Important Notes:

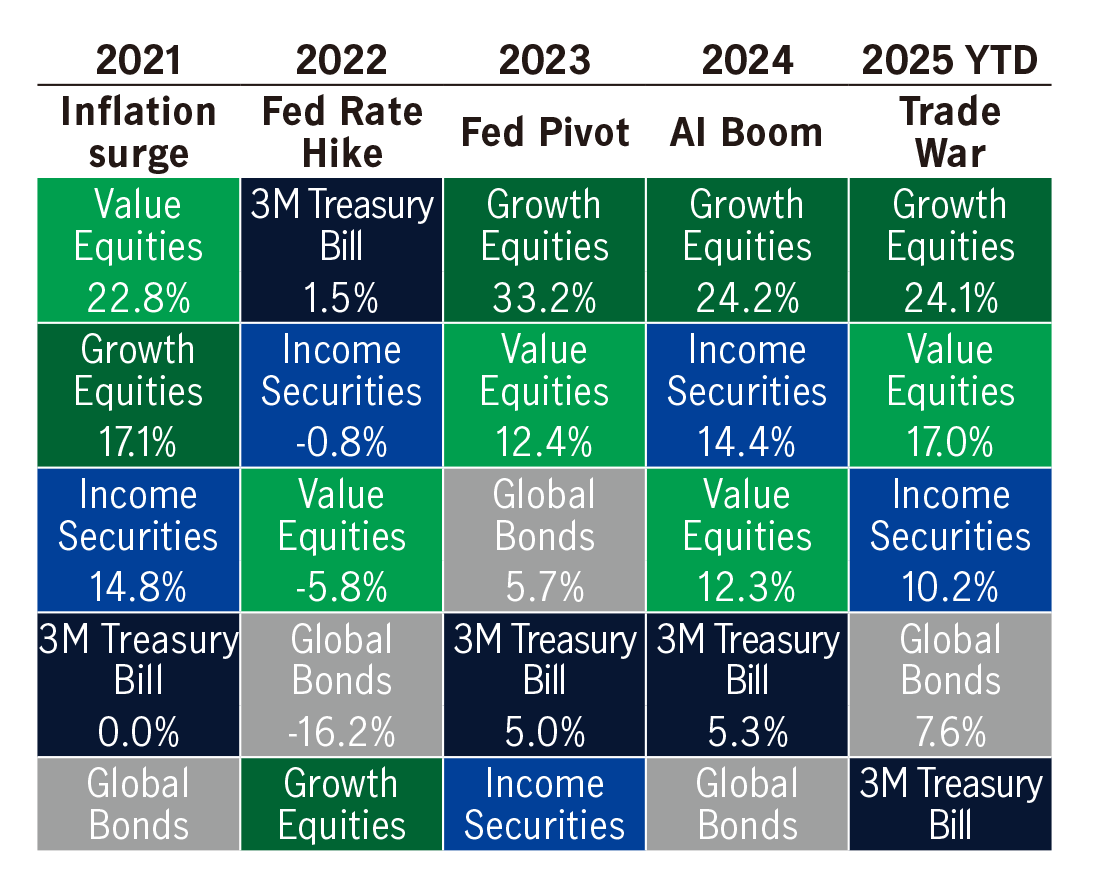

Holding cash is typically regarded as a short-term, stable approach; however, it can constrain the potential for long-term capital appreciation. In addition, different equity styles tend to perform differently across market cycles.

