Important Notes:

Manulife STARS Income and Growth Fund – Aiming to be your one-stop-shop solution for financial peace of mind

One-stop-shop solution aiming to help investors meet their financial goals and achieve financial peace of mind

Invest in multiple and specialised funds within a single product

Managed by our Multi-Asset Solutions Team with over 25 years of experience in managing multi-asset portfolios

An extra level of diversification via underlying funds

Manulife STARS Income and Growth Fund – Aiming to be your one-stop-shop solution for financial peace of mind

One-stop-shop solution aiming to help investors meet their financial goals and achieve financial peace of mind

Invest in multiple and specialised funds within a single product

Managed by our Multi-Asset Solutions Team with over 25 years of experience in managing multi-asset portfolios

An extra level of diversification via underlying funds

Regions, sectors and asset classes perform and correlate differently under different market conditions.

A well-balanced multi-asset portfolio can navigate through market cycles and effectively grasp valuable investment opportunities.

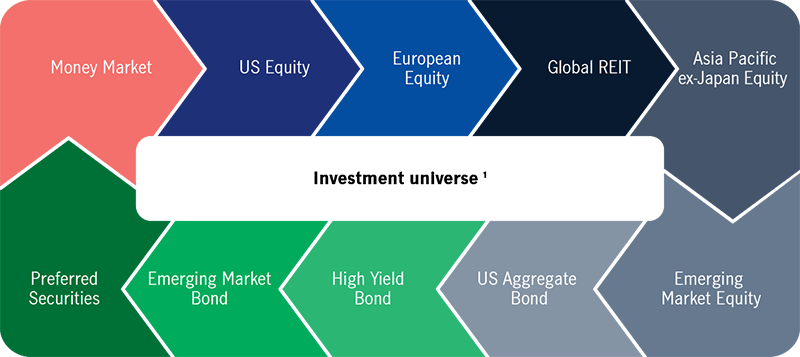

With our proprietary Strategic, Tactical, Asset allocation, Rebalancing Strategy, the Fund aims to provide income and potential for capital appreciation by tapping into a broad opportunity set of asset classes.

Select and access funds from across different regions, sectors and asset classes

• Tailored search criteria

• In-depth quantitative and qualitative analysis

• Fund selection and on-going monitoring

Construct the STARS portfolio

• Employs a proprietary optimisation process

• Utilises our forward-looking strategic views

• Tactically adjusts for short-term market considerations

• Adjusts for underlying manager style bias

Based on our Multi-Asset Solutions Team’s long-term and tactical views, the Fund aims to invest strategically for long-term growth, while simultaneously navigating short-term market dynamics. Watch our experts’ insights and strategies that can help you discover income and growth.

We continue to believe that emerging market (including Asia) equities remain appealing from a strategic perspective, especially in view of compelling valuations. On a structural basis, the United States has the healthiest long-term economic profile in the developed world.

We remain positive on credit, within US high-yield, investment grade and emerging market debt. We maintain ourfavourable view of US high-yield bonds, largely due to the carry, which the asset class can offer in the current low interest-rate environment.

Being strategically overweight in emerging market bonds remains one of our high-conviction views. We think the asset class could provide some of the most attractive expected total returns over both the short and long term, thanks to the relatively high level of expected income returns the asset class offers.

Emerging Market Equities

We currently hold a relatively positive long-term strategic view on emerging market equities versus those in developed markets. Across the universe of emerging market managers, our portfolio invests in the JPMorgan Funds – Emerging Markets Opportunities Fund, with additional diversification benefits coming from another reputable emerging market manager, the Schroder International Selection Fund – Emerging Markets.

Asian Equities

Within the emerging markets, Asian equities are our key preference. Our portfolio invests in the Manulife Global Fund – Asia Equity Fund which follows a fundamental bottom-up strategy to invest in a diversified portfolio for Asian equities.

Emerging Market Investment Grade Bond

Emerging market debt, especially high grade, stands out from a total return perspective within the fixed income universe. Our portfolio invests in the JPMorgan Funds – Emerging Markets Investment Grade Bond Fund which has exposure to a broad range of both sovereign and corporate credit.

Based on our Multi-Asset Solutions Team’s long-term and tactical views, the Fund aims to invest strategically for long-term growth, while simultaneously navigating short-term market dynamics. Watch our experts’ insights and strategies that can help you discover income and growth.

We continue to believe that emerging market (including Asia) equities remain appealing from a strategic perspective, especially in view of compelling valuations. On a structural basis, the United States has the healthiest long-term economic profile in the developed world.

We remain positive on credit, within US high-yield, investment grade and emerging market debt. We maintain ourfavourable view of US high-yield bonds, largely due to the carry, which the asset class can offer in the current low interest-rate environment.

Being strategically overweight in emerging market bonds remains one of our high-conviction views. We think the asset class could provide some of the most attractive expected total returns over both the short and long term, thanks to the relatively high level of expected income returns the asset class offers.

Emerging Market Equities

We currently hold a relatively positive long-term strategic view on emerging market equities versus those in developed markets. Across the universe of emerging market managers, our portfolio invests in the JPMorgan Funds – Emerging Markets Opportunities Fund, with additional diversification benefits coming from another reputable emerging market manager, the Schroder International Selection Fund – Emerging Markets.

Asian Equities

Within the emerging markets, Asian equities are our key preference. Our portfolio invests in the Manulife Global Fund – Asia Equity Fund which follows a fundamental bottom-up strategy to invest in a diversified portfolio for Asian equities.

Emerging Market Investment Grade Bond

Emerging market debt, especially high grade, stands out from a total return perspective within the fixed income universe. Our portfolio invests in the JPMorgan Funds – Emerging Markets Investment Grade Bond Fund which has exposure to a broad range of both sovereign and corporate credit.

Preferred Securities

Yields of preferred securities stand out from other investment grade and high yield bonds with relatively less default risk. Our portfolio invests in the Manulife Global Fund – Preferred Securities Income Fund, one of the key fund managers in this asset class which also aims to adopt a relatively defensive approach versus peers.

Global High Yield Bond

We believe the fundamentals of US corporates remain supportive and our portfolio maintains a healthy exposure to US high yield via the Fidelity Funds – US High Yield Fund, a highly diversified portfolio with a long track record. Our portfolio also invests in the JPMorgan Funds - Global High Yield Bond Fund and Barings - Global Senior Secured Bond Fund to gain additional diversification benefits across the high yield universe.

The Fund consists of multiple strategies which are driven by different expertise. These strategies are specially selected to navigate through market cycles while complying with a rigorous investment process, helping you capture income and growth. Watch the experts to share their analysis and find out more about characteristics, performance, and outlook of the strategy.

25+ years

History of managing multi-asset solutions

60

Investment professionals in multi-asset solutions team across the world

USD165.8 billion2

in AUM of multi-asset solutions

Source: Manulife Investment Management, as of 30 September 2021.

*Manulife Hong Kong Series – Manulife STARS Income and Growth Fund (Manulife STARS Income and Growth Fund or the “Fund”). STARS is an acronym for Strategic and Tactical Asset Rebalancing Strategy. The reference to “STARS” in the Fund’s name is not indicative of the Fund’s performance or returns.

Investment involves risk. Investors should not make investment decisions based on this material alone and should read the offering document for details, including the risk factors, charges and features of the product. This material has not been reviewed by the Securities and Futures Commission. Issued by Manulife Investment Management (Hong Kong) Limited.

549140