25 January 2024

Hui Min Ng, Portfolio Manager, Equities

Asia Pacific (ex-Japan) REITs (Asia REITs) experienced a challenging 2023 on the back of a restrictive interest rate environment and uncertainty over the timing of a Federal Reserve (Fed) monetary policy pivot. Additionally, high rates across the Asia region led to concerns of significant asset de-valuations. However, a more dovish tone from the Fed, coupled with expectations of potential rate cuts, drove a strong rally in Asia REITs in the fourth quarter. As Hui Min Ng, Portfolio Manager, outlines in this 2024 outlook, Asia REITs offer investors a unique income opportunity in the new year as rates have likely peaked with the possibility of declining borrowing costs in 2024.

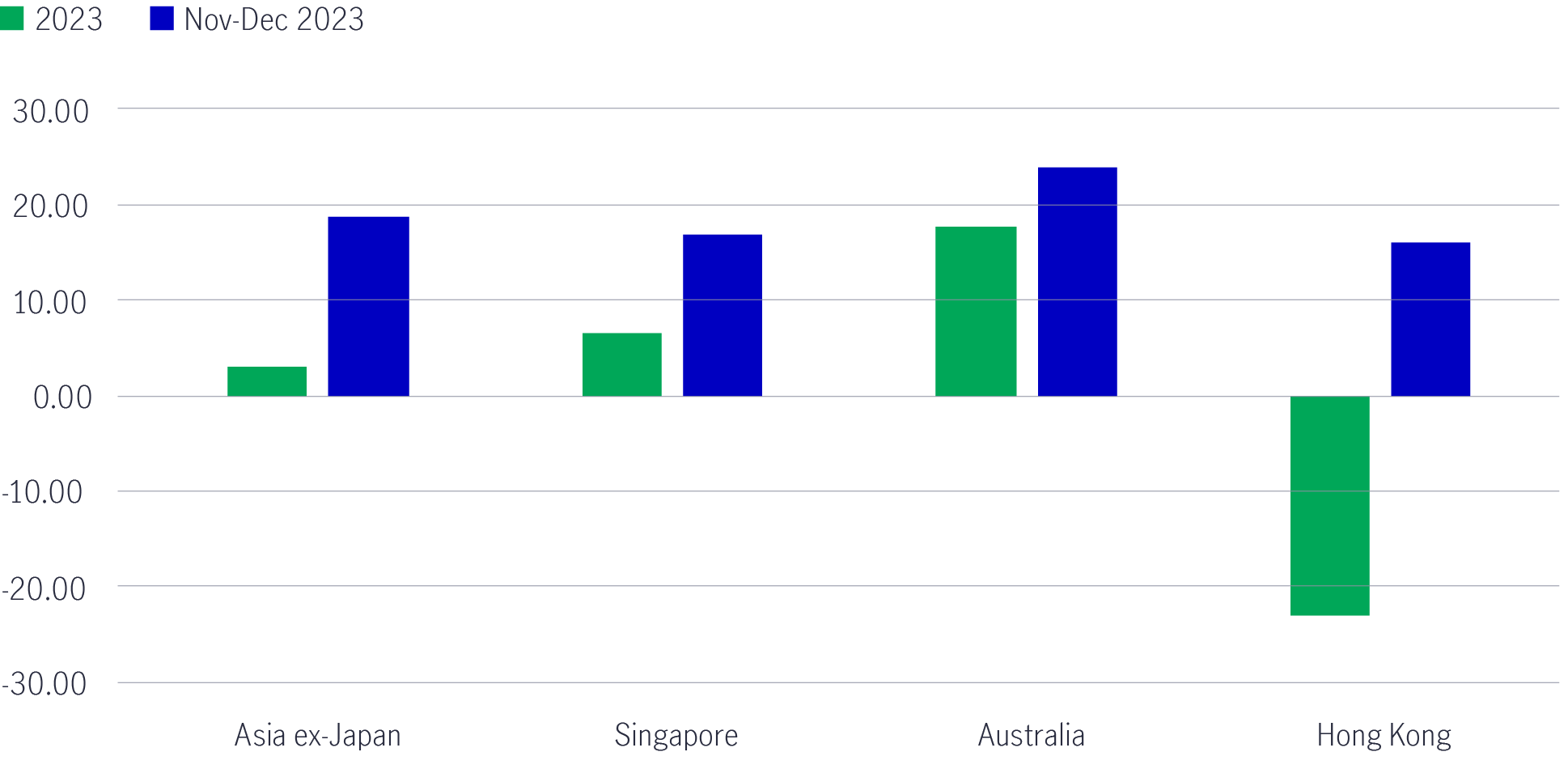

2023 was another volatile year for Asia REITs. Performance challenges were apparent for most of the period due to the high interest-rate environment, uncertainty around borrowing costs vis-à-vis the Fed’s rate-hike profile, and the negative implications for REIT distributions, asset values, and growth opportunities. However, Asia REITs rebounded strongly in November and December 2023 as global 10-year benchmark yields declined in response to the Fed’s dovish tone (See Charts 11 and 2). This led to market expectations for potential rate cuts in 2024.

Chart 1: Asia REIT geographic performance, 2023 and November/December 2023

Chart 2: Asia REIT sector performance, 2023 and November/December 20232

Overall, Australia REITs were clear beneficiaries of the changing interest-rate narrative, given they are the most sensitive to US rate moves. In contrast, Hong Kong’s underperformance was more idiosyncratic due to concerns about the impact of China’s economic slowdown on Hong Kong’s reopening optimism.

Despite the persistent macro headwinds negatively impacting Asia REITs, the market’s underlying operational fundamentals remained resilient throughout the year. Positive rental reversions, high occupancy rates, and recovering demand were common drivers across most sectors, which helped mitigate some of the negative impacts on distribution and asset valuations that the market was pricing in.

Considering the potential lower rate environment, we believe that overall financial strength and resilient operational metrics should provide a base for growth momentum to improve once the interest-cost drag peaks in 2024.

