Important Notes:

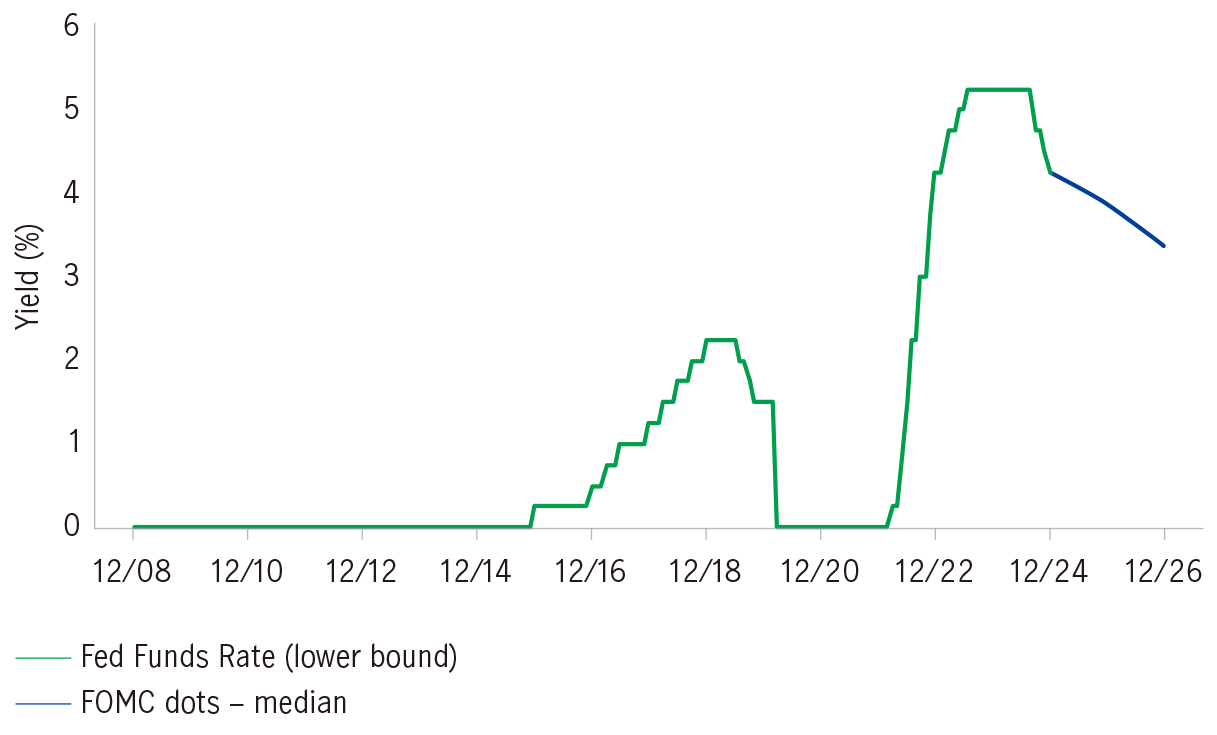

The current economic environment is marked by sustained higher yields, potential rate cuts, and ongoing market volatility. Rather than holding onto cash while waiting for investment opportunities, investors might consider cash management solutions.

The Fund can serve as a good alternative to sitting on cash while providing the opportunities to earn the USD money market rate. It also tends to have relatively lower risk with primary considerations of maintaining asset value against the volatility.

Source: Bloomberg, Manulife Investment Management, as of September 2025.

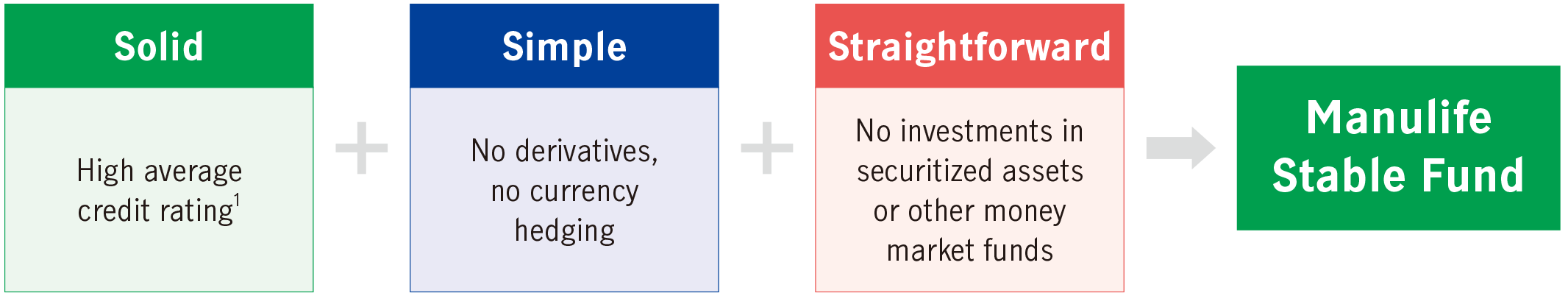

Characterized by the 3S principles, the Fund aims to deliver returns in USD that align with the prevailing money market rates. It achieves this by investing in short-term, high-quality money market instruments, including Treasury bills, certificates of deposit, commercial papers, and high-quality corporate bonds.

The Manulife Stable Fund offers a relatively liquid and stable cash parking solution, tailored to meet diverse wealth needs. It helps to:

| Fund name | Manulife Stable Fund |

Base currency |

USD |

Effective date |

March 28, 2025 |

Available share classes6 |

AA (USD) Inc; AA (HKD) Inc; AA (USD) Acc; AA (HKD) Acc; AA (USD) Inc (N); AA (HKD) Inc (N); AA (RMB) Inc (N) Hedged; AA (AUD) Inc (N) Hedged; AG (HKD) Inc; AG (USD) Inc |

Initial subscription fee5 |

Currently up to 5% of the NAV per share |

Management fee5 |

Currently 0.25% p.a. |

For illustration purposes only.

Due to the change of the investment objective and policy of the Fund, the Fund has been renamed from Manulife Capital Conservative Fund to Manulife Stable Fund with effect from March 28, 2025. The performance data prior to March 28, 2025 was achieved under circumstances that no longer apply. Please refer to the offering document for details.

Unless otherwise stated, all information sources are from Manulife Investment Management, as of September 30, 2025. Projections or other forward-looking statements regarding future events, targets, management discipline or other explanations are only current as of the data indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different than that shown here. Investment involves risk. Investors should not make investment decisions based on this material alone and should read the offering document for details, including the risk factors, charges and features of the product. This material has not been reviewed by the Securities and Futures Commission. Issued by Manulife Investment Management (Hong Kong) Limited.

4857183