We are positive on preferred securities1 for a number of reasons:

The first reason is interest rates, which are likely to be even lower for longer. We believe it will be some time before the US Federal Reserve decides to raise rates for fear of derailing a recovery.

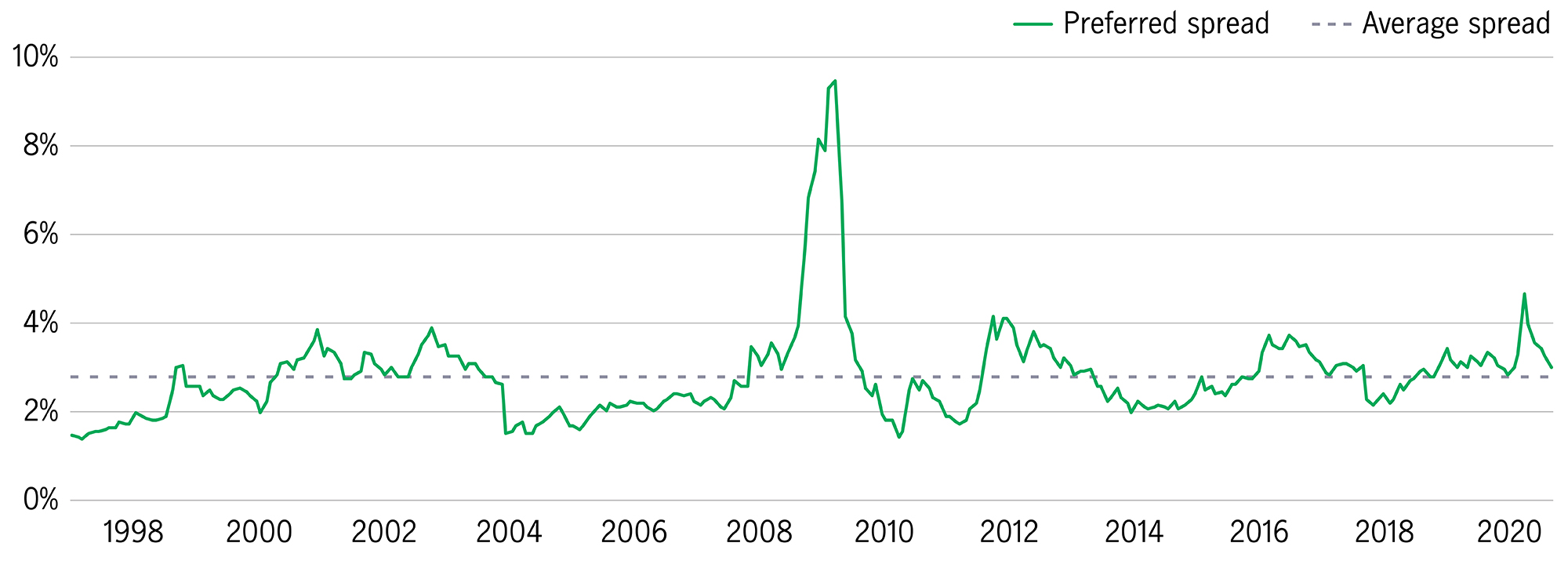

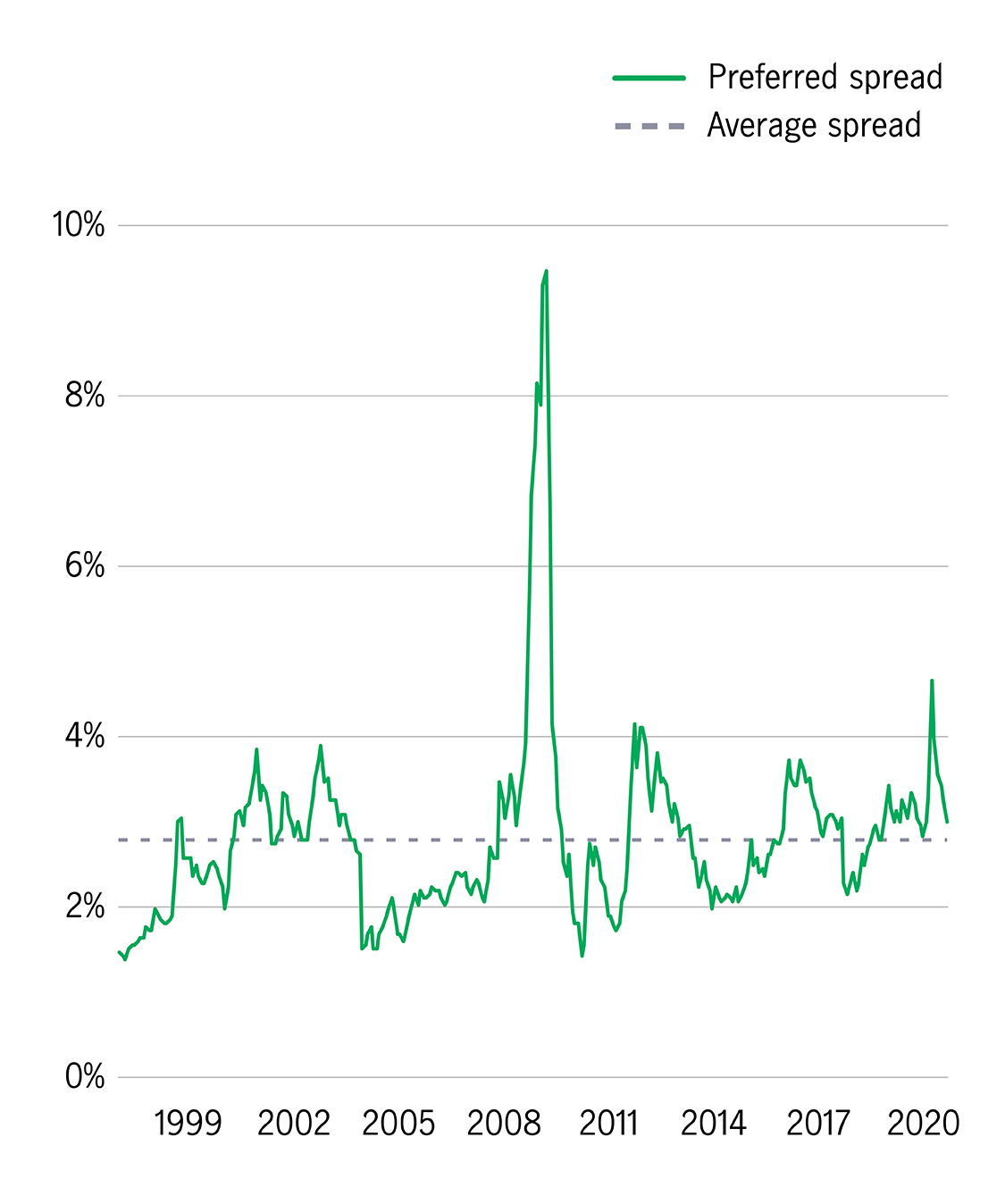

Secondly, preferred security spreads over the 10-year US Treasury bond yields remain relatively attractive and are currently at levels not seen since the global financial crisis in 2008-092.