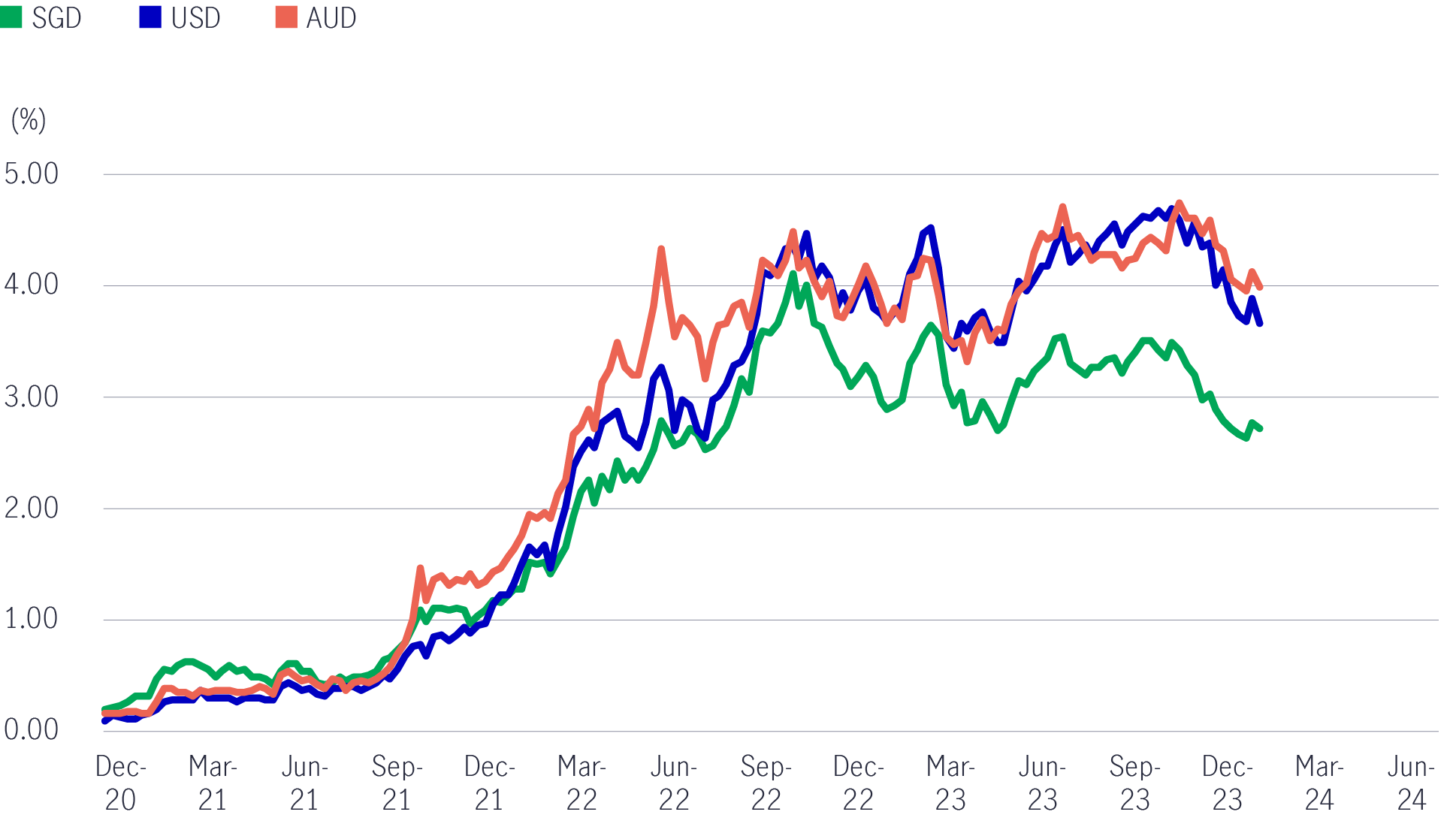

Key swap rates moved lower at the end of 2023 (See Chart 3), which indicates declining marginal debt cost for Asia REITs.

Chart 3: Three-year swap rates in selected markets

Source: Bloomberg, January 2024.

Today, the borrowing costs for new capital are lower than just three months ago. REITs will need to refinance their debt, and we expect that the cost of debt will peak soon.