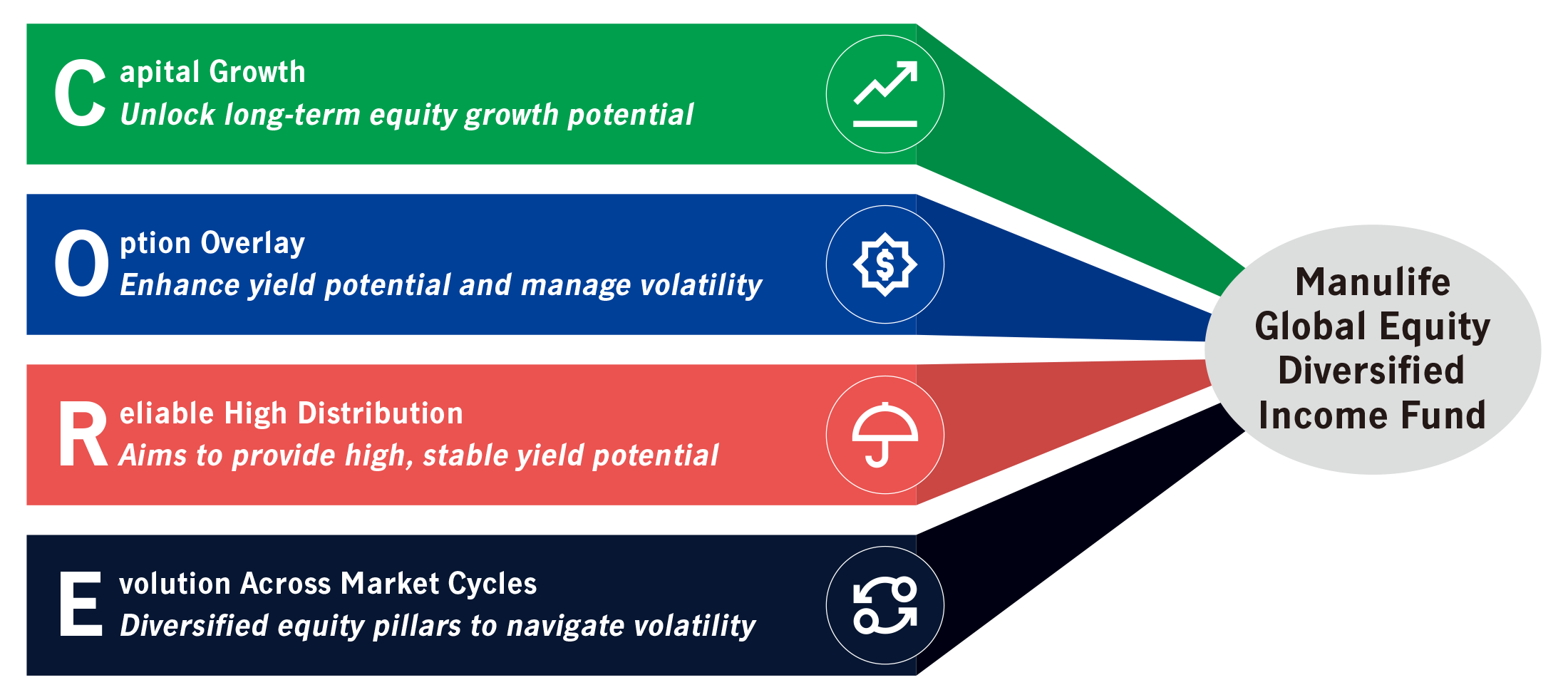

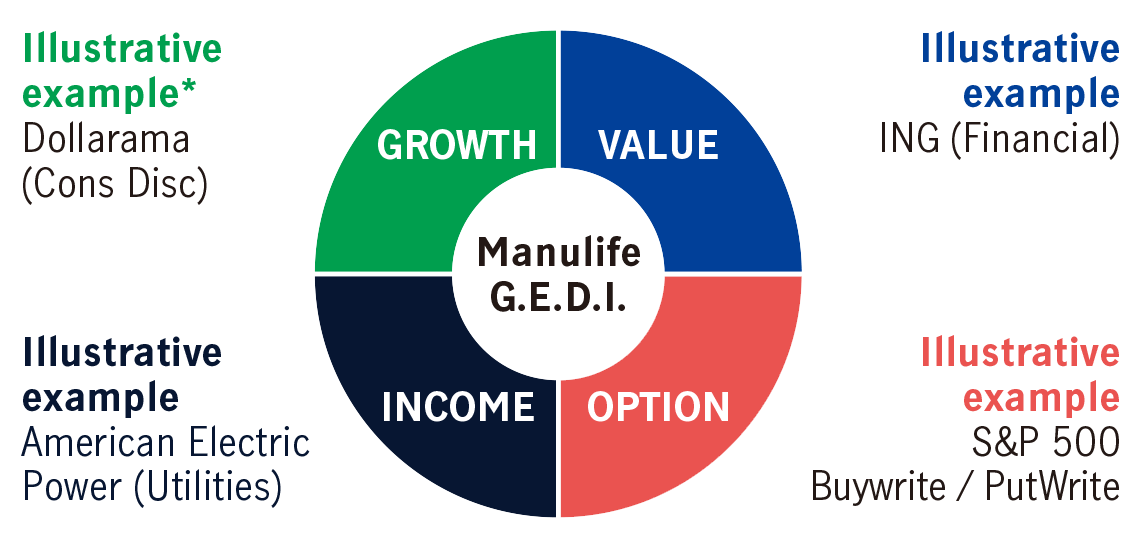

Our unified equity portfolio combines four powerful pillars – growth, value, income, and option overlays – seeking to deliver attractive yield and long-term capital growth.