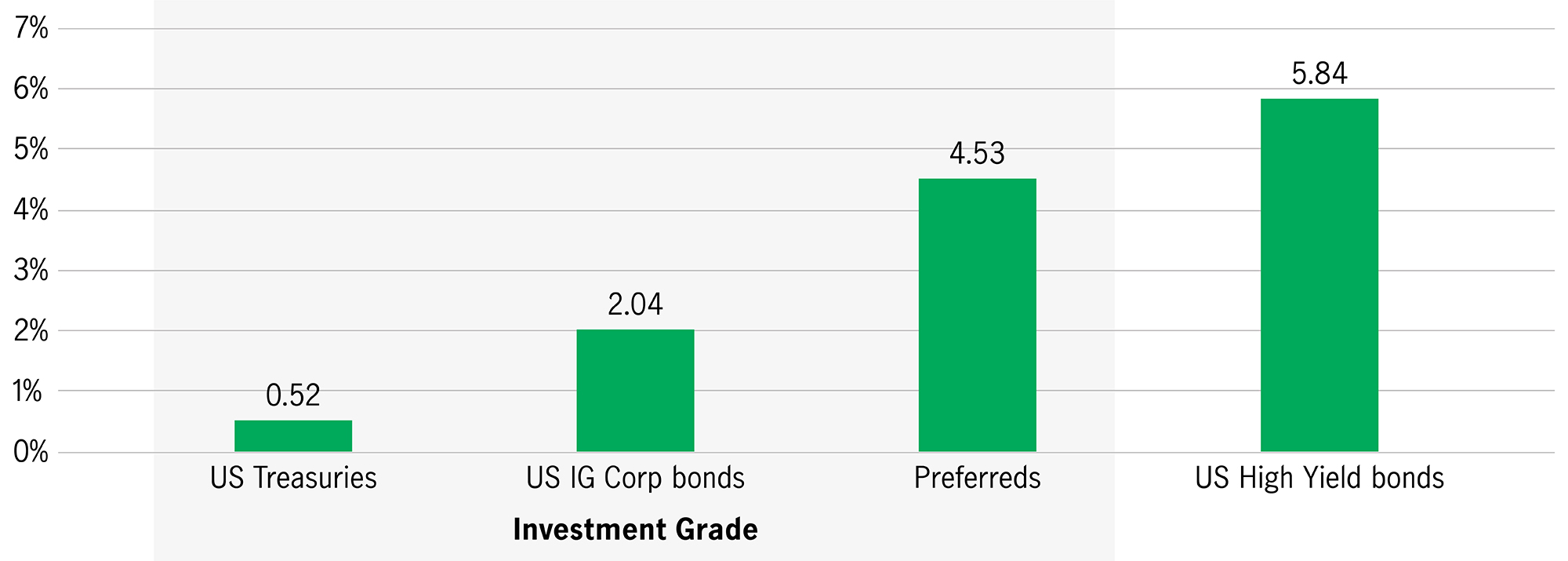

Preferred spreads over 10-year US Treasury bond yields2

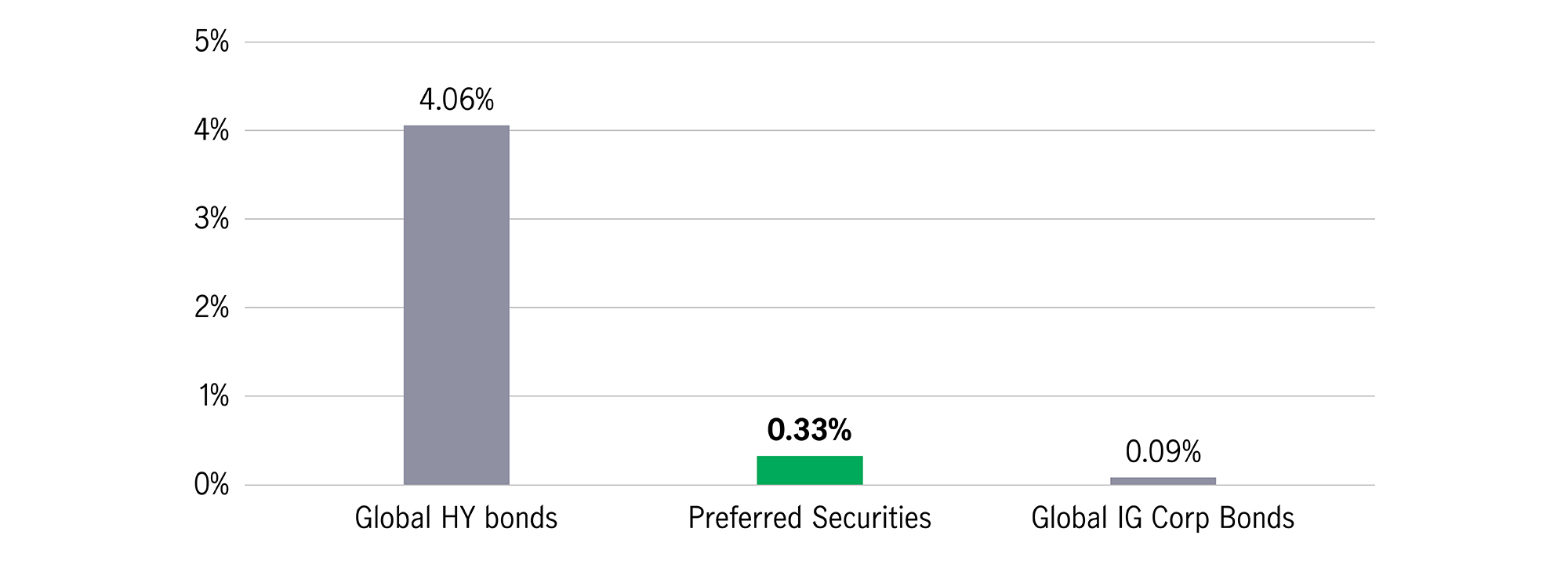

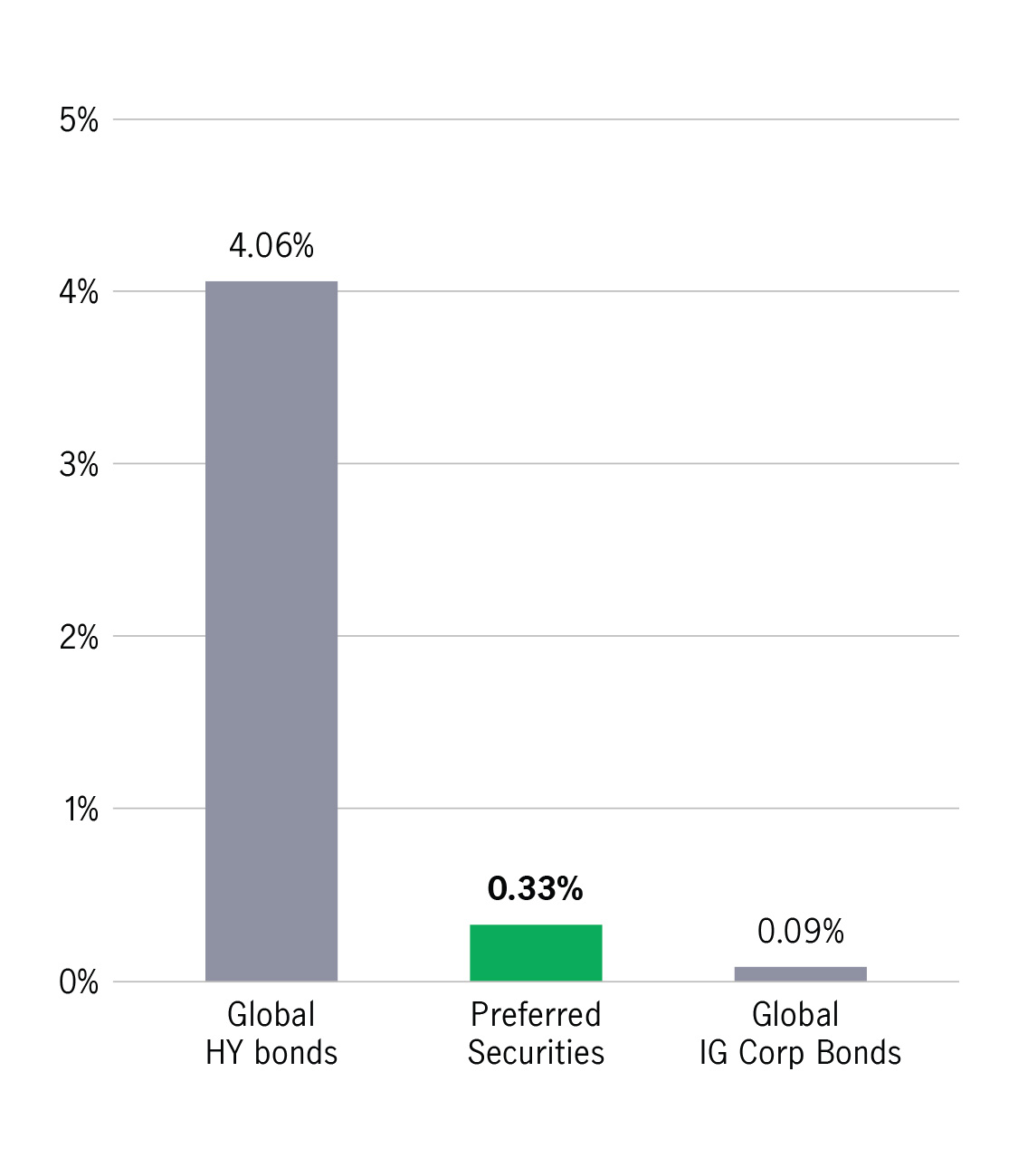

Thirdly, preferred issuers enjoy a relatively high credit quality. The average credit rating of preferreds is BBB-3. This is classed as investment grade (IG) – indeed, most preferred issuers are investment-grade rated. In terms of corporate defaults, preferred have experienced relatively few events compared to high-yield (HY) issuers4.

Averaged long-term default rates4

Over time, we believe that the market will recognise the value of these high-quality companies.