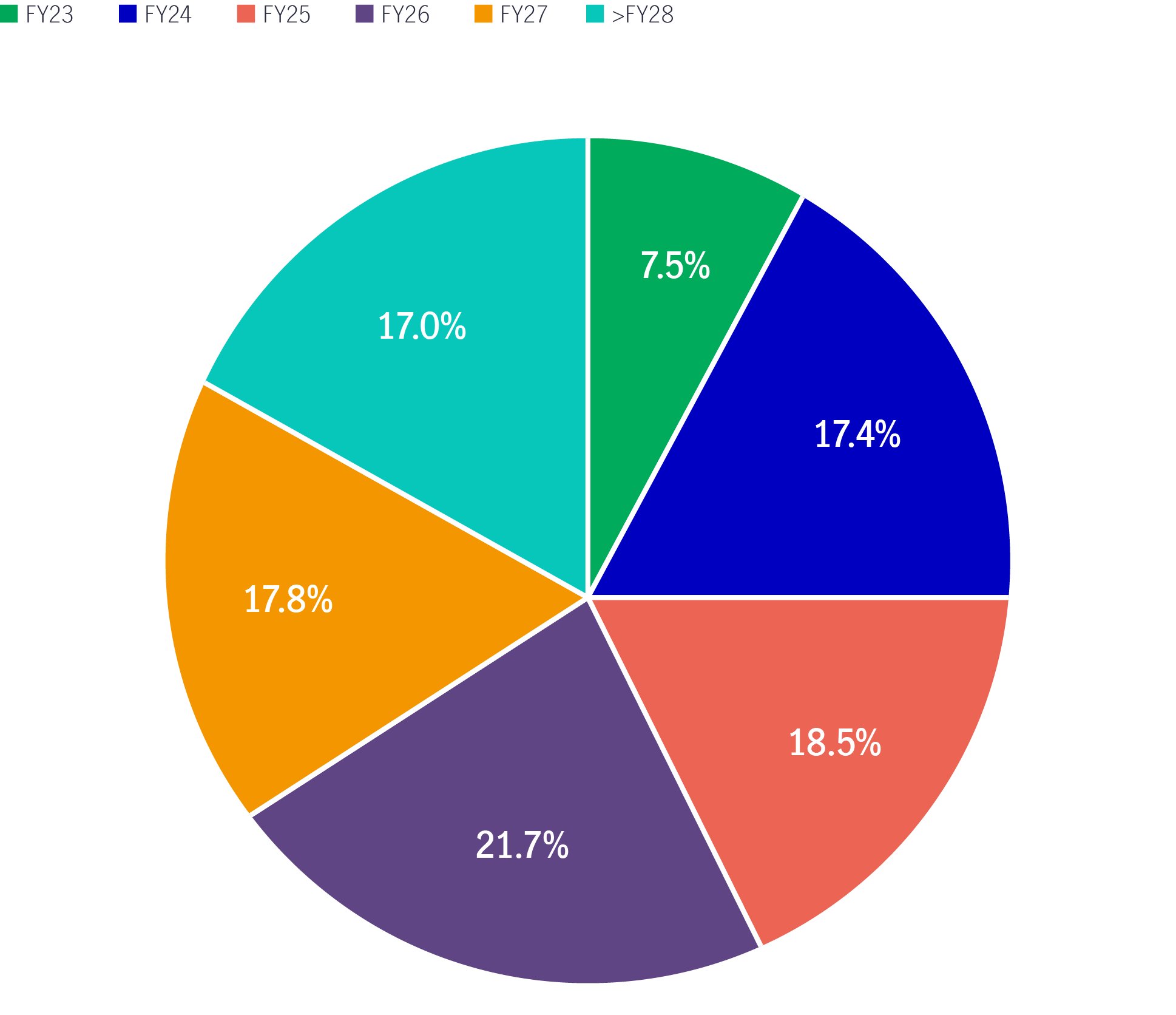

For 2024, the distribution per unit (DPU) outlook is muted. For instance, 25% of Singapore REIT debt will need to be refinanced (at still elevated rates) by the end of the year (See Chart 4). However, visibility has improved as lower rates in the second half of 2024 should allow for dividend growth to resume in 2025.

Chart 4: Debt expiry profile for Singapore REITs

Source: DBS Bank, January 2024.

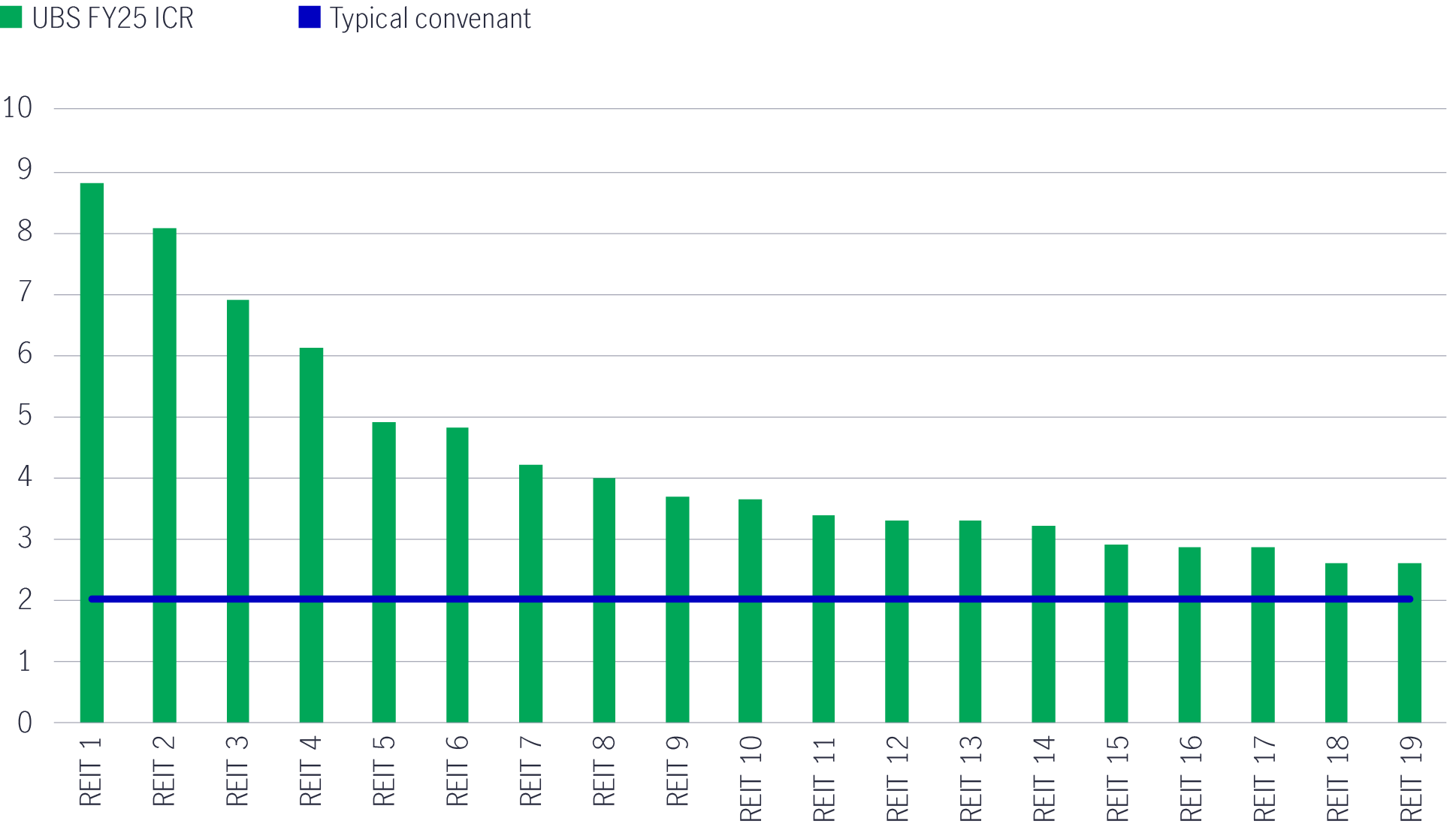

Meanwhile, in Australia, interest coverage ratios for most of the REIT sector are quite healthy and above the typical covenant levels (see Chart 5). As debt cost headwinds are subsiding, this could potentially relieve pressure on downward earnings revisions for FY 2025 (estimated).

Chart 5: Interest coverage ratio (FY25) for selected Australian REITs

Source: UBS, January 2024.

