26 February 2024

Nathan Thooft, Chief Investment Officer, Senior Portfolio Manager, Multi-Asset Solutions Team

There were a number of key economic and market themes in flux in 2023, most notably a global economic environment that held up stronger than most market participants predicted. As 2024 gets under way, we look at some of the themes driving our asset allocation outlook.

A confluence of factors helped drive large-cap equity growth in 2023 beyond what most people anticipated. The information technology and communication services sectors—which account for almost all technology and artificial intelligence (AI)—contributed more than 70.0% of the S&P 500 Index’s 26.3% total return for the year1.

S&P 500 Index level

3/1/2023–9/2/2024

Source: S&P Dow Jones Indices LLC, February 2024. The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Yet even as broad equity markets push ahead with the S&P 500 Index breaching the 5,000 level for the first time in early February2, we remain cautious about economic growth overall, particularly in the United States, where we anticipate lower growth than the 2.5% gross domestic product growth experienced in 2023. We also believe that most major global central banks have now reached peak rates for this economic cycle after seeing inflation moderate fairly consistently throughout 2023 and, should this trajectory continue, we anticipate central banks globally beginning to cut rates at some point in 2024.

From a market perspective, while 2023’s returns were driven by a narrow basket of U.S. large-cap technology stocks, 2024 should present an environment with broader market participation, particularly on the equity side. While we feel that technology and AI will continue to be strong contributors to equity returns, we also feel that opportunities will broaden out to areas of the market that have been laggards. This includes areas such as small-cap stocks, which tend to perform better during falling rate environments, healthcare, along with certain equity factors, including high dividend or quality stocks. We also continue to have a favorable outlook on the Japanese equity market, which had an outstanding year, reaching 33-year highs with returns of around 22% in U.S. dollars in 2023.

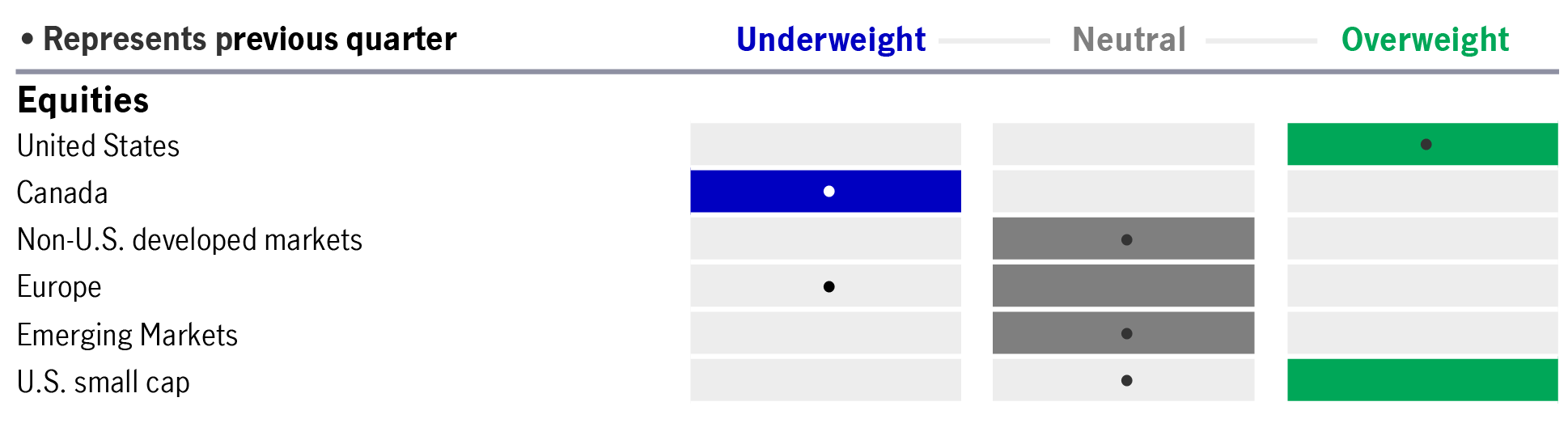

Broad equity outlook

Source: Multi-Asset Solutions Team, Manulife Investment Management, as of 31 January, 2024. Projections or other forward-looking statements regarding future events, targets, management discipline or other expectations are only current as of the date indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different than that shown here. Information about asset allocation view is as of issue date and may vary.

On the fixed-income front, we expect interest rates to come down across the entire yield curve and we're positioning portfolios for more duration rather than increasing credit exposures.

As long-term multi-asset investors, we believe robust portfolios are built on diversification on three levels: asset class diversification across sectors, subsectors, and geographic regions; manager diversification to blend specialist skills in key markets; and diversifying investment styles, using active management where it may add value and low-cost passive implementation for broad market exposure. In our view, this combined strategic approach helps investors realize the potential benefits of multi-asset investing.

1 S&P Dow Jones Indices, 31 December 2023.

2 Bloomberg, 8 February 2024.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.