Source: Manulife Investment Management, Bloomberg, as of 31 October 2025. Past performance is indicative of future results. There is no guarantee that any investment strategy will achieve its objectives. Global High Div Eq measured by MSCI World High Dividend Index; 3M Treasury Bill measured by ICE BofA 3M US Treasury Bill index; Global Bonds measured by Bloomberg Global Aggregate Index; Global equity measured by MSCI World index; Growth Equities represented MSCI ACWI Growth Index. Value Equities represented by MSCI World Value Index. Income Securities represented by John Hancock Tax-Advantaged Dividend Income Fund (unlevered).

A unified approach aiming to deliver Enhanced Income + Growth potential

For illustrative purposes only.

Our multi-pillar equity strategy seeks to provide resilience and balance:

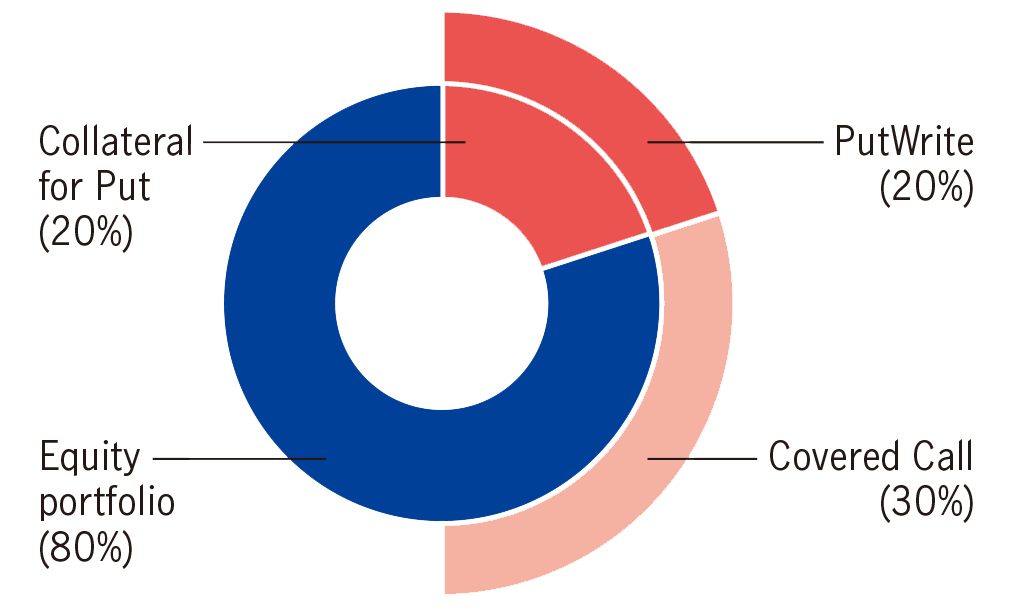

Indicative asset allocation (%)1

Flexibility to adjust exposures based on market environment

1 Source: Manulife Investment Management, as of 30 September 2025. Past performance is indicative of future results. There is no guarantee that any investment strategy will achieve its objectives. The indicative asset allocation is are based on model portfolio. Model portfolio results were created by Manulife Investment Management using historical data of underlying funds. The performance results do not represent the results of actual trading but were achieved by means of the retroactive application of a model designed with the benefit of hindsight.

* Illustrative examples are for demonstration purposes only and do not necessarily represent the actual holdings of the Fund.

To enhance consistency, we integrate dual option strategies – including covered calls and collateralized puts – designed to keep income as stable as possible. This holistic approach helps investors to achieve both income and growth in a single, well-structured solution.