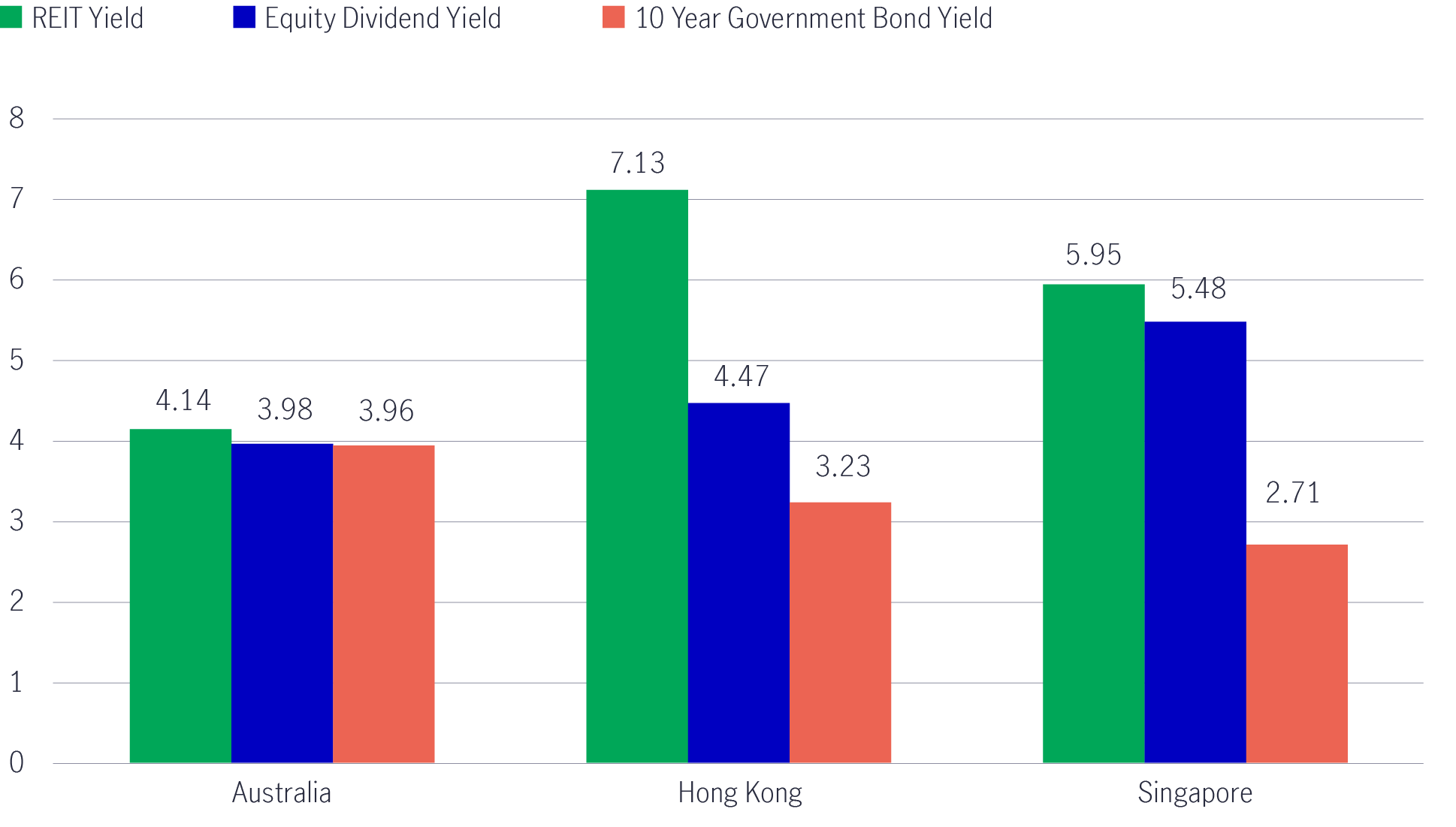

Despite the most recent rally, REIT yields are still attractive relative to other asset classes (See Chart 6).

Chart 6: Regional REIT yields still attractive among similar investments3

Source: Bloomberg, as of 31 December 2023.

As the macro headwinds of 2023 are expected to ease in 2024, we believe that the market (and investors) will begin to focus on the underlying fundamentals of REITs. Most Asia REITs have demonstrated resilient operating fundamentals, which we expect to continue in 2024.

This will be underpinned by recovering retail tenant sales amid limited new retail supply, regional supply chain shifts, and/or relatively tight supply, improving spot rentals for suburban retail, data centres and logistics. Furthermore, as leases signed at depressed rental rates during the height of COVID are renewed (particularly in retail), we see sustained healthy rental reversions.

