Susan A. Curry, Senior Portfolio Manager, Capital Appreciation

Ryan P. Lentell, Portfolio Manager, Capital Appreciation

Despite recent bank failures, the latest round of quarterly earnings shows that it’s mostly been business as usual for U.S. regional banks in terms of their day-to-day operations. In this investment note, Susan A. Curry, Senior Portfolio Manager, Capital Appreciation, and Ryan P. Lentell, Portfolio Manager, Capital Appreciation, assess the outlook and prospects for further market volatility.

Following the unexpected collapses of Silicon Valley Bank (SVB) and Signature Bank (SB) in March, first-quarter earnings were an important barometer to evaluate how the failures affected the broader industry. Fortunately, most U.S. regional banks saw limited direct impact on their day-to-day operations, in our view. The earnings reports released in mid- to late April corroborated what we had heard from management teams as well as regulators in the weeks following the events in mid-March.

Despite the news headlines and an isolated number of banks with asset versus liability mismatches, we believe the higher interest-rate environment has largely benefited the industry over the last year. In fact, the median bank saw net interest revenue up 22% year over year in the first quarter.1

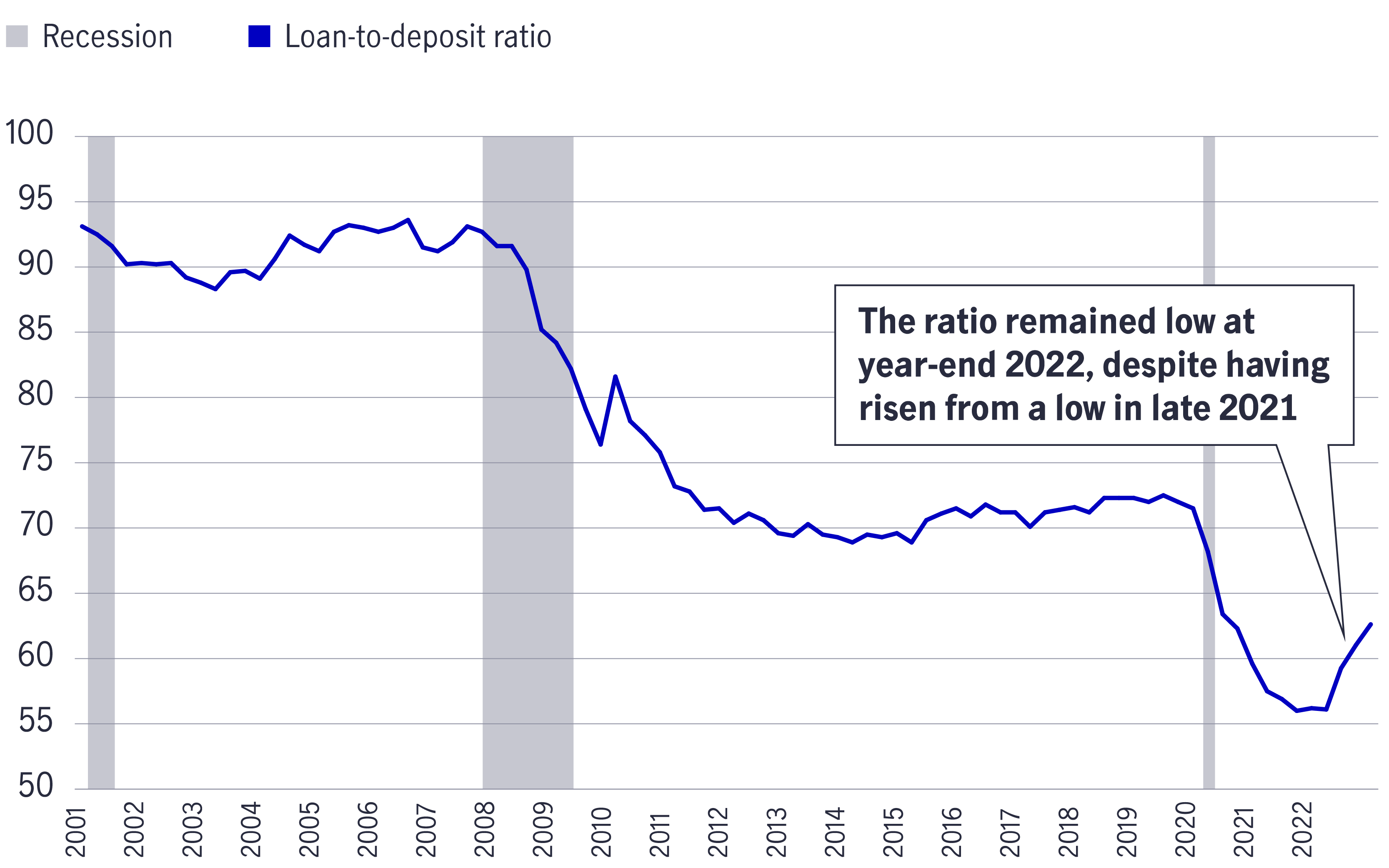

Across the banking system, institutions have seen deposit outflows over the past few quarters as customers reallocated some of their deposits to higher-yielding money market accounts or other cash alternatives. This is natural and expected in a higher-rate environment. For the typical bank, this is also very manageable, as the median bank saw average deposits decline by 0.3% in the first quarter.1 Even with these outflows, deposits in the banking system remain healthy, in our view, as the loan-to-deposit ratio for the industry hit a record low in 2021 of 56% compared with a 20-year average of 76%. (At year-end 2022, the ratio had moved to around 63%, but remained historically low.) As a result, we believe that, on the whole, banks have significant liquidity to deal with contingencies.