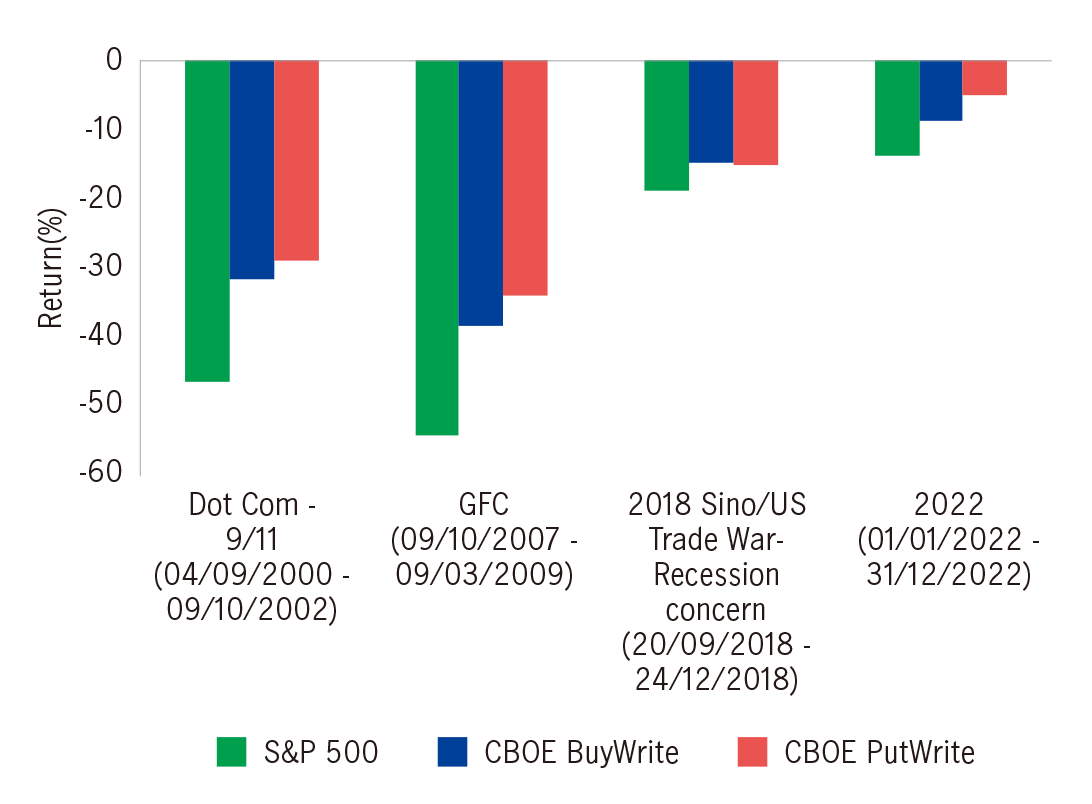

Option writing: Downside buffer

Option writing: Enhanced returns through volatility

Source: Bloomberg, as of September 30, 2025. Information is for reference only. Historical performance is not indicative of future results.

* Applicable for F (USD) MDIST (G), F (HKD) MDIST (G), F (AUD Hedged) MDIST (G), F (RMB Hedged) MDIST (G), F (JPY Hedged) MDIST (G), F (GBP Hedged) MDIST (G), F (CAD Hedged) MDIST (G), F (NZD Hedged) MDIST (G).

* Applicable for F (USD) MDIST (G), F (HKD) MDIST (G), F (AUD Hedged) MDIST (G), F (RMB Hedged) MDIST (G), F (JPY Hedged) MDIST (G), F (GBP Hedged) MDIST (G), F (CAD Hedged) MDIST (G), F (NZD Hedged) MDIST (G).

We are the global wealth and asset management segment of Manulife Financial Corporation. We draw on more than 150 years of financial stewardship to partner with clients across our global retail, institutional and retirement businesses.

29+ years

average investment experience of portfolio managers of the Fund

170+

investment professionals in equities

USD 175 billion

AUM in equity assets

Source: Manulife Financial Corporation as of June 30, 2025. AUM includes certain equity and fixed income portions of balanced investments. The methodologies used to compile the total assets under management are subject to change. Manulife Investment Management’s global investment professional team includes expertise from several Manulife IM affiliates and joint ventures; not all entities represent all asset classes.

5169759