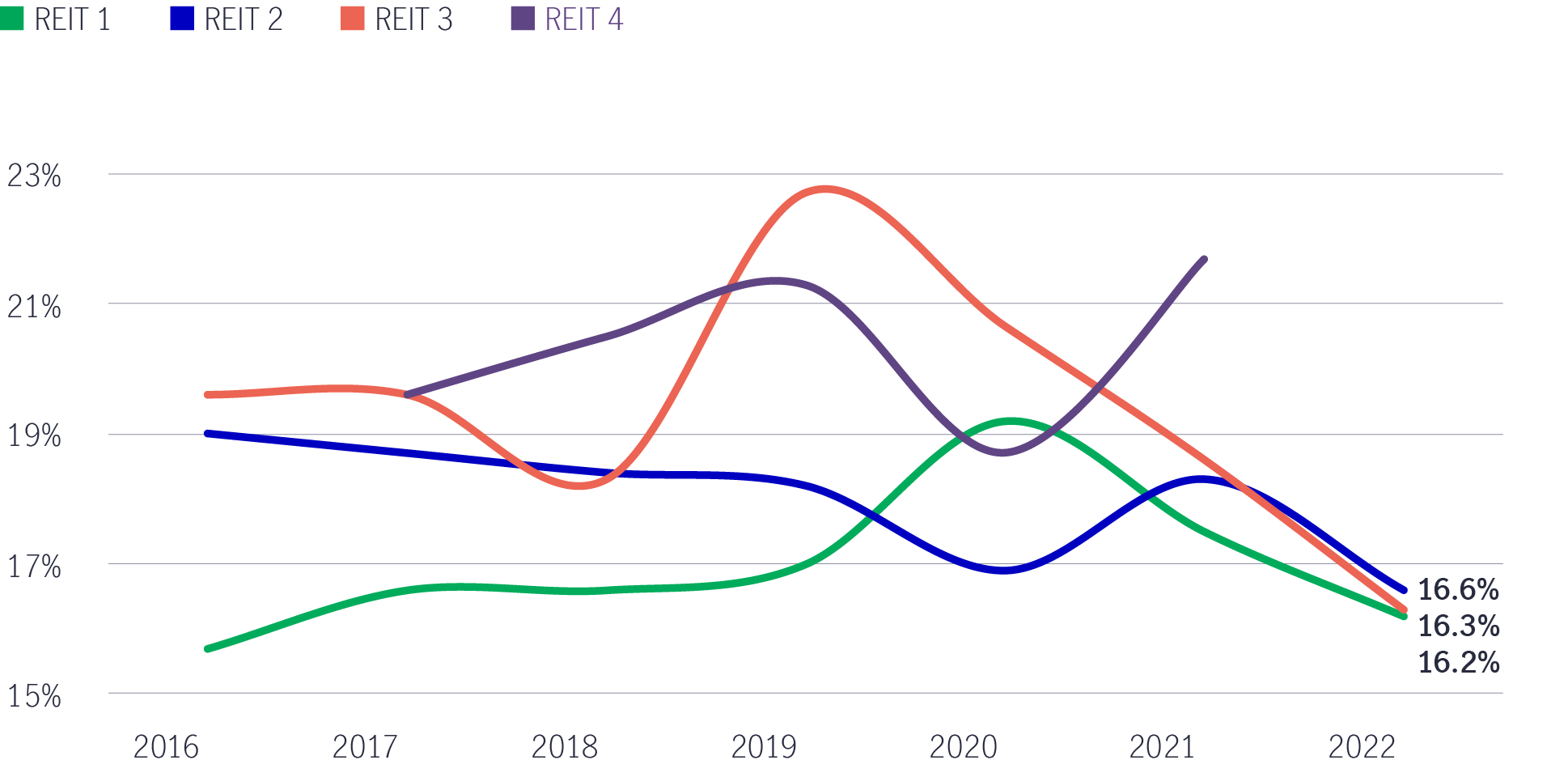

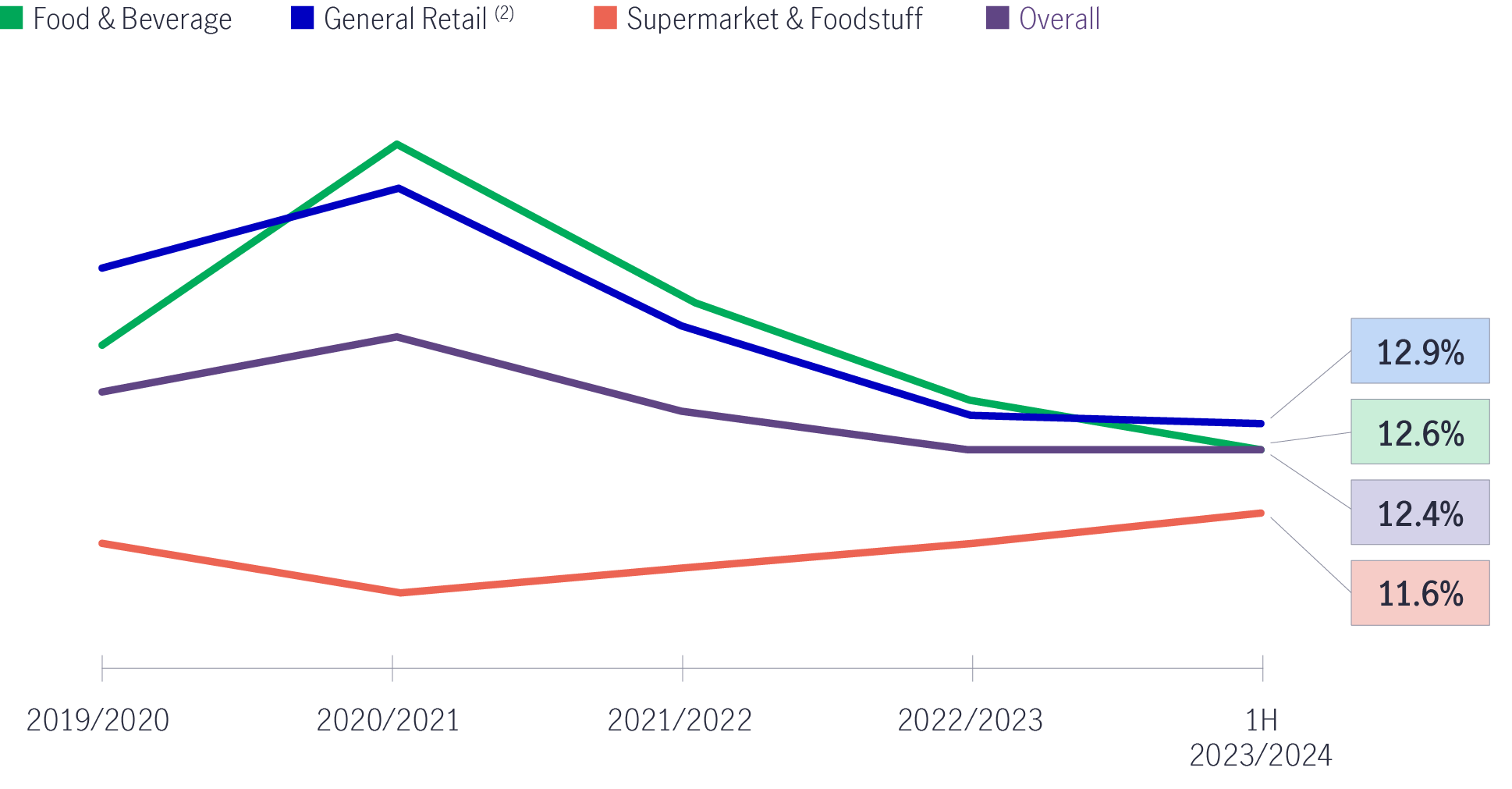

In Singapore and Hong Kong retail, we have seen a decline in the overall occupancy costs for tenants (See Chart 7 and 8). The lower the occupancy costs, the more room landlords have to raise rents. This should be one of the contributing factors to positive rental reversions for the retail sector in 2024.

Charts 7 and 8: Occupancy costs generally falling among Singapore retail REITs and across sectors4

Source: Company reports, DBS Bank, January 2024.

Source: Company reports, November 2023.

Industrial and data-centre REITs performed well during a turbulent year in 2023. These are sectors with structural growth where strong demand for assets and limited new supply resulted in high occupancy rates, positive rental reversions and distribution visibility. We believe the new economy story is still resilient, with data centre demand a bright spot.

