The sudden emergence of COVID-19 has left a major dent in the global economy. To comply with regulatory requirements, some international banks cut or even suspended their dividend payouts last year without warning1. As a result, many investors who rely on dividends have been left in the lurch. How important is income to investors?

Bruno Lee, Regional Head of Retail Wealth Distribution, Wealth & Asset Management, Asia at Manulife Investment Management points out that global central banks have been implementing quantitative easing measures for years. This attempt to stimulate the economy by substantially increasing money supply has prolonged the low-rate environment, which, in turn, makes it harder for investors to generate income (It can take the form of cash dividend, interest, or coupon payments, while it doesn’t come from buying or selling assets).

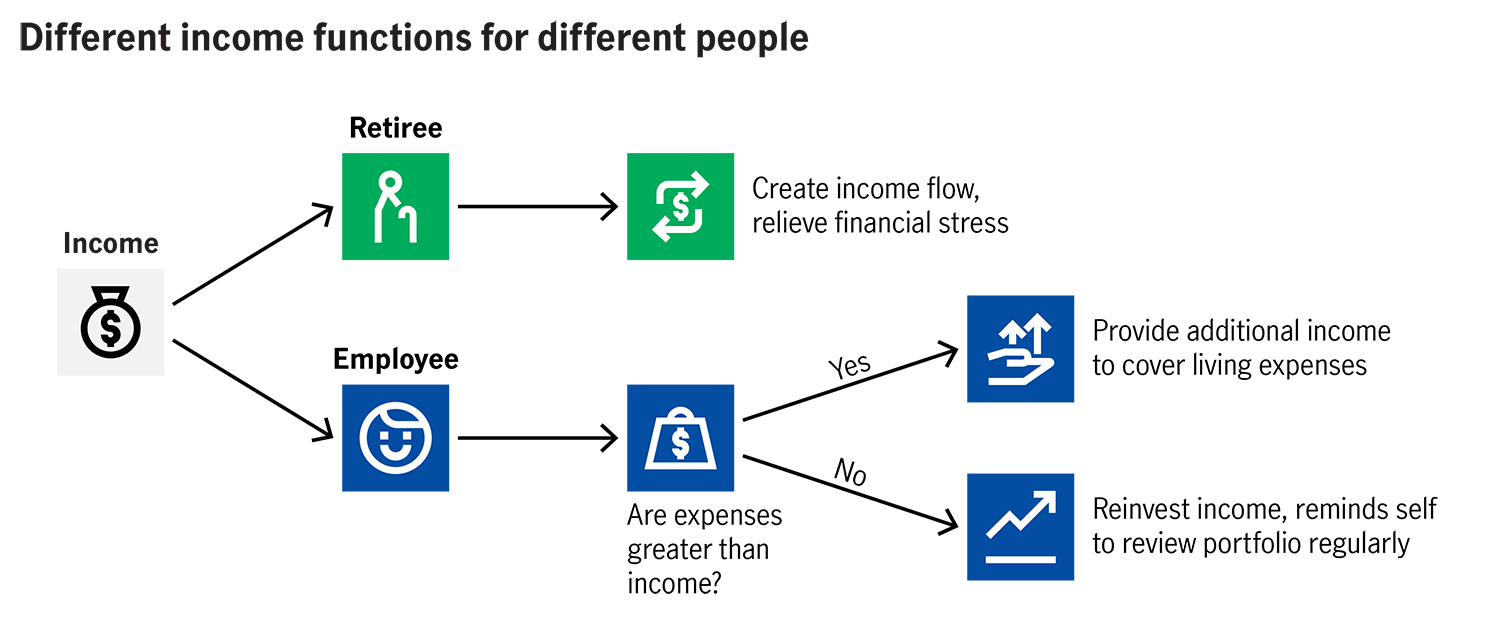

Income serves as an additional source of cash that allows investors to manage their daily expenses, for example. Something that is especially important for retirees, as they generally have to rely on their savings in the absence of a salary from paid employment. A steady investment income can also help to create an “alternative salary” by reversing the net cash outflow situation, which, in turn, alleviates the financial burden.

Younger people and those with established careers already have a regular salary, so they are probably more focused on capital gains. That’s why an investment tool that offers income payouts is not necessarily their first choice.

In fact, the purchase of income-paying assets actually serves two functions: firstly, income can be reinvested to achieve greater potential returns (potential income plus capital gains). Secondly, it serves as a reminder to review one’s portfolio regularly.

Investors may be unaware that besides acting as an additional cash source, income-focused investments help to reinforce effective wealth management.

Lee believes that it is common for investors to neglect wealth management due to their hectic work schedules or lifestyles. Investing in assets that offer regular dividends can, therefore, provide a cordial reminder when any payouts are made. In Lee’s experience, whenever a distribution is received, the amount is directly deposited into his cash account and he gets a notification with details of that transaction. His account balance continues to rise with each payment. This has the effect of highlighting any idle assets and, consequently, the need to review his portfolio. Lee can then decide whether reinvestment is required – a cycle that allows him to remain a disciplined investor.

Lee reveals more about his strategy: “I hold different types of funds with regular payouts. When, after a few months, the accumulated income reaches a certain level, I would consider how to reinvest the newly gained capital. For instance, I can increase my current holdings or look for investment opportunities in other equity funds during a sell-off.”

In terms of investment allocation, Lee says investors may consider taking a conservative approach for the principal coupled with flexible asset allocation according to the investor’s risk tolerance, lifecycle stage, and wealth-management objectives. As for the additional income, more aggressive investors can select higher-risk tools in the pursuit of better potential returns, as it accounts for only a small proportion of the portfolio’s total value.

(Income Series, Part 1 of 3)

Click here to discover the income sources available in the market.

Click here and learn how to include income tools in your asset allocation.

1 Source: Prudential Regulation Authority (PRA) of Bank of England (BoE), 31 March, 2020; European Central Bank (ECB), 28 July, 2020; Bloomberg, 14 October, 2020. The PRA of BoE requested local banks to suspend cash dividend payouts and share buybacks until 2020 year-end, and the situation will be reviewed in Q4 2020. The ECB requested regional banks to suspend cash dividend payouts and share buybacks until 1 January, 2021. Statistics from Bloomberg show that 28% of Asia Pacific companies have announced dividend suspension or cuts.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

How much do you know about rates?

Recognise the different terms related to interest rates and understand how much yield global government bonds can offer.

Four essential keywords related to interest rates

Central banks in some emerging and Asian markets have started to hike rates, but deposit rates may not necessarily move in tandem. This would gradually erode depositors’ purchasing power in an inflationary environment. To achieve potential returns that beat inflation, deposit-focused investors should base any investment decisions on their risk tolerance levels and wealth management objectives.

Why demographic change requires a new set of cards

Many Asian governments are considering incentives to encourage larger families. These evolving policies will be vitally important, as the region looks to sustain a fast-greying population.