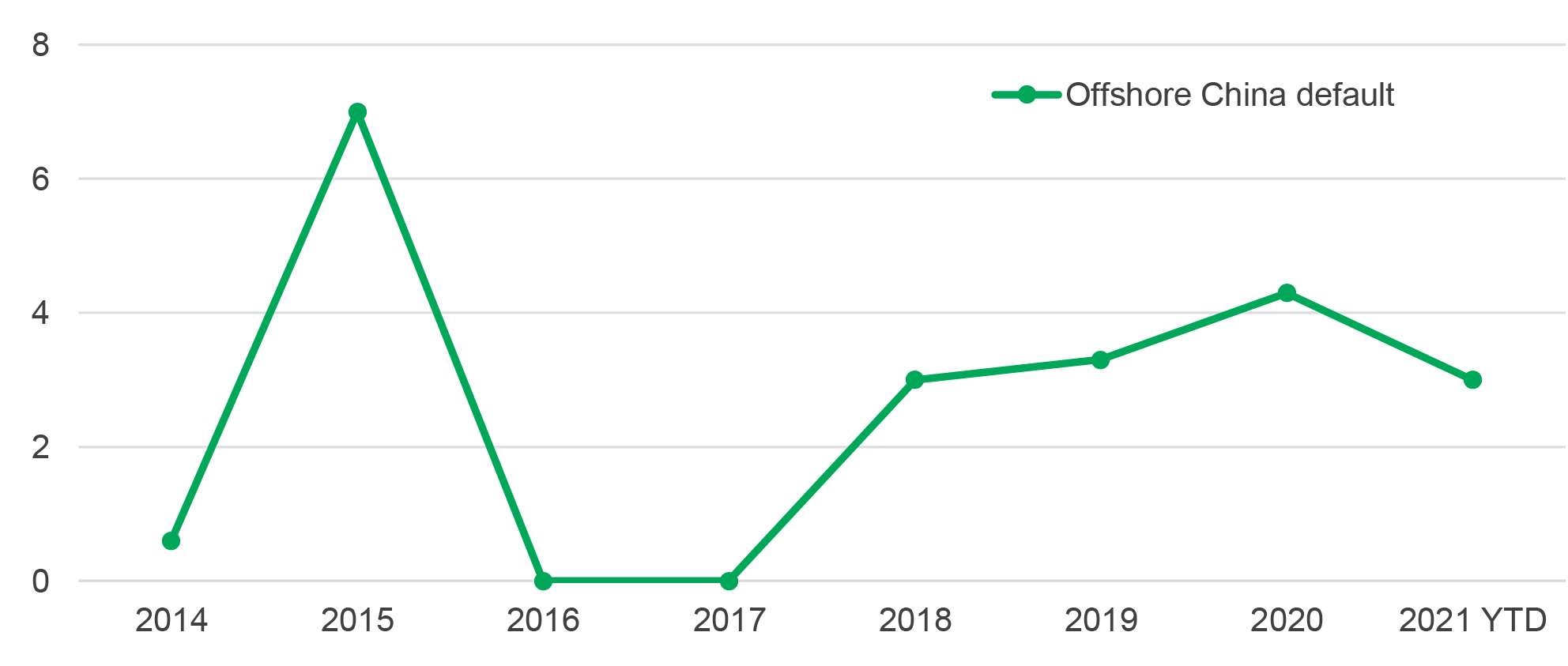

Overall, we think the China offshore US-dollar-bond default risk is manageable (see Chart 3), as China’s offshore high-yield (HY) market is dominated by local property developers8. As the Chinese government continues with its more proactive approach to managing systematic risk in the sector, we do not expect sharp credit deterioration or widespread defaults. Given the significance of property in terms of its economic contribution and citizens’ store of wealth, we believe it is in China’s interest to promote healthy and sustainable development within the sector instead of an abrupt intervention that could lead to sharp price correction and drastic surge in defaults. In fact, we are already seeing some uptick in single B-rated9 developer default.

Chart 3: China G3 HY bond market default rate (weighted by outstanding amount)

Source: Goldman Sachs, as of 17 June 2021.

The recent funding curbs on China’s property developers aim to manage risk in the housing market, which is showing signs of overheating. This policy tightening will inevitably lead to challenges for weaker developers with limited access to funding and financial flexibility. That said, we expect that the overall default risk in the sector should be manageable. Under the “three red lines” rule10, developers with excessive leverage will be under pressure to slow their expansion and focus on improving the quality of their growth, which we think may improve their credit profiles over time. Furthermore, we believe that larger developers with financial flexibility and access to funding should play a greater role in the industry’s consolidation over the coming years. We believe this would lead to further polarization within the sector and accelerate consolidation over the medium-to-long term.

We believe that developers with decent scale and financials to buffer the ride through various market cycles should stand out. These players tend to have ample land reserves, either nationally or in major economic clusters where they hold leading market positions. In addition, developers with access to diversified funding channels in both onshore and offshore markets should be in an advantageous position. In our view, this is critical to a developers’ liquidity position, as well as its long-term success.

China’s credit market is already the world’s second largest and still growing11. As China’s onshore and offshore bond markets continue to develop, there exists a certain information gap. At Manulife Investment Management, we take pride in our bottom-up fundamental research capabilities, with both onshore and offshore research presence, including dedicated credit analysts in Shanghai and Beijing. When assessing the creditworthiness of a local SOE or central SOE, it is essential to understand its role in the eyes of either local or national government, and their access to onshore and offshore funding. Often, movements in onshore market could be verified via the offshore presence, and vice versa, to see through the nuances. Having both an onshore and offshore presence with access to on-the-ground intelligence, therefore, fills the information gap by providing us with an additional layer of detail on the quality of each issuer. Ultimately, this market knowledge helps us identify attractive opportunities for our investors.

1 Bloomberg, Manulife Investment Management, 30 June 2021.

2 Goldman Sachs, 21 June 2021.

3 So far, the default rate of SOEs in China is still below 1% (of total China onshore corporate bonds outstanding), a level that is low compared to other bond markets around the world. Chinese authorities have shown in the past that they are willing to take bold measures to support and restore confidence in the market to prevent any contagion risk.

4 Manulife Investment Management, as of 26 July 2021.

5 China Daily, 5 June 2020: “SOE reforms to drive economic development”. Premier Li Keqiang delivered the Government Work Report on 22 May 2020 in which it was announced that China will launch a three-year action plan for SOE reform, improve the system of State capital regulation and intensify mixed ownership reform of SOEs.

6 China pledges to be “carbon neutral” by 2060, Financial Times, 23 September 2020.

7 Goldman Sachs, 25 June 2021: As a percentage of total China onshore corporate bonds outstanding, a level that is low compared to other bond markets around the world.

8 These make up about 46% of the JACI China High-Yield segment.

9 Considered speculative, subject to high credit risk.

10 The People’s Bank of China and the Ministry of Housing announced in 2020 that they’d drafted new financing rules for real estate companies. Developers wanting to refinance are being assessed against three thresholds: a 70% ceiling on liabilities to assets, excluding advance proceeds from projects sold on contract, a 100% cap on net debt to equity, a cash to short-term borrowing ratio of at least one.

11 Bank of International Settlements, 23 June 2021.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.