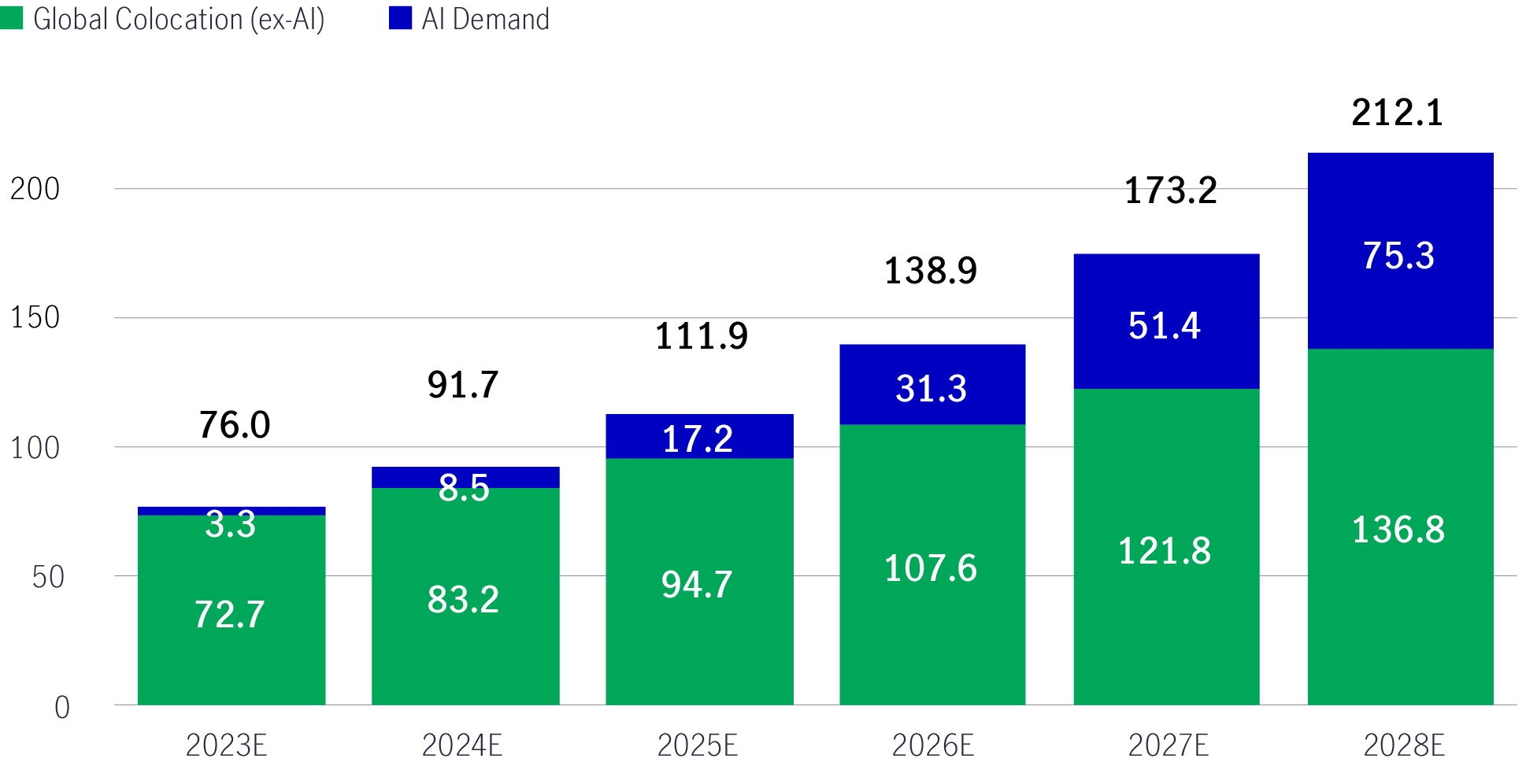

While artificial intelligence (AI) is not a recent phenomenon, the rapid rise of consumer applications leveraging generative AI (e.g., ChatGPT) has seen AI emerge as a key market theme. The ongoing evolution of AI usage is expected to result in solid volume growth across the server industry in the next five years, with the AI service market, driven by AI-enabled hyperscalers, growing by an estimated 30% over that period.

As the server industry’s main growth driver changes from “storage” to “computing”, greater content expansion and demand for computing power should be positive for data centres.

The contribution to the data-centre market growth from AI demand is expected to expand at a compound annual growth rate of 86% over the next five years. It should make up around 36% of the market by 2028, compared to approximately 4% in 20235.

Colocation demand, which is capacity that is leased from a third-party data centre operator, is also forecast to increase (See Chart 9).

Chart 9: Global co-location (ex-AI) and AI demand market forecasted to rise

Source: Structure Research, January 2024.

Note: Colocation – capacity that is leased from a third-party data centre operator.

While we are in the early stages of adoption, with use cases still fairly novel, the longer-term impact looks significant.