With banks' loan-to-deposit ratio still low, deposits remain healthy

Quarterly U.S. banks' loan-to-deposit ratios, January 2001–December 2022 (%)

Source: Federal Deposit Insurance Corp., 2023. Recession periods indicated are as defined by the National Bureau of Economic Research. Past performance does not guarantee future results.

Indeed, banks have begun to pay higher rates on deposits—again, a natural development of today’s rate environment. Repricing accelerated in the first quarter as the U.S. Federal Reserve (Fed) raised rates by a further 50 basis points, or half a percentage point, over the course of two meetings in February and March. This continued deposit re-pricing led to some negative earnings revisions for banks. Despite these cuts to the earnings outlook, U.S. regional banks as a group have recently been trading at a price-to-earnings2 multiple of less than 9x, which is more than one standard deviation3 below its historical discount relative to the 500 Index4 dating to the mid-1990s. Additionally, in our view, analysts’ earnings estimates seem conservative today, as we believe that they generally expect the elevated deposit-pricing environment to remain in the medium term.

Moreover, we believe that banks remain attractively valued on a price-to-book2 value basis as well. Bank stocks were trading at 0.91x their reported book value as of May 5, 2023—a meaningful discount to their long-term average of 1.58x dating to the mid-1990s.5 In addition, this is in an environment where book value is growing driven by steady earnings. The median bank posted a return on equity6 of over 12% in the quarter.1

While we expect there is likely to be some continued volatility, historically, periods like these have been an attractive entry point for investors, in our view.

In the wake of March’s failures of SVB and SB, the Federal Deposit Insurance Corp. (FDIC) announced on May 1 that it seized First Republic Bank (FR) and sold the deposits and assets to JPMorgan Chase (JPM). The more than $100 billion in deposit outflows that FR had sustained were by far the largest in the industry. To fill the gap from the lost deposits, FR leaned heavily on the Fed’s discount window and a $30 billion coordinated deposit from a consortium of 11 banks to stabilize liquidity. FR was an outlier in this regard, as the median bank saw average deposits decline by only 0.3%.1

The effect of this was that FR’s future profitability was severely impaired. This became more apparent to the market after the bank reported earnings on April 24. Its report was starkly different than the stability shown at most institutions, which was accentuated when FR’s management didn’t take analysts’ questions on its earnings conference call, as is industry practice. As a result, FR’s stock came under further pressure, and regulators saw that there was little chance for an open bank restructuring of the institution.

The sale to JPM fully protected both depositors who were insured under the standard FDIC coverage of up to $250,000 and those customers with deposits that exceeded that threshold. In fact, for FR customers on the Monday morning of its closure, it was effectively a normal course of business. We believe that FR’s acquisition by JPM is likely to further limit contagion risk within the banking system, since depositors were fully protected in this process.

FR’s troubles put regional banks back in the forefront of investors’ minds, and fears that other banks could be at risk sparked a crisis of investor confidence in early May. We believe this situation was likely exacerbated by short selling—a strategy employed by market participants who seek to generate investment gains from a decline in the price of a given security. This crisis of confidence seemingly peaked on May 4 following a media report that a West Coast bank was seeking strategic options. The news report received intense focus, even though the bank had openly discussed many strategic options—including partnering with another institution—during its earnings conference call held the previous week. At the time, the earnings report was well received by the market. This bank was one of the handful of institutions that had suffered abnormal deposit flows in days following the SVB collapse due to a portion of its business overlapping with SVB’s business. That said, the bank was able to manage the initial liquidity pressure and had grown deposits in April. If pressure were to continue to build on a bank such as this, we believe such a scenario could serve as a catalyst for the Fed or FDIC to provide further support for the industry and to try to ensure that contagion risks are contained.

Our fundamentally driven research process requires extensive interviews with companies to gather intelligence about individual banks and the industry as a whole. Given this environment of market stress, we’ve increased our typical level of industry contact. The bank management teams with whom we’ve been in contact with recently indicated no abnormal behaviour from clients or businesses in their communities. It was comforting to us that, despite the frequent negative news and strong selling pressure in the market, most banks’ day-to-day operations appear to be conducting business as usual. Furthermore, we’ve been closely monitoring the regulatory environment through meetings with both former federal officials as well as U.S. policy strategists and experts to stay abreast of potential regulatory changes and updates.

1 “KBW Bank Earnings Wrap-Up 1Q23: 1Q Results Reveal Earnings Headwinds, but Universal Fared the Best,” Keefe, Bruyette & Woods, May 2, 2023.

2 Price to earnings (P/E) is a valuation measure comparing the ratio of a stock’s price with its earnings per share, Price/book is the ratio of a stock’s price to its book value per share.

3 Standard deviation is a statistical measure of the historic volatility of a portfolio. It measures the fluctuation of a fund’s periodic returns from the mean or average. The larger the deviation, the larger the standard deviation and the higher the risk.

4 The S&P 500 Index tracks the performance of the largest publicly traded companies in the United States. The S&P Composite 1500 Banks Index tracks the performance of publicly traded large- and mid-cap banking companies in the United States. The S&P Composite 1500 Index tracks the performance of 1,500 publicly traded large-, mid-, and small-cap companies in the United States. It is not possible to invest directly in an index. Past performance does not guarantee future results.

5 FactSet, as of April 28, 2023, for the S&P 500 Index relative to its average dating to December 31, 1994.

6 Return on equity (ROE) is a measure of profitability that calculates how many dollars of profit a company generates with each dollar of shareholders’ equity.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.