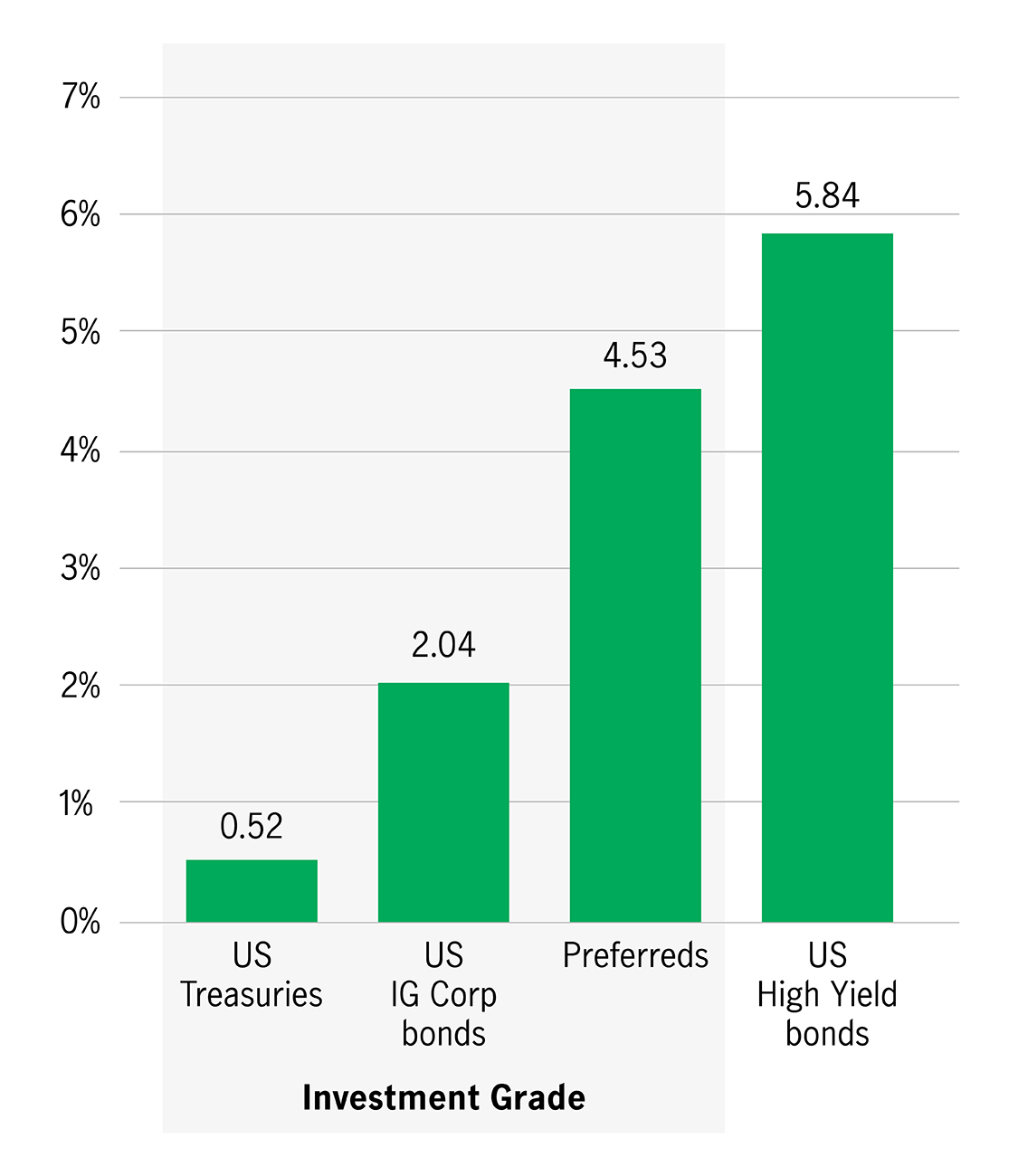

With most classed as investment grade, preferreds offer a yield to maturity of around 5%, compared to 0.53% for US Treasuries, and 2.53% for US investment-grade corporate bonds1.

The Federal Open Market Committee (FOMC)'s latest projections indicate policy rates will remain on hold through 20225. As the recovery could be a bumpy ride, investors would not only look for higher yielding asset classes for income but also focus on higher asset quality.

Yield to maturity of fixed income1

In terms of asset allocation, we differ greatly from our peers6 and the preferred market, as we generally have a smaller allocation in financials and a higher exposure to utilities – a sector known for its defensive nature. Also, we currently have no contingent convertible bonds (CoCos) in the portfolio7.

Through our differentiated strategy, we aim to provide investors with a more defensive approach to the preferred securities market.