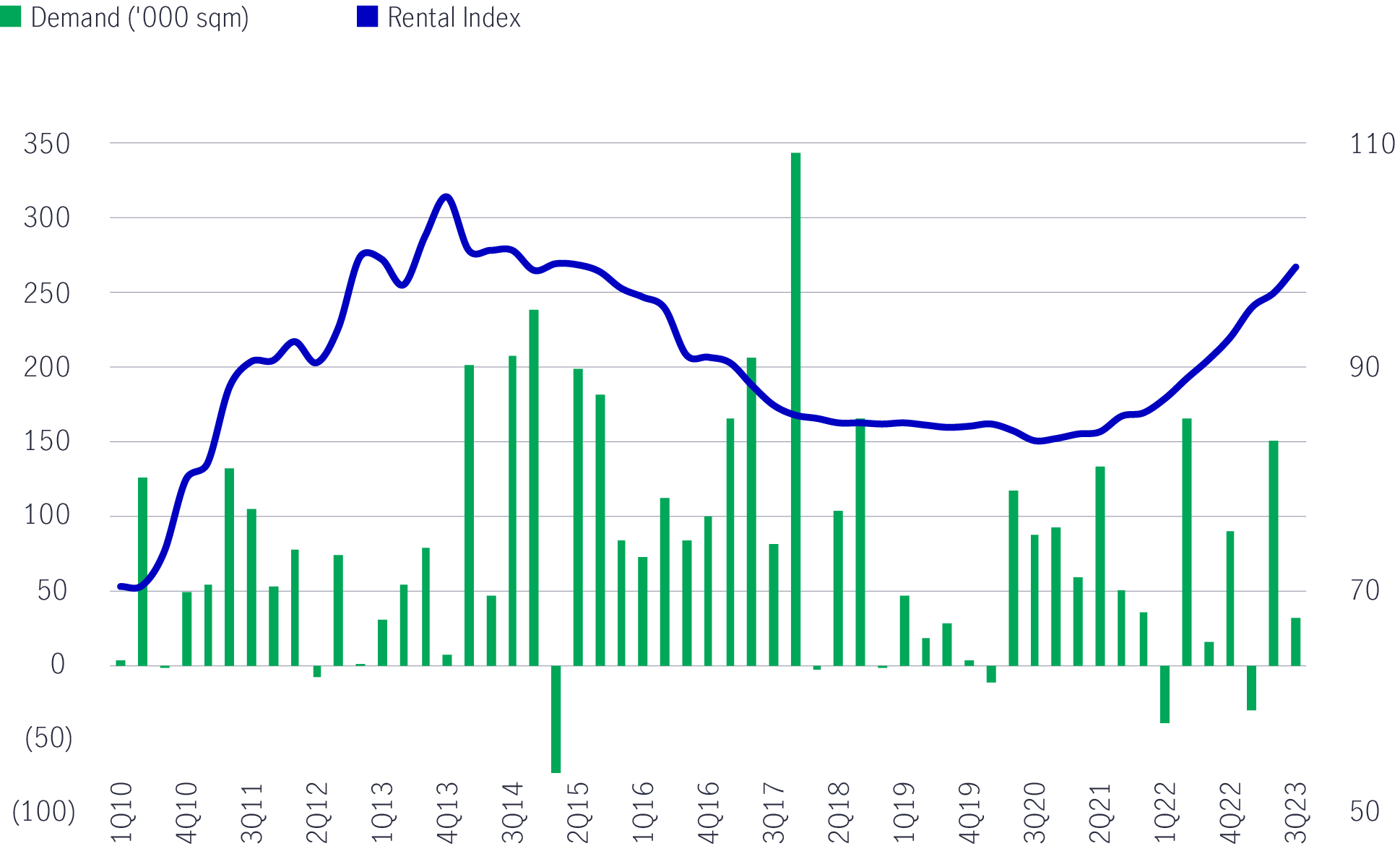

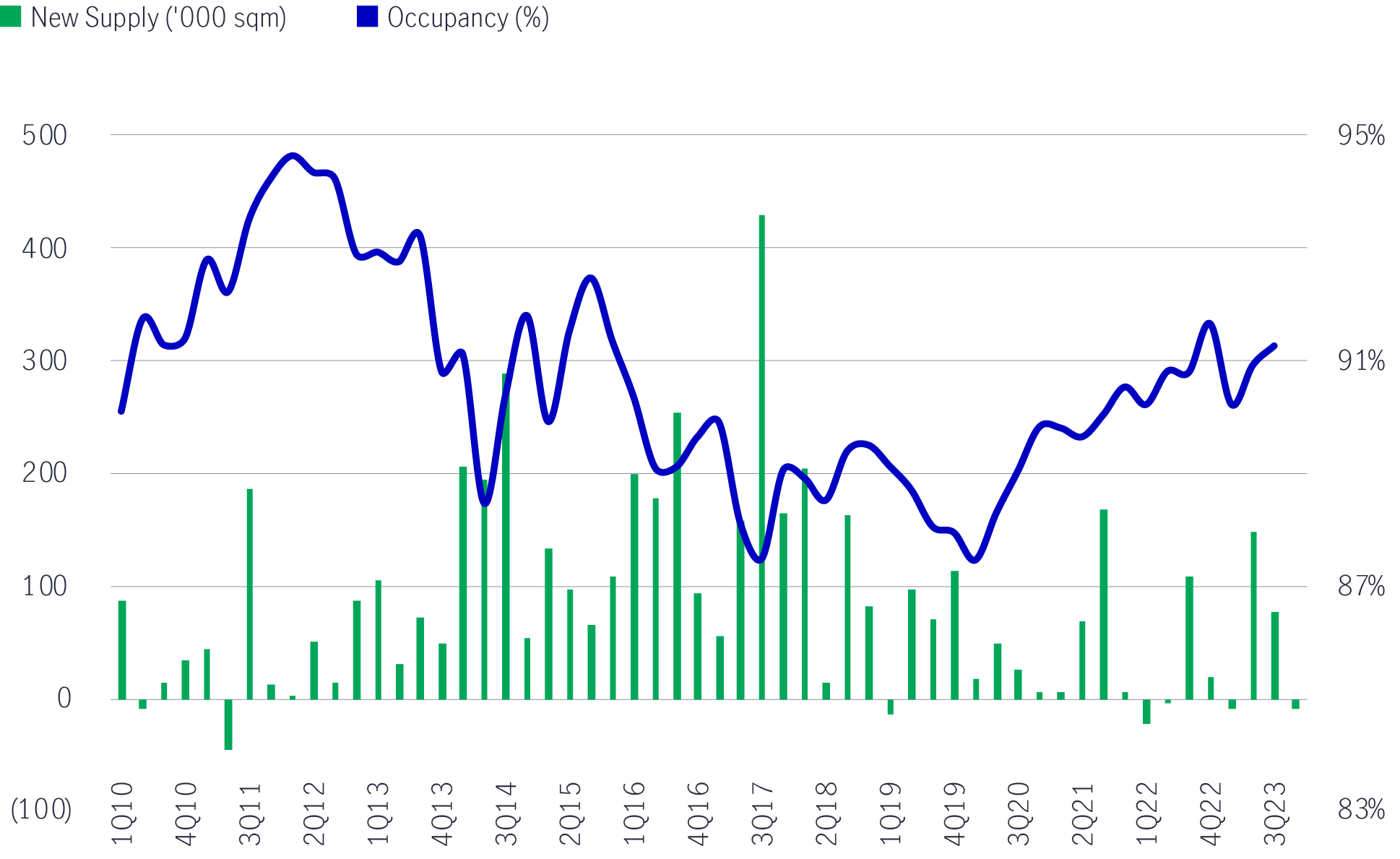

For industrial REITs, warehouse demand is expected to remain healthy, given the expansion of the logistics sector, with tenants still operating a just-in-case model. Considering where spot rents currently sit, this strong demand and improving occupancy should allow for positive rental reversions across the sector, driving organic growth (See Charts 10 and 11).

Charts 10 and 11: Lower supply with improving occupancy and stronger demand supports pricing

Source: DBS Bank, URA, January 2024.

As rates peak and begin to move lower throughout 2024, lower financing costs could result in a revival of M&A activity, allowing REITs to seek inorganic growth opportunities. This could provide support for medium to long-term DPU growth. We believe lowly- geared REITs can deploy their balance sheet capacity to deliver DPU-accretive acquisitions. Real-estate fund managers should also benefit from a pickup in transactional activities.

Despite an easing of headline macro challenges, fundamental aspects that deserve monitoring are tenant renewal risk and default risk. These factors would directly impact cash flow, which would negatively affect distributions.

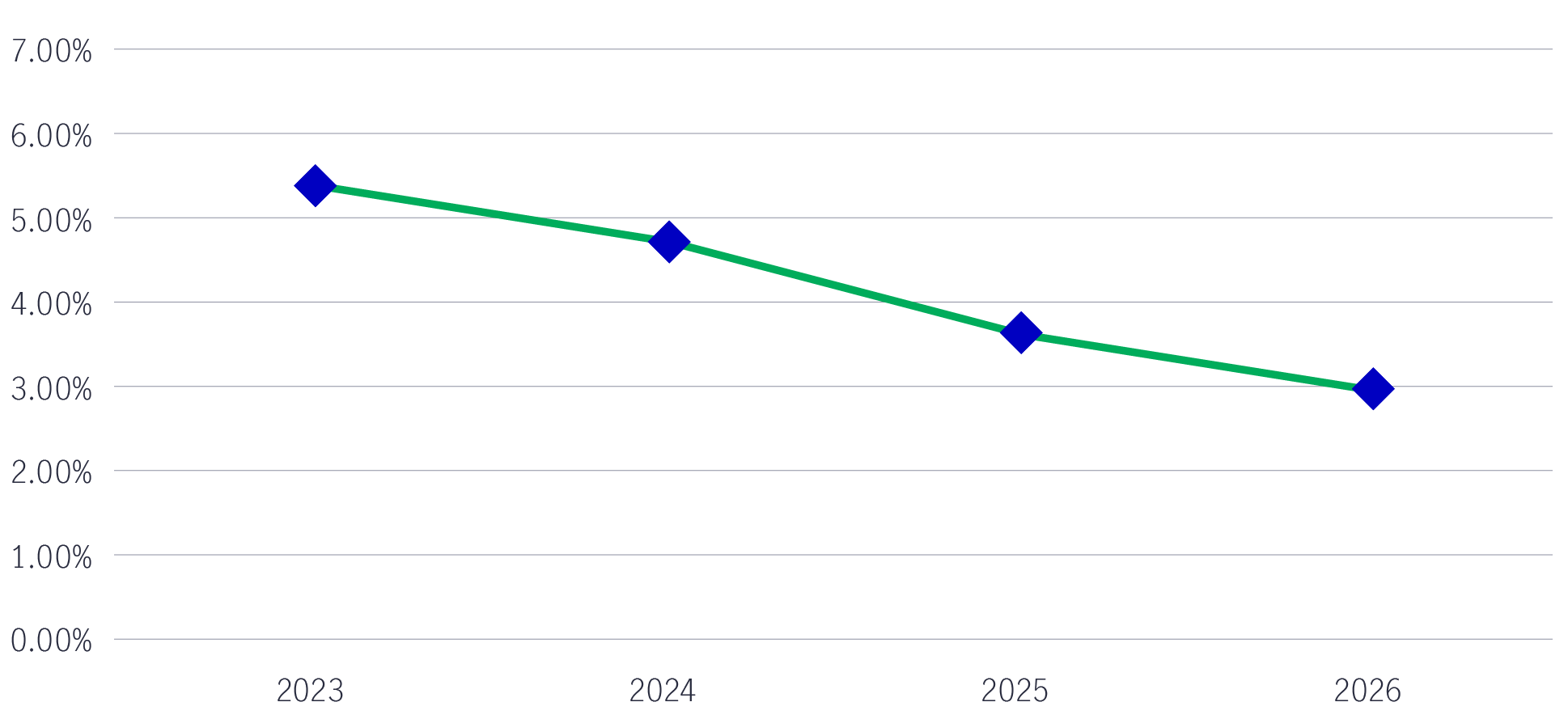

Entering 2024, Asia REITs should perform marginally better, given relatively low market expectations, discounted valuations and low sector exposure by investors. With peak hawkishness likely behind us, a key macro pressure point weighing on Asia REITs should reverse in the year ahead, as shown by the Federal Open Market Committee’s ‘dot plot’ (See Chart 12). Resilient operating fundamentals should continue in key sectors, providing investors with unique income opportunities in 2024.

Chart 12: FOMC dot plot (as of December 2023 meeting)

Source: Bloomberg, January 2024.

1 Source: Bloomberg, as of 31 December 2023. Asia ex Japan- S&P Pan Asia Ex-JP, AU, NZ, PK REIT 10% Capped Index (USD) TR; Australia- S&P/ASX 200 A-REIT Index; Hong Kong- Hang Seng REIT Index; Singapore- FTSE ST All-Share Real Estate Investment Trusts Index SGD.

2 Source: FactSet, Manulife Investment Management, as of 31 December 2023. Index: S&P Pan Asia Ex-JP, AU, NZ, PK REIT 10% Capped Index (USD) TR.

3 Source: Bloomberg, as of 31 December 2023. Equity dividend: Australia- S&P/ASX 200; HK- Hang Seng Index; Singapore- Straits Times Index. REITs: Australia- S&P/ASX 200 A-REIT Index; HK- FTSE EPRA Nareit Developed REITs HONG KONG Total Return Index USD; Singapore- FTSE ST All-Share Real Estate Investment Trusts Index SGD. Fixed Income: Australia- 10-year government bond; HK- HKMA Hong Kong Government Bond Fixing 10 Year Yield. Singapore- Monetary Authority of Singapore Benchmark Govt Bond Yield 10 Year.

4 REIT 4 performance data starts from 2017.

5 Source: Structure Research and Manulife Investment Management, January 2024.

Midyear 2025 global macro outlook: what’s changed and what hasn’t

More forceful-than-expected government policy decisions, particularly by the United States, have swiftly overtaken some of our early 2025 views. Global trade issues and deglobalization have indeed come to the fore, with knock-on effects for many trade-sensitive emerging markets. Elsewhere, capital markets the world over are contending with a big wave of government debt supply, which is driving global bond yields higher.

Greater China Equities: 2H 2025 Outlook

The latest Greater China Equities Outlook highlights how our investment team navigates global uncertainties and invests through the lens of our investment framework via the “4A” positioning: Acceleration, Abroad, Advancement, and Automation.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

Midyear 2025 global macro outlook: what’s changed and what hasn’t

More forceful-than-expected government policy decisions, particularly by the United States, have swiftly overtaken some of our early 2025 views. Global trade issues and deglobalization have indeed come to the fore, with knock-on effects for many trade-sensitive emerging markets. Elsewhere, capital markets the world over are contending with a big wave of government debt supply, which is driving global bond yields higher.

Greater China Equities: 2H 2025 Outlook

The latest Greater China Equities Outlook highlights how our investment team navigates global uncertainties and invests through the lens of our investment framework via the “4A” positioning: Acceleration, Abroad, Advancement, and Automation.

Quick comments on Moody's cut US credit rating

On May 16, credit rating agency Moody's Ratings downgraded the United States' credit rating from Aaa to Aa1. Alex Grassino, Global Chief Economist